Stocks Week Ahead: Trade Wars Make a Comeback With the Return of the Tariff Man

2025.02.03 04:09

The Tariff Man is back, and I guess at this point, those on social media who thought that tariffs were negotiating tactics and thought Trump was bluffing weren’t around during Trump 1.0.

This version of Trump 2.0 seems even more emboldened, given the size of his win. With that, tariffs were placed on Canada, Mexico, and China. Worse, those countries are all preparing or have already announced countermeasures.

The IG US 100 CFD is trading lower by about 1.3%, indicating where might open tonight.

doesn’t like the news either, and it is trading lower by nearly 3% this weekend. But until Bitcoin breaks below 91,000, everything that happens is just noise. That support level has held multiple times.

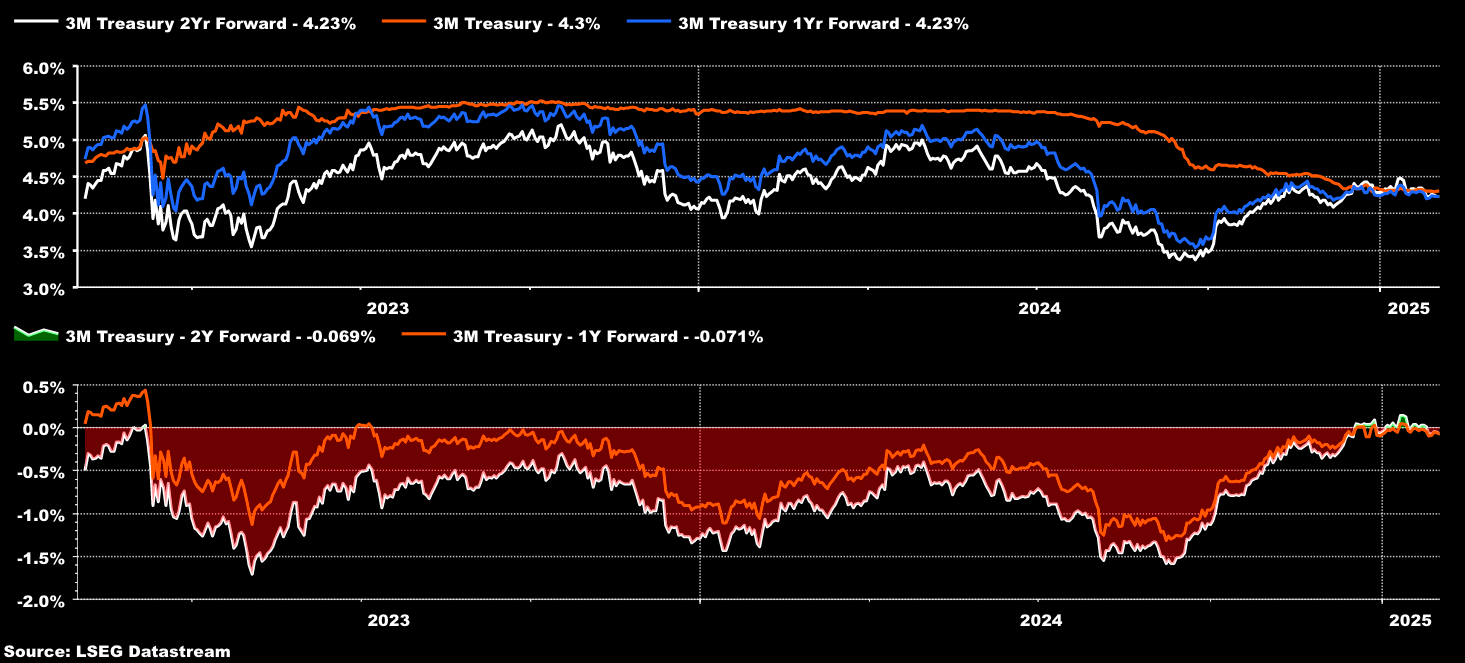

Certainly, 2-year swaps can move higher from here if the market fears the inflationary impacts of Trade Wars on the economy.

The swap has been consolidating at the upper end of the trading range for some time, and a breakout would not be favorable for the Fed’s fight against inflation.

Speaking of the Fed, the market still thinks there is a good chance the Fed is finished with cutting rates. The 1-year and 2-year forwards are trading in line with the 3-month Treasury spot rate.

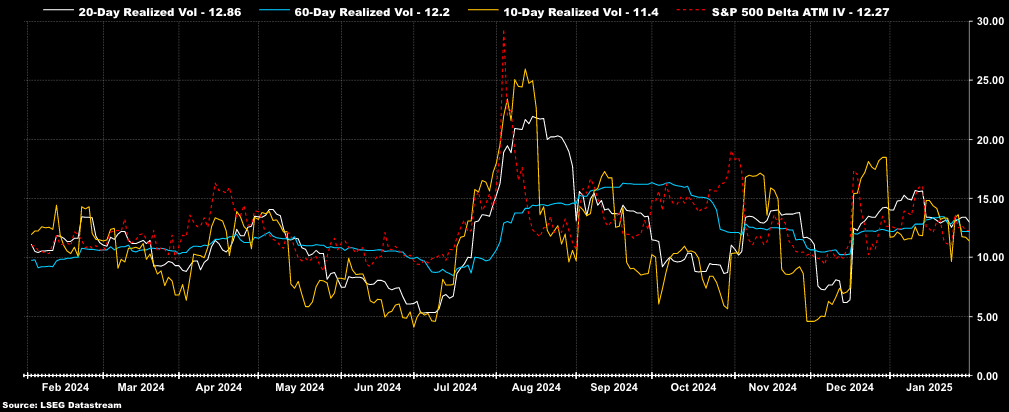

Trade wars will complicate the market when realized volatility and implied volatility are low. This means that if we start to see days when the moves by roughly 75 bps or more, realized and implied volatility will begin rising.

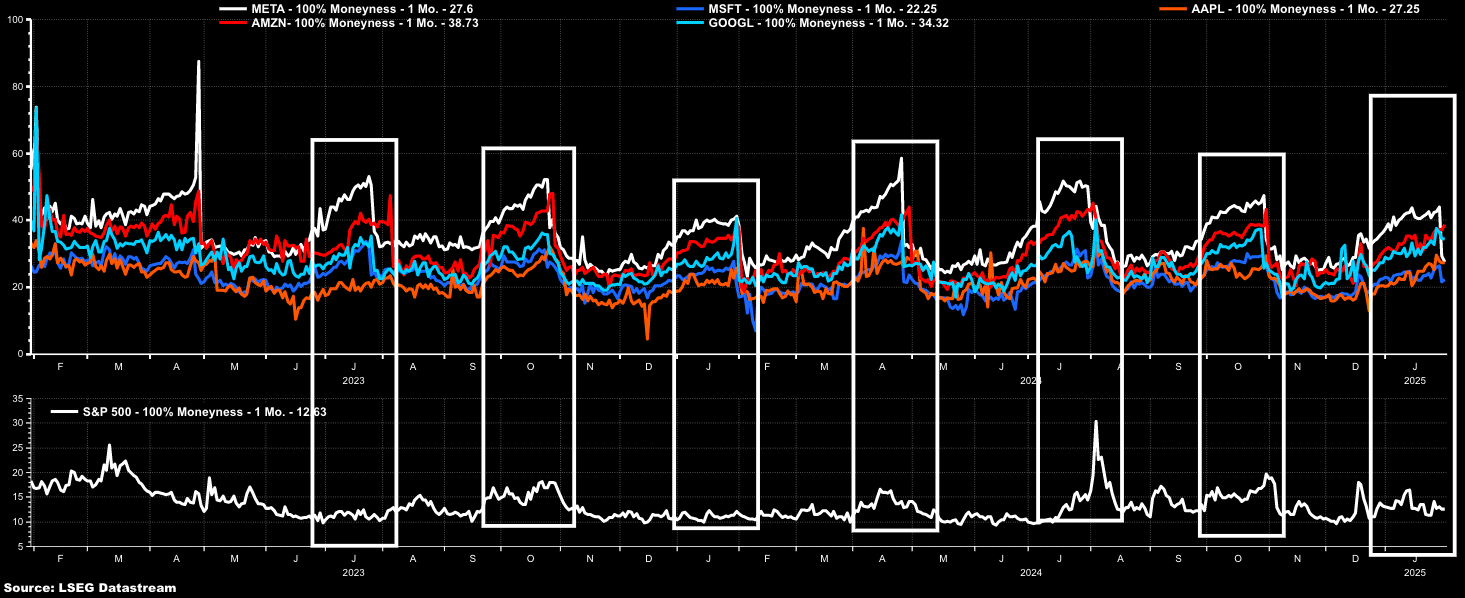

This, of course, comes at a point in the cycle where implied correlations are very low. The 1-month implied correlation is at 8, despite the sell-off we saw in stocks on Friday.

Readers of this commentary know that when the 1-month implied correlation index bottoms and starts to rise, the S&P 500 tends to put in a short-term peak.

Implied correlations were due to rise anyway because the volatility dispersion season is now ending. Implied volatility for the Fab 5 started falling last week, with just Amazon (NASDAQ:) and Alphabet (NASDAQ:) left to report; the rest will come down this week.

But more importantly, if volatility returns to the S&P 500 and IV start to rise, and stock IV rises too, correlations will increase.

Original Post