The Deflation Dilemma: Unmasking the Silent Threat Looming Over U.S. Economy

2023.05.26 03:38

Over the last two years, has been a big threat.

And for good reason.

Post-COVID, all three levers – fiscal, monetary, and supply-side – were aggressively pushing prices higher.

Governments ran massive deficits and spending programs to provide stimulus. Central banks pumped a tidal wave of liquidity into financial sectors. And supply chains were essentially locked down.

But that was yesterday’s problem.

Now, deflation – which is often overshadowed by inflation – is becoming the real threat. Especially in such a credit-driven global economy.

And while deflation – aka the persistent decline in general price levels – may seem appealing at first (rightfully so). Its implications reveal the very serious dangers it poses to financial stability, growth, and household wealth.

So let’s examine the deflationary trend and why it’s increasing systemic fragility and shouldn’t be underestimated going forward. . .

Deflation Is Coming: Price Pressures Continue Amplifying Across The World

After 2021-2022’s inflation boom – prices have started cooling at a fast pace.

Many supply issues have returned to normalcy (somewhat). Central banks are tightening aggressively (chocking off credit). And governments have scaled back deficits and stimulus spending.

Thus the three self-reinforcing inflationary loops have reversed over the last year.

Or, simply put, what drove prices up now drives prices down (I wrote an article highlighting these deflationary drivers back in January – you can read it here).

But let’s take a closer look at the price indexes. . .

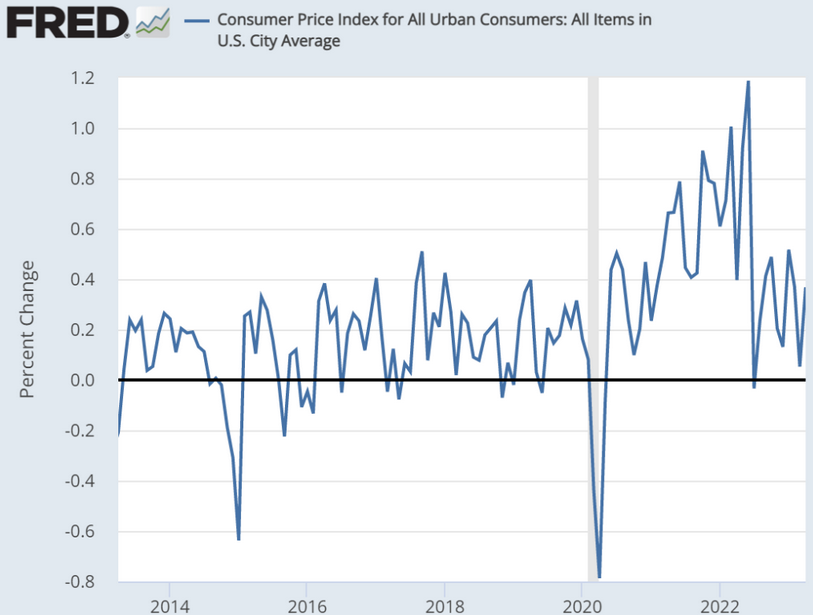

1. The Fed’s consumer price index (CPI) has seen a sharp decline in its month-over-month rate of change (aka momentum) over the last year. Which is now roughly back to its pre-covid trend.

CPI for All Urban Consumers

CPI for All Urban Consumers

It’s important to note two things.

First – the Fed’s CPI data is a lagging indicator (aka backward-looking, in hindsight). Thus they only show us what’s happened already, not what’s going to – although this can show a trend.

And second – that the Fed’s CPI has two aspects – headline inflation (which includes food and energy) and inflation (which excludes food and energy).

I prefer to look at the headline because food and energy make up a significant share of household expenditures.

For instance, BankRate noted in 2021 that average household expenditures were $67,000 – with transportation expenditures at $11,000 and food at $8,300.

That’s roughly 30% of the average household’s spending (and I’m aware that not all of the transportation budget is for gasoline or energy).

But there are also home power-utility costs that require energy – and this shows a troubling trend.

Nearly 20 million households are behind on utility bills (up 2.4 million year-over-year and now a total of $20 billion in unpaid bills). Indicating households have been squeezed amid higher food and energy inflation.

Thus I prefer to look at the Fed’s headline inflation for these reasons.

And its momentum continues fading lower.

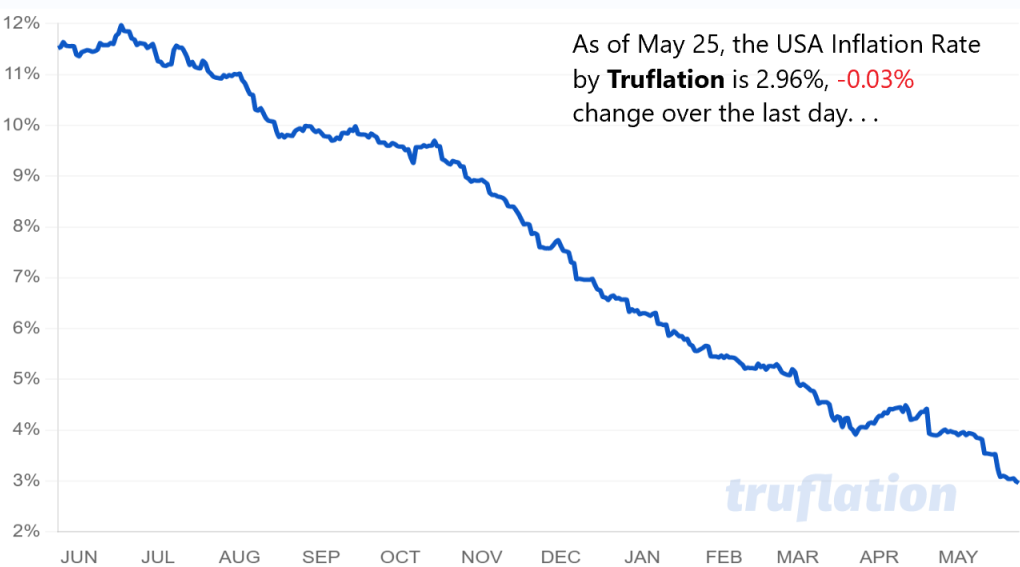

2. The U.S. Truflation Index – an independent and real-time adjusted price gauge – continues sinking. Now at just 2.96% as of May 25th.

To give you some context: Truflation was created by a decentralized finance (DeFi) firm to track inflation data independent from governments.

The index calculates 10 million data points and updates its price basket daily with a transparent methodology – making it more of a leading indicator (to forecast future economic activity) compared to the Fed’s CPI.

The Truflation Index has shown steady deflationary pressures over the last year. And it’s only amplified since April 2023.

And for any doubters of this, I’d like to point out that the Truflation Index showed inflation nearly 3% higher – in year-over-year terms – than the Fed’s CPI last June.

Meaning while the Fed showed headline CPI at 8.9% in June 2022, Truflation was 12%.

Either way, it continues to show deflation mounting.

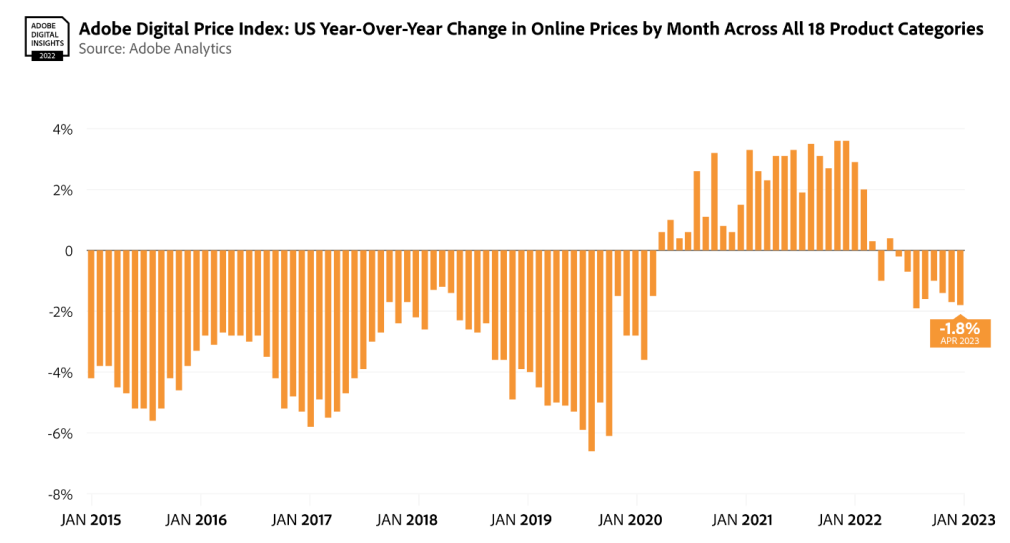

3. The Adobe Digital Price Index (ADPI) – meaning prices of goods sold online – fell negative 1.8% year-over-year in April. Marking its 8th straight month in decline.

Adobe Digital Price Index

Adobe Digital Price Index

The ADPI is a massive price index for online goods. Analyzing one trillion visits to retail sites and more than 100 million items across 18 categories to find price changes.

And in a world where e-commerce is a $6 trillion market, and households buy more than ever online – this is an important (yet underrated) price index.

In fact, this index was developed with the help of economist Austen Goolsbee – before he became the president of the Chicago Federal Reserve Bank.

And according to the ADPI, in April, eleven-of-the-18 categories tracked saw prices decrease from the previous year.

Appliances dropped 7.1%, which is the largest decline in data going back to 2014.

And the declines were even sharper for electronics, computers, and flowers – all dropping -11.6%, -15.4%, and -27%, respectively.

There was one notable exception: the grocery category, which saw a 9.3% increase from the previous year. But it’s important to note the price increases have slowed for seven straight months – thus, they’re declining (albeit slower than the rest).

Regardless, the prices for online goods continue drifting lower.

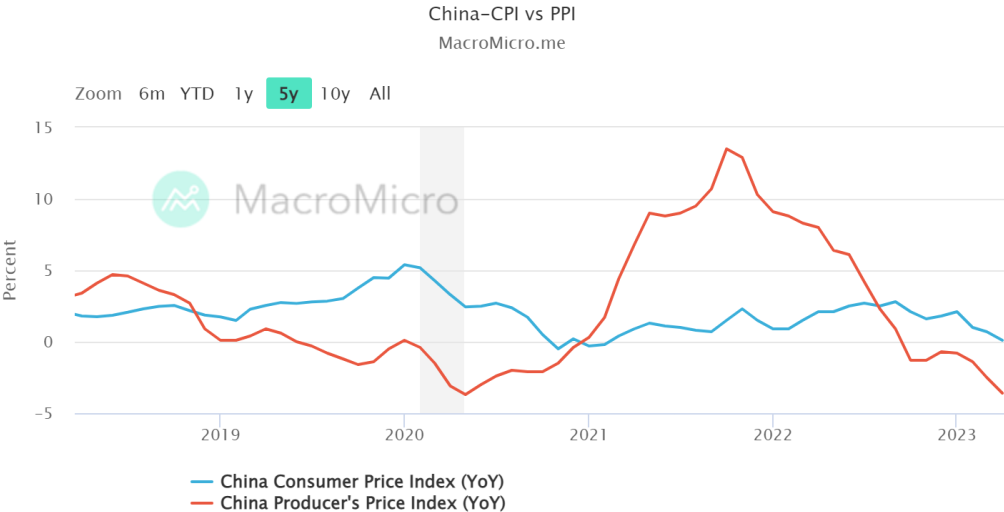

4. China is sliding back deeper into deflation for both CPI and PPI (producer prices) – even six months after reopening.

China – the second largest economy in the world – ended its COVID lockdowns in mid-December 2022. And many pundits expected it to unleash a ‘wave of inflation’ as the consumer was unleashed.

But – as I’ve warned many times before – China has a very anemic domestic economy. And was more likely to slip further into deflation rather than inflation.

Well, six months later, that’s exactly what happened. . .

China’s consumer inflation has declined steadily – and was just 0.10% in April in year-over-year terms (down -0.10% month-over-month – the third straight month negative).

To put this into context, it was up 0.80% month-over-month in January.

Meanwhile, China’s – the producer price index – fell -3.6% in April year-over-year, its largest annual drop since early-2020. And has grown increasingly negative since October 2022.

What’s more important is that since China is running ever-larger current account surpluses (indicating weak domestic imports and more exports), thus they’re exporting this deflation abroad.

And I expect this to continue.

Why Deflation Is The Growing Threat In A Credit Based World

Now, while falling prices may sound like a good thing (and I believe it is) – it does come at a steep cost.

Remember: there are always two sides to a coin.

Inflation benefits some (fixed debtors, corporations, commodity producers, etc.). And deflation benefits some (consumers, savers, lenders, etc).

The problem here is that in a credit-based system – where financial products, asset values, and debt are significantly larger than the global economy – and deflation can lead to serious issues that become amplifying feedback loops.

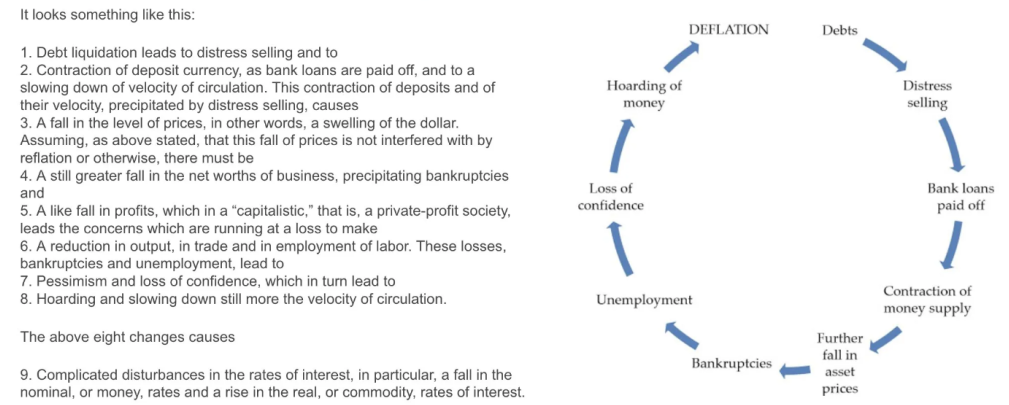

The early 1900’s economist – Irving Fisher – called this phenomenon ‘debt-deflation’. . .

For context, Fisher wrote about debt deflation after he witnessed the debt-fueled implosion that triggered the Great Depression. He theorized that depressions are due to the overall level of debt rising relative to falling asset prices and consumption. Thus fueling a feedback loop into further asset declines, rising unemployment, higher debt burdens, and on and on.

Here are some of the troubling issues with any deflation going forward. . .

1. The Spiral of Decreased Demand – which causes a vicious cycle of sinking consumer spending.

When prices fall, consumers tend to delay purchases in anticipation of even lower prices in the future. This delay in spending can lead to reduced demand for goods and services, negatively impacting businesses and causing layoffs.

And as unemployment rises, consumer confidence weakens further, perpetuating the downward spiral. The resulting slump in aggregate demand hampers economic growth and can lead to a prolonged recession or depression.

2. Debt Deflation – which as mentioned above – amplifies the burden of debt on both individuals and businesses.

In a deflationary environment, the real value of debt increases as prices decline. This means that borrowers must dedicate a larger portion of their income to debt repayment, leaving less money available for spending and investment.

And as debt becomes increasingly burdensome, defaults rise, leading to a contraction in credit availability and further dampening economic activity.

The debt deflation spiral can have severe consequences, as witnessed during the 1930s Great Depression,1991 in Japan, and the 2008 global financial crisis.

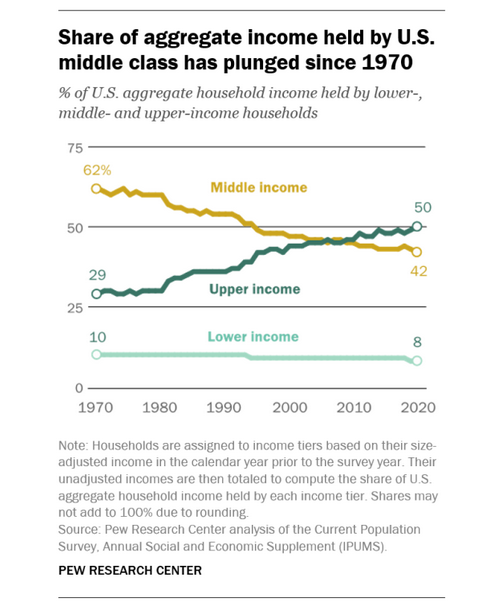

3. Falling wages and widening income inequality – deflationary pressures can lead to wage deflation, as businesses strive to cut costs amidst shrinking revenues.

The burden of deflation falls disproportionately on workers and households that are net-debtors (essentially the bottom 90%).

Falling wages not only reduce disposable income for individuals but also exacerbates income inequality.

And as Marriner Eccles – Franklin D. Roosevelt’s Fed Chairman – masterfully pointed out years later about the Great Depression,

“As mass production has to be accompanied by mass consumption, mass consumption, in turn, implies a distribution of wealth … to provide men with buying power. . . Instead of achieving that kind of distribution, a giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth. . . The other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped. . . “

I’ve written about this growing wealth gap and its implication in squeezing the bottom 90% into a ‘debt trap’ as the wealthy save more ().

But as falling wages proliferate from deflation – this gap will only widen until a debt-deleveraging crisis leads to a rebalancing.

And – according to Pew Research – the share of middle-to-lower-class incomes has already fallen steadily since the 1970s while the upper-income bracket rose sharply. Showing us how wealth inequality has widened.

Share held by US Households

It’s no coincidence then that more and more middle-lower class households (which are the mass consumers) depend on ever-more debt to subsidize spending.

To put this into perspective – according to the New York Fed – household debt reached $17.05 trillion in Q1-2023. A record high.

But as we learned from the economist – Hyman Minsky – private debt can’t rise forever.

Eventually, debt burdens will exceed income capacity, leading to deleveraging (selling assets) and reduced spending. Reinforcing further deflation from the drop in demand.

As Eccles noted, “When their [middle class] credit ran out, the game stopped. . .”

4. Monetary policy limitations during deflation – historically, central banks play a crucial role in managing inflation and stabilizing economies by tinkering with interest rates.

For instance, if inflation is too low, they stimulate (cut rates). And vice versa when inflation is too high.

But combating deflation presents unique challenges since interest rates approach zero amid declining demand (if credit demand declines, rates will fall).

Thus central banks face limited room to use their monetary tools.

Because once interest rates reach the zero-lower bound (too much supply of credit without demand), further rate cuts become ineffective in stimulating demand.

This is called a ‘liquidity trap’ – aka when further central bank easing does nothing as reserves pile up in banks because of a lack of credit demand and doesn’t flow into the economy (think Japan post-1990 or post-GFC).

Thus a central bank will move towards unconventional measures – like quantitative easing (QE) – which may have limited effectiveness or unintended consequences. Such as fueling asset bubbles, moral hazard, and malinvestment.

In Conclusion

Deflation is often overlooked or dismissed as a benign economic trend. And more generally as a ‘good’ thing.

And while it is in some aspects, it does harbor substantial risks that can cripple economies – especially in such an environment where debt is rampant.

It’s clear that the momentum for inflation has faded. And is now heading toward deflation.

And this poses real systemic issues – as we’ve seen historically.

Now – contrary to many pundits – I’m not an ‘inflationista’ (those betting on persistently higher inflation rates) as I believe that global structural trends are heading towards deflation.

Things like fading demographics, automation, and excessive debts are only some of the deflationary overhangs.

So I expect this trend to continue (all else equal).

There may be spurts of cyclical inflation from fiscal policies (further stimulus) or supply shocks. But the structural trend seems to have a bias toward deflation.

And that will become a problem in a debt-dependent world.