Torturing the Data: Mid-Term Elections Implications

2022.11.15 11:40

[ad_1]

It’s been tempting in recent weeks to look at the stock market’s performance following US mid-term elections as biased upward for reasons linked to a special factor that prevails after voting. This is probably narrative mining than robust quantitative analysis.

The stock market does, in fact, show an upward bias in the 12-month periods following mid-term elections. The problem is that there are only a handful of mid-term elections in the historical record vs. thousands of 12-month-return windows, which are in fact upward biased. Teasing out why the former are a special subset from the latter due to mid-term elections isn’t obvious, but it makes for great headlines.

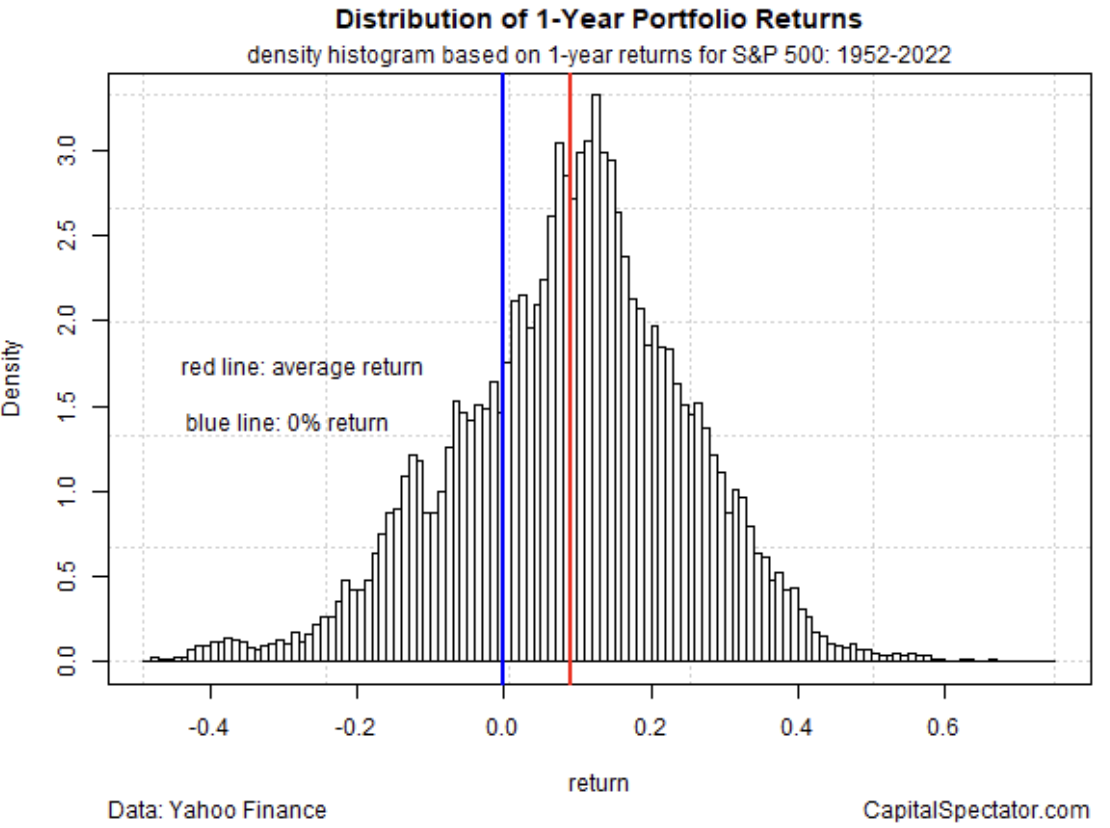

Consider how all the ’s one-year returns stack up since 1952. Clearly, there’s a strong positive skew. The average performance for 18,000-plus one-year returns is +9.1%. Roughly 74% of the one-year results are positive, which means that randomly choosing a handful of data points will likely show gains. Are mid-term election dates something special as start dates for analyzing one-year returns? Maybe, but it’s going to take more than a simple profile of return histories to make that case.

Distribution of 1-Year Portfolio Returns

Distribution of 1-Year Portfolio Returns

But let’s not be too critical of the stories in recent weeks that suggested there’s some unique force that tends to lift markets following mid-term elections. In a rough year for markets it’s understandable that investors are in need of a timely bullish narrative. But there’s always one waiting in the wings if your time horizon is the next 12 months.

The stock market’s general bias to rise can be attributed to many things, but it’s not obvious that mid-term elections are a critical, much less the only factor. To posit otherwise requires a degree of qualitative and/or multi-factor quantitative analysis that’s been lacking in the profiles making the rounds lately.

The point here is that it’s all too easy to assume that the stock market rises or falls because of one factor – mid-term elections in this case. Finding deep support in the data is something else entirely.

[ad_2]

Source link