U.S. Dollar Breaks its Bullish Trend: What’s the Winning Trade?

2022.11.14 08:13

[ad_1]

- Dollar endured one of its largest weekly drops in 15 years last week

- Commodities as a whole did not rally, surprising many macro traders

- European markets among biggest beneficiaries of a weaker dollar

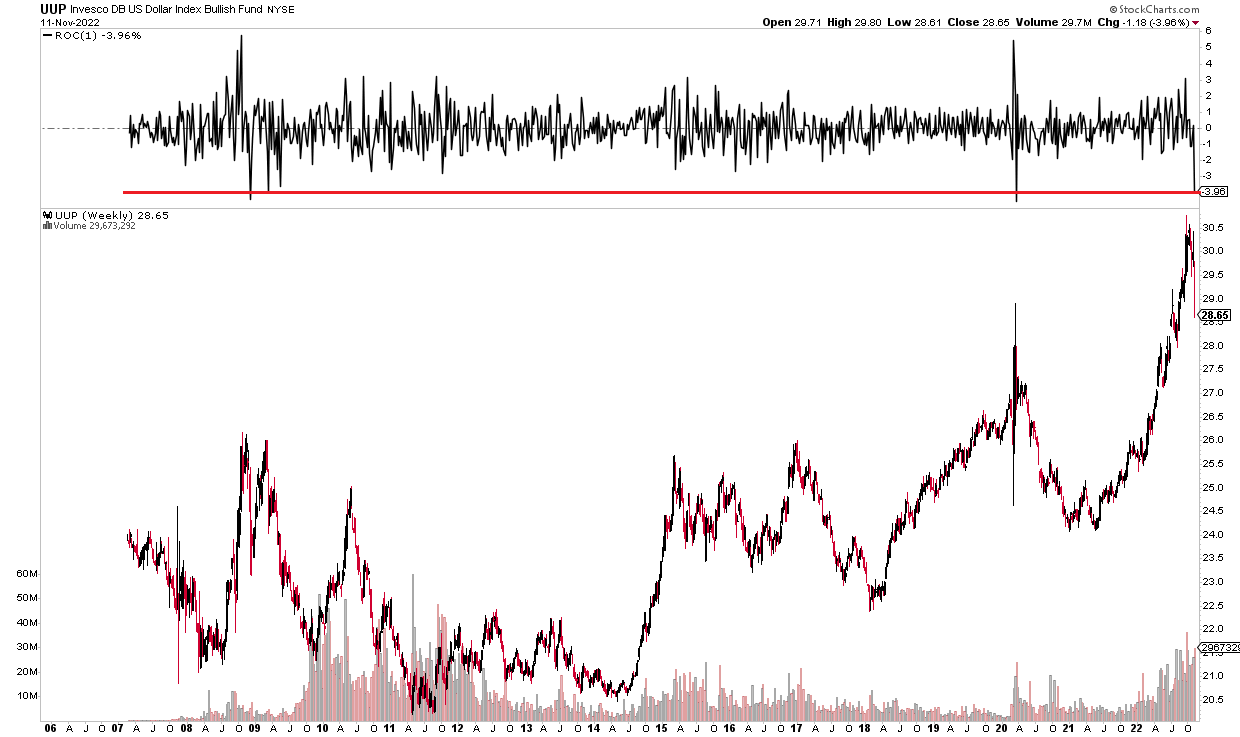

The has dropped sharply from its September high. Just last week, the Invesco DB US Dollar Index Bullish Fund (NYSE:), which tracks the dollar, fell nearly 4% for its third worst weekly return in the fund’s 15-year history. The only periods featuring bigger moves were at the depths of the Great Recession and around a handful of sessions near the COVID Crash.

U.S. Dollar ETF: Third Worst Week Since 2007

Source: StockCharts.com

Importantly for technical analysts, the greenback broke its critical uptrend support line dating back to the first quarter of this year. Also notice in the first chart that there was heavy volume in this latest upward thrust before the bearish breakdown took place. That tells me that dollar euphoria was perhaps setting in. And who can forget last month when George Washington donning the cover of popular investment magazines? A bit frothy, no?

Dollar Breaks Its Uptrend

Source: TradingView.com

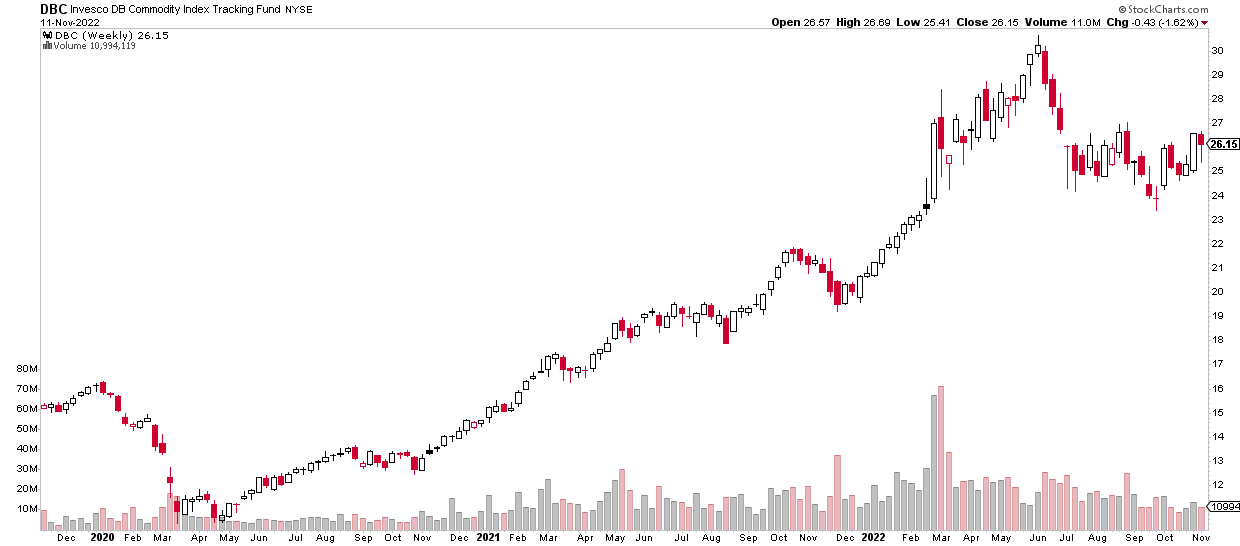

How should investors play this? It’s not such an easy answer. Normally, one would assume that a weaker USD would be bullish for commodities. But we didn’t see that last week. I like to focus on trading action with the Invesco DB Commodity Index Tracking Fund (NYSE:). It holds a diversified portfolio of commodities, but it is mainly allocated to oil. DBC actually finished down on the week on muted volume.

Dollar Down, Commodities… Down??

Source: StockCharts.com

Consider that for much of 2022, the dollar and commodities have performed well (particularly from January through early June). Geopolitical tensions certainly contributed to bullish cases on both asset classes. I assert, though, that we could be in a new regime in which the DXY and many commodities (particularly and ) move together.

A New Macro World

You must remember that today is a much different environment than, say, the mid-2000s when the U.S. was highly dependent on foreign sources of energy. Back then, when the commodities were in a bull market, led by intense foreign demand from emerging markets, U.S. consumers simply had to pay more for oil and gas. Today, however, those higher prices are a boon to major U.S. energy exploration and production companies since the nation exports much more of these products.

Where’s the Dollar Inverse Beta Play?

So, I would focus attention on other avenues to garner exposure to a weakening U.S. dollar. Take a look at some of the wild upside moves seen in Europe last week. The heat map below illustrates well where some of the biggest gains were seen.

The Vanguard FTSE Europe Index Fund ETF Shares (NYSE:) rose a whopping 8.3% while the was up just 5.9%. Germany, using the iShares MSCI Germany ETF (NYSE:) as a proxy, was up a stunning 11.3% for its best week since March/April 2020. To me, these are the ideal weaker (or even just stable) U.S. dollar plays.

Will the Real Weak-Dollar Play Please Stand Up? ETF Returns Last Week

Source: Finviz

The Bottom Line

We might have finally seen the top in the greenback. While anything can happen, we caught a glimpse of what assets might perform best in a weak-dollar environment. I assert that Europe’s cheap valuations and high negative beta to the USD make a compelling overweight case for the months ahead.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.

[ad_2]

Source link