The Ferruccio Lamborghini Stock Market

2023.03.02 14:25

One of my favorite pastimes, when I have a little free time, is reading books and watching movies about extraordinary individuals who overcame significant obstacles to ascend to greatness.

In recent weeks, I rented a movie on Amazon Prime called “Lamborghini: The Man Behind the Legend” (2022) – which chronicled the rise of a man who grew up poor in a farming family, and after the war, took his mechanical skills to build a tractor company from scratch. He put it all on the line and achieved great success – which afforded him the opportunity to own and drive many Ferraris.

After some time, he met with Enzo Ferrari and noted to him that he loved the cars, but the clutch and transmission were weak and if they could in some way partner together, Ferruccio would build him an indestructible transmission and clutch so that it would retain its status as the greatest car in the world. Enzo insulted Ferruccio and told him to stick to tractors. This was a mistake.

With Enzo’s cavalier language, he birthed a formidable competitor in Ferruccio. At the Geneva auto show in 1964 – where Ferruccio launched the Lamborghini GT – all of the attention was shifted away from Ferrari (NYSE:) and to the new kid on the block. Ferruccio declared to the fawning press, “you own a Ferrari when you want to BE somebody, but you own a Lamborghini if you already ARE somebody.”

It was a gut punch to Enzo, and to further rub salt in the wound during the unveiling of the green GT, Ferruccio had his assistant deliver the header image above (Bull and Horse) to Enzo. This was a clear message he had won the battle and that Enzo made a colossal mistake with his dismissiveness just a few years earlier. I’ll leave it to your interpretation what the drawing above implied, but the theme is crystal clear…

Now I don’t know whether Ferruccio was correct in his assertions of the superiority of his product or the people who drive it, but one thing was clear, had Enzo operated with a bit more tact and diplomacy – a farmer turned tractor manufacturer would have never given him a run for his money. Nor would Lamborghini have followed up on the success of the GT just over a year later (and presented at the Geneva auto show in 1966) with what some consider the first supercar and most beautiful car of all time…the Lamborghini Muira:

So what does this have to do with the stock market?

The header image above depicts a scenario of what the Stock Market Bulls may have a chance to do to the Bears (swap out the Ferrari horse) in coming months…

Last night, I discussed our outlook and the reasons why we hold this view with Phil Yinn on CGTN America. There is some new content here (at the end) so you don’t want to miss it. Thanks to Phil and Ryan Gallagher for having me on:

First let’s debunk a few myths:

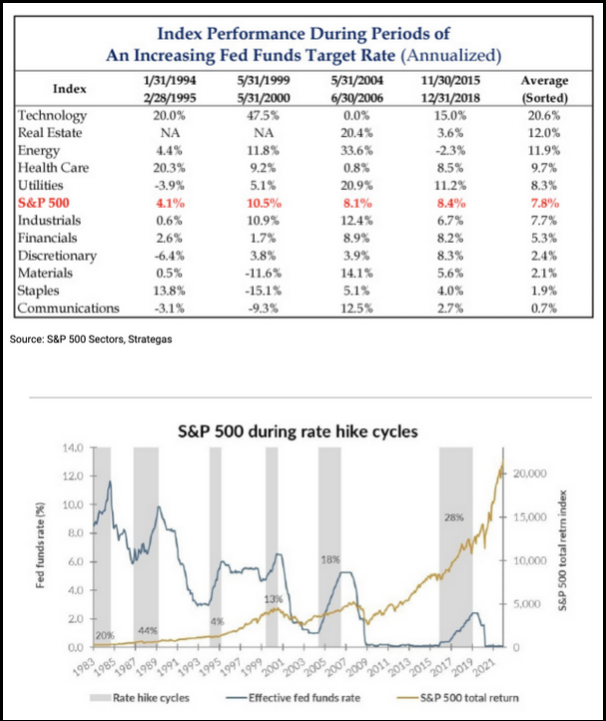

1) Stocks don’t go up during tightening cycles “aka don’t fight the Fed.”

Rate Hike Cycles

Source: Strategas via Seth Golden (Finom)

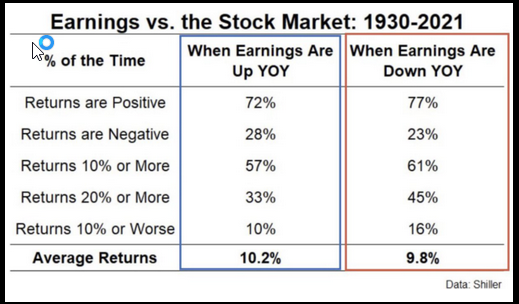

2) The stock market MUST go down when earnings are coming down:

Earnings – Up/Down YOY

Source: Shiller via Seth Golden (Finom)

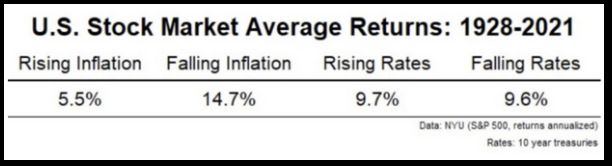

3) The stock market can’t rally with high inflation:

US Stock Market Avg Returns

Source: NYU via Seth Golden (Finom)

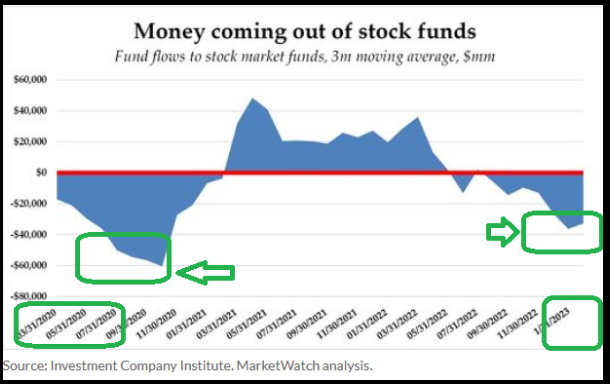

Here’s what the crowd is currently doing

1) They are coming out of stocks at a pace not seen since the Spring of 2020. To jog your memory, this was right after the first rally off the lows. All of the “big name” commentators were declaring that we were going to go back and take out the lows. Sound familiar?

Money coming out of stock funds

SPY SPDR S&P 500 ETF NYSE

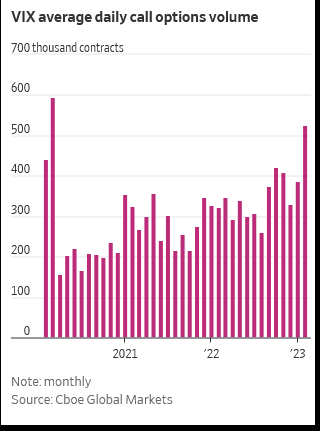

2) Everyone is buying call options. This is the highest VIX call buying since the LOW in the stock market in March 2020:

VIX average daily call options volume

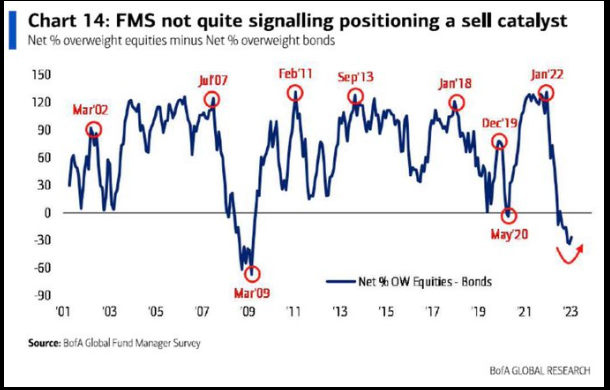

3) Everyone is piling into bonds and out of stocks at a pace not seen since the March 2020 Pandemic Lows and March 2009 GHC Lows. These were the times to buy equities, not bonds:

FMS not quite signalling positioning a sell catalyst

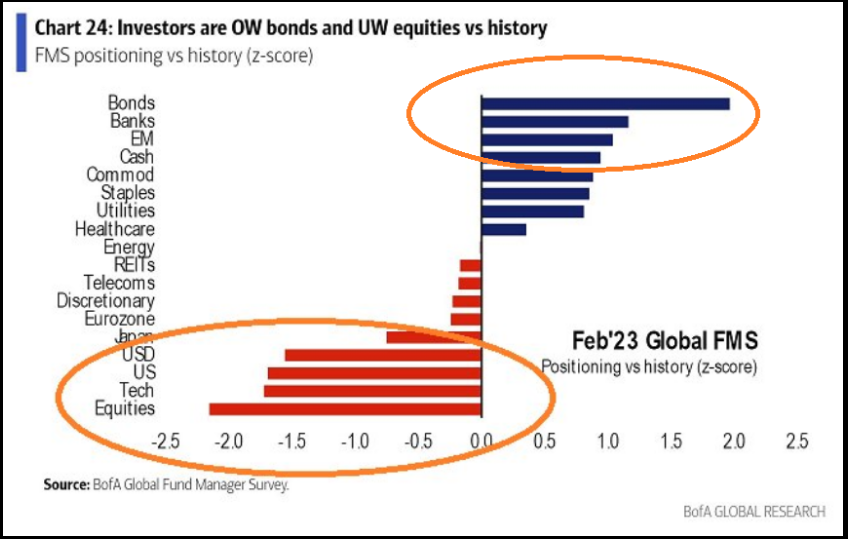

Investors are OW bonds and UW equities vs history

Investors are OW bonds and UW equities vs history

If you agree with the herd, try being like George Costanza and “do the opposite:”

What’s next?

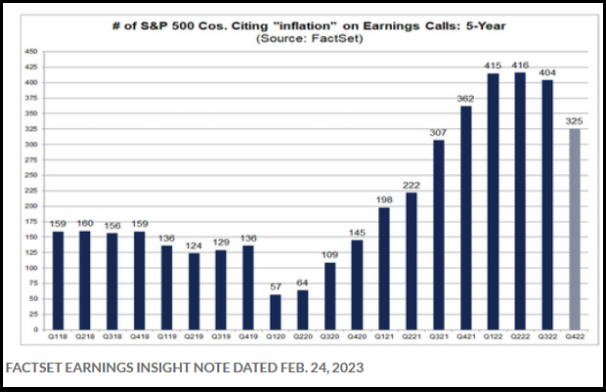

1) Inflation will continue to come down over time:

Inflation will continue to come down over time

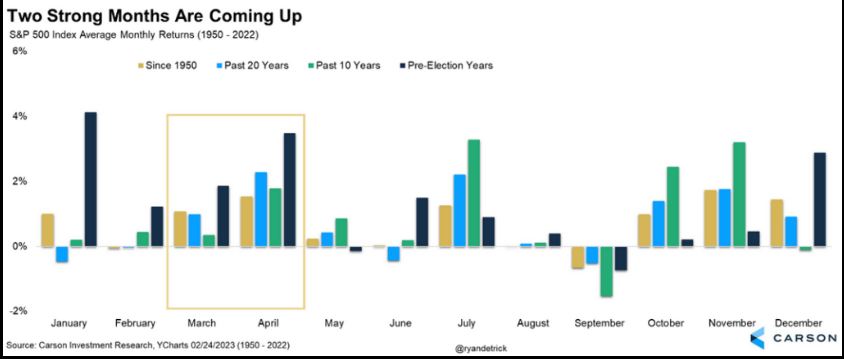

2) Seasonality will improve following February weakness:

Seasonality will improve following February weakness

Seasonality will improve following February weakness

Source: Ryan Detrick (Carson Group)

3) Global growth will exceed expectations as the second largest economy (China) comes out of a three year stop and start lockdown. This is the “white swan” that no one is positioned for. A rising to tide lifts all boats. Last night was a preview of coming attractions when China printed a composite PMI (which measures the economic activity in manufacturing and services) that was GREATER THAN PRE-PANDEMIC LEVELS OF ACTIVITY:

Global growth will exceed expectations

So the next time you think about selling high quality stocks to buy bonds, ask yourself, “do I want to be the Bull (in the picture) or the Horse’s …?”

Now onto the shorter term view for the General Market:

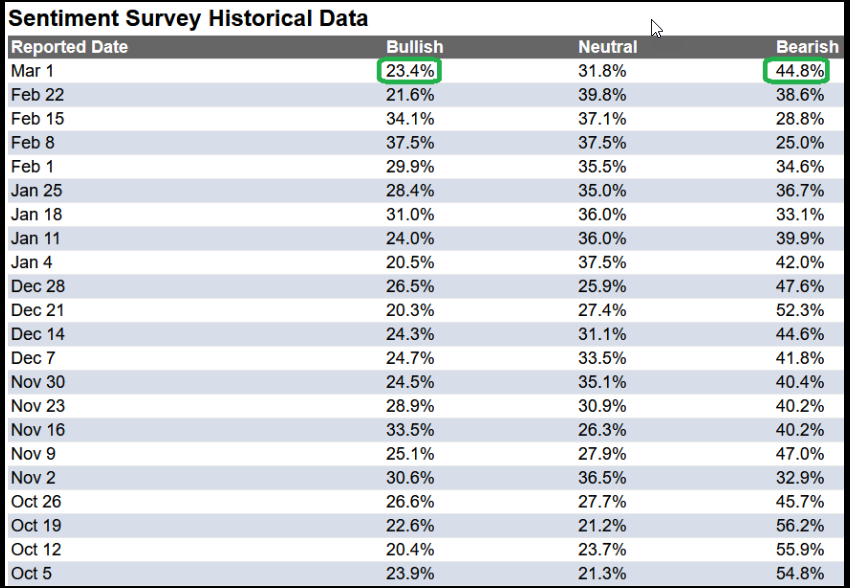

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 23.4% from 21.6% the previous week. Bearish Percent jumped 44.8% from 38.6%. Retail traders/investors are shaking in their boots…

Sentiment Survey Historical Data

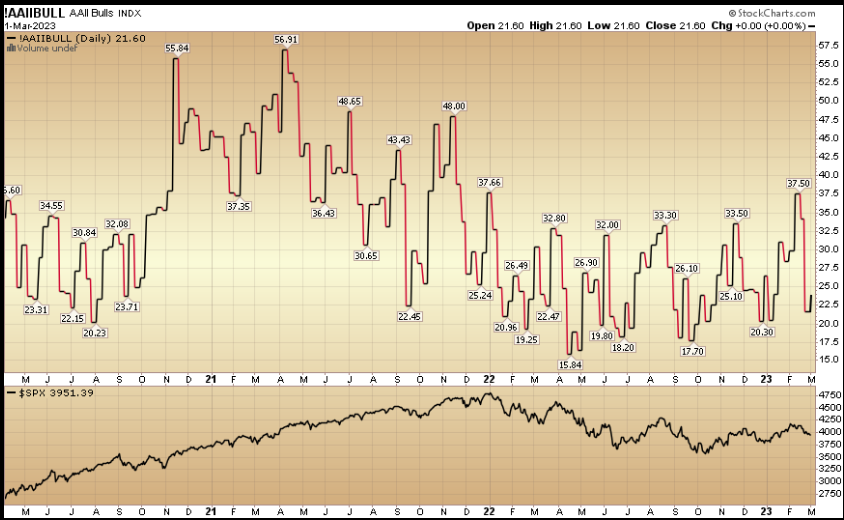

Sentiment Survey Historical Data !AAIIBULL AAII Bulls INDX

!AAIIBULL AAII Bulls INDX

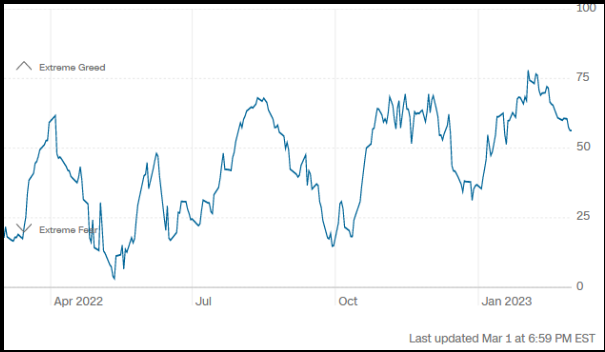

The CNN “Fear and Greed” fell from 63 last week to 56 this week. Sentiment is neutral. You can learn how this indicator is calculated and how it works here: (Video Explanation)

Fear & Greed Index

Extreme Greed

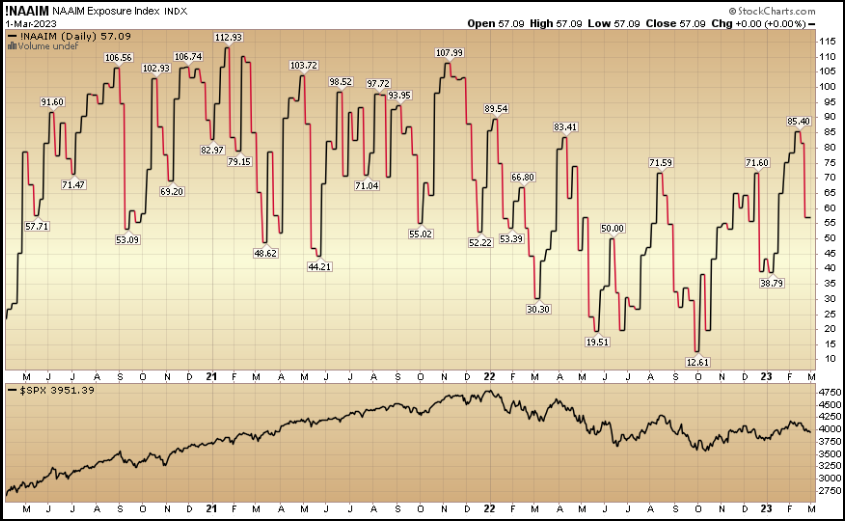

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 57.09% this week from 81.43% equity exposure last week.

!NAAIM NAAIM Exposure Index INDX

!NAAIM NAAIM Exposure Index INDX

***

This content was originally published on Hedgefundtips.com.