Time to Recalibrate Our 3 Market Scenarios?

2025.01.27 02:45

We regularly assess the subjective probabilities that we assign to our three scenarios: the Roaring 2020s (55%), the Meltup 1990s (25%), and the Stagflationary 1970s (20%). The last scenario, with the lowest probability currently, is our what-could-go-wrong “bucket.”

Our main concern since early 2022 was that geopolitical crises might cause oil prices to soar as occurred during the 1970s. Along the way, we have included other potential bearish developments for the economy, as well as for the bond and stock markets, such as overly restrictive monetary policy, a US debt crisis, a Chinese debt crisis, and more recently tariff and currency wars.

The has been easing since September 18 and leaning toward easing some more. prices have remained amazingly subdued despite the conflicts in the Middle East and the war between Russia and Ukraine. Oil prices have increased recently after the outgoing Biden administration toughened sanctions on Russian oil exports, but the incoming Trump administration is expected to boost US oil production. The latest ceasefire agreement between Israel and Hamas is in place.

Meanwhile, last week’s drop in bond yields suggests that a US debt crisis isn’t imminent.

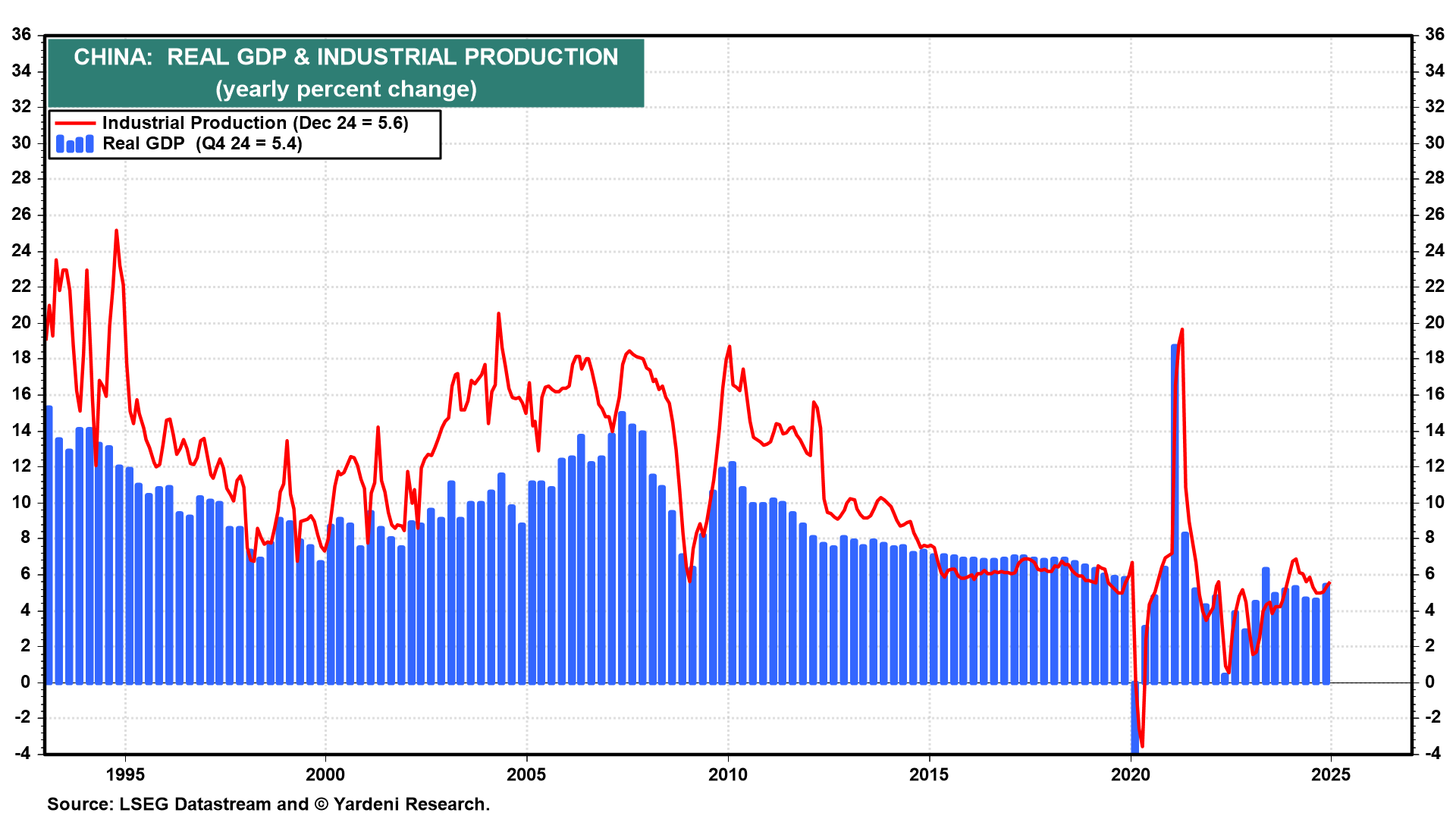

However, the Trump administration will likely announce hefty tariff hikes today, especially on China. Recent stimulus measures by the Chinese government seem to have boosted China’s real at the end of last year.

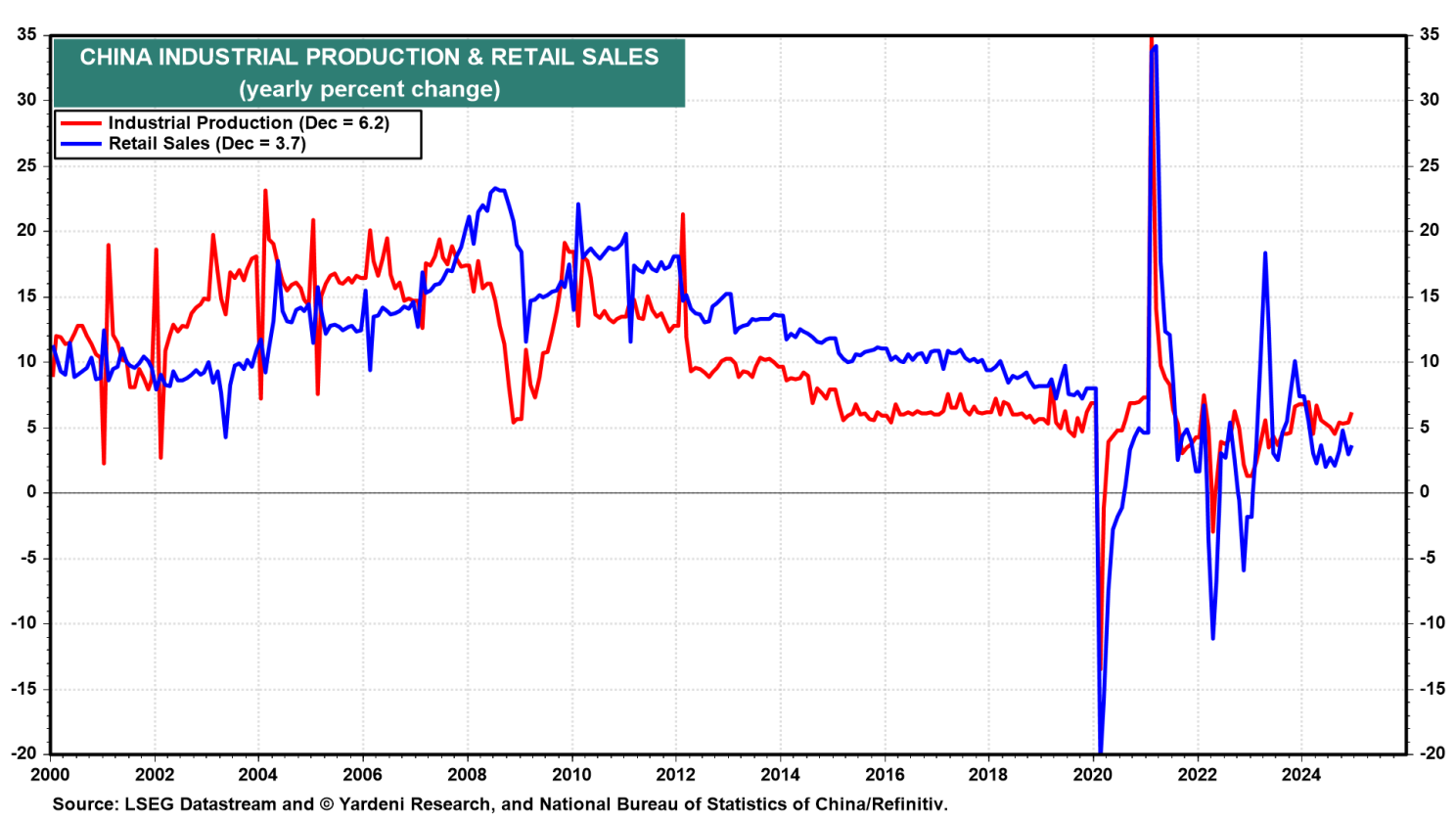

During December, Chinese and real rose 6.2% and 3.7% y/y, respectively. However, additional US tariffs on Chinese imports could exacerbate China’s property-led economic woes.

On balance, we are thinking about reducing the odds of the bearish scenarios in our bucket of what could go wrong. We aren’t doing that yet, but we are thinking about it. If we do so, then we will most likely increase the odds of the melt-up scenario, assuming that Waller’s dovish cooing last Thursday represents the majority view of the FOMC.

As we’ve been saying since August of last year, the Fed shouldn’t be stimulating an economy that doesn’t need to be stimulated. That’s especially so given that Trump 2.0 policies are only now about to be announced and may have lots of unanticipated consequences.

The bottom line is that we are still assigning a subjective probability of 80% to a continuation of the current bull market in stocks with our targets for 2025 and 2026 currently at 7000 and 8000.

Original Post