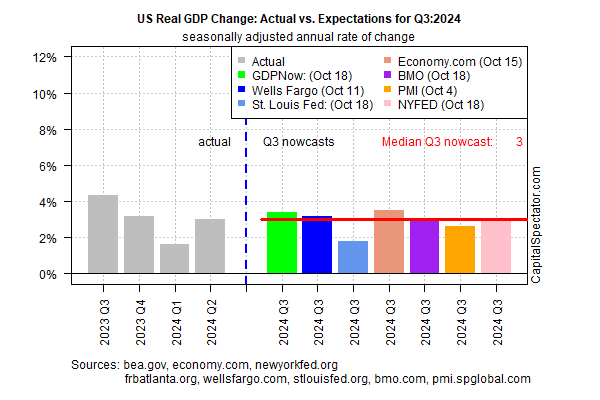

Strong US Growth Still Expected for Next Week’s Q3 GDP Report

2024.10.23 09:14

Will the two hurricanes that hit the US Southeast region recently weigh on the upcoming third-quarter data?

Probably, although for the moment the impact is expected to be minimal, based on set of nowcasts compiled by CapitalSpectator.com.

The median growth estimate for the upcoming third-quarter GDP report (due on Oct. 30) is a robust +3.0% (seasonally adjusted annual rate).

The nowcast matches the strong rise reported for Q2. The fallout from hurricanes Milton and Helene, it appears, will be slight for the national data.

Yet the economic cost of the storms for the 2024 hurricane season is projected to be among the most expensive in history. One estimate is a $50 billion price tag.

But so far it’s hard to discern any conspicuous influence for the GDP nowcasts. Quite the opposite, in fact, for the Atlanta Fed’s GDPNow model, which has lifted its Q3 nowcast this month relative to September estimates.

There has been a noticeable runup in US jobless claims recently, which has been attributed in part to the impact of the hurricanes.

New filings for unemployment benefits rose sharply to 260,000 for the week through Oct. 5, the highest in three years, but much of the spike reversed in the following week.

Analysts will be watching tomorrow’s update for any lingering effects. The consensus forecast sees claims rising by 6,000 to 247,000, according to Econoday.com’s consensus point estimate.

The general consensus at the moment is that while stronger headwinds may be brewing for the fourth quarter, the Q3 GDP report will probably reflect an economy that’s humming. That’s the message in yesterday’s revised IMF economic forecast:

“Projected [US] growth for 2024 has been revised upward to 2.8%, which is 0.2 percentage point higher than the July forecast, on account of stronger outturns in consumption and nonresidential investment. The resilience of consumption is largely the result of robust increases in real wages (especially among lower-income households) and wealth effects.”