Stock Market Braces for Crucial Test Ahead of Data-Packed Week

2023.10.30 03:51

If you are taking a vacation this week, you chose the wrong week. From Tuesday until Friday, there will be a massive data dump. Starting Tuesday, we get the and .

On Wednesday, we get , , , and the . Thursday, costs, , , and .

On Friday, the and the .

This is the type of data that is not going only to move the markets but also set the tone and the dialogue for fourth-quarter growth.

This means the and rates will be more volatile, and the equity market will be trading off dollar and rate changes.

US Dollar Poised to Go Higher?

The dollar looks like it wants to go higher from here based on what appears to be a bull flag that has formed. That pattern in the dollar could be setting up for a considerable move higher back towards 109.50 on the dollar index.

The data that comes this week will need to support that narrative, and the Fed messaging will, too. However, based on how the dollar appears to be setting up heading into this week, it seems the dollar may get the hot data and hawkish Fed.

US Dollar Index-Daily Chart

US Dollar Index-Daily Chart

Euro in Bear Flag: What Awaits?

Similar patterns are present in the with what appears to be a bear flag, which makes sense given the euro’s weighting in the dollar index. This bearish pattern in the euro suggests a drop back to around 1.03.

10-Year Consolidating Around the 5% Level

Meanwhile, we are seeing the also consolidate around the 5% level and appear to be forming a bull flag, too, which is suggestive of a 10-year rate that is also likely to move higher and see a move perhaps to that 5.25% level.

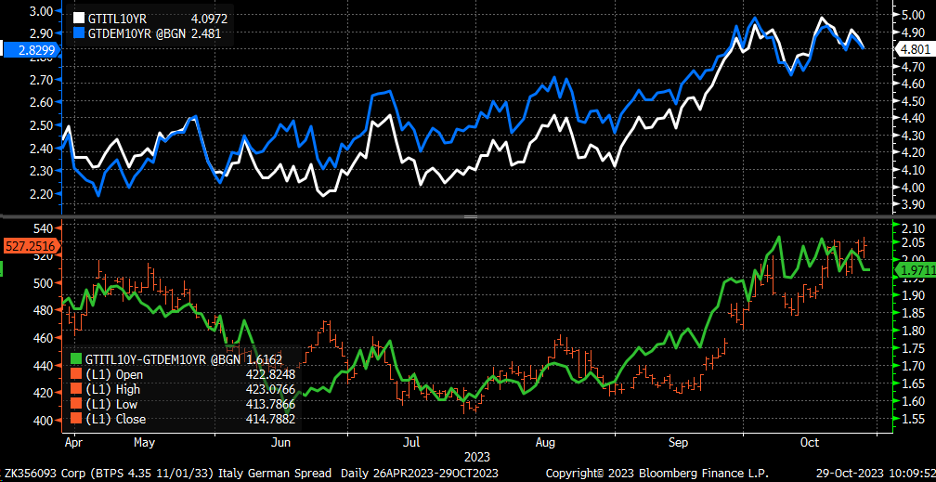

It isn’t that we are only seeing higher rates, but we are finally witnessing spreads widen as investors reassess the rates they are getting paid for the amount of risk they are taking.

This is happening not just in the US but in Europe, too, with German and Italian sovereign spreads widening, which has resulted in high-yield spreads here in the US widening, too.

German-Italian 10-Yr Spread Chart

German-Italian 10-Yr Spread Chart

Widening spreads in the US have led to rising levels of implied volatility for the equity market and higher earning yields, which have led to lower equity prices.

What is pushing equities lower is not only higher rates but the repricing of risk due to those higher rates.

The market seemed to think that rates would stay low, and because, in the market’s view, rates would remain low, there was no reason to reprice risk. But that has all changed.

So, as long as rates and the dollar continue to climb, the repricing of risk shall likely continue because it doesn’t seem that, at the current level, stocks are correctly priced given bond yields.

The to ratio shows that stocks will likely underperform relative to bonds over the short term.

SPY/IEF Ratio-Daily Chart

SPY/IEF Ratio-Daily Chart

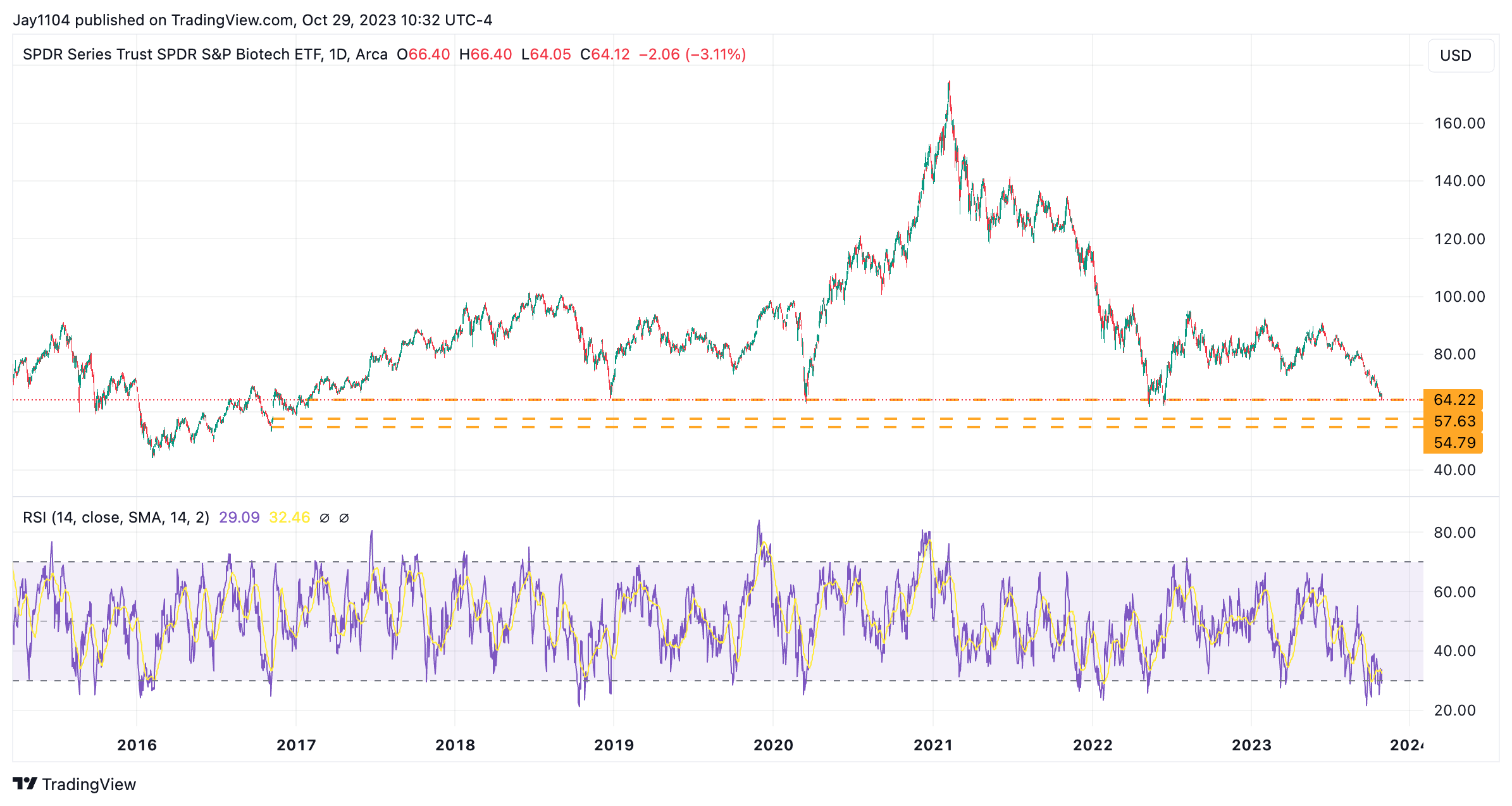

Biotech Sector May Continue Lower

For the biotech ETF () has fallen back to levels seen in 2017, 2018, 2020, and 2022. The sad thing for this group is that it may not be finished falling, either.

If the XBI should break support around $64, the next level of support comes at gap fills from 2016 at $54 and $57.

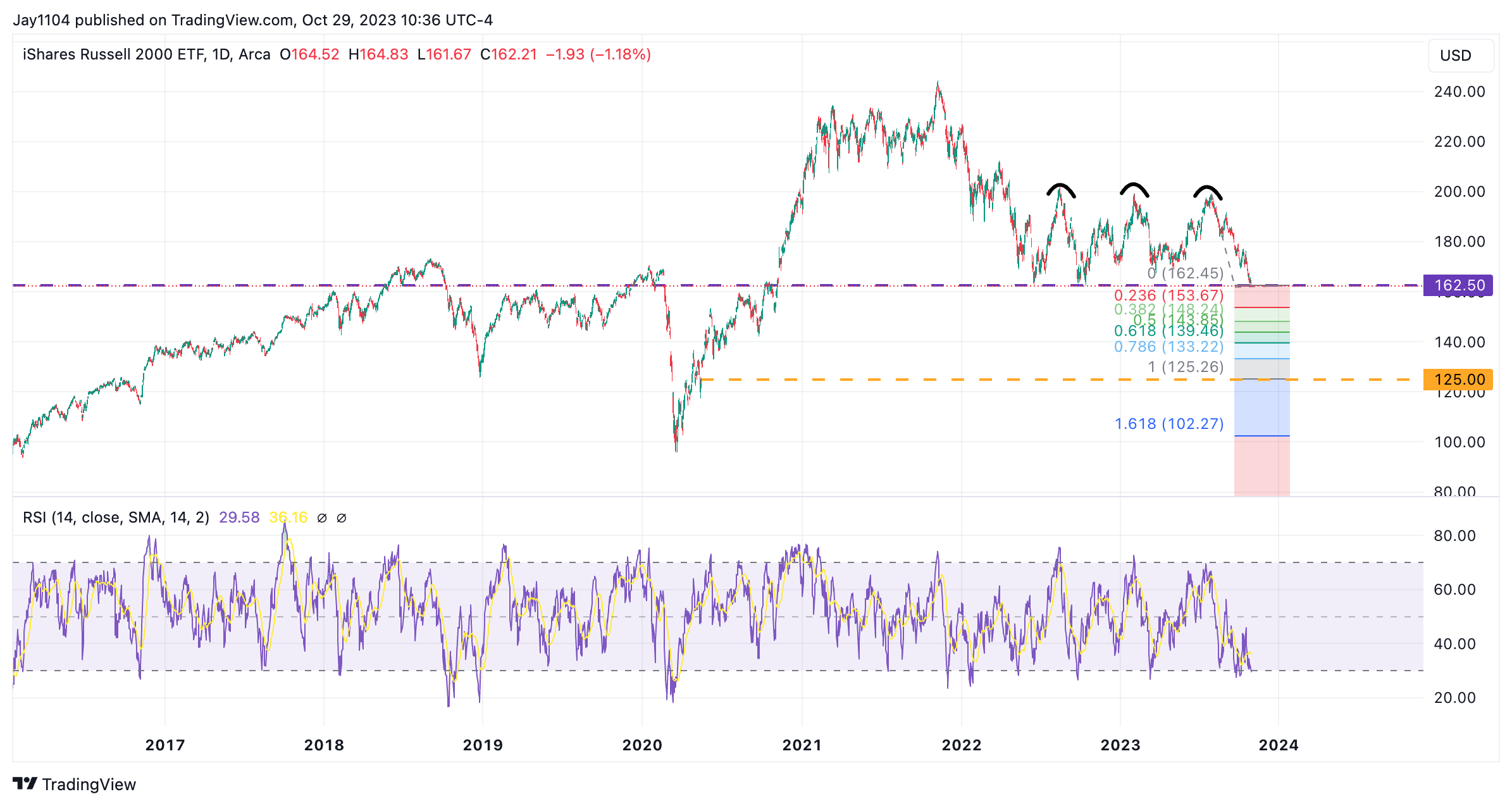

Russell 2000 (IWM) Back to Its 2022 Lows

When biotech underperforms, small-cap underperforms, which has the () back to its 2022 lows.

You can see how ominous the triple top in the IWM looks and what a break of the neckline at $162.50 could mean for the IWM, with gaps to fill down around $127.

Russell 2000 ETF-Daily Chart

Russell 2000 ETF-Daily Chart

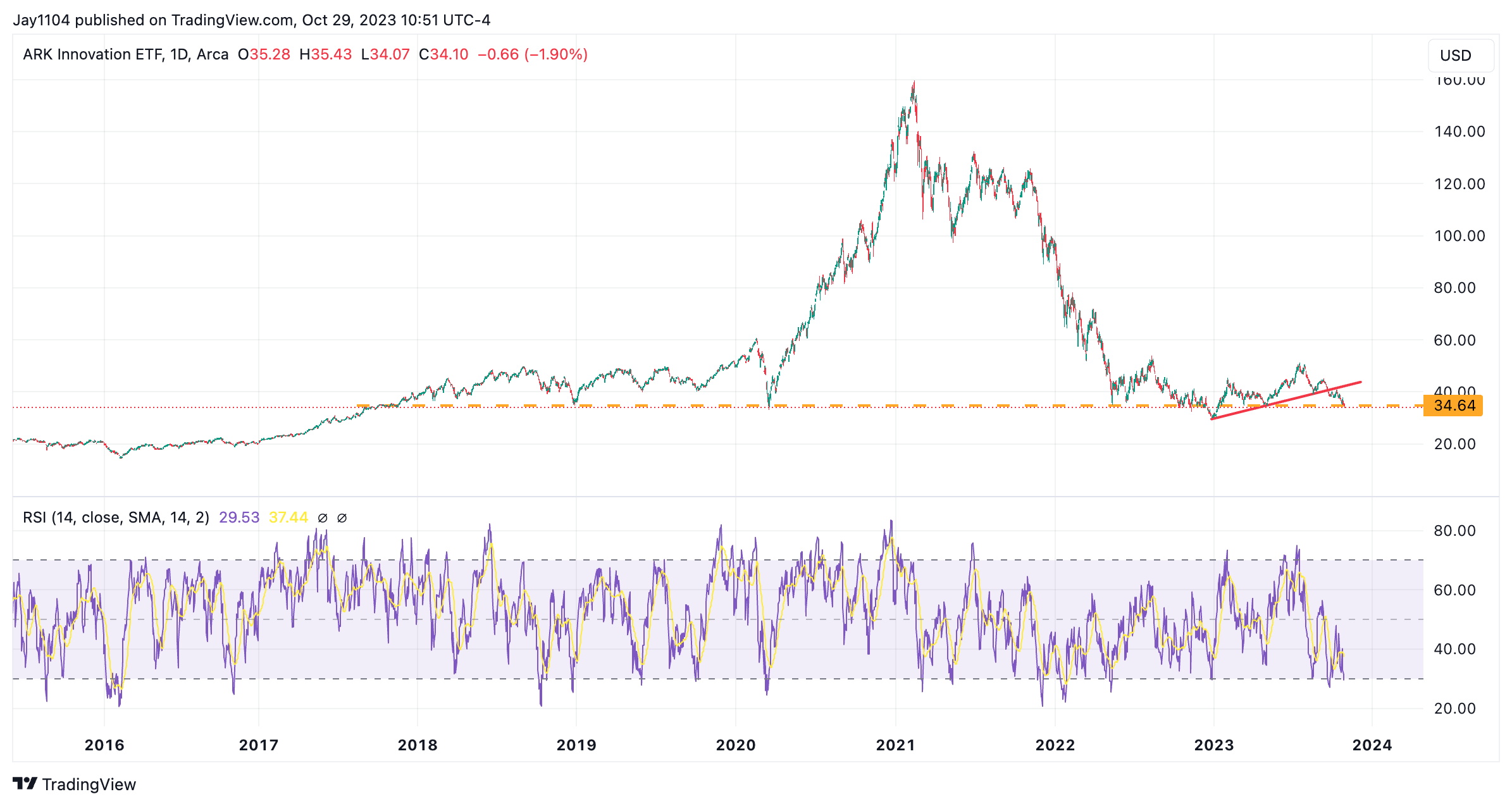

ARKK Innovation ETF Trades Near 2017 Low

This is more broadly a sign of long-duration growth assets doing poorly, which is also why the ETF is trading back near its low and a level seen back in 2017.

Magnificent 7 Stocks Start to Price in High Rates

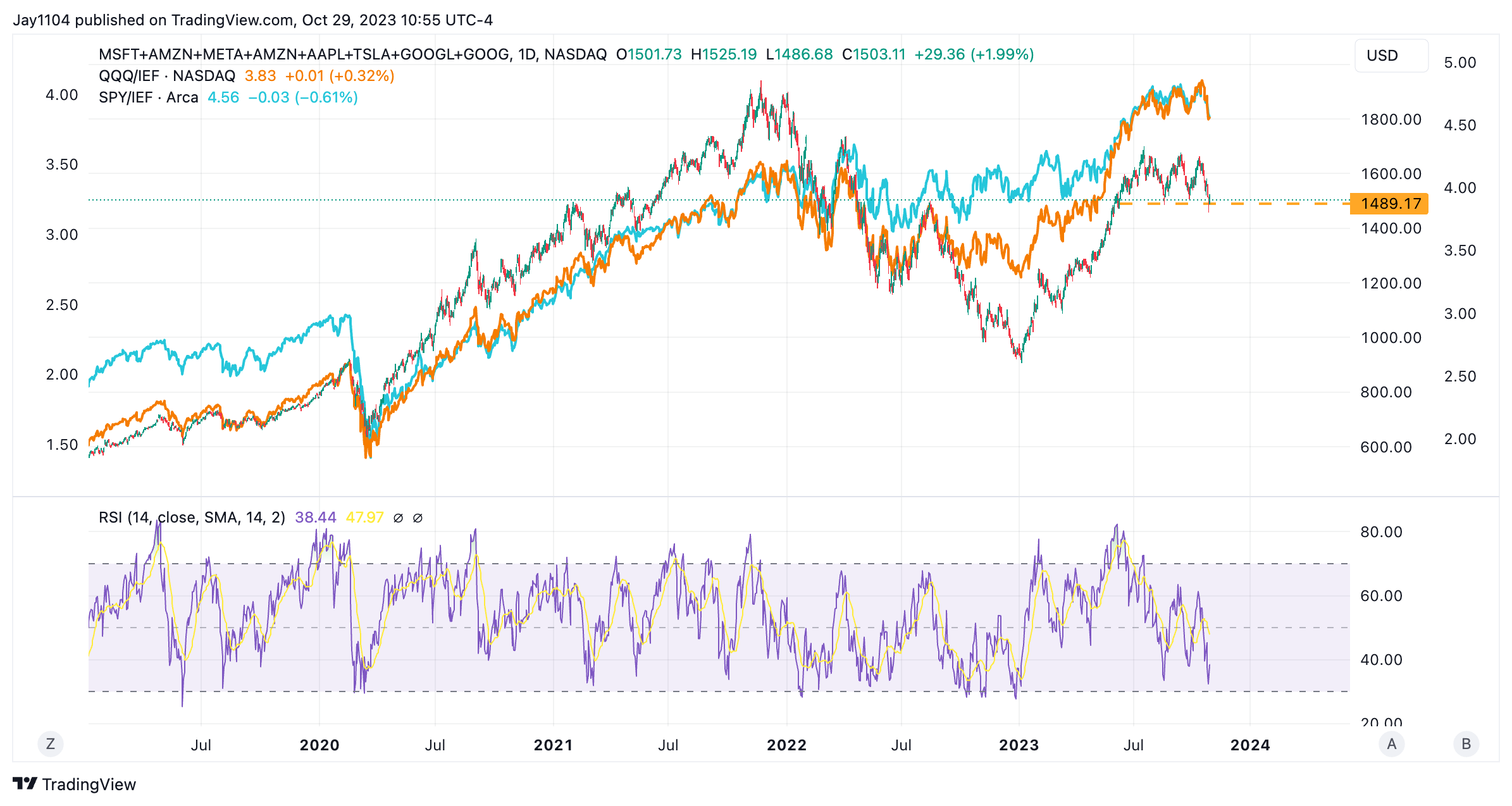

This is probably why the Mag 7, when added into one entity, has the same look as the SPY to IEF and the to IEF ratio. They are telling us the same thing.

Stocks are repricing for a higher rate world, and the higher rates go, the more stocks will need to reprice.

So, if you are trying to understand when stocks will stop falling, turn your attention to the macro data, bonds, and the dollar. They will tell you when stocks have finished falling before stocks will tell you when they are finished falling.

THIS WEEK’S FREE YOUTUBE VIDEO:

Original Post