Stocks resume climb after uptick in jobless claims, dollar tumbles

2023.06.09 06:26

- US weekly jobless claims hit highest in 1½-years, boosting Fed pause bets

- Tech stocks find reason to celebrate as yields decline but China weakness weighs

- Dollar skids but steadier today, leads FX weekly gains

Jobless claims lift spirits ahead of big week

Market expectations for a Fed pause received a slight boost on Thursday, reviving hopes ahead of next week’s FOMC decision after hawkish turns from the RBA and Bank of Canada had dented them. Initial claims for unemployment benefits increased more than expected in the week ending June 3, reaching the highest since October 2021. The four-week average also edged higher.

While it is too early to get clear signs that layoffs are on the rise and weekly claims remain low by historical standards, the data does provide the Fed with an added incentive to skip a rate hike in June. A softening labour market is an essential prerequisite for the Fed to ease up on its tightening campaign.

However, policymakers won’t be making up their minds before the May CPI report that comes out on Tuesday just as the Fed convenes for its two-day meeting. Moreover, with other central banks demonstrating their wariness in taking their foot off the brakes too soon, the reaction in Fed fund futures has been very cautious.

Questionable optimism in equity markets

So this wasn’t quite the game changer investors have been waiting for and the odds have tilted only slightly in favour for an early pause. But there was somewhat of a more notable response in bond markets as Treasury yields at the long end of the curve slid, spurring risk appetite.

Shares on Wall Street headed higher, with all three main indices closing up on Thursday. Tech and AI stocks resumed their rally, and although they failed to fully recoup Wednesday’s losses, the S&P 500 did manage to extend its gains from the October trough to just above the 20% threshold that most traders use to define a bull market.

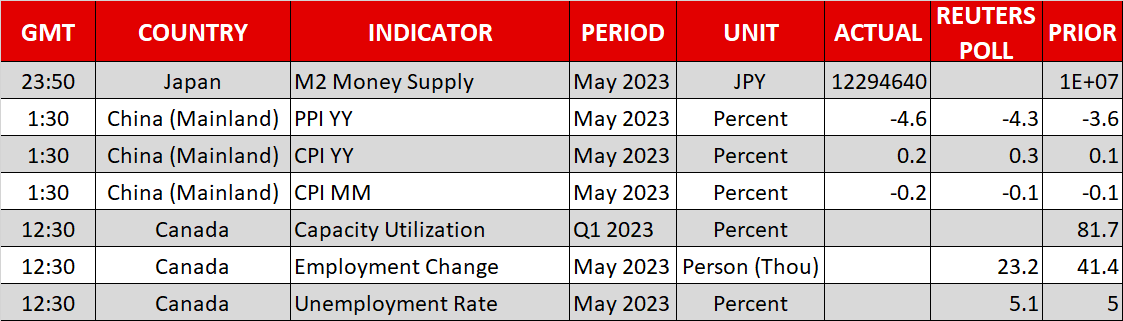

In Asia meanwhile, there was a similar ‘bad news is good news’ reaction to Chinese data. China’s consumer and producer price inflation disappointed again in May, adding to worries about sluggish domestic demand. Yet, investors are hoping that authorities will step in with more stimulus to prevent the economy from stagnating further.

Asian indices ended Friday in the green, though it was a mixed start in Europe and US futures slipped.

Aussie leads FX winners after bruising week for the dollar

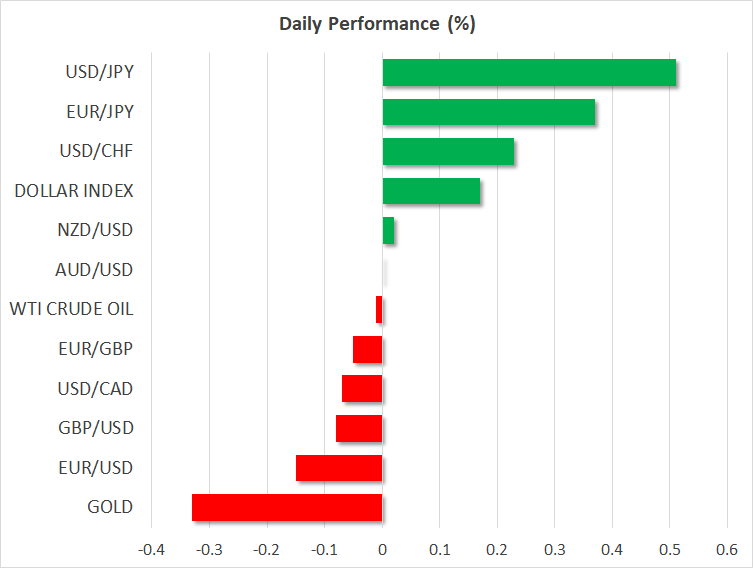

The drop in yields trounced the US dollar on Thursday as market bets that the Fed will pause before other major central banks were rekindled. The has fallen to a two-week low, with the Swiss franc applying the most downside pressure following hawkish remarks from SNB Chairman Thomas Jordan yesterday. Sterling also surged on Thursday, climbing above $1.25.

For the week, however, it is the Australian dollar that looks set to be the biggest winner as the currency continues to ride higher on the back of the RBA’s surprise rate increase on Tuesday. The Canadian dollar’s advances have been more modest after the Bank of Canada restarted its rate-hiking cycle, but the may get another chance today if employment numbers due at 12:30 GMT are stronger than expected.

The Japanese yen on the other hand struggled to keep up as the latest commentary from BoJ Governor Kazuo Ueda suggest the Bank is not planning any changes to its policy when it meets next week.