Stagflation Warning: Fed’s Battle Against Inflation Is Far From Won

2023.06.19 04:10

The upcoming week in the stock market is set to be bustling as Jay is slated to deliver his testimony before both the House and Senate on Wednesday and Thursday. It’s unlikely that Powell will deviate from his statements made just last Wednesday. Still, it’s noteworthy that the equity market remains skeptical when Powell indicates that rates are poised to rise. This may push Powell to emphasize the anticipation of more rate hikes later this year.

This situation poses a considerable risk for equity prices, especially now that we have past June OPEX. Consequently, the hedging flows bolstering stocks are expected to dwindle. This coincides with a period when stocks are overbought on the index level, which is set to challenge the determination of bullish investors as flows begin to change and markets appear stretched.

Over the past few weeks, I’ve been discussing the upcoming narrative that foresees several challenges looming over the market this summer. These hurdles include the likelihood of the Fed continuing to hike rates, dwindling hedging flows, and replenishing the Treasury General Account (TGA), all occurring as stocks reach overbought and overvalued statuses. The has escalated more than my initial projections, but the narrative and associated risk remain consistent. Additionally, it could be argued that there’s a mounting risk of a resurgence in inflation during the year’s second half.

The S&P 500 is trading above its upper Bollinger Band, with the RSI trading above 70. This doesn’t necessarily imply that stocks must decline, but it indicates that a consolidation phase might be warranted. This could manifest in stocks dropping or trading sideways until the overbought levels lessen.

S&P 500 Index Daily Chart

S&P 500 Index Daily Chart

The same is the case for the .

The crux of the matter is what’s driving the market. I speculate that a couple of factors are in play, the most significant being the volatility crush we’ve observed as the dips below 15. Another factor could be the newfound conviction in a soft landing scenario, where the economy manages to dodge a recession, and earnings growth remains relatively unscathed.

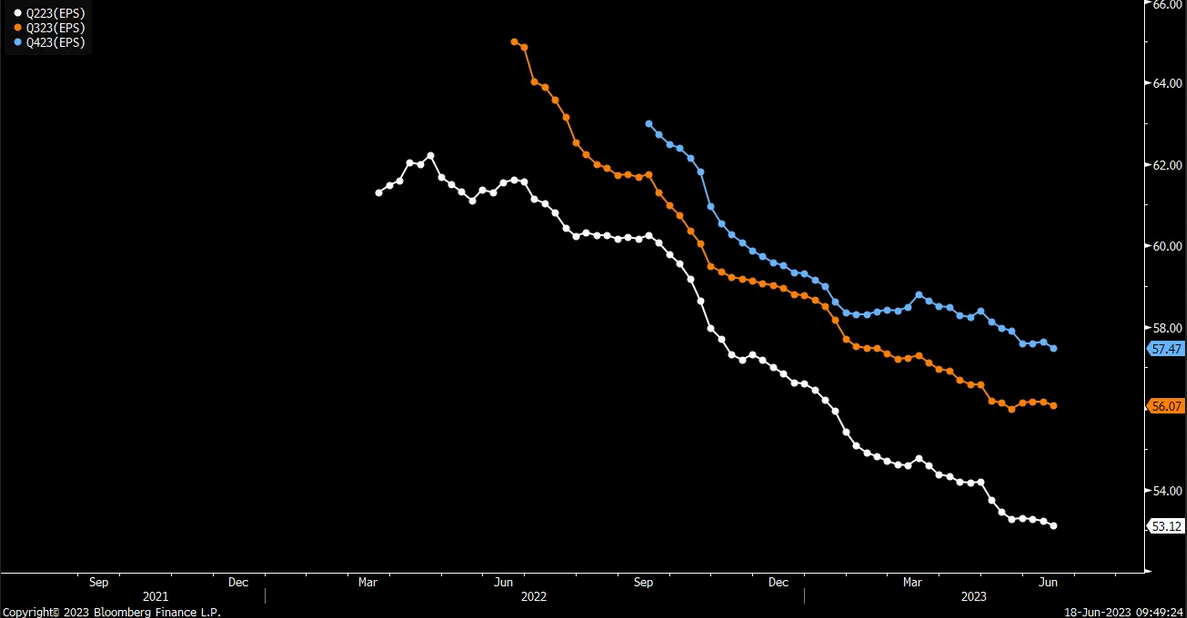

Such a scenario is plausible, but thus far, we haven’t observed a substantial or tangible increase in earnings estimates for the next three quarters. Earnings trends have been on a downward trajectory over the past few weeks. It’s possible, however, that the earnings might outperform pessimistic predictions when companies start revealing their results in a few weeks.

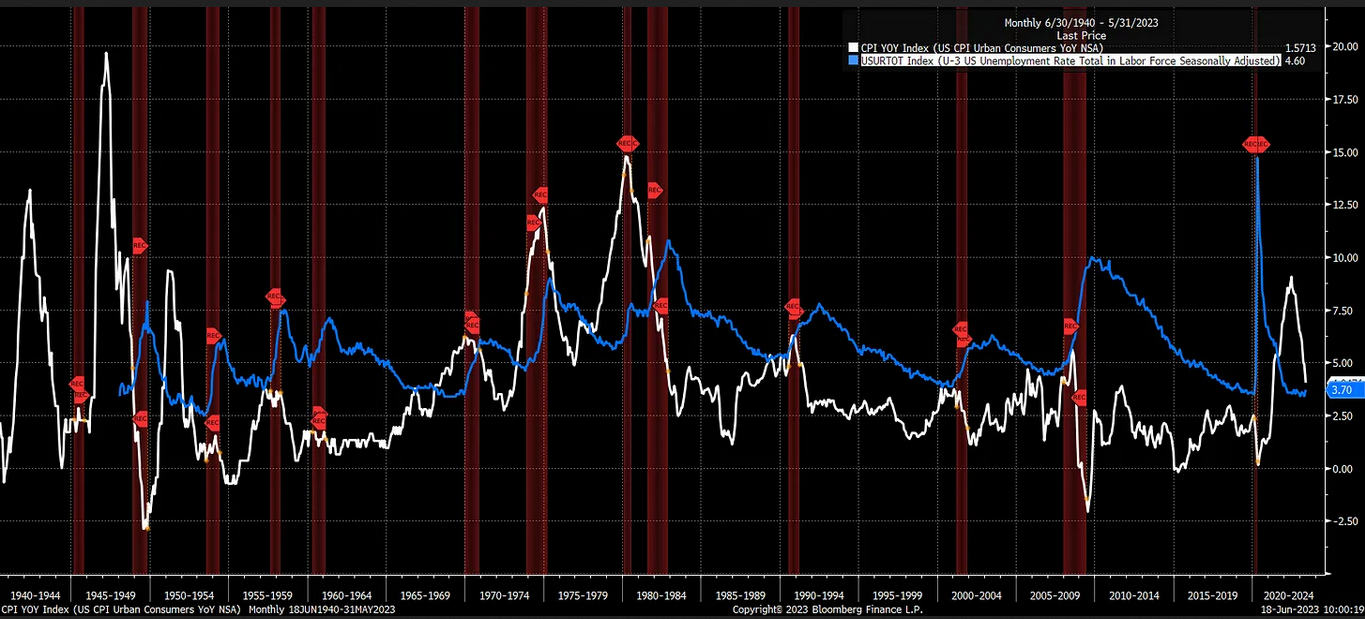

I’ve always leaned towards the belief that we will likely witness staying stubbornly high, with the US existing in a slow, grinding growth environment. History has taught us that periods of high inflation typically coincide with rising unemployment rates, which often trigger a recession.

It seems improbable that this time will diverge from the pattern. Indeed, only when the has escalated in the past has inflation has been truly suppressed. Thus, I think that even though headline inflation has dropped, bringing it back to the 2% area the Fed desires without elevating the unemployment rate will be challenging. To achieve that, a recession will likely be necessary.

Hence, the recent uptick that the stock market has managed to assemble isn’t likely to hold firm, considering that the entire rally is currently predicated on the hope of averting a recession, which doesn’t seem probable. Additionally, the inflation rate is only subdued due to a significant drop in energy prices in recent months.

However, is demonstrating resilience on its chart, and if it can surpass $75, it could potentially rebound back to $83. Moreover, as we transition into the year’s second half, oil will be compared against much lower prices. This means that oil’s dampening effect on inflation will gradually wane.

CFDs on WTI Crude Oil Daily Chart

CFDs on WTI Crude Oil Daily Chart

The same scenario applies to gasoline, establishing a base of around $2.32. It appears to be moving upwards, potentially returning to $2.85. Moreover, as we progress into the summer, the base effect of gasoline will start to diminish.

Gasoline Futures Daily Chart

Gasoline Futures Daily Chart

Even has shown signs of breaking out of a downtrend.

Wheat Futures Daily Chart

Wheat Futures Daily Chart

Therefore, as we progress into the year’s second half, the same factors that have helped suppress inflation are likely to start contributing to inflation again. This represents the most significant risk for the Fed and could be one reason we continue to see higher rates. This is because rates are aware of the negative inflation trends looming, and they know the Fed will have to take further measures to temper prices.

This is likely why the US 2-year yield marked its highest close on Friday since mid-March.

US 2-Yr Yield Daily Chart

US 2-Yr Yield Daily Chart

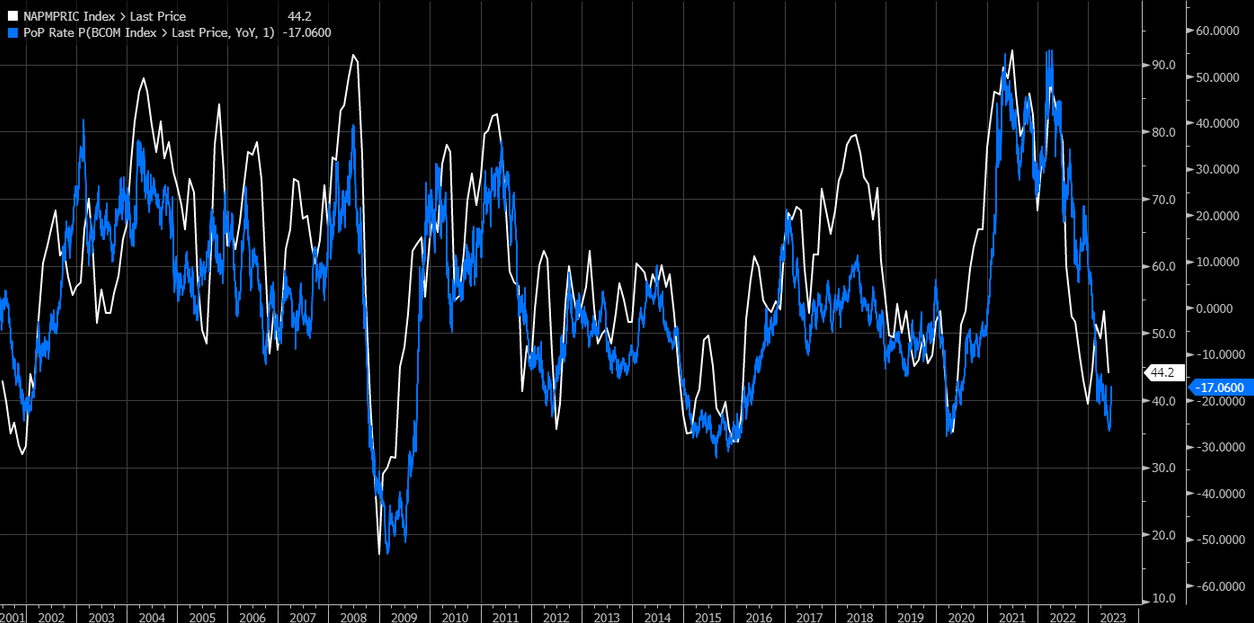

More significantly, with China likely to initiate growth stimulation measures again, there’s a reasonable chance that commodity prices might start to ascend. The appears to be breaking a downtrend, setting the stage for a sharp upward move.

Bloomberg Commodity Price Index

Bloomberg Commodity Price Index

This matters to us because the year-over-year change in the value of this index correlates with the ISM Prices Paid Index. If we observe this index climbing, it will add to producer prices, and the recent deflationary trend in goods might start to reverse.

My overall perception is that while the equity market is contemplating the possibility of a soft landing, the bond market seems to be considering a scenario of persistently higher rates. This is due to rates staying resilient and the potential setup for a renewed increase in commodity inflation.

This generally suggests that the Fed will have a significant task at hand to suppress demand enough to lower core inflation. Simultaneously, they’ll face an even bigger problem if China does decide to stimulate its economy and we begin to see commodity inflation kick-start again. This would drive headline inflation higher, which is much harder to combat unless the Fed can somehow cause the dollar to appreciate, which may mean even higher rates.

This scenario likely implies that financial conditions will need to tighten further, and real rates will have to increase. This is typically not beneficial for stocks – it hasn’t been in the past, and it’s unlikely to be so. Therefore, we may be moving towards a period of true stagflation, characterized by rising prices and increasing unemployment, as the Fed strives to suppress core inflation and keep headline inflation from spiraling out of control.

This week’s Free YouTube Video:

Original Post