U.S. Dollar And Rates May Be Heading To New Highs

2022.11.04 07:28

[ad_1]

The Fed told markets what they didn’t want to hear. Rates would need to be higher than previously thought, and with that, rates across the curve and the are moving higher. Both rates and the dollar may have much further to climb before all is said and done.

This could especially be the case if overnight rates are heading above 5%, which is what the Fed Funds Futures are currently suggesting, and that means the rate will probably head towards 5%, and the entire curve will be taken higher with it.

Rates Further To Climb

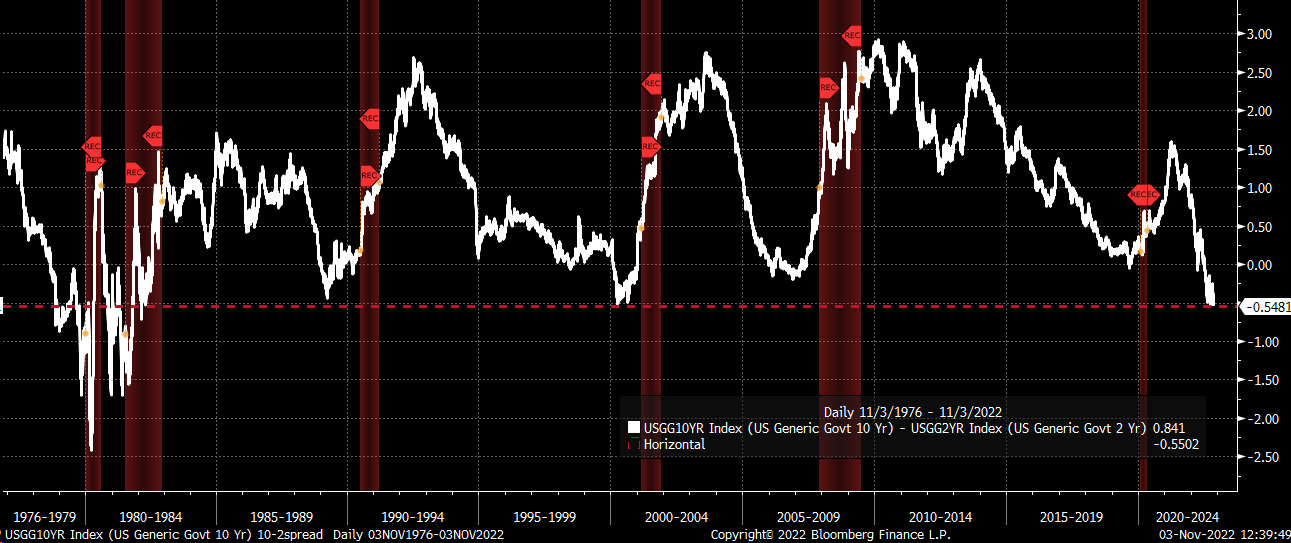

Unless the Treasury curve is going to invert even further, it seems likely that as the 2-year rises towards that 5% level, the rates should rise along with it. Given that the current spread between the 2 and 10-year rates is around 55 bps, one would think the US 10-year could rise to about 4.5% in the future.

The spread between the two yields has reached nearly the lowest point in 40 years. It was only lower in the late 1970s and early 1980s. At least, in more recent times, when the spread inverted, it tended to flatten out for some time before eventually turning higher. So, a 2-year heading to 5% and a 10-year pushing up to 4.5% could be possible given how markets are positioned currently.

10-2-year Treasury Spread

10-2-year Treasury Spread

Dollar Strength

Additionally, the more rates rise in the US, and the spreads with other countries widen, the more the dollar should strengthen. The spread currently between US and German rates appears to be heading higher and is getting very close to breaking out to a new high. Also, the distance between the US and Japanese rates is already very high. The bigger the spreads get, the stronger the dollar should become.

US Treasuries Vs. Japanese And German Bonds

US Treasuries Vs. Japanese And German Bonds

Additionally, a weak economy in China should allow the dollar to continue to strengthen versus the . The yuan has already weakened materially to the dollar in recent weeks.

A stronger dollar and higher rates should continue to weigh on commodity prices as they already have. But as the two push even higher, that will apply a downward force on commodities like , , and even . Oil prices have fallen significantly recently, and one can’t help but think how much higher oil would be if not for the strong dollar. This would also be a negative for stock prices, and a strong dollar lowers earnings and sales estimates, and higher rates drive valuations lower. A new high in rates and the dollar could send stocks to new lows.

With the Fed much more hawkish than the market expected and signaling that rates still have much further to climb, the impacts should result in the dollar and yields pushing higher from their current levels.

Disclaimer: This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice.

[ad_2]

Source link