SVB Collapse Is Positive for Industrial Technology

2023.03.20 10:12

The collapse of the Silicon Valley Bank rattled the markets, but the consequences are yet to be felt. In this report, we dive deeper into why we believe this is a systematic problem and why it creates a positive setup for industrial technology.

Our base case framework for the next five years is very slow economic growth, high inflation, and interest rates (10Y) at ~3.5%. We believe that productivity improvement will be the only way to address inflation on a structural basis. Industrial technology can outperform in this type of environment.

Contents:

- SVB collapse, consequences, and implications for technology

- Role of productivity improvement in addressing inflation

- What we learned from industrial tech earnings – identifying focus areas within our macro framework

Why SVB is a systematic problem

We believe that SVB was not a one-off but a systematic problem that is just starting to trickle across the banking system globally. While the SVB collapse was caused by a unique set of circumstances (i.e., a concentrated depositor base reliant on the VC ecosystem), we believe this was the catalyst, not the underlying problem. Rapid increases in the risk-free rate have created large unrealized losses on the balance sheets of many institutions (including, but not limited to, banks).

While the public equity market was very quick to price in the rapid interest rate increases, with many high-growth stocks down 70% from their peaks by 2Q22, only months after the Fed began tightening, other asset classes were not marked down as quickly even though they are facing the same dynamic. The challenges are not only limited to banks/MBS but include:

- Risky FCF negative private investments marked at a premium to their publicly traded comps

- Potential bankruptcies from companies that have maturities coming due in the next two years, needing to replace free money with debt at prevailing market rates (if that is even an option)

- Auto loans issued at ~1% interest rate on car values above MSRP

- Corporate loans to risky (FCF negative) companies with lower interest rates than the risk-free rate

- Convertible debt that yields ~0% interest with way out-of-the-money options

- Governments outside of the US that are reliant on borrowing (e.g., Japan)

The consequences have started to emerge over the past week: regional banks are under pressure, which will likely lead to more consolidation in the US. European banks are under severe pressure already, resulting in bank rescues (UBS (SIX:) stepping in to take over Credit Suisse (SIX:) almost entirely wiping out equity holders with heavy government guarantees). Likely more to come.

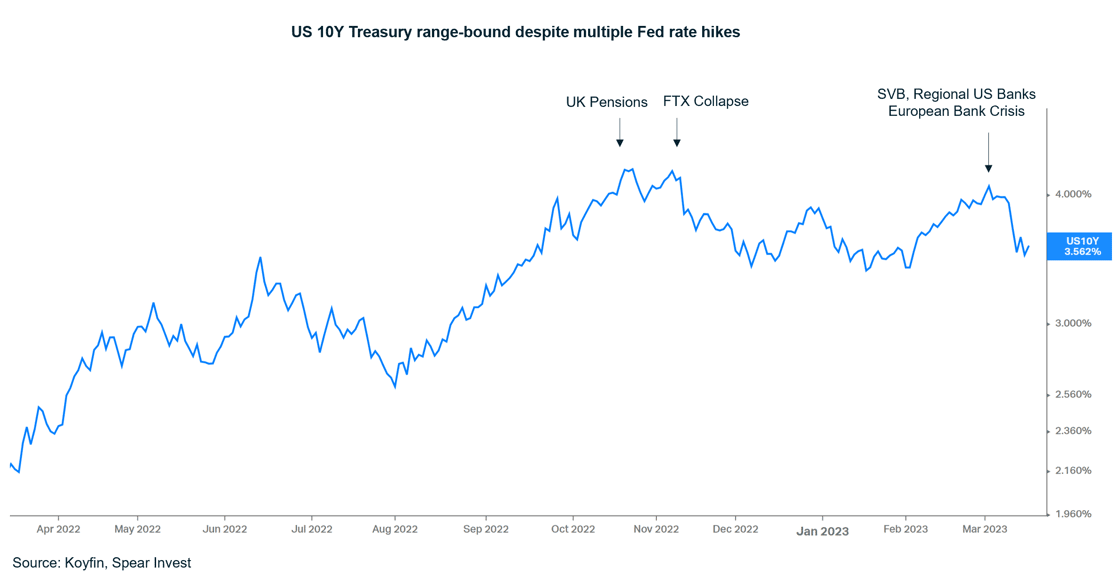

In short, every time the reaches 4%, something breaks. In October/November, we had the UK Pension crisis and the FTX collapse. While the market wrote off those two events as isolated, the banking crisis is very different. We believe that this crisis creates a ceiling for the 10Y, and even if the Fed continues to raise interest rates, it will be hard to push those to the real economy.

Ceiling on interest rate is a significant positive for technology stocks, as they have already taken a significant hit and are pricing in a risk-free rate of >4% (10Y). Moreover, we believe an environment of persistently higher inflation will be positive for industrial/B2B companies as productivity improvement will be key in structurally bringing down inflation.

US 10-Yr Treasury Rates Chart

US 10-Yr Treasury Rates Chart

Tighter credit = slower growth. We expect liquidity to dry up, and less liquidity generally means slower growth. This creates a tough setup for companies that do not generate cash flow. We believe that small/mid-sized businesses and start-ups could be hardest hit. Conversely, companies that do generate cash flow and can self-fund their growth (both organic and M&A) could get a valuation premium.

It is important to note that this crisis is the reverse of a typical crisis. A typical crisis is usually caused by overcapacity, which is then followed by credit defaults (borrowers unable to meet their obligations), and finally, the government comes to the rescue. In this case, there is no overcapacity, and the borrowers are in decent shape and locked in attractive deals, but the lenders are getting the short end of the stick.

B2B technology and inflation?

Our research suggests that while has cooled off since 2022 levels, bringing it down to the 2% goal will be very difficult. have effectively slowed the economy down, but we are reaching a point where the marginal benefit does not outweigh the costs.

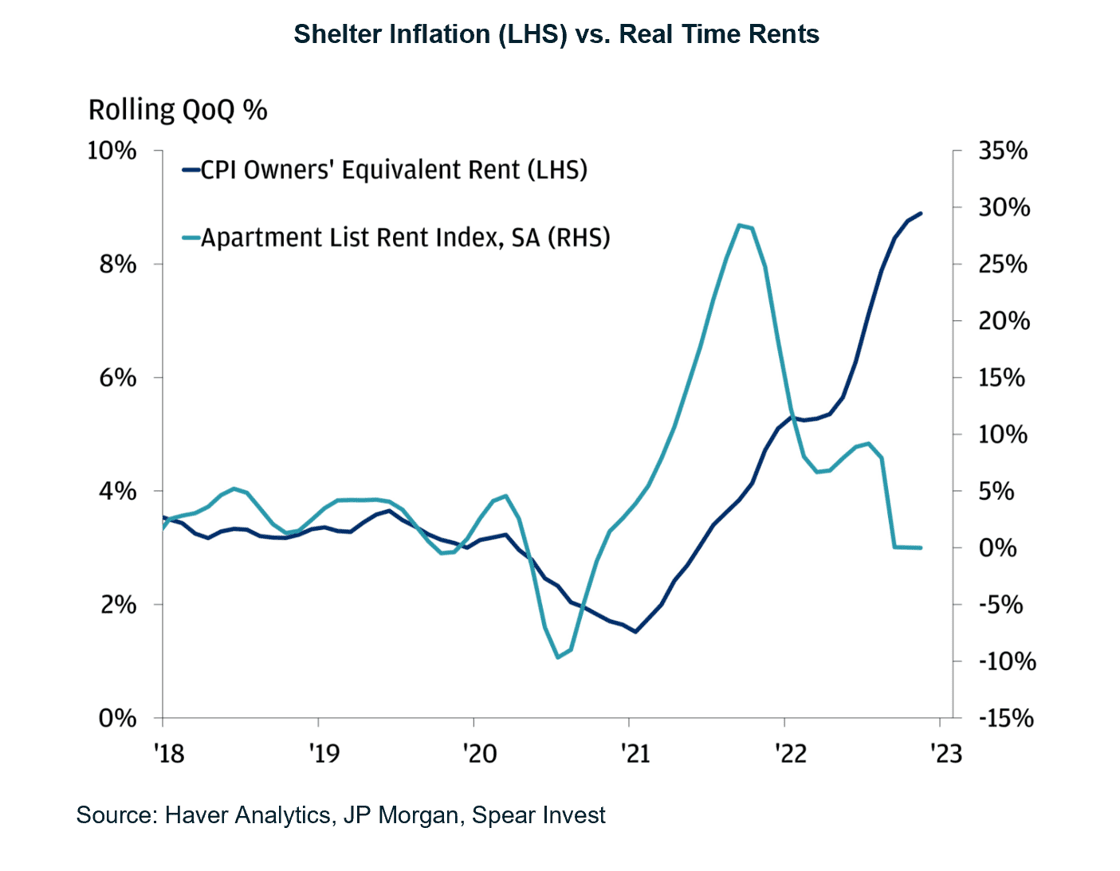

An example is shelter inflation. While the housing market has significantly cooled off and rents have declined, we are starting to note capacity constraints. The general expectation is that shelter inflation will follow rents, but we may see a reverse version. With limited capacity and higher mortgage rates, rents may actually start increasing.

Shelter Inflation vs Real Time Rents

Shelter Inflation vs Real Time Rents

Our channel checks indicate that inflation is much more sticky than most investors believe. Some structural drivers are at the core, e.g., re-shoring/de-globalization, ESG, and capacity constraints.

As we emerge from this downturn, we expect that wage inflation will resurface as a challenge. We believe that productivity improvement will be the only way to address inflation structurally.

We are at the cusp of significant artificial intelligence (AI) developments that will have a game-changing impact on productivity. Today, the largest application of AI at a scale that falls within the productivity theme is AI used in code development.

Microsoft’s (NASDAQ:) GitHub already has 1 million developers that have used GitHub Co-pilot (its AI assistant) to date. According to Microsoft, users are 55% more productive and 40% of code they are checking is AI generated and unmodified.

Several companies have since announced new AI integrations: AI for CRM systems (Salesforce (NYSE:) and Hubspot writing assistants), AI as a shopping assistant (Shopify (NYSE:)), etc. It is important to note that embedding AI in an application will be a requirement rather than a differentiator, similar to having a website or a mobile version of it. While we are in the early days, we believe that the productivity gains will be visible systemwide even in a medium-term (3-5 year) timeframe.

Focus areas in the current macro backdrop

The majority of our technology coverage universe reported earnings over the past month, and the overall results were underwhelming. The theme across all reports was similar to last quarter: elongated sales cycles, customers only purchasing what they need, splitting-up large deals in small pieces, etc.

On the positive side, semiconductor fundamentals have clearly bottomed with Nvidia (NASDAQ:) expecting qoq growth in all segments. This is very significant, as semis usually lead the rest of enterprise software out of a downturn.

We noted a few clear trends coming into 2023 from this earnings season:

- Cost cutting is just starting to show up in results (Salesforce, Meta (NASDAQ:), HubSpot (NYSE:))

- Early-cycle semiconductor fundamentals are bottoming (Nvidia, AMD (NASDAQ:))

- Platforms are performing better than point-solutions (Palo Alto Networks (NASDAQ:), CrowdStrike (NASDAQ:))

- “Must-haves,” such as cybersecurity, performed better than “nice-to-haves,” such as DevOps, collaboration tools

We expect that these themes will continue for the rest of the year. We will dive deeper into each trend in our next report.

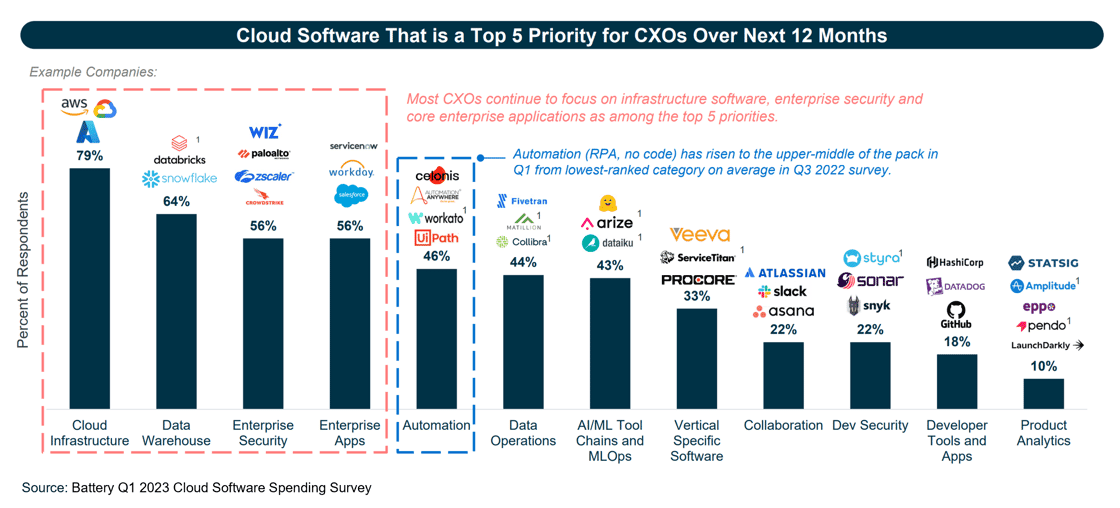

Top 5 Priorities for CXOs

Top 5 Priorities for CXOs

Disclosure:

Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR’s objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.