The Bright Side Of Rising Interest Rates

2022.09.16 09:28

[ad_1]

The dark side of rising interest rates is conspicuous near and far, but there’s also a bright side: higher yields, which are a byproduct of risk assets that take a beating in price, which in turn lifts trailing payout rates.

There are caveats, of course, including the elephant in the room: . Earning a higher yield looks good on paper, but at a time of elevated inflation the resulting real (inflation-adjusted) yield may be a bust. That opens the possibility that a higher nominal yield may translate into a lower real yield.

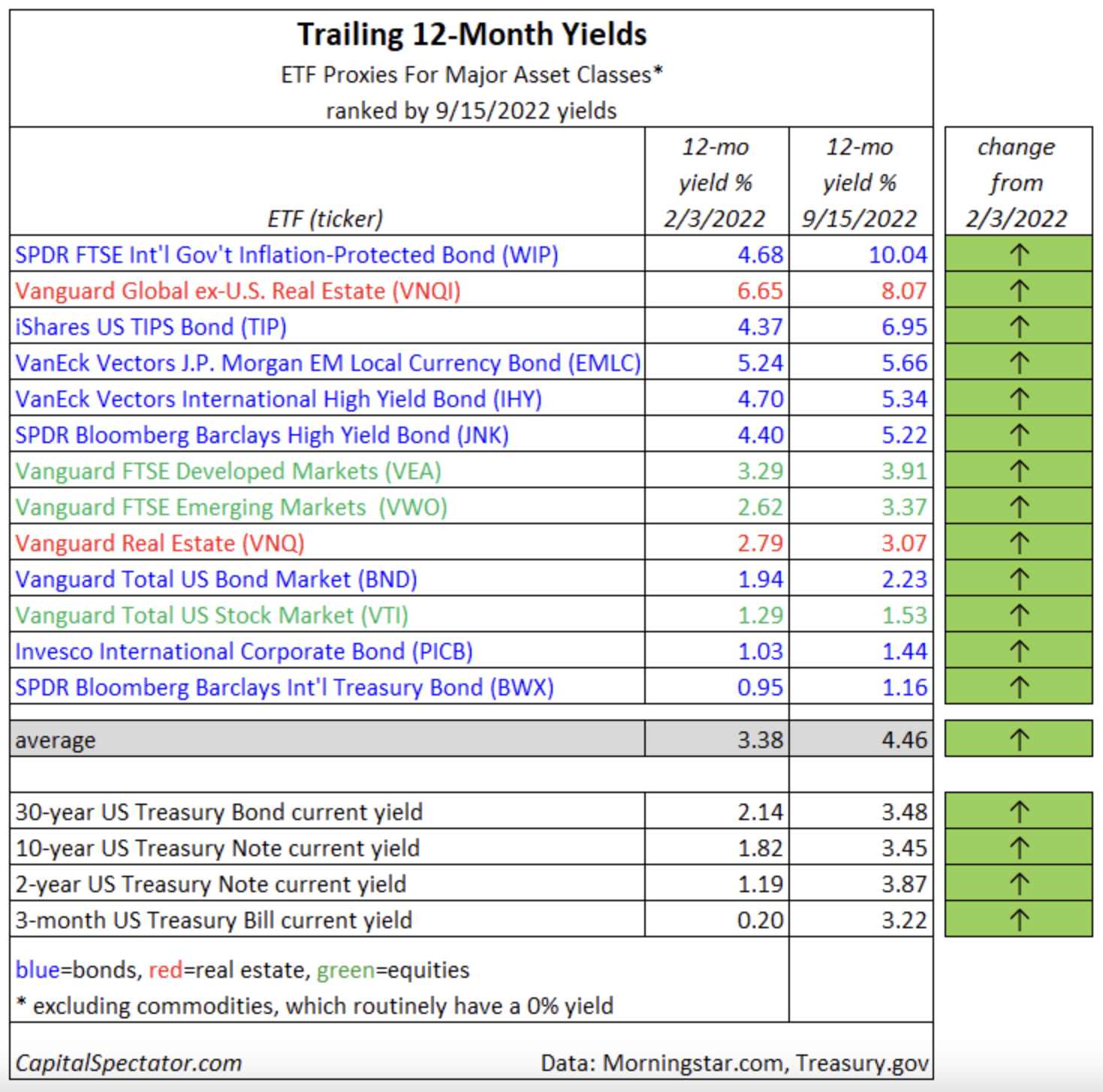

For now, let’s focus on nominal payout rates to get a sense of how global assets stack up, based on a set of ETF proxies representing the major asset classes. Not surprisingly, yields have popped since CapitalSpectator.com’s previous in February 2022. In fact, all of the usual suspects are posting higher—in some cases substantially higher—payouts.

Leading the pack: inflation-protected government bonds ex-US (NYSE:), which posts a 10% trailing 12-month yield, according to Morningstar.com. That’s more than the double its payout in February.

Similar increases in payouts abound. The average of the payout of the major asset classes via ETFs is currently 4.46%, or more than a percentage point higher than the update in February.

In real terms, however, most ETF yields are underwater when compared with US consumer inflation, which continues to run hot—8% on a year-over-year basis through August.

Meanwhile, the usual risks still apply, namely: there are no guarantees that you’ll earn a trailing yield going forward by way of ETFs. Trailing yields are a snapshot in time and indicate payouts received for holding assets in the past. Extrapolating that history into the future is a tricky business for all the usual reasons when it comes to forecasting trends for risk assets. In short, you’ll need to do more homework on specific funds beyond simply reviewing trailing results.

Nonetheless, it’s obvious that payouts are higher and so there’s greater opportunity to earn more. The sweet spot would be: earning a higher yield while inflation peaks. Even if inflation has peaked, it’s unclear how fast it will fall. But the possibility of exploiting volatile markets and changing economic conditions opens the door to earning more, perhaps in real terms, too.

[ad_2]

Source link