Stocks Rally And Now It Is Getting….

2022.10.05 03:43

[ad_1]

I was thinking about the market and what is potentially behind this stupid rally, and at heart, this seems like nothing more than an oversold bounce, given a lot of bond market dislocation last week. Bonds have started to settle down.

Today we will get the , and estimates are for a reading of 56. The is also expected to show 200,000 new jobs in September. But the most important data will be the on Friday, with jobs expected to rise by 263,000 and an of 3.7%.

So this data is going to have an impact one way or another. My thinking is that rates are closer to their lows at this point.

S&P 500

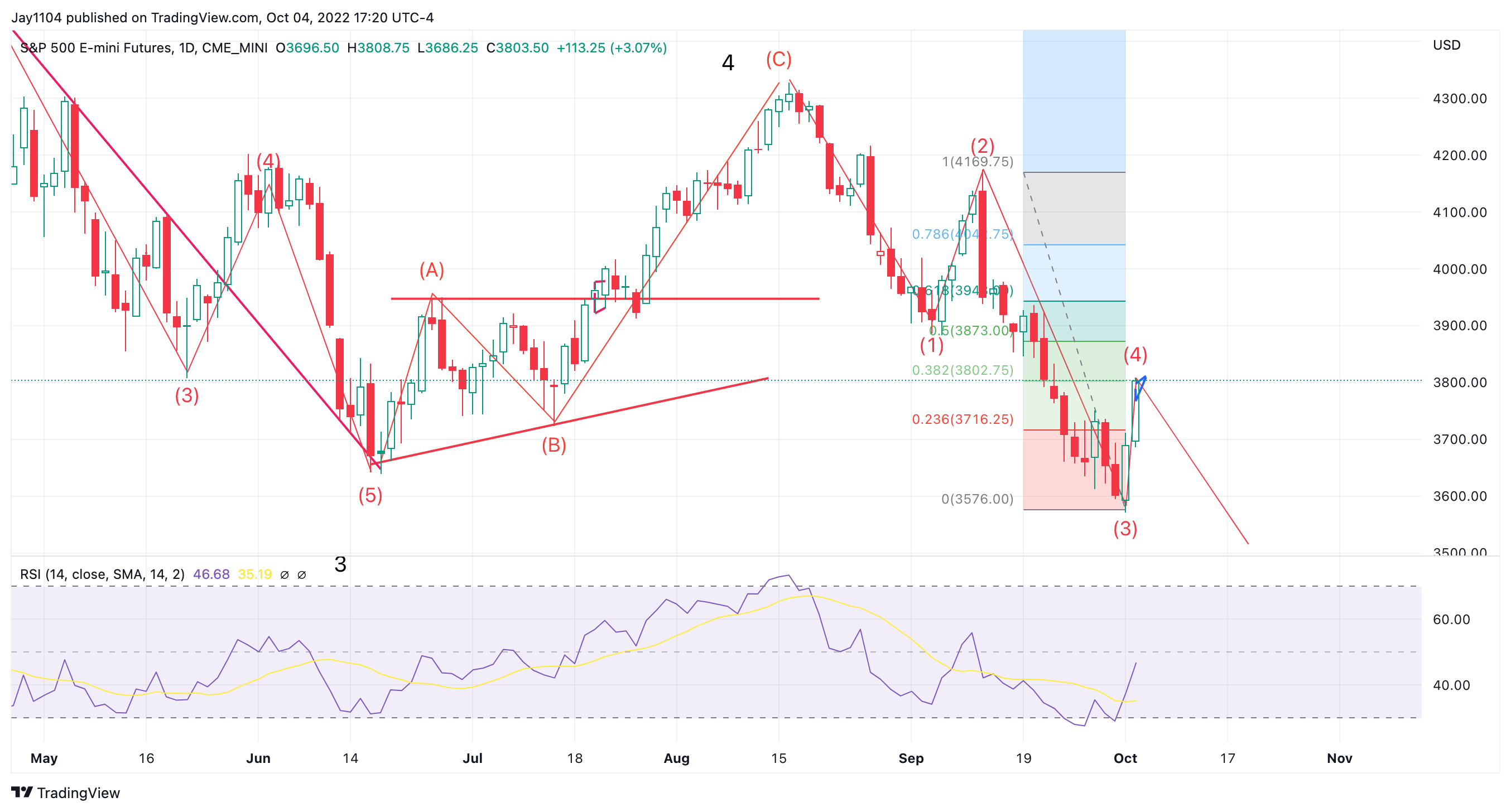

Looking at the , there are many reasons to think this rally ends around 3,800 or goes higher to around 3,950. At this point, I can’t come up with enough to feel the rally extends to 3,950. Additionally, if it went all the way to 3,950, my five wave count lower would be invalidated. So, I am sticking with my view for an S&P 500 to head lower to 3,500.

At this point, the rally has been a 38.5% retracement of wave three down.

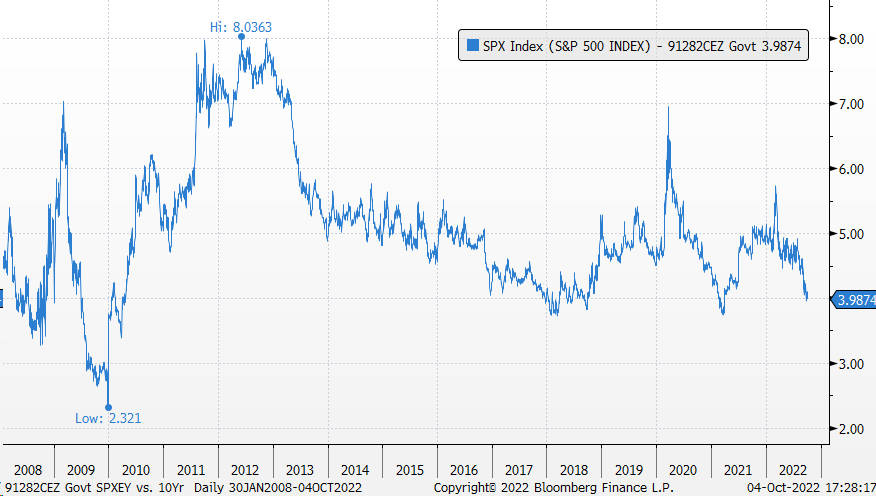

Maybe I will be wrong; I can’t be right all the time. But even with the move lower in yields, the spread between the S&P 500 earning yields and the Treasury is right back to its lows on September 26. I don’t know precisely where the ERP should be, but something about it being near the equivalents of January 2018, October 2018, and March 2021 doesn’t feel right to me. In 2018, there were stock market tops, and in 2021, it was a peak in the 10-year rate.

At this point, I’m more willing to bet that the 10-year yield doesn’t have too much further fall. This would mean equity values are too high, and if the ERP rises, it will be due to stock prices tumbling.

S&P Vs. 10-Year TreasuriesDisclaimer: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

S&P Vs. 10-Year TreasuriesDisclaimer: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

[ad_2]

Source link