Testing Times Ahead for the Global Economy as Credit Impulse Fades

2023.05.30 04:03

I may sound like a broken record here, but in this post-1980s global economy, credit drives everything.

From assets and equities to growth and price pressures.

There are two key reasons for this:

1. Real wages have essentially been flat for 40 years; thus credit is required to subsidize spending (if wages can’t keep up, debt is needed).

2. The hyper-financialization (the process in which institutions, markets, producers, etc. expand credit-based growth) of the global system has exploded on the back of securitization relative to economic growth.

Complex credit products – like CDOs (collateralized debt obligations), MBSs (mortgage-backed securities), ABSs (asset-backed securities), and many more in this alphabet soup – have proliferated through the system.

These products allow institutions to extend massive amounts of credit while – as they believe – lowering risk (creating moral hazard).

And because of these two facts – it’s critical to study credit flows to gauge the economic and asset price momentum.

Remember, credit is essentially the lifeblood that drives economic activity.

So, what are credit flows telling us?

Well, it looks rather pessimistic.

And this is why I believe the global economy is growing ever more fragile as credit tightens everywhere. Leading to slower growth, asset price volatility, and deflation.

Or said another way, as the credit tap turns off, so does everything else at the margin.

Let’s take a look at some of these credit flow indicators. . .

Global Credit Impulses: Fading Fast And Hard

Now, a key way to look at aggregate credit flows is credit-impulse measures.

“What exactly is credit impulse?”

Putting it simply, it’s a term coined by former Deutsche Bank economist – Michael Biggs – that gauges the change (flow) in new credit issued as a percentage of growth (GDP).

And it has a great track record as a lead for economic momentum.

For instance – according to ARP Investments – the 6-month credit impulse has been by far the best historical indicator for growth.

Meaning when the credit impulse rises, so does growth. And when it goes down, growth follows lower.

So, how do credit impulses currently look?

Well, they’re in decline for the three largest economies.

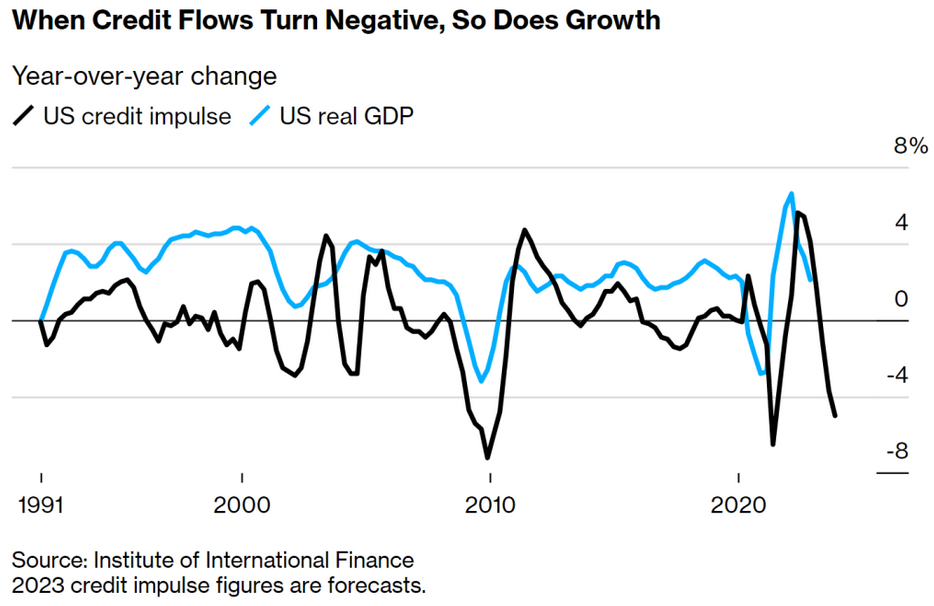

1. In the U.S., credit impulse – according to Bloomberg – is forecasted to sink deeper negative in year-over-year terms over 2023 as banks further tighten lending.

US Credit Impulse Figures

US Credit Impulse Figures

We’ve already seen banks tighten lending standards dramatically over the last year across all major loan categories. From business and commercial real estate to auto and consumer loans.

Meanwhile, the net percentage of banks reporting increased loan demand has dropped negatively across all these categories as well (I wrote more on this recently – you can read here).

And this trend should continue.

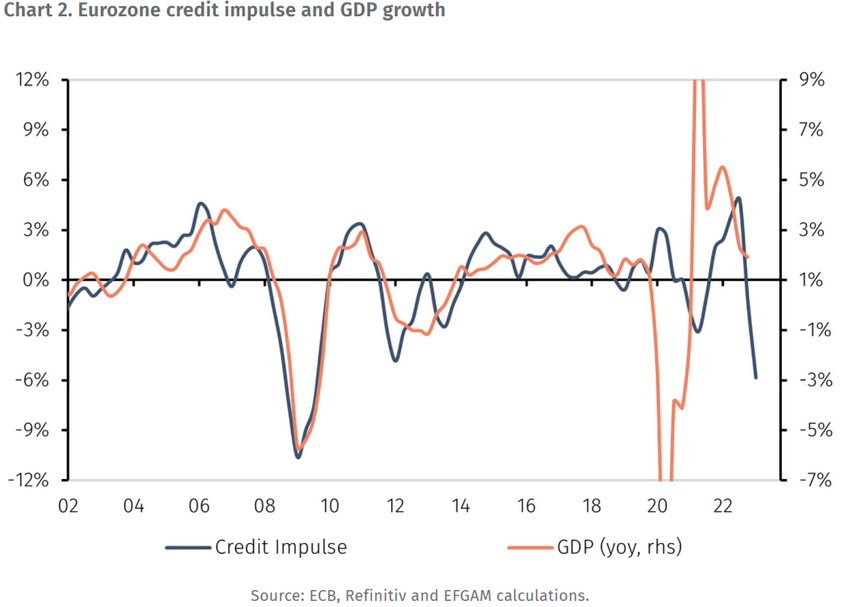

2. The Eurozone credit impulse – according to EFG International – has plunged negative 6% as of Q1-2023. Indicating very anemic credit flows to the private sector.

Eurozone Credit Impulse and GDP Growth

Eurozone Credit Impulse and GDP Growth

It’s no surprise then that Germany – the Eurozone’s largest economy – fell into recession last week ( fell -0.3% in the first three months of the year, following a -0.5% contraction at the end of 2022).

But the Eurozone as a whole only grew 0.1% in Q1-2023 – and was flat at 0% in Q4-2022.

Meanwhile, we’ve seen loan demand absolutely plunge across the four major Euro economies – France, Italy, Germany, and Spain – as banks tightened credit across the board.

This trend should also continue.

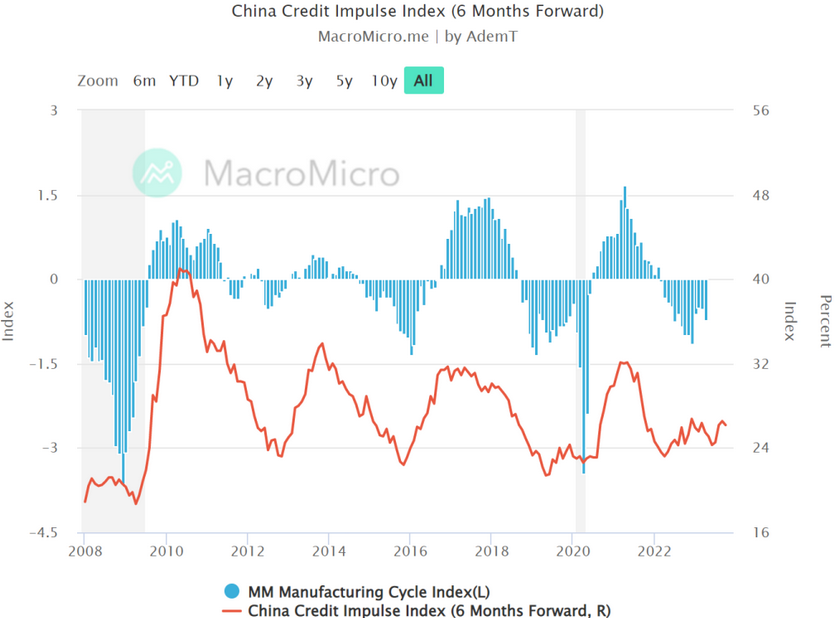

3. China’s credit impulse index (6 months forward) is also very anemic – indicating a weaker manufacturing cycle.

China Credit Impulse Index

China Credit Impulse Index

After China reopened in December-2022, the credit impulse rose briefly. But has since rolled over as China deals with an anemic consumer.

It’s important to note that since 2008, the global economy was heavily carried on the back of Chinese credit (fueling excess demand).

As the chart above shows, when China opened the credit floodgates, growth in manufacturing and the global economy picked up after each major slowdown (like after 2008, the 2011 euro crisis, and the 2015-16 global stagnation).

The problem with this? Well, it’s created a massive debt bubble in China.

For instance, China’s macro-leverage is already at 280%–to GDP – and this doesn’t even factor in local government debt (aka LGFVs). Which is – according to the IMF – estimated at around $9.5 trillion (about 50% of GDP).

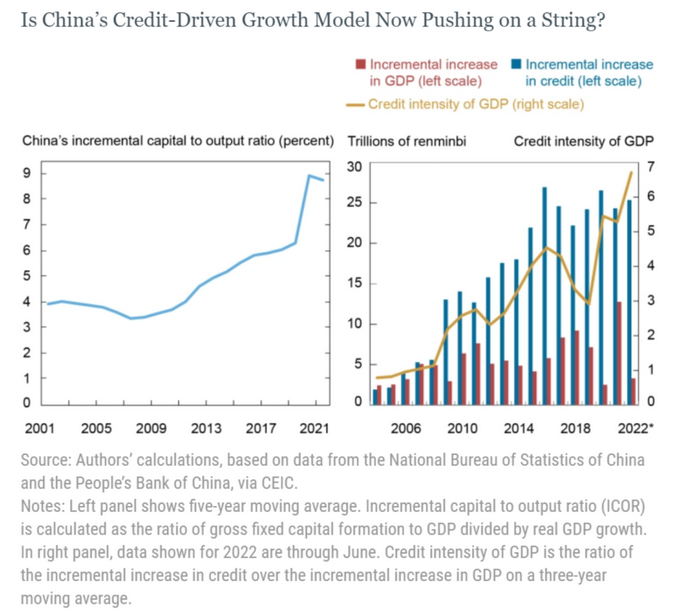

Making matters worse, as I’ve written about before, China has hit the law of diminishing returns.

To put this into perspective – China’s incremental capital output ratio (ICOR) has soared nearly 300% over the last decade in the face of ever-less growth.

Meaning they must spend much more and extend huge amounts of credit for half the growth.

China Capital to Output Ratio

China Capital to Output Ratio

And since the law of diminishing returns is inescapable, trying to pump ever more credit into the system won’t really work anymore. And will only add to excess speculation, rising debt, and malinvestment (reinforcing their current situation further).

Thus even as the Chinese government tries to boost its post-lockdown economy, further credit will likely yield less and less and only add to instability.

Either way, I expect China’s credit impulse to remain rather anemic.

So – it’s clear that credit flows are eroding globally (at least where it matters) and will most likely remain a headwind for growth going forward.

But there are also other issues in credit, showing us that the flow of liquidity is drying up. . .

The Chicago Fed’s Financial Conditions Index Is Flashing A Warning Sign

The Chicago Fed’s NFCI (national financial conditions index) is made up of over 105 different indicators that track U.S. financial activity – like what’s going on in money, debt, equity markets – and even the “shadow banking” system.

Put this all together, and you get a relatively easy way of measuring market liquidity.

But let’s break it down further. . .

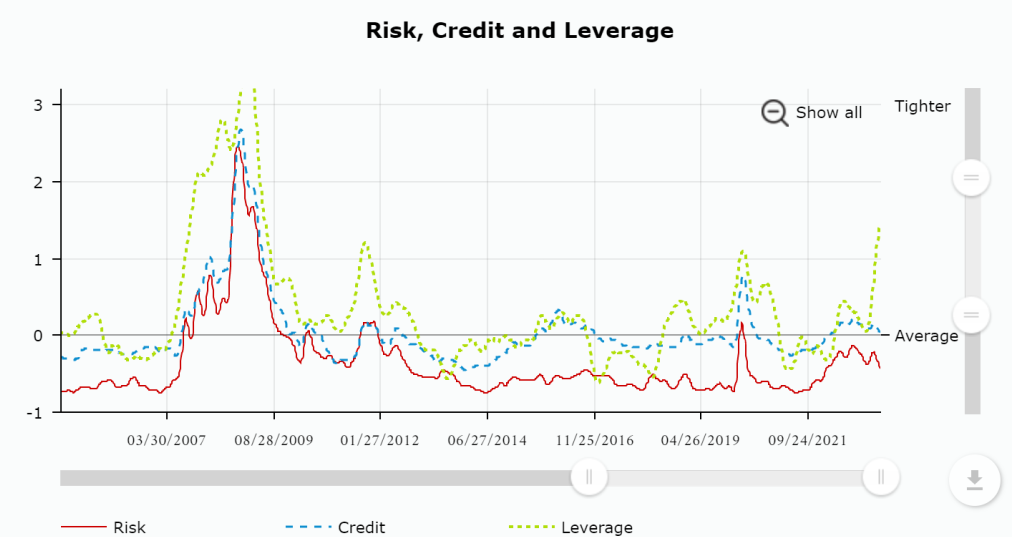

The NFCI has three major sub-indexes:

1. The Risk Subindex – capturing volatility and funding risk in the financial sector.

2. The Credit Subindex – measuring credit conditions.

3. And the Leverage Subindex – measuring debt and equity.

And while all three are important to watch – the Leverage Sub-index is what I believe is the most critical.

For starters – it’s a ‘leading indicator’ (aka an economic factor that changes before the rest of the economy begins to go in a particular direction).

And secondly – since we live in a credit-driven world – leverage is what drives the boom-and-bust cycle.

For instance, when leverage is cheap (low rates and lower credit standards), the private sector has easier access to debt. And thus more marginal spending/investing capacity (the boom phase).

But when leverage is expensive (higher rates and tighter credit conditions), the private sector borrows less to consume/invest. And may often liquidate riskier assets to pay back debts, pushing prices lower (the bust phase).

So – what can we learn from this key sub-index today?

Well – as of mid-May 2023 – it shows us that leverage has tightened significantly over the last few months. And back to its highest level since the 2008 financial crisis. . .

Risk, Credit and Leverage

Risk, Credit and Leverage

Keep in mind that the NFCI reads inversely – meaning any reading above zero signals tightening monetary conditions (tightening liquidity). And anything below zero signals easing monetary conditions (flush with liquidity).

This indicates that the cost of leverage has become much more expensive. And if history means anything (I believe it does), it signals further downside ahead for the economy and financial system.

To put this into perspective – there’s already a massive wall of corporate debt maturing over the next 34 months (estimated at around $6.51 trillion – which is 30% of total corporate debt). And most of it’s held by companies with a BBB-credit rating – which is just one downgrade away from ending up in the junk category.

And there’s a tidal wave of commercial real estate debt – specifically for offices – that continues to grow extremely unstable with each passing day.

These areas will most likely increase stress in the financial system in the coming months.

In Conclusion

The overall erosion of credit impulses globally suggests a headwind for future growth.

And since credit is the lifeblood in our hyper-financialized and indebted global economy, it’s crucial to closely monitor these credit flows.

And as the Federal Reserve and major central banks continue tightening (shrinking their balance sheets), it will only aggravate this trend by increasing fragility in the economy and financial system.

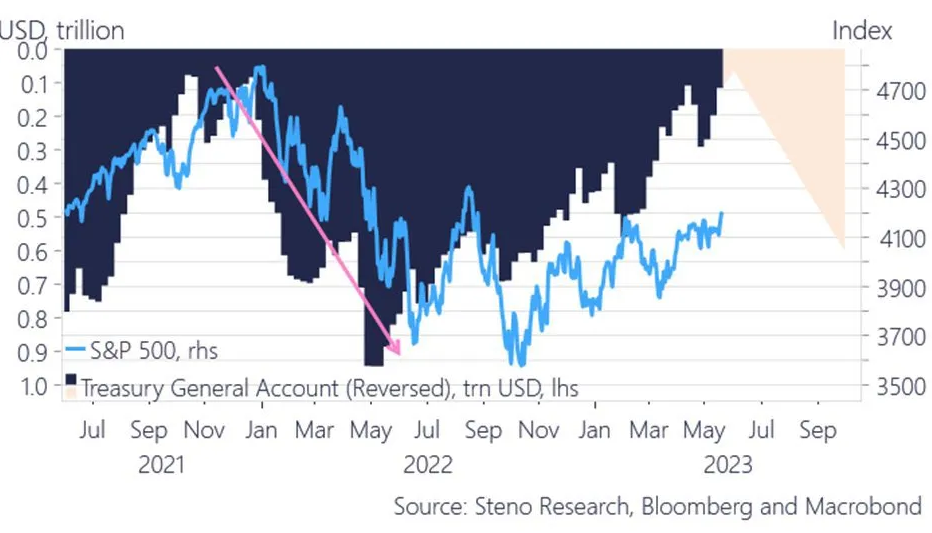

Making matters worse for global credit and liquidity, the U.S. treasury just passed a deal to raise the debt ceiling. And if passed, it comes with two drags.

First: – as the Treasury refills its TGA (expected to be over $600 billion by the end of June), it will soak up a huge amount of liquidity.

Remember: when the Treasury issues debt, it’s taking in cash.

And this is a huge amount to be sucked out of the financial system at a time when U.S. bank reserves are already down –25% year-over-year and global liquidity has plunged.

To put this into perspective – as shown by Andreas Steno Larsen – when the TGA refills its coffers, it tends to negatively affect equities (which makes sense as liquidity tightens).

And second: the debt-ceiling deal came with federal spending caps, adding to the growing downside.

Keep in mind that the fiscal side is one of the two major liquidity spigots (the other being the monetary side).

Why?

Because of the ‘fiscal multiplier’ – aka the effect that increases in fiscal spending will have on a nation’s economic output or GDP.

Thus when the Treasury cuts back on spending, it means less liquidity in the economy (and vice versa when they spend more).

So with both the Fed tightening and the Treasury reducing spending at the margin, both are amplifying a slowdown.

As Jack Ablin – chief investment officer at Cresset Capital Management – noted, “It’s an important development. It’s been more than a decade since monetary and fiscal policymakers were rowing in the same direction.”

Thus as a macro-speculator, it’s important to gauge what drives momentum.

And currently, things are looking bleak, and the black swans are lurking.