Spike in Oil Prices to Spoil the Party for S&P 500

2023.08.02 03:48

As the market and economy cheer the rise in , we can thank consumer spending: 70% of GDP, services (what consumer pay for in aid, help, or information): 45% of GDP, and government spending: about 19% of GDP.

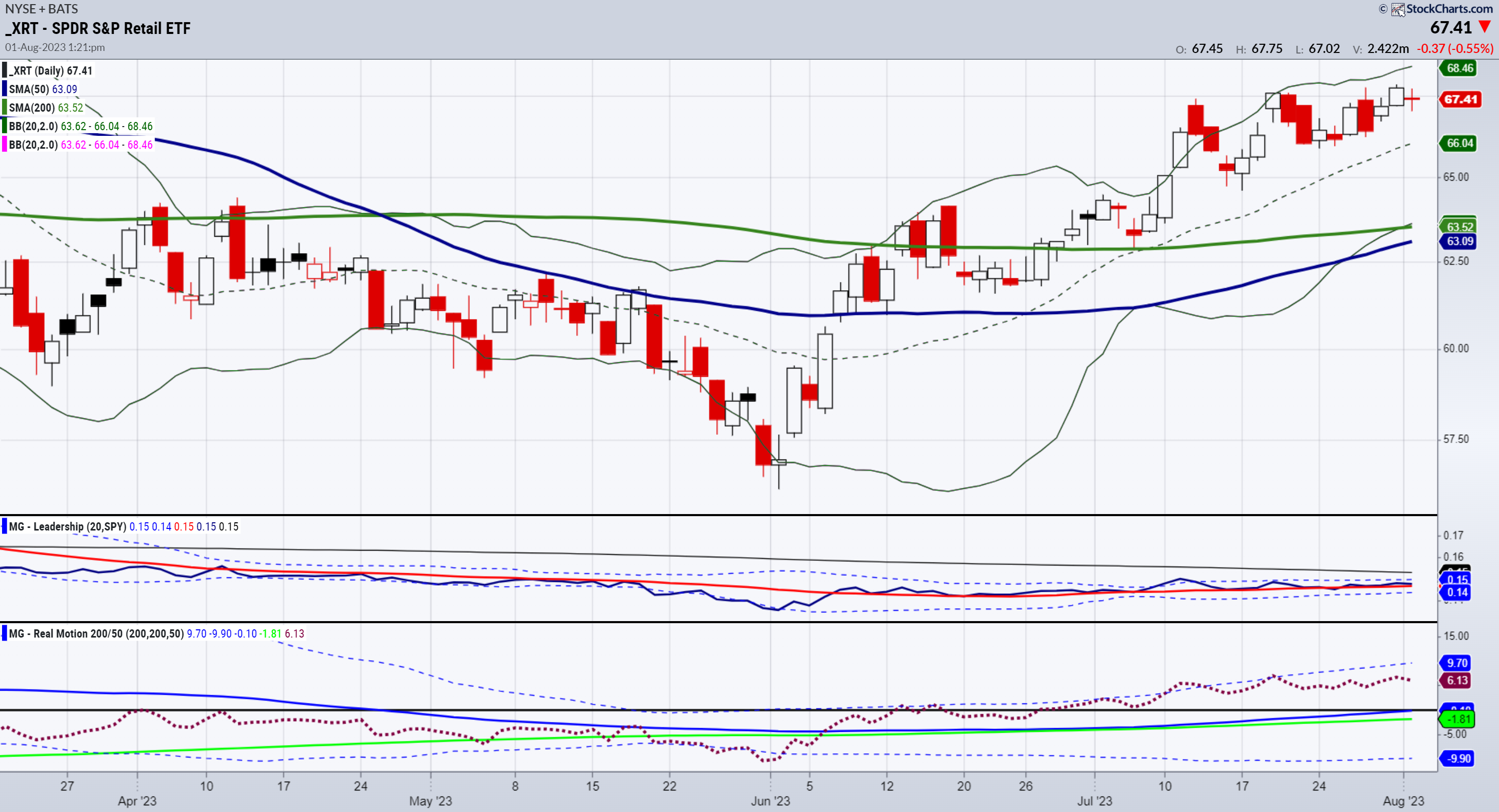

Hence, one sector to watch carefully is retail through the SPDR S&P Retail ETF (NYSE:).

The ETF XRT is still well underperforming the S&P 500 (NYSE:) over the course of this year.

However, considering that, XRT looks ready to enter a bull phase with a golden cross.

Furthermore, as measured by our Leadership indicator, XRT is slightly outperforming the SPY.

The SPY chart is signaling a mean reversion sell signal potential, but otherwise, looks good as long as it holds 452-its July calendar range high.

XRT also sits at an inflection point as the July 6-month calendar range high is at current price levels.

While yields and prices rise, that could hurt consumers.

For how long can the “Fed pause/pivot in 2024” sentiment give markets and consumers hope if yields and oil both remain high?

For now, XRT shows more optimism than not. We will look at that chart carefully this month.

Oil is over $81 a barrel. We know if that continues, , , – all of it will go up during the next round of economic releases.

That should curtail “Fed will pause” enthusiasm even if they do pause.

Clearly, high rates and high energy prices are bad for consumers.

Light Crude Oil Futures Daily Chart

Light Crude Oil Futures Daily Chart

Where should we look then to see what might happen next?

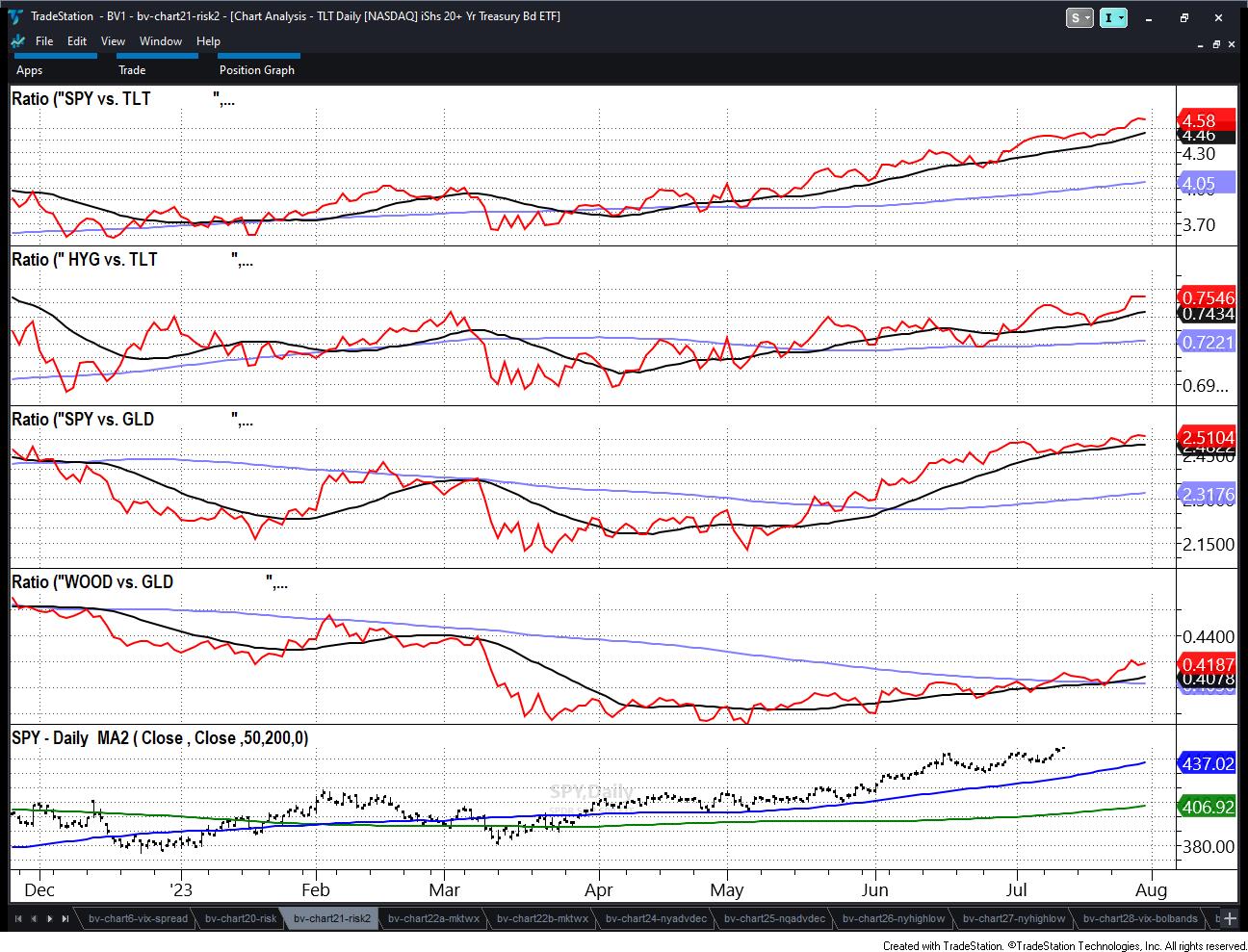

Our Big View has been useful in helping us see the various risk factors.

The key ones we look at are how the SPY is doing versus the long bonds through the iShares 20+ Year Treasury Bond ETF (NASDAQ:),

How is the TLT doing versus the junk bonds (NYSE:)?

How is doing versus the SPY.

How WOOD is doing versus gold and how utilities are doing versus the SPY.

All risk factors right now say risk on.

Hopefully, that continues to be the case.

Should that change, we will be right on top of it to share it with you.

ETF Summary

- (SPY) 452 July calendar range hi now support

- (IWM) 193 is the 23-month holy grail

- Dow (DIA) 35,000 support

- Nasdaq (QQQ) 384 pivotal based on the calendar range

- Regional banks (KRE) Consolidating over its July calendar highs-positive

- Semiconductors (SMH) Holds here ok-needs to clear 161 and under 147 trouble

- Transportation (IYT) 240 is the key underlying area of support

- Biotechnology (IBB) 128 support now to hold like to see it clear 130

- Retail (XRT) 67.40 the calendar range and pivotal