Top 5 Potential Gold and Silver Breakouts to Watch in 2025

2025.01.24 03:16

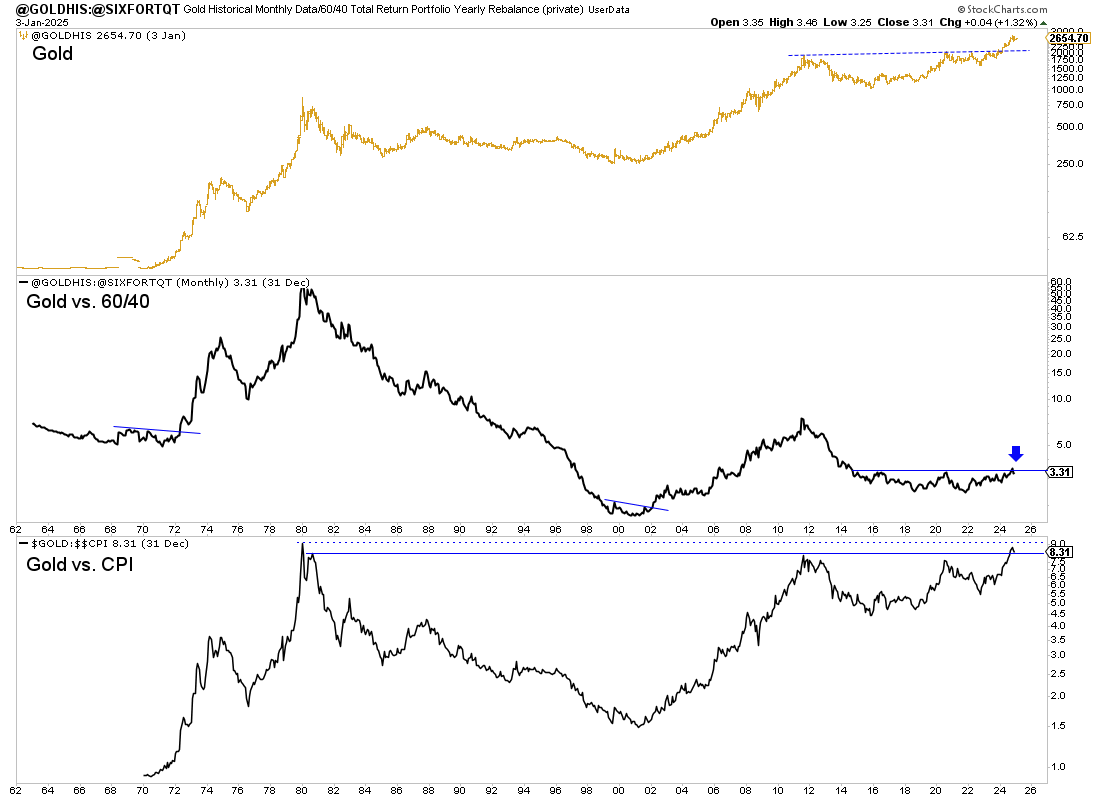

’s breakout from a 13-year cup-and-handle pattern should have been more significant for the precious metals sector.

It was not because of continued strength in the stock market and the lack of strength in precious metals in real terms.

The good news for 2025 is there are quite a few potential breakouts in real terms.

The first two potential breakouts are:

- Gold against the 60/40 Portfolio

- Gold against the

The bull markets in precious metals in the 1970s and 2000s were confirmed and unleashed when the Gold to 60/40 Portfolio ratio began its surge at the end of 1971 and 2001.

The inflation-adjusted Gold price (Gold against the CPI) is important because it is an excellent fundamental indicator for mining margins and gold stocks. It is on the cusp of breaking out from a 45-year base.

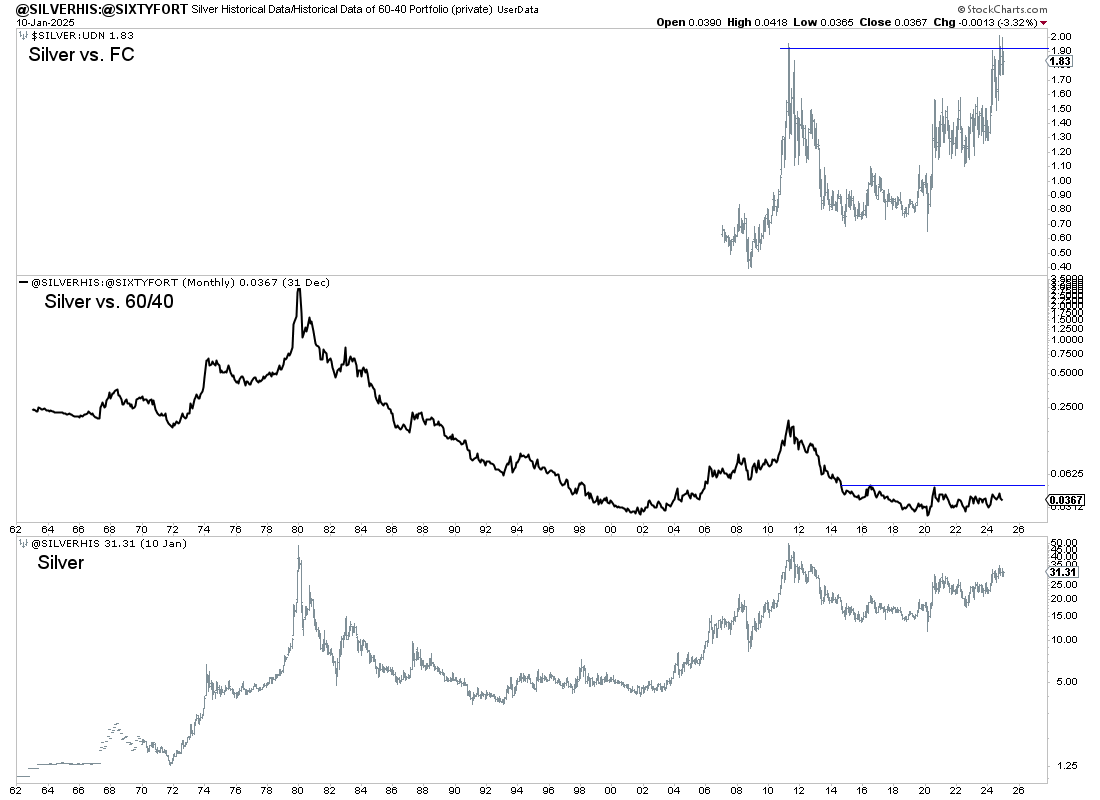

Turning to , we see two potential breakouts:

- The first, which is very close, is Silver against foreign currencies (Silver/FC). This is Silver divided by the inverse of the basket.

Gold/FC has been a leading indicator for Gold, meaning Silver/FC should be a leading indicator for Silver. Silver/FC is testing 2011 levels and, if it can push higher, could notch a 44-year high.

- The second, which would happen last out of the five in this article, is Silver against the 60/40 Portfolio. That ratio has come out of a massive double pattern but needs to strengthen to test 10-year resistance.

If and when Silver can break out against the 60/40 Portfolio, it would put Silver in a position to break above $50/oz.

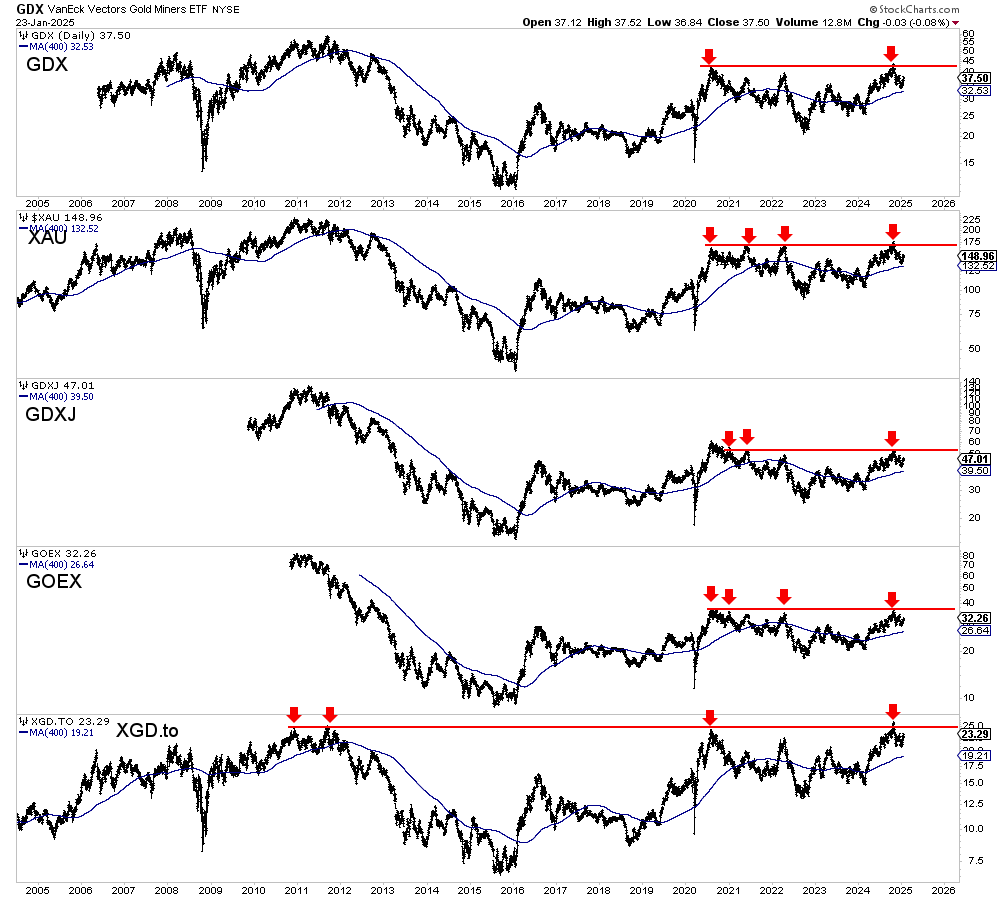

Finally, multiple gold stock ETFs and indices are in a position to break out this year.

, , and (an ETF similar to ) are trading in 4.5-year bases. XGD, the Canadian GDX, is trading in a 14-year base.

The gold stocks are in position for the most significant breakout since 2005.

Gold made a spectacular breakout last year and has gained 40% in the last 11 months.

Leveraged plays like Silver, gold stocks, and small juniors have not outperformed because too much money is flowing into general equities, thereby mitigating Gold’s gains in real terms.

Gold’s pending breakouts against the 60/40 Portfolio and Inflation will signal better performance in real terms which will trigger more capital to move into the sector. A breakout in the gold stocks will follow, leading to outperformance from Silver.

In the meantime, one should position in quality junior gold and silver stocks that will lead the next move higher.