The Sweet Spot Until the Credit Event

2023.07.19 15:37

With the disinflationary process continuing in June, economic conditions appear to be in the sweet spot at the moment – steady positive growth coupled with falling . We know, however, that the economy isn’t the market and much of the rally that’s already taken place in 2023 is reflective of these economic conditions.

While we can be short-term bullish, conditions still appear to be favouring a long-term bearish pivot. Most investors at this point believe it’s more likely than not that we can pull off the soft landing and completely avoid a deep recession (Goldman Sachs recently cut its 12-month recession odds to 20%, while Janet Yellen sees no recession at all), but the longer-term warning signs are still there. It’s impossible to ignore the fact that the 10Y/3M Treasury yield spread is still near an all-time low and the spread is at a 40-year low. Unless you believe this time is different, this would be a historic anomaly if we were able to avoid recession here.

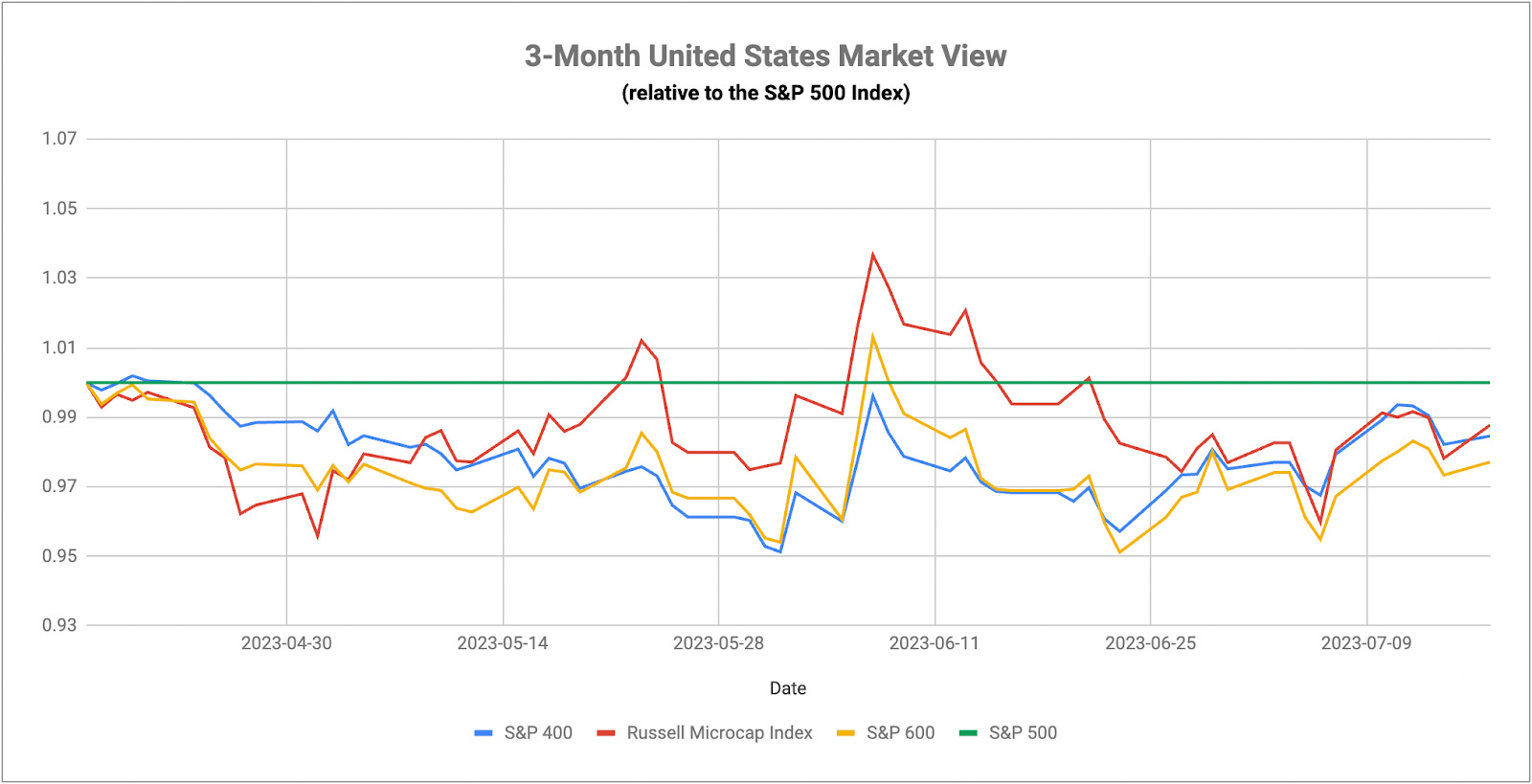

3-Month United States Market View

3-Month United States Market View

The short-term signs from equities are still positive here. Growth and high beta continue to lead, while small-caps have begun outperforming large-caps and the equal-weight leads the traditional index. It’s no longer just a “magnificent 7” rally and, while this group continues to generate positive returns, we’re starting to see things spread out across areas, such as industrials and even real estate. While these are positive signs if you’re an equity investor, the next big rotation, I believe, is going to be from stocks into bonds, not small-caps or defensives.

We can look at the recent behaviour of Treasuries and some of the ancillary data already out there to support this notion. Long-term yields shot higher earlier this month when Powell reiterated his hawkish tone and “two more rate hikes” comment. After June’s cooling inflation data and a developing belief that the Fed is likely done later this month, the immediately shot lower again and yield spreads widened further. The next move lower in Treasury yields might be delayed a few weeks if Q2 earnings don’t produce any big downside surprises, but the signs are still there.

Most notable was Bank of America’s (NYSE:) revelation that losses on its bond portfolio had grown to more than $105 billion in Q2. We suspected that banks extending their duration risk in pursuit of higher yields over the past couple of years wasn’t just a regional bank thing and it looks like that may indeed have been the case. Of course, it’s not to the level that would turn the big banks insolvent, but it suggests there may be some bond risk still out there. Corporate bankruptcy filings have also been on the rise in the past several months.

All of this acts as a reminder that the credit event is still out there.