Stock Market Doom While Gold and Silver Zoom?

2024.11.12 15:54

Is the US stock market now in a blow-off stage, like in 1929?

If so, how will the coming collapse affect , , and mining stocks?

These are questions that investors should be asking. Here’s a look at the going into 1929, and the ensuing collapse.

The good news is that even if the stock market is going to collapse in 2025, there will likely be significant rallies, just as there were in the tumble of 1929.

The weekly Dow chart. There is significant support at 37,000. A collapse from somewhere between the current price and 50,000 would likely halt in that 37,000 area, albeit temporarily.

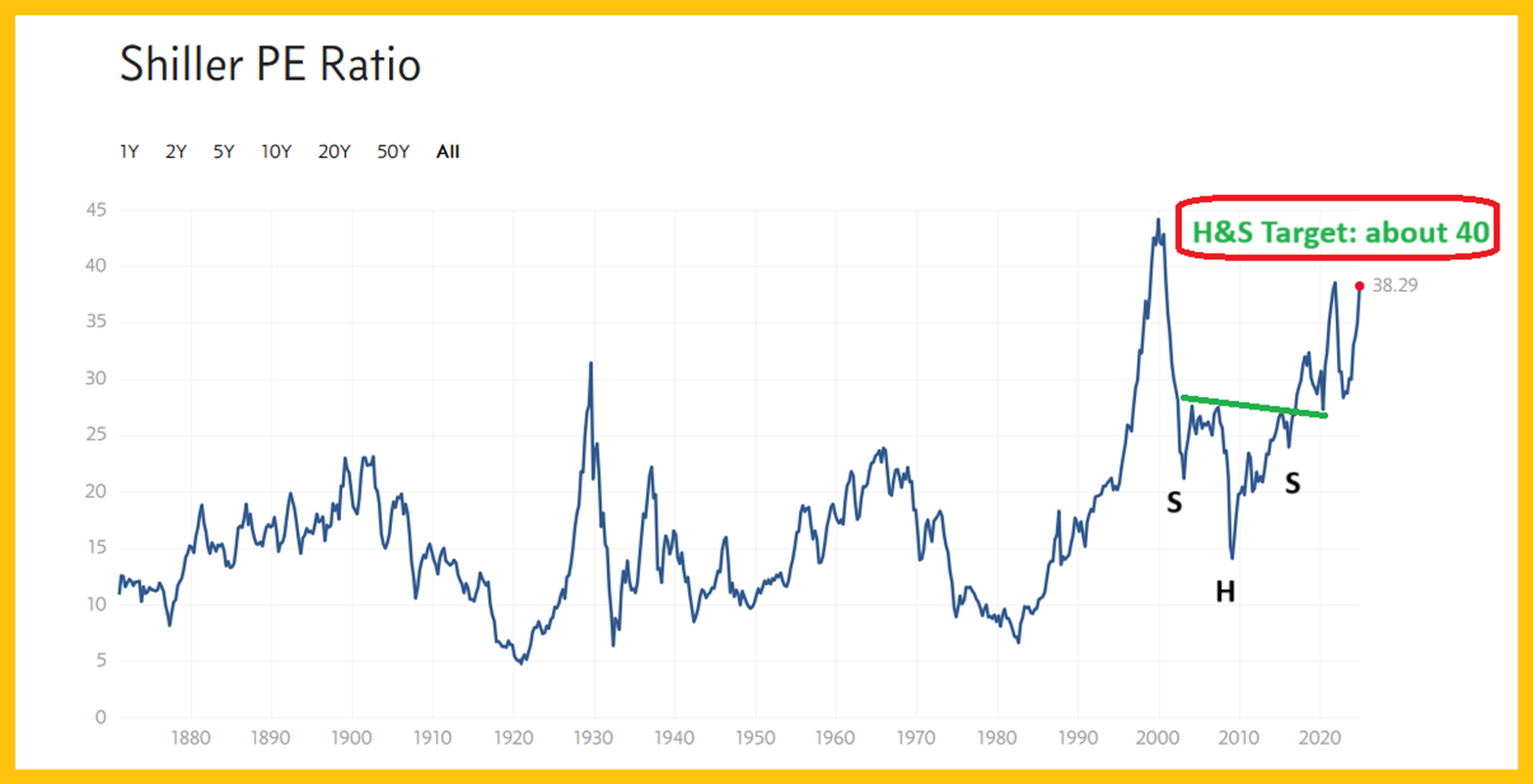

Just how overvalued is the US stock market? The Shiller inflation adjusted PE ratio is well above the highs of 1929. It could rise to 40 or even to the 44 area highs before collapsing… and it vividly highlights just how overbought the US stock market truly is.

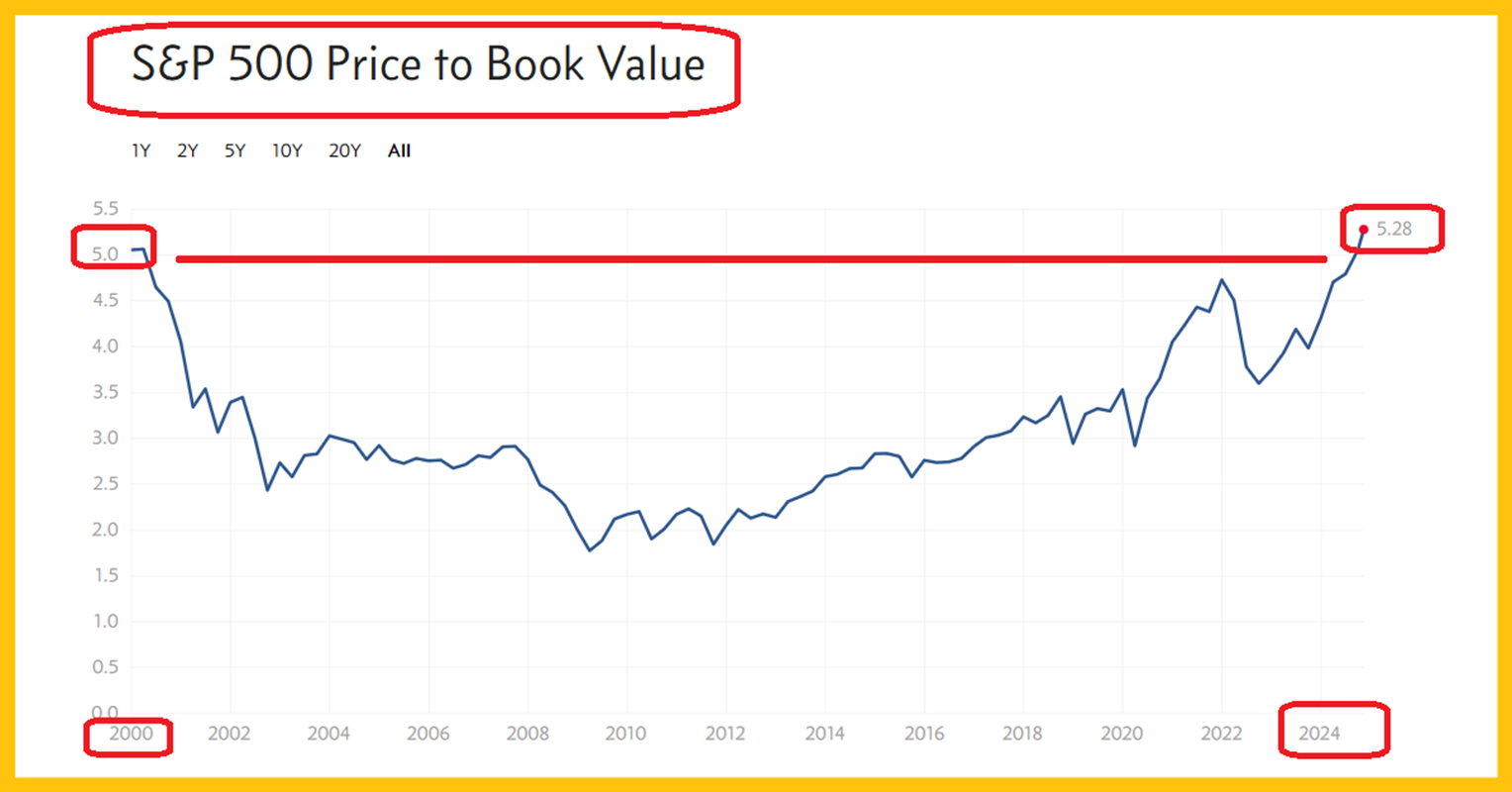

Incredibly, the price to book value (price to breakup) is now above where it was at the peak of the outrageously overvalued market of 1999.

Does this US chart suggest that the stock market is about to crash, and rates will be reduced dramatically?

It’s certainly a scenario that investors need to be open to, especially given the H&S top action and the potential imminent drop from the neckline of the pattern.

A look at gold. Gold has dropped into a minor support zone of $2600-$2590. There’s another slightly “meatier” one at $2530.

Having said that, H&S top formation is in play, targeting the much bigger support zone of $2450-$2300.

A look at that zone on the weekly chart. Tactics? I suggest very light buying of gold ETFs or fully paid futures contracts at $2600 and $2500.

If gold does reach the important $2450-$2300 zone, significantly more gold can be bought (preferably physical gold) along with silver and mining stocks… in anticipation of a huge rally, not just back to the $2790 area highs, but to $3000-$3300.

Silver should reach $40-$50 on that move, and GDX (NYSE:) could surge to $50-$60. From there, a more significant pullback could be expected, and it would likely correspond with the start of a multi-decade bear move for the US stock market.

Silver could catch a nice bid from frightened small investors once the stock market collapses but right now it looks a tad shaky. Stochastics is almost oversold, but unfortunately the coming rally may only create the right shoulder of a second H&S top. Investor patience is required.

The new US government (Trump 2.0) is likely to respond to a stock market meltdown with even more aggressive cuts in government size than are planned right now. New tariff taxes and “big GDP growth” income tax cuts won’t generate anywhere near the amount of capital that is now needed to manage the outrageous government debt. With the markets in meltdown mode, significant measures of austerity will be required.

Debt-funded “diversity” and other frivolous programs will be eliminated. Sadly, but deservedly, a long reckoning lies ahead for the debt and fiat obsessed citizens of America… and for the government. If Trump lets Elon “Mister Chainsaw” Musk off his leash, the slashes in spending could look “other worldly”.

What about the miners? I asked the open question, “Will GDX trade at $36 if gold trades at $2600?”, and that’s what has happened. Gamblers can buy, but I suggest investors be more patient and wait to see if gold trades at $2450, which “should” see VanEck Gold Miners ETF (NYSE:) trade at about $33.

The CDNX is a true microcaps index, and a lot of the biggest components are in the gold and silver mining business. It looks solid here.

Here’s a look at it versus the GDX ETF. It’s mauling it.

For years, I’ve been adamant that to get a real multi-decade bull run in the miners, CDNX must take the lead baton… and that’s clearly beginning to occur.

Oil is slumping on a collapse in global growth, especially in China, and no new mid-East war that threatens the strait of Hormuz. Is it possible that the Trump-oriented stock market rally that began with his election turns into an inauguration day crash? Well, he’s likely to want to refill the SPR (Strategic Petroleum Reserve) and he has to buy oil to do that.

Also, he’s pro-Israel and anti-Iranian government. The Israeli government could take his inauguration as an open invitation to devastate Iranian oil infrastructure, and while Trump could theoretically keep domestic prices low by limiting exports, that plan would likely fail.

The bottom line: An oil price low sometime between now and inauguration day looks increasingly likely, and the ensuing rally could cause both stock market chaos and a gold and silver price surge. This is a simple and long-overdue pullback of decent size for the metals. I’ve clearly marked the key buy zones for action. Hopefully, all gold and silver bugs of the world are ready to buy.