The Perfect Storm for Investors to Lose Big in 2023 Is Upon Us, Unless…

2023.01.05 15:04

[ad_1]

I rang the bell telling investors and traders to wake up and smell the hot coffee because 2023 is going to be a life-changing year, and likely, not for the better.

The 30,000-foot view of where we are in the stock market cycle is shown on my gauge.

Bullish/Bearish Sentiment

Mike’s Investment Story Of Losing Big

Mike had always been a big believer in the “buy and hold” investment strategy. He had read all the books and articles and was convinced that if he just stayed the course, he would come out ahead in the end. So when the stock market started to tank in 2008, Mike didn’t panic. He told himself that this was just a temporary blip and that things would bounce back soon.

But as the weeks turned into months, it became clear that this was no ordinary market downturn. Mike’s portfolio was taking a beating, and he was starting to lose a lot of money. He tried to stay positive and hold on, but the losses just kept piling up. Finally, he couldn’t take it anymore and panicked, which led to him selling everything.

Emotions of Market Participants

Emotions of Market Participants

When the dust settled, Mike had lost a significant chunk of his life savings. He was devastated and couldn’t believe that his beloved buy-and-hold strategy had failed him so badly. He vowed never to make the same mistake again and to always be more cautious and proactive with his investments.

Despite his painful experience in 2008, Mike couldn’t shake his interest in the stock market. He spent years studying and learning as much as he could about investing, determined to make up for his past mistakes. Finally, in 2020, he felt ready to give it another shot.

With a newfound sense of caution and well-researched stocks, Mike slowly began to rebuild his investment portfolio. At first, things seemed to be going well. The market was strong, and his stocks were rising sharply.

But in 2022, disaster struck again. A bear market hit both stocks and bonds, and Mike watched in horror as his portfolio took another hit, almost as bad as the 2008 financial crisis, because this time, the price of bonds fell with stocks due to the rising interest rates.

Now, 14 years after his 2008, and the recent 2022 losses, Mike is older and much closer to retirement. He knows bear markets can take 3-12 years to recover, so it is critical that he invest differently now to avoid multi-year drawdowns that would delay his retirement.

Mike is not alone, and maybe even you are having a similar situation with investing. In 2021 and again in 2022, investors started to challenge the status quo buy-and-hold strategy because holding stocks and bonds did not protect their capital as they were told it should.

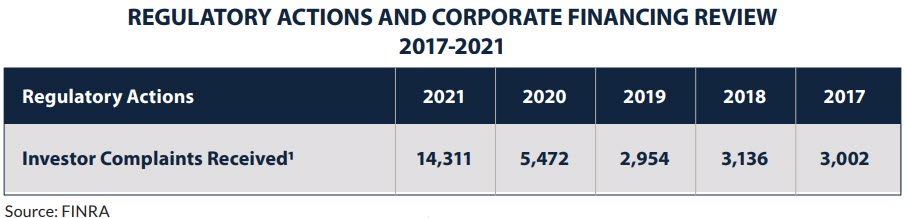

Take a look at investor complaints received in 2020 and 2021. This tells us the 60/40 portfolio and standard advisor by-and-hold strategy has done some serious damage to investors accounts, and the reputation of advisors. This is the same scenario that happened during the 2008 bear market. The problem I have is that investors are always told to stay calm and to keep their money in the market, everything will be fine, and corrections are part of the process, but I say Hell No!

Regulatory Actions and Corporate Review 2017-2021

Regulatory Actions and Corporate Review 2017-2021

Investors have been manipulated to think losing money during bear markets is normal. Investors have Stockholm Syndrome and are being tortured for no reason because bear markets can be avoided. In fact, investors can make substantial returns during falling stock prices.

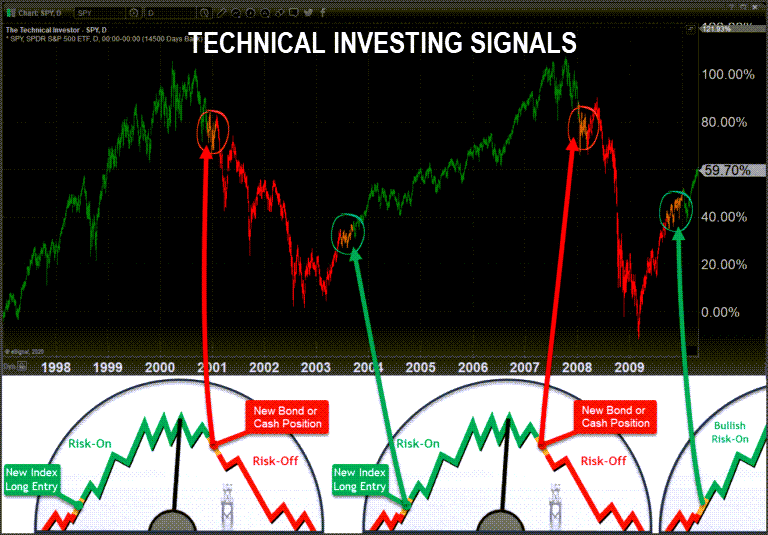

Savvy investors and traders know the markets move through cycles and that price trends can be tracked and traded using technical analysis signals.

A Different Way To Invest: Technical Trading Signals

Technical trading signals can help traders make informed decisions and manage risk by providing clear direction on market trends and potential risks. By following these signals, traders can hold positions in assets that are performing well and quickly exit those that are underperforming, leading to lower volatility in the portfolio. When a signal is triggered, traders know to take action, whether that means entering or closing a position, which can help them avoid significant losses and outperform the market in the long run.

Technical Investing Signals

Technical Investing Signals

Investment signals for ETFs and other asset types can provide a systematic, repeatable approach to investing that helps to reduce emotional stress and introduce consistency and capital preservation. These signals are based on rules rather than predictions or emotions, which can provide a clearer path to predictable outcomes. Many individuals now are using autotrading investing systems to take the guesswork out of things and remove the need to learn how the markets work, technical analysis, and risk and position management.

How to Increase Returns and Save Money With Technical Trading Signals

Technical trading signals can be a cost-effective way for investors to boost their returns and save money, especially if they currently use a financial advisor who charges an AUM fee. These fees, typically around 1% of the assets under management, can add up over time for investors with large accounts. For example, a $500,000 investment with an advisor charging a 1% AUM fee would result in annual fees of $5,000.

In contrast, technical trading signals are offered with a flat annual subscription, which can be significantly lower than the AUM fees charged by advisors. Additionally, these signals can help investors preserve capital and profit in both rising and falling markets, unlike the high-risk “buy-and-hope” strategy used by many advisors. Buy-and-hold, which exposes investors to the risk of significant multi-year drawdowns, may be suitable for younger investors but may not be appropriate for those over the age of 45.

[ad_2]