Stocks Week Ahead: CPI to Get Final Say on the Size of Rate Cut

2024.09.09 02:57

This week all eyes will turn to prices, with the report on Wednesday, the report on Thursday, and / prices on Friday.

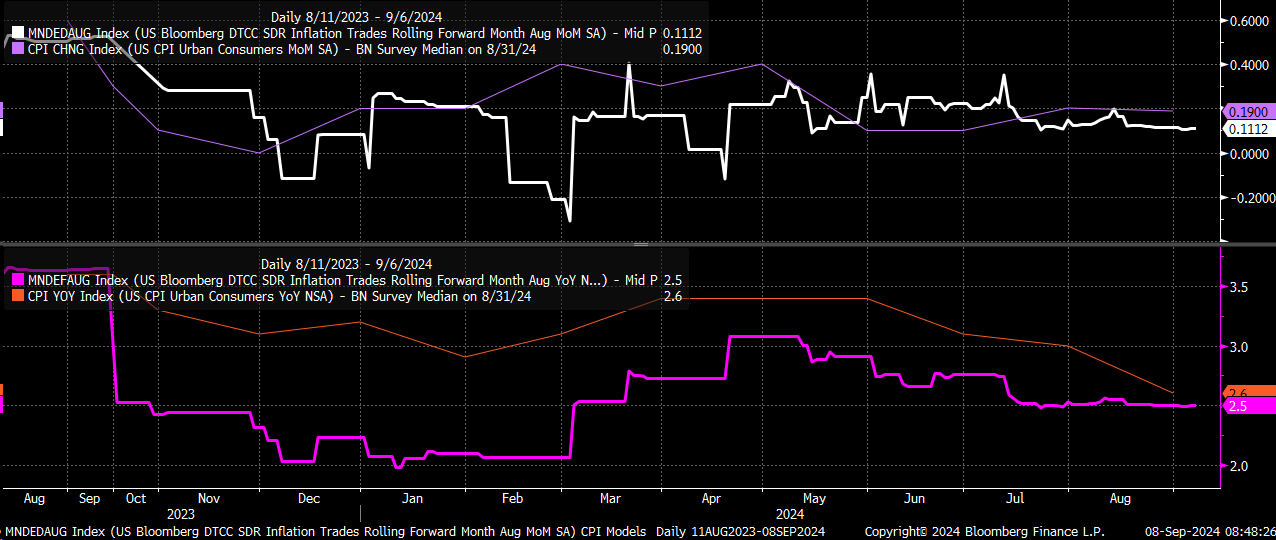

Analysts expect the report to show a 0.2% month-over-month increase for both headline and core. Meanwhile, headline CPI is expected to slow to 2.6% year-over-year from 2.9%, and is expected to hold steady at 3.2% year-over-year.

Swaps are pricing in a CPI miss, with the current market expectation for headline CPI at 0.1% month over month and 2.5% year over year.

A rate reduction at the FOMC’s upcoming meeting on September 18 looks all but certain, but the upcoming CPI report could serve as a tiebreaker between a 25 or 50 bps cut.

A CPI miss may seem optimistic, but it likely signals more yield curve steepening and a stronger . The yen strengthened against the on Friday, rising by 80 basis points following the weaker-than-expected report, and closed right on technical support.

A weak CPI report could quickly strengthen the yen to 137.80 versus the dollar. We would likely see it reach critical support and “oversold/overbought” conditions at that level based on indicators like the RSI, Bollinger Bands, and the expansion-contraction indicator.

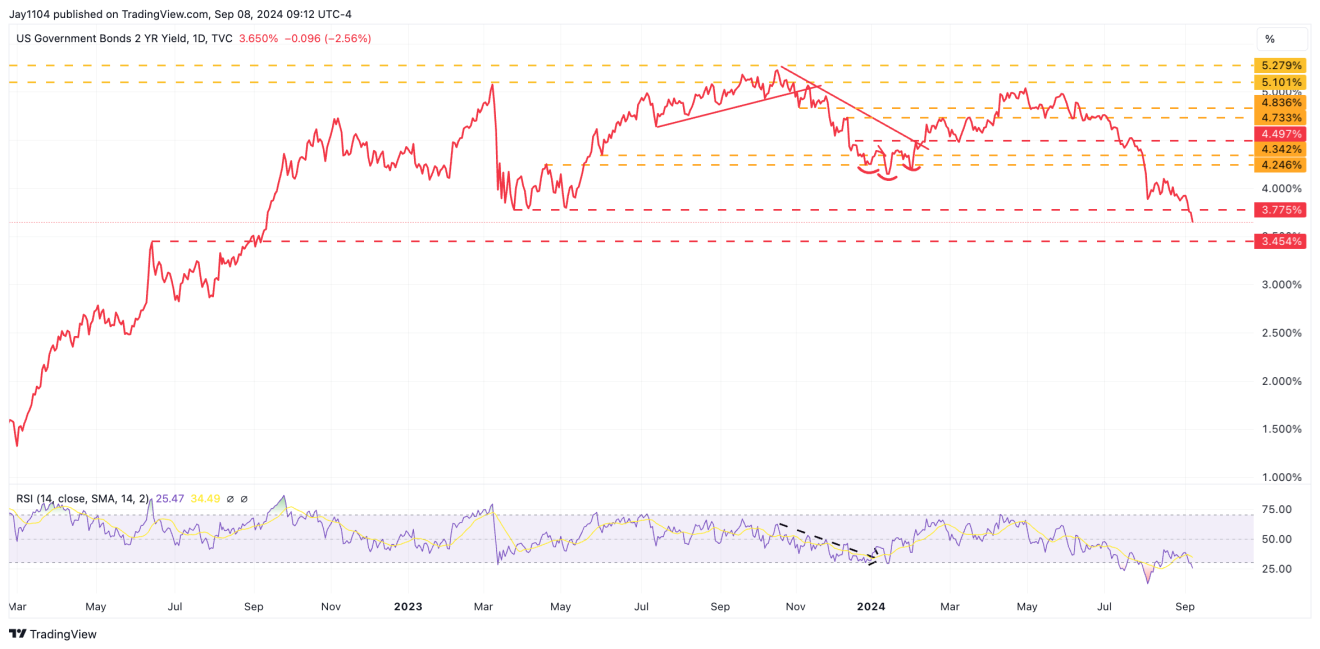

The would likely fall further as the market starts pricing in even higher odds for a 50 basis point rate cut from the Fed at the September meeting.

The 2-year recently hit its lowest closing level since September 2022, which is significant, with the next level of support now around 3.45%

This would likely cause the spread between the yields to steepen further, potentially rising to a positive 13-15 basis points.

Based on the cycles we discussed last week, the appears to be in a downward phase. This likely means we could see some short-term bounces that push the market higher, but according to the current cycle, a sustained turn higher might not occur until the beginning of October.

The index also touched the lower trendline of the rising wedge on the log chart for a second time but failed to break through that resistance zone, confirming the break of the rising wedge pattern that dates back to the October 2023 lows.

Additionally, note that the 120-day minus the 20-day moving average has turned lower, signaling that systematic funds are now likely sellers.

The is also at a critical level, having fallen back to its 61.8% retracement level. If the NASDAQ continues to head lower, the 61.8% retracement level at 18,404 is unlikely to hold for long, and the index could move lower at some point this week.

The has also been relatively weak. It seems to be forming a head-and-shoulders pattern, though it still needs to develop further and break the $205 support region.

What may be more significant in the short term is that, unlike the NASDAQ, the SMH has already retraced more than 61.8%. This likely indicates that the SMH could retest the lows from August 5 in the not-too-distant future, and the NASDAQ follows.

So, if we get a weak CPI report and the USD/JPY strengthens, it will likely pull the SMH down and the entire market with it, as the SMH has been trading closely with the USD/JPY.

This highlights how much liquidity from the yen carry trade has flowed into semiconductor stocks, especially Nvidia (NASDAQ:).

Original Post