S&P 500 Selloff: Embrace Short-Term Pain for Sustainable Long-Term Gains

2023.09.27 08:06

- Current selloff in stocks is absolutely normal and expected

- Despite the declines and investors’ overreactions to it, we are still in the green for the year

- Short-term pain is a key part of the journey to long-term investing success

I’m back in the thick of market action after a refreshing vacation, which included a visit to the picturesque Santiago de Compostela, renowned as one of the final destinations along the famous spiritual pilgrimage route.

Santiago de Compostela holds a special place for pilgrims who traverse miles on foot or by bicycle, marking it as their ultimate goal.

What caught my attention as I strolled through the city’s streets was a compelling message: “Sin dolor, no hay gloria!” accompanied by an image of weary feet. In English, it translates to “no pain, no glory.”

The journey itself is undeniably challenging, and I could sense the incredible feeling of achievement upon reaching the finish line.

As a dedicated investor, I couldn’t help but draw parallels between this pilgrimage and the financial markets of recent years.

Particularly in these weeks spanning August to September, the market still appears to be in a corrective phase, a topic we’ve previously discussed.

Whether this correction is due to seasonal factors or a more substantial adjustment following the impressive rally up to the end of July, it’s clear that many investors are growing impatient.

It’s worth noting, however, that despite a 7.15% dip from July highs, the is still up nearly 11.5% since the start of the year.

Once more, it appears that we’re surrounded by predictions of impending doom, with forecasts of everything on the verge of collapse.

It’s the same once again – interest rates, inflation, Central Banks – all seemingly conspiring to bring about another collapse, perhaps akin to the events of 2022 or even worse.

However, in times like these, maintaining the right perspective becomes crucial. It enables us to sift through the noise and maintain our composure by refocusing on what truly matters.

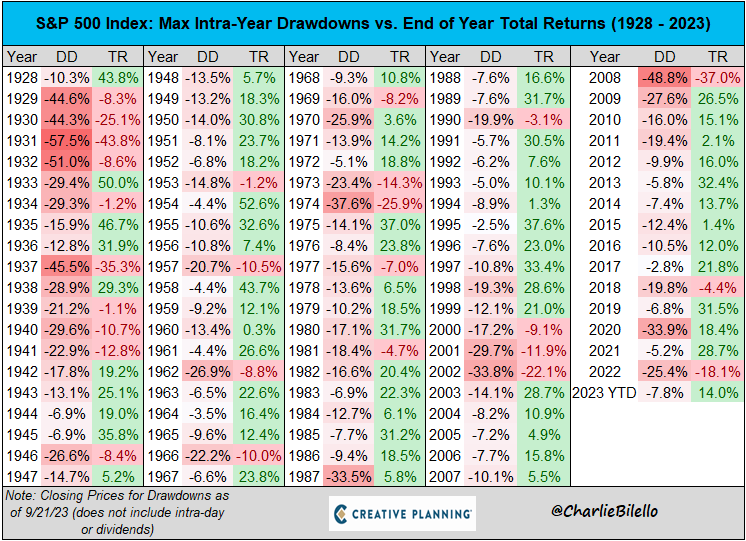

S&P 500 Max Intra-Year Drawdowns

S&P 500 Max Intra-Year Drawdowns

Source: Charlie Bilello

First and foremost, it’s crucial to remember that markets, in their upward journey over the long term, experience drawdowns as a natural part of their cycle.

On average, drawdowns dating back to 1928 have fallen in the range of 20 percent. This means that even in prosperous years, investors must be prepared to weather these declines if they aim to generate long-term gains.

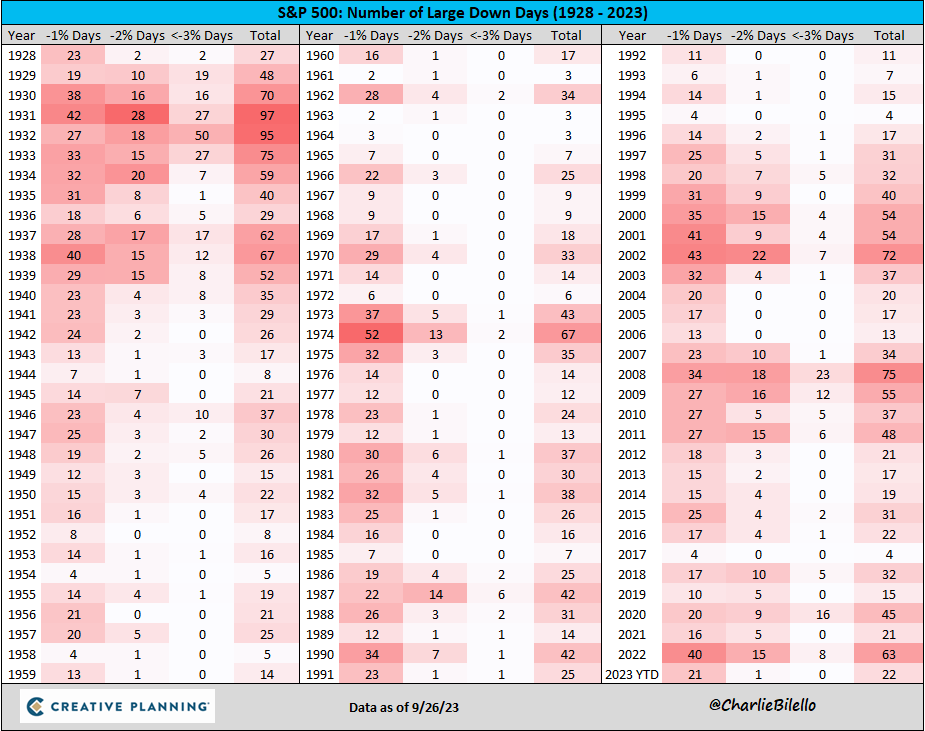

Another important point to note is that days like yesterday, characterized by declines exceeding 1%, are also entirely normal occurrences in the market.

Even in a year that has seen favorable performance thus far, we’ve witnessed 22 instances of declines surpassing the 1% mark. Does that sound like a high number?

S&P 500 Number of Large Down Days

S&P 500 Number of Large Down Days

Source: Charlie Bilello

Looking at the chart, it becomes evident that the average number of such declines per year is around 30. In 2022, we experienced 63 such instances. Does this help put our fears into perspective? It certainly should.

I’ve always maintained that not everyone is cut out for investing. It’s not for the faint of heart or those seeking quick and random gains.

For many, it can resemble a form of gambling, where money is put into the markets without a deep understanding of market history and its inherent nature.

What often gets overlooked is the behavioral aspect, which is arguably the most critical. Even those who understand the numbers and market history can struggle when confronted with market declines.

It’s a test of one’s emotional resilience, and it’s not easy. Many end up selling at the lowest points or hastily abandon strategies that were carefully crafted for the long term.

Remember, “sin dolor, no hay gloria” – no pain, no glory. See you at the finish line!

***

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis.”