Trading Desk Notes: The Blunt Instrument Of Higher Interest Rates

2022.06.26 10:41

Inflation fears morph into recession fears; stocks and bonds rally, commodities and the USD weaken

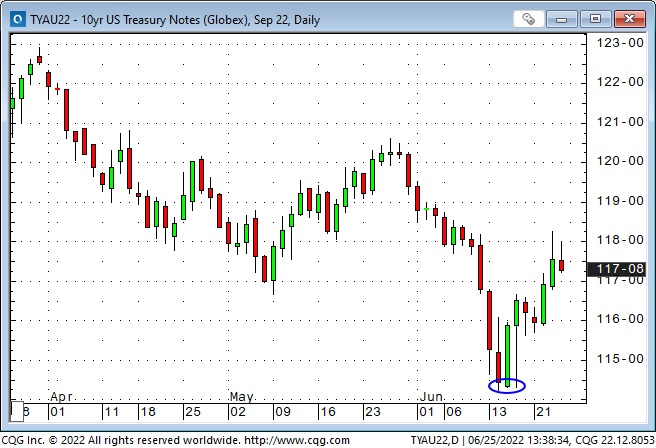

The Fed hiked s/t interest rates by 75bps on Wednesday of last week, with Powell using the term to describe the strength of their efforts to reduce inflation. The US Treasury 10-year bond yield touched a 12-year high of 3.5% that day and began to fall. It hit a low of 3.02% this Thursday. (TNote futures rise in price as yields fall.)

UST 10 Yr Note Daily Chart

UST 10 Yr Note Daily Chart

The March 2023 Eurodollar futures contract indicated a yield of 4.4% on Fed day; on Thursday of this week, the indicated yield hit a low of 3.58%, a decline of ~80bps.

Eurodollar Daily Chart

Eurodollar Daily Chart

Market interest rates have declined since the Fed raised rates last Wednesday (and indicated that they would continue to raise rates) as market sentiment has turned from worrying about persistently high inflation to fearing that the Fed (and other Central Banks) will cause a recession by tightening monetary policy.

The Fed seems to be in mode, but trying to fight inflation with the blunt instrument of higher interest rates reminds me of the famous Thomas Sowell quote, “There are no solutions, only trade-offs.”

The US dollar hit a 20-year high on Fed day, June 15, then turned lower. The USD has been trending higher against most other currencies on the notion that the Fed would maintain a more aggressive monetary policy than other Central Banks.

The implicit message from market interest rates is that the Fed may not be as bold over the next several months as previously thought.

Dollar Index Daily Chart

Dollar Index Daily Chart

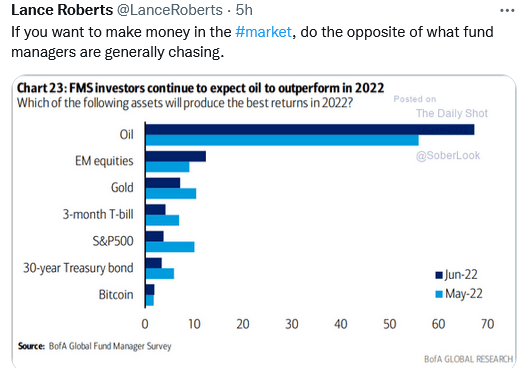

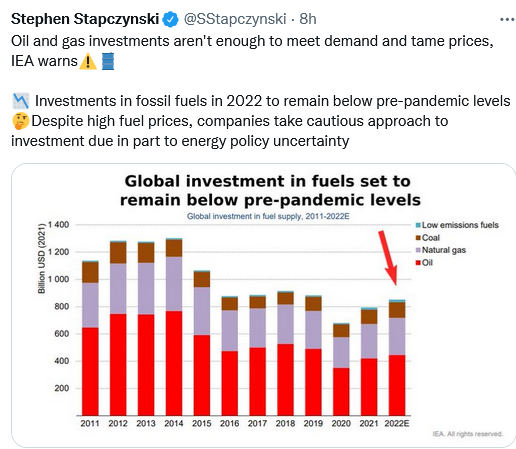

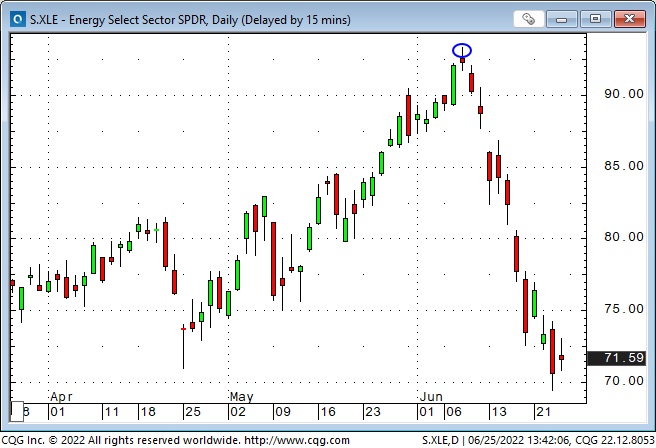

Commodities, especially fossil fuels, were the “hottest” market from January to early June. That changed on the June 8 Key Turn Date.

The energy sector hugely outperformed all other stock market sectors from January through early June as WTI rose from ~$75 (January 2) to ~$125 (mid-June.) There was a huge within the stock market from into energy and other commodities.

The driving narrative was that (of near and long-term duration) could not be fixed.

XLE Weekly Chart

XLE Weekly Chart Crude Light Oil Weekly Chart

Crude Light Oil Weekly Chart Oil Performance In 2022

Oil Performance In 2022 Oil & Gas Investments

Oil & Gas Investments

Energy shares have tumbled 20 – 30% (uranium, too) since the May 8 Key Turn Date as WTI and RBOB gasoline have dropped ~15%.

(I use the term Key Turn Date when several different markets all reverse course on or about the same date, and the fact that several markets act in sync adds significance to the reversal. I have circled May 8 on many of the following charts.)

XLE Daily Chart

XLE Daily Chart Crude Light Oil Daily Chart

Crude Light Oil Daily Chart

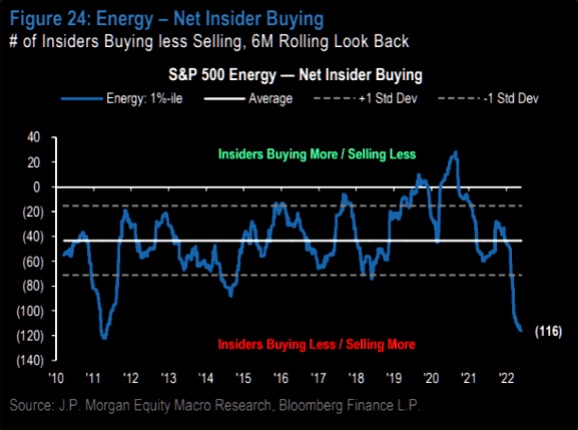

Markets that soar when the public embraces a compelling narrative often fall sharply when they reverse, i.e., energy shares. I posted a chart of heavy insider selling of energy shares in my May 28 TD Notes.

Energy – Net Insider Buying

Energy – Net Insider Buying

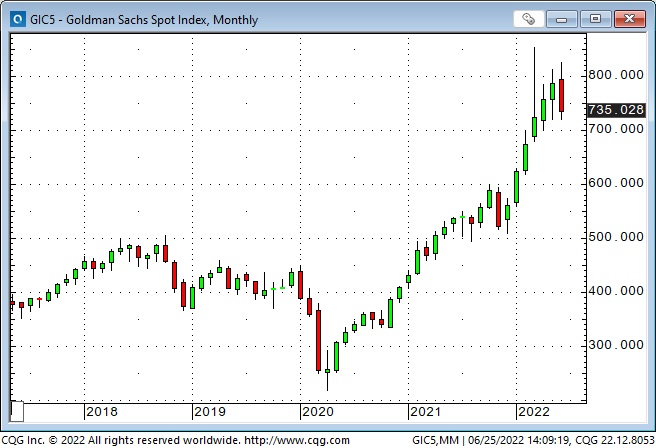

The Goldman Sachs Commodity Index (with a heavy energy weighting) dropped to a 20-year low in April 2020 (when WTI briefly traded at negative prices.)

It rallied nearly 3X from those lows to the highs reached following the Russian invasion of Ukraine.

GS Spot Index, Monthly Chart

GS Spot Index, Monthly Chart

Commodity market strength was broad-based, with gains in metals, grains, materials, and energy. The strength was maintained from January through June of this year even as stock markets fell from All-Time highs, interest rates rose, and the USD rose (commodities priced in USD might otherwise weaken when the USD rose.)

Some analysts wondered if/when the commodity sector would from other markets, but the flow of funds into the commodity sector continued—until the Key Turn Date on June 8, when commodities to the pervasive pessimism that took the leading stock indices down to their lowest levels since December 2020.

GS Spot Index, Daily Chart

GS Spot Index, Daily Chart

Comex copper hit an All-Time high of $5 per pound the same day (Mar. 7) that WTI touched its highest level since 2008, but the red metal has been trending weaker than WTI since then and hit a 17-month low this week.

(Remember that the bullish narrative driving copper prices was a looming supply shortage—that could not be fixed—that was going to be caused by a massive increase in the number of electric-powered vehicles. That story seems to have been overwhelmed by other considerations.)

Copper Daily Chart

Copper Daily Chart

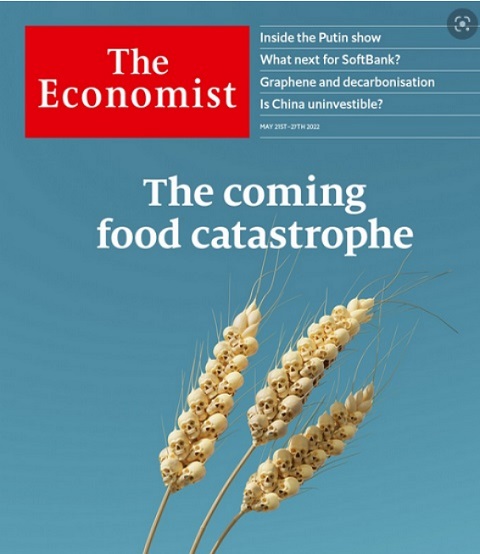

July CBOT wheat spiked to 14-year highs ~$12.80 on the invasion and made another high on May 17 as the Economist magazine cover featured

(I noted in the May 21 TD Notes that the Economist, and other famous magazine covers, have a history of signaling market reversals.) Wheat closed this week at the lowest since late February, down ~ 27% from the May 17 highs.

Wheat Daily Chart

Wheat Daily Chart The Economist Article

The Economist Article

NY cotton prices hit the highest level since the 2011 commodity boom on May 17 (the same day wheat made a high) and have trended lower since then—plunging this week— down ~27% from the May 17 highs.

Cotton Daily Chart

Cotton Daily Chart Commodity Prices Since May 1st

Commodity Prices Since May 1st

The Canadian Dollar has historically had a strong correlation with commodity prices, and it reversed on the commodity Key Turn Date of May 8 and fell more than three cents to last week’s lows.

This year, the CAD has had a robust correlation (+80%) with the S&P (my favorite risk barometer). As stocks and commodities both tumbled on pervasive pessimism, the CAD tumbled against the USD—despite widening s/t interest rate differentials.

CAD Daily Chart

CAD Daily Chart

The Toronto Composite Index, which had outperformed the American stock indices earlier this year (underpinned by commodity markets,) began to tumble on the June 8 Key Turn Date and dropped ~10% to this week’s lows.

S&P / TSX Composite Index, Daily Chart

S&P / TSX Composite Index, Daily Chart

Stock markets rally in the hope that a recession will cause the Fed to reverse tighter monetary policy

The DJIA closed this week ~1,850 points above last week’s 19-month nadir as pervasive pessimism was swept aside by faint hope. The Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) was down ~25% from its January ATH at last week’s lows and was overdue for at least a bounce.

DJIA Daily Chart

DJIA Daily Chart

My short-term trading

I started trading the TNote futures with a bullish bias on June 13 (two days too early.) I have been outright short puts, long futures against short calls and outright long calls. I covered the last of those positions on Wednesday this week (one day too early.)

While the TNotes rallied ~2.5 points from last week’s lows to this week’s highs, my net P+L on the TNote trades was only up ~0.15% – a fitting result for entering and exiting the market too early.

I started trading the S&P with a bullish bias on June 15 (Fed day) which was one day too early. I made eight S&P trades last week and this week, using small size and tight stops, and my P+L lost ~0.5%. I stopped buying the S&P one day too early on Thursday, and it had a terrific rally on Friday.

I made a small profit long the euro last week and took small losses short the CAD and long gold this week. My net P+L on those three trades was down ~0.1%, and my net P+L was down ~0.45% for the last two weeks.

Thoughts on trading – risk management

Trading is about surviving. I’ve lost money over the past two weeks, but the good news is that my total losses were less than 0.5%, and I’ve got a clean sheet to start next week.

The last two weeks were a great example of having some good trade ideas but getting bushwacked by poor timing (poor order entries and exits) and a lack of conviction in my trade ideas (which led to placing stops too tight—in hindsight!) Have I mentioned before that trading is not a game of perfect?

I watched another great RTV video this week. Mark Ritchie, featured in the second Market Wizards book, was interviewed by his son. The veteran trader had some great zingers:

1) You’ve got to do your own thinking,

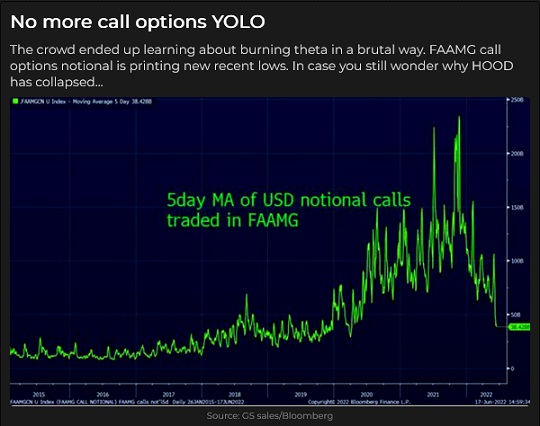

2) Sell whatever the crowd wants to buy,

3) The opinion of the crowd never alters the truth, but the opinion of the crowd always alters the price,

Call Options YOLO Chart

Call Options YOLO Chart

4) Never confuse brilliance with a bull market,

5) What traders need to learn most is not sexy: you don’t make money back by trading bigger; maintain your confidence by cutting your size; if you’re not bored, you’re trading too big.

6) He also talked about emotional risk management; he knew three people who committed suicide because of trading losses.

I also watched a great video of Stephanie Pomboy making her case that deflation is a more significant risk than inflation. I think Stephanie and David Rosenberg could agree on a lot of things. (When the crowd only sees inflation, it’s helpful to think about how deflation might change the markets.)