The Residual Effect on Rent Inflation of the Eviction Moratorium

2024.07.18 12:34

Today’s column will be a brief one, because it’s summertime and the people on the beach generally don’t read my column. I saw a headline today for an article on Realtor.com. “June 2024 Rental Report: Median Asking Rents Continue to Fall.”

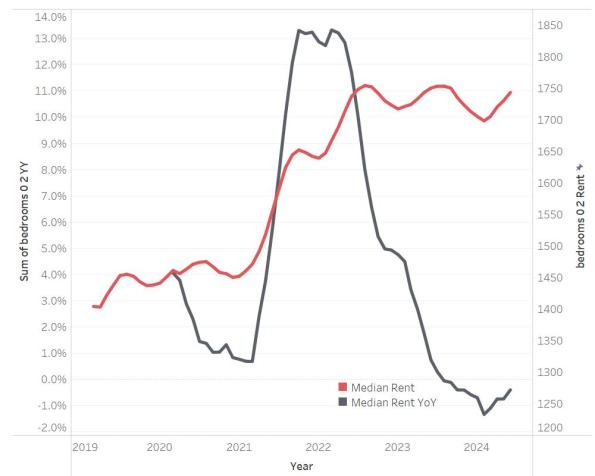

Here is the first chart, under the title ‘Rents Decline Again,’ which un-ironically shows asking rents are rising (but, on a y/y basis, still a tiny bit lower than a year ago.)

My article, though, is not meant to beat up on the journalistic merits of this article.

No; I want to run back a chart I showed a couple of years ago which was interesting at the time and – what surprised me when I updated it yesterday – is actually still interesting now.

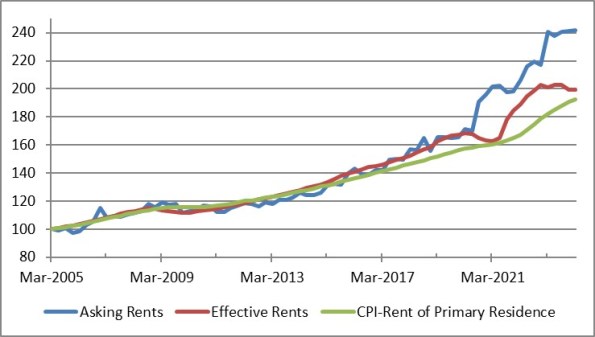

The chart shows asking rents (Source: US Census), effective rents (Source: REIS), and the CPI for Rent of Primary Residence (Source: BLS).

When I first ran this chart, the point was that the eviction moratorium instituted by the Biden Administration had held down realized rents but opened up a large gap between actual rents and asking rents, which meant that there would eventually be a large catch-up.

Prior to the eviction moratorium, these three measures paralleled quite well – as one would expect them to. But the point of divergence is obvious, as was its implications (and I noted them for example back in March 2021. You’re not wasting your time here, people).

Sure enough, rent inflation accelerated sharply when the moratorium ended. Look at how the red line moved smartly up towards the blue line starting in the summer of 2021.

The BLS measure, with a lag, also accelerated, and now has just about caught up to the Effective Rents measure. The animated discussions you hear today about how rents are still rising in the even though effective rents and rents for new apartments are in some cases declining is mostly an argument about lags.

The BLS series understated rent inflation for a while, and has been gradually catching up. It’s almost there.

But the interesting part to me is the blue line, especially in the context of an article about how “Asking Rents Continue to Fall.”

I would absolutely expect asking rents to be falling, since they are up about 41% since the divergence began, while effective rents are up only 18% or so.

The curious part is the question about why this divergence has recently re-accelerated, and the secondary question about whether asking rents lead effective rents as they did during the eviction moratorium. That, though, was an unusual event, and otherwise, there doesn’t appear to be a lead relationship there.

Also, there hasn’t previously been such a divergence. I wonder if the elevated asking rents measure is due to shortages of rental properties in areas of the country where the population growth (of both legal and illegal migrants) is hot.

I don’t know. What does seem to be clear here is that the eviction moratorium caused massive turmoil in the rental market, and that volatility is continuing even today.

All the more reason to hate the idea of price controls on rents! Stop poking the hornets’ nest and let the market settle down.

Original Post