Stocks Feel the Heat as US Election Jitters Take Hold, US Dollar Gains Traction

2024.10.24 06:56

- Reduced Fed rate cut bets and growing odds of a Trump win push up yields

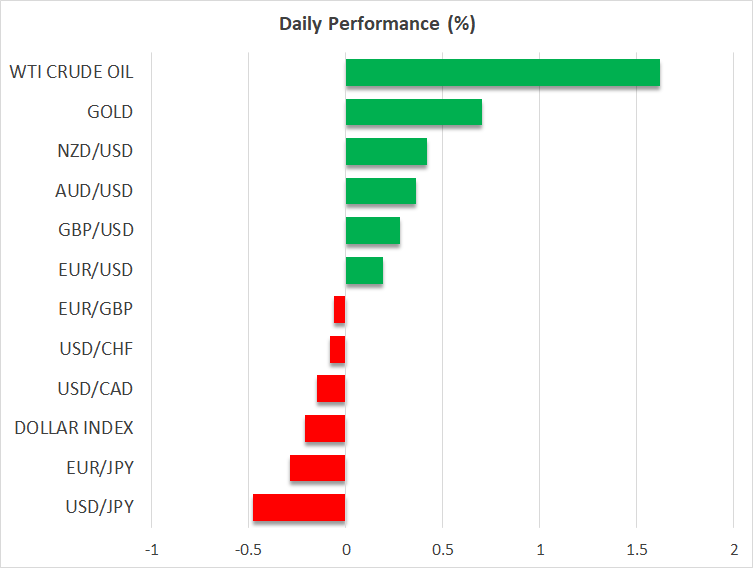

- Wall Street slips; gold also takes a hit, but only temporarily

- Dollar climbs to 3-month high, yen and euro struggle

Wall Street headed for weekly losses

The rally on Wall Street came to an abrupt end this week as uncertainty about the looming US presidential election as well as about the pace of rate cuts undermined confidence in risk assets.

The closed down for a third straight session on Wednesday, losing more than 1% so far this week.

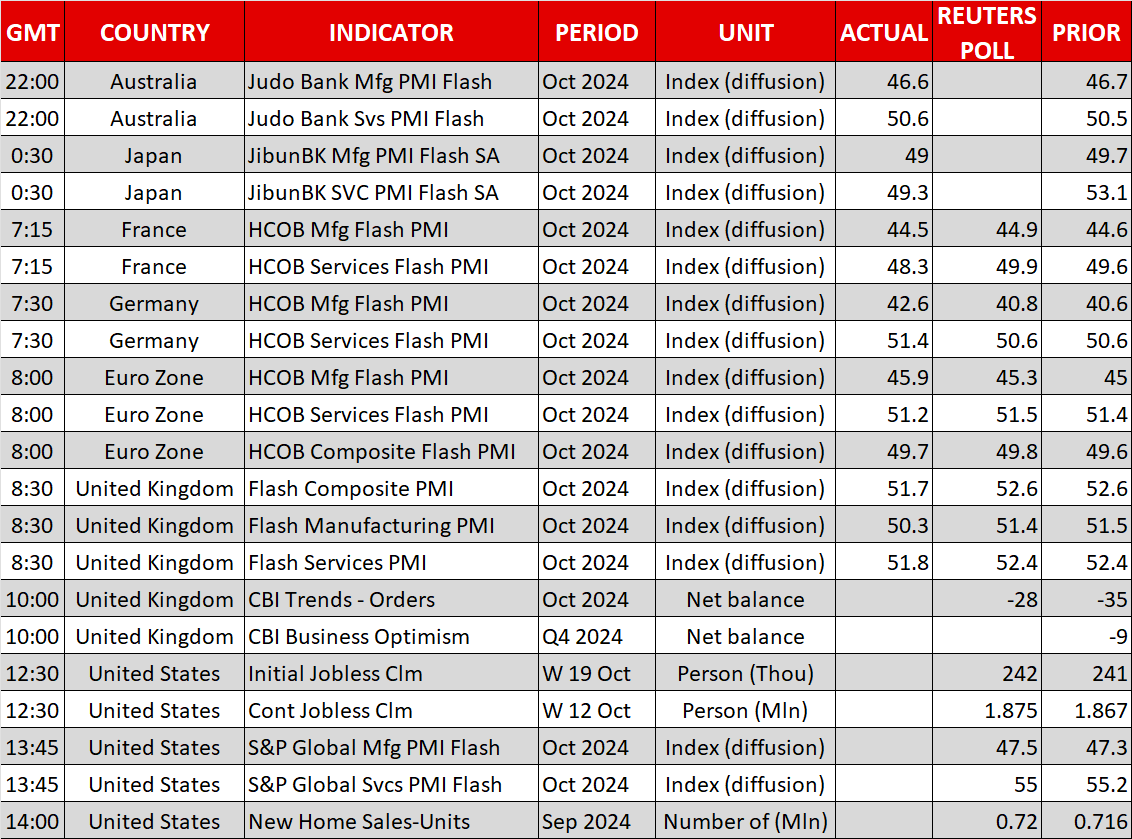

Several Fed officials have been on the wires this week, most of whom made the case for ‘gradual’ rate cuts. Worried about policy being too restrictive, San Francisco Fed President Mary Daly was notably in the minority and investors have started to price in the possibility of the Fed pausing at one of its upcoming meetings.

Although a rate cut in November is almost fully priced in, there are growing doubts if the Fed will cut again in December and January is even less certain.

The paring back of rate cut bets since the September meeting has spurred a rebound in US Treasury yields, with the reaching a three-month high of 4.26% yesterday.

Trump creeps up in the polls

But the shifting outlook on the Fed rate path isn’t the only thing driving yields higher. Donald Trump’s recent gains in the polls have started to worry investors as he quickly closes the gap with Kamala Harris. The Republican candidate is campaigning on big tax cuts and higher tariffs, both of which are seen as being inflationary for the US economy.

The real risk of the Fed’s easing cycle being derailed by a flare-up in inflationary pressures has started to spook markets as the November 5 election day approaches. Despite Trump’s economic policies being broadly more positive for stocks than Kamala Harris’s, it seems that many investors do not welcome the uncertainty that some of his more radical ideas and his unpredictable nature would bring if he were to return to the White House.

Trump risks are also bolstering , which is rebounding today after pulling back from fresh record highs on Wednesday. The jump in yields likely sparked some profit taking but with so much uncertainty surrounding the US elections and the crisis in the Middle East, it’s hard to be bearish on gold currently.

Dollar stands tall, yen takes the biggest punch

With yields surging, and election risks setting in, the has been on a roll this month, rising to a near three-month peak and on track for a fourth straight week of gains. The greenback’s unexpected strength has been very bruising for the yen, which lost almost 6% in October.

The Bank of Japan remains wary about hiking rates too quickly, making a rebound unlikely in the near term. Speaking at an IMF panel discussion yesterday, Governor Ueda said “It’s still taking time” to reach the 2% inflation target sustainably.

The has been under pressure too as the ECB considers whether to cut rates at a faster pace. The flash PMIs for October were somewhat mixed today, but overall, growth remains very feeble across the Eurozone.

The has also fallen below key levels against the dollar, with BoE Governor Andrew Bailey hinting at further rate cuts by sounding upbeat on inflation in remarks at the Institute of International Finance yesterday. But it’s a little firmer today despite slightly disappointing UK PMI readings.

The , meanwhile, is on a steadier footing following yesterday’s dip from the ’s decision to slash rates by 50 basis points.