The Most Misunderstood Concept in Finance

2023.04.28 14:14

Recently, US House Speaker McCarthy tweeted this:

And although it sounds like common sense, it’s dead wrong.

The government doesn’t need money to spend money.

The government creates money for the private sector when it goes for deficit spending.

Let’s explain this with the use of some simple T-accounts and a stylized example involving the government, the Central Bank, commercial banks and the private sector (us).

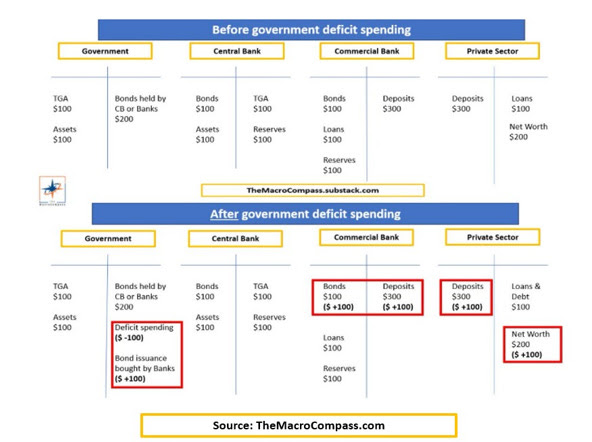

Before government deficit spending, here is the stylized situation:

- 1. The government has liabilities (bonds issued, purchased by commercial banks and the Fed) and assets in the form of student loans for example and money parked at the Fed (Treasury General Account);

- 2. The Central Bank takes deposits in from the government (TGA) and issues bank reserves on the liabilities’ side, and it owns government bonds and other assets (say foreign exchange reserves);

- 3. Commercial banks have deposits on the liabilities side, and an asset base composed of reserves at the Central Bank + government bonds + loans to the private sector;

- 4. The private sector has deposits at commercial banks on the asset side, and debts and capital on the liabilities side.

What happens when the government goes for the so-demonized deficit spending?

Before/After Government Spending

The government blows a hole in its balance sheet, effectively creating negative equity through deficit spending – public opinion would say it spent money it didn’t have, and hence it must borrow (issue bonds).

But have a look at what the government really did.

The government spent $100 by sending cheques home to people (private sector), which all of a sudden find their bank deposits have gone up by the same $100 without any liability (!) immediately attached to it.

In other words, the government blew a hole in its balance sheet but increased people’s net worth!

Now, as private sector with an increased net worth (cheques sent to us) we might decide to immediately spend that money or keep it in a commercial bank.

If we’d spend this newly created money on buying a car, the car seller would now own the new bank deposit.

In any case, this new money will end up as a deposit in the commercial banking system.

Hence, commercial banks now have more deposits (+$100).

Given how balance sheets work, this also means they must have more assets right?

The standard is that as deposits go up, commercial banks have more reserves to deposit at the Fed.

We could literally stop here.

Merely accepting the fact the government issues the very money the private sector uses, and it does not ‘’need’’ to save or find money before it spends it as McCarthy and many others believe.

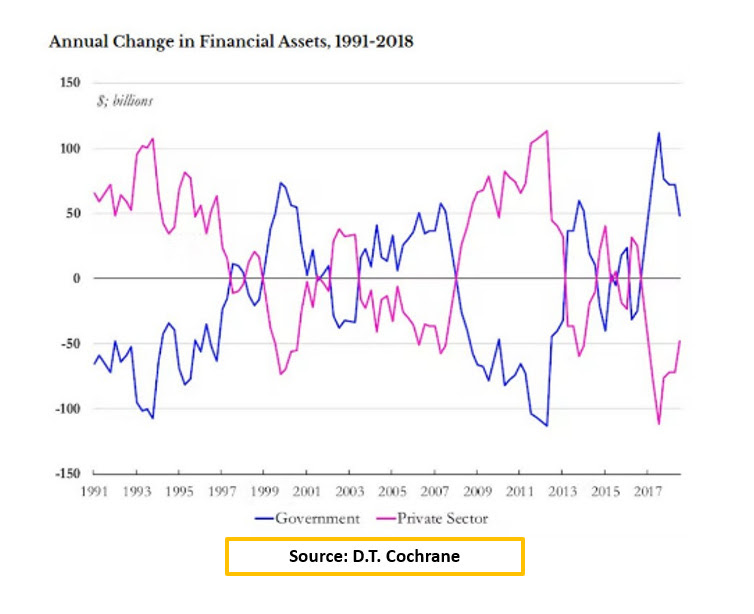

Another way to visualize this is by understanding that government deficits = private sector surpluses!

The government doesn’t ‘’need’’ money from us, but instead it increases (deficit spending) or decreases (austerity) the private sector net wealth through its fiscal decisions.

Annual Change in Financial Assets (Government Vs. Private)

Annual Change in Financial Assets (Government Vs. Private)

Back to the T-accounts for one last step.

In our system, we have several self-imposed rules: one of them is that the government can’t run negative equity positions, but instead it issues bonds – it doesn’t ‘’need’’ to, but accounting standards dictate it does.

Remember where we stood: the government does deficit spending, the private sector has more net worth and more bank deposits and commercial banks receive these deposits and increase their reserves at the Fed.

When the government issues bonds to ‘’fund’’ deficit spending, commercial banks use reserves to buy them: after all, bonds often provide with higher yields than reserves and banks are in the business of making money.

Now you can square all the process through the T-accounts above, and get it right: government deficit spending adds net worth to the private sector, and commercial banks use reserves to buy bonds issued to ‘’fund’’ deficits due to our accounting standards.

The government doesn’t need money to spend money.

The government creates money for the private sector when it goes for deficit spending.

Does this mean the government can proceed with limitless deficit spending without consequences?

No.

The limits to government deficit and debt are inflation and real resources.

Excessive deficit spending creates too much money for the private sector, and if the supply of labor and real resources can’t expand rapidly enough we get sharp bouts of inflation.

This is exactly what happened after the US spent $5 trillion (!) in 2020-2021, and inflation ran hot after.

The main point is that government deficit spending is not bad per se – actually, it’s the obsession with zero deficits and ‘’paying off government debt’’ which is quite toxic.

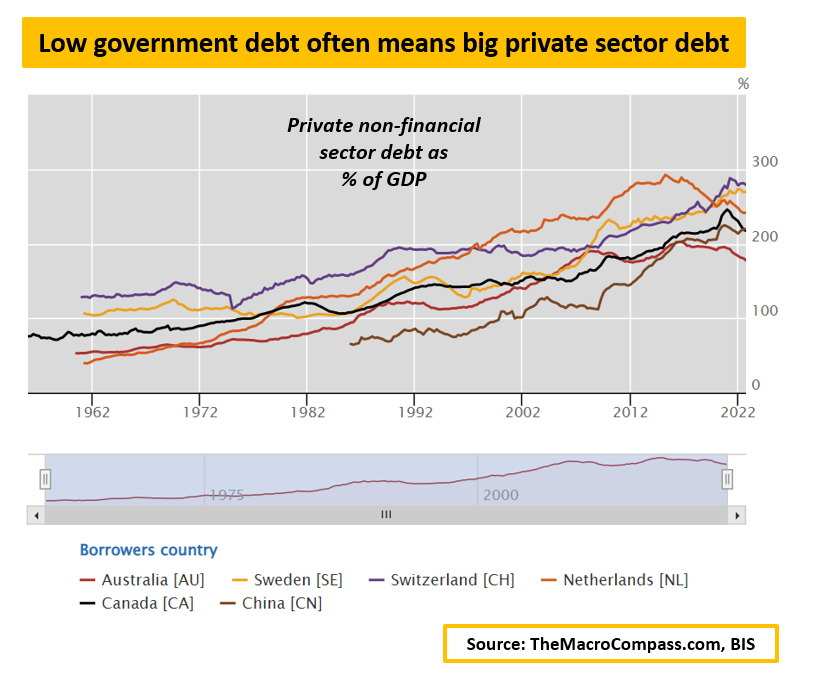

To close this educational piece, let’s play a short game: pick any government with limited debt and very conservative fiscal policies – what came to mind?

Switzerland, Sweden, Canada, the Netherlands, Australia or even China with low public debt levels?

Well, their obsession with no deficit spending and low government debt levels led to large levels of private sector debt – all these ‘’virtuous’’ countries run 200-300% private sector debt as % of GDP.

Private Non-Financial Sector Debt as a Percent of GDP

Private Non-Financial Sector Debt as a Percent of GDP

Private sector debt is inherently more unstable than government debt.

That’s because the private sector doesn’t print money, but it needs real cash flows to finance their big debt burdens – and when a recession hits, these cash flows disappear rapidly leading to de-leveraging and economic instability.

All in all, these are the main takeaways:

- The government doesn’t need money to spend money.

- The government creates money for the private sector when it goes for deficit spending.

- This doesn’t mean there are no limits to deficits: excessive deficit spending creates too much money for the private sector, and if the supply of labor and real resources can’t expand rapidly enough we get sharp bouts of inflation like in 2022.

- But the obsession with no deficits and low government debt is much more toxic, as it leads to high levels of private debt and more financial instability.

***

If you have enjoyed this piece, consider joining The Macro Compass premium platform. The best investment you can make is in your own macro education, and TMC is trusted by thousands of worldwide investors to deliver unique and actionable macro insights every week.