Stocks Roar Higher as U.S. Inflation Cools Slightly, Optimism Rises

2023.07.03 06:54

- Tech stocks lead Wall Street higher in strong first half as PCE inflation eases

- Growth optimism outweighs Fed rate hike bets as Asia rallies too

- But dollar bounces off lows ahead of ISM PMIs, jobs report

Recession fears ease further after soft core PCE

US stocks continue to defy gravity, shrugging off concerns about more Fed rate increases and an uncertain economic outlook to notch up solid gains for the first half of 2023. The S&P 500 just had its best start to the year since 2019 while the had its strongest first half rally in four decades. Even more astonishing in the current economic backdrop is how the tech mega-cap managed to post a record first half, growing almost $5 trillion in value.

The latest wave of euphoria got a boost last Thursday from data showing that the US economy grew more than expected in the first quarter of the year despite rising borrowing costs and sticky inflation. Whilst this may not be enough to lift the gloom for value stocks and small caps, it was another sign for investors that the Big Tech will be able to ride out the storm just fine, especially with all the buzz surrounding AI.

There was more good news on Friday when the Fed’s favourite inflation metric – the core PCE price index – moderated slightly to 4.6% in May and consumption slowed too, raising hopes that a soft landing is still achievable.

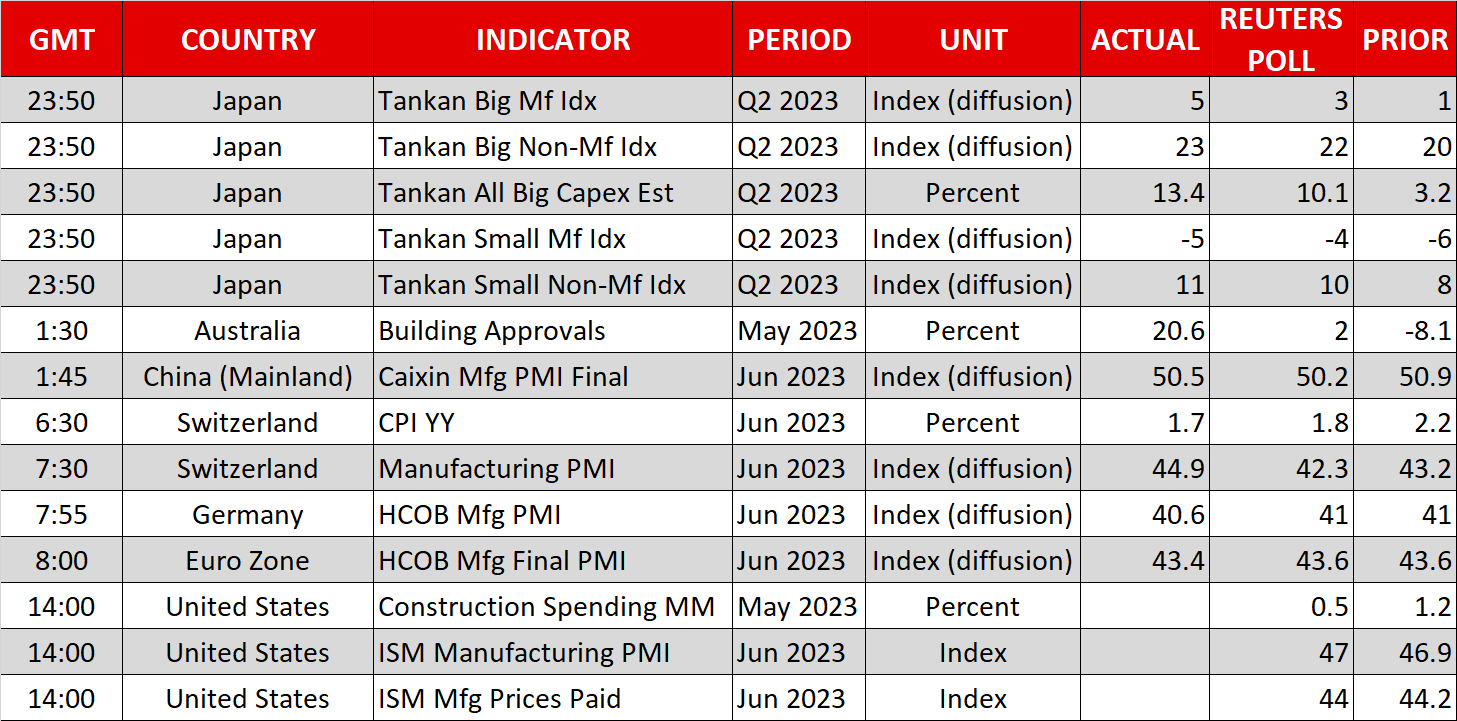

Even Asian equities were able to join in the fun today with the in Tokyo closing at its highest since March 1990 and Chinese blue chips gaining more than 1% in the first trading day of July after a bumpy first half. Aside from the positive sentiment from Wall Street, Asian markets were buoyed by China’s central bank promising “precise and forceful” policy to shore up the faltering economic recovery and the Bank of Japan’s quarterly Tankan survey pointing to improving optimism among Japanese businesses.

Big Tech becoming immune to higher rates

US futures appear to have lost some steam today, however, in what is expected to be a quieter session ahead of tomorrow’s Independence Day holiday. But the downtime shouldn’t last long as the June payrolls report is due on Friday. The risk going forward for equities is that markets are behaving as if the Fed’s tightening campaign is over and inflation is well on its way down to the 2% target.

But Powell couldn’t have made it clearer last week that more rate hikes are in the pipeline even with inflation steadily moving lower amid a still very tight labour market, which Friday’s numbers are once again expected to highlight. What’s really surprising, though, is that rate hike bets fell only marginally after the PCE inflation data and Treasury yields continue to climb.

It seems that for tech stocks, it’s all about betting on the future and as long as recession risks remain contained, higher yields are no longer such a deterrent. Tesla (NASDAQ:) is a good example of this as the electric vehicle maker just announced a record number of deliveries in the second quarter.

On the other hand, Apple (NASDAQ:) is reportedly scaling back production of its much publicized Vision Pro headset due to complications, risking a correction in its stock price after becoming the first company on Friday to hit a market capitalization of $3 trillion.

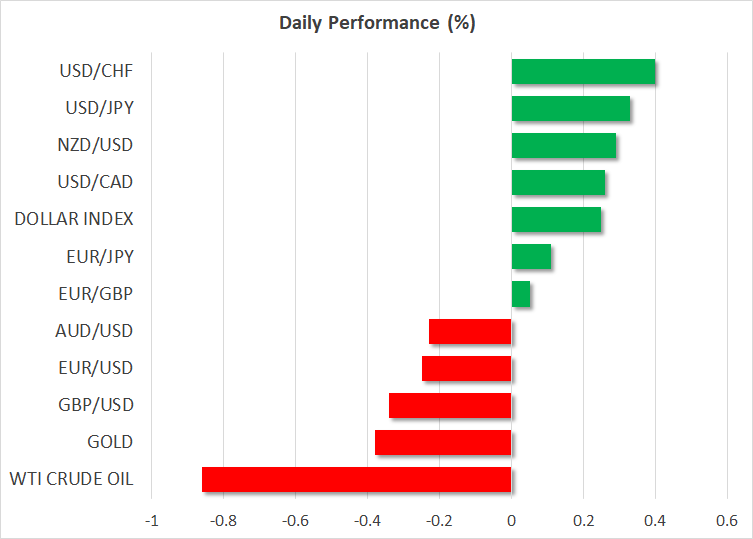

Dollar rebounds, eyes ISM manufacturing PMI, yen steady

In foreign exchange markets, the US dollar was back on the front foot on Monday after a short-lived selloff on Friday following the soft data. The focus later on will be on the ISM manufacturing PMI, which may revive recession worries if it disappoints, before attention turns back to the Fed on Wednesday when the minutes of the June meeting are published.

The euro is slipping today after the Eurozone manufacturing PMI was revised lower in the final estimate and although the UK one was revised slightly up, the pound is struggling too.

The yen was also down against the dollar but was steadier against other majors. If this week’s releases out of the US surprise to the upside, there’s a risk that the yen could come under renewed selling pressure, prompting Japan’s finance ministry to intervene.

Meanwhile, the Australian dollar was trading somewhat lower on Monday amid diverging views between economists and the markets on whether or not the Reserve Bank of Australia will hike interest rates when it meets on Tuesday. Markets think that the RBA will stay on hold so a surprise rate rise could lift the .