Financial market overview

S&P 500 E-Mini Forms 9-Bar Bull Microchannel: Time to Go Long?

2023.12.26 09:10

Market Overview: S&P 500 Emini Futures

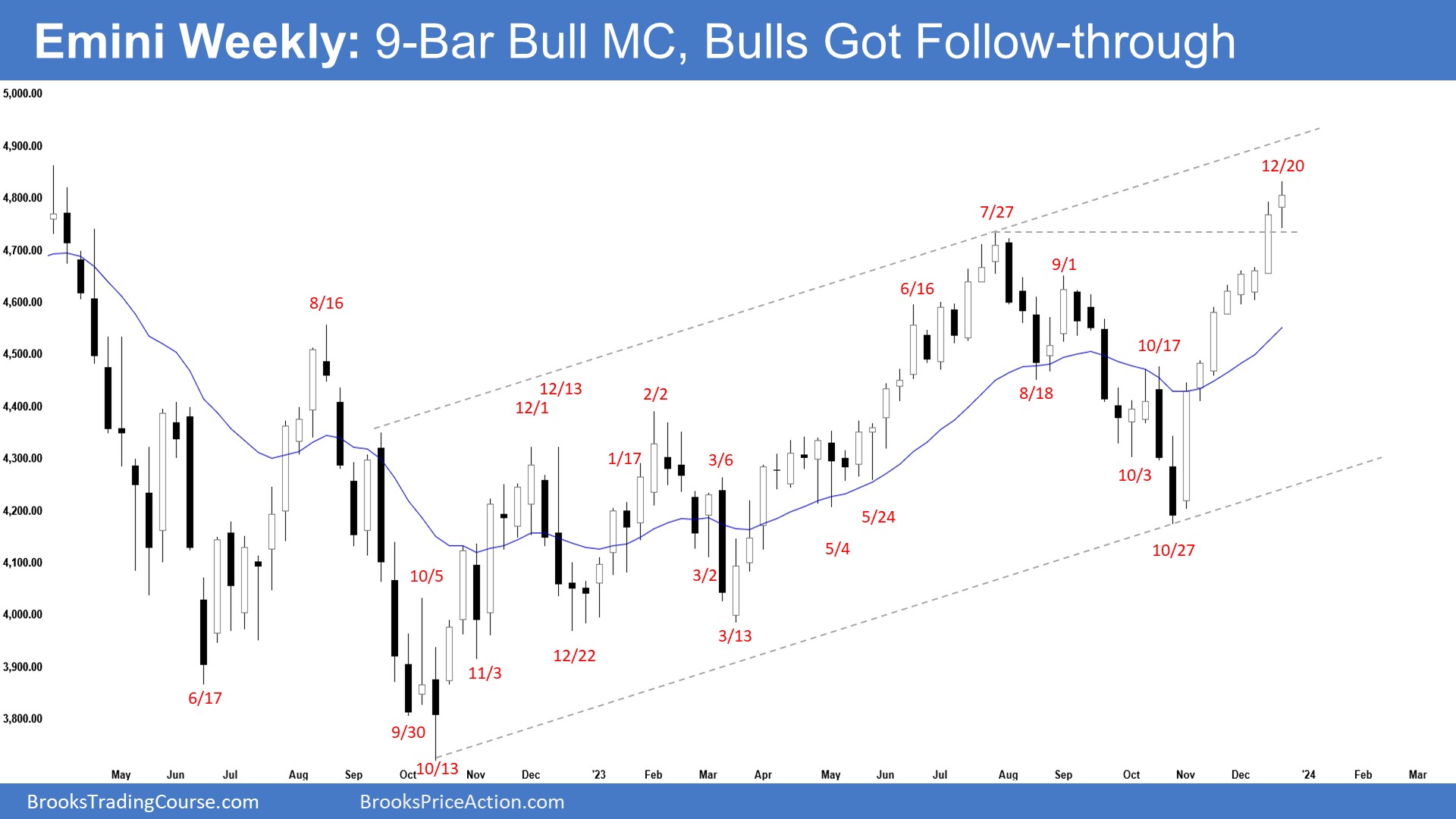

The weekly chart formed an 9-bar bull microchannel which means strong bulls. There may be buyers below the first pullback from such a strong bull microchannel. The bears need to create strong bear bars with follow-through selling to increase the odds of a deeper pullback.

S&P 500 Emini Futures

- This week’s Emini candlestick was another consecutive bull bar closing in its upper half with a noticeable tail above.

- Last week, we said that until the bears can create strong consecutive bear bars, odds continue to favor the market to remain in the sideways to up phase. Traders will see if the bulls can get another follow-through bull bar (even if it is just a bull doji).

- This week was a bull doji and the bulls got some follow-through buying following last week’s breakout above the July 27 high.

- The bulls got a strong rally in the form of a 9-bar bull microchannel with bull bars closing near their highs. That means strong bulls.

- The bulls hope to create a short covering spike above the July 27 high. Bears that have covered will likely not sell again until another significant resistance above (probably above the all-time high next).

- The next target for the bulls is the all-time high. They want a strong breakout into new all-time high territory, hoping that it will lead to many months of sideways to up trading.

- There likely will be buyers below the first pullback from such a strong bull microchannel.

- If a two-legged pullback begins, the bulls want it to be sideways and shallow, with doji(s), bull bars and overlapping candlesticks with long tails below.

- If there is a deep pullback, they want a second leg sideways to up and the 20-week EMA to act as support.

- The bulls want a strong bull bar next week closing near its high which will lead to the monthly candlestick closing near its high.

- If the December monthly candlestick closes at its high, the market may gap up on the Yearly, Monthly, Weekly and Daily chart the following week. (The cash index SPX is just 65 points shy of the all-time high)

- The bears hope that the strong move is simply a buy-vacuum test of what they believe to be a 36-month trading range high.

- They want a reversal from a higher high major trend reversal (with the July 27 high) or a double top (July 27 high). They also see a large wedge forming (Feb 2, July 27, and December 22)

- The problem with the bear’s case is that the rally is very strong.

- They will need to create strong bear bars with sustained follow-through selling to increase the odds of a deeper pullback. So far, they have not yet been able to do so.

- The bears will need a strong reversal bar or at least a micro double top before they would think of selling.

- Since this week’s candlestick is a bull bar closing in its upper half, it is a buy signal bar for next week albeit weaker. The risk for new buyers is becoming big because of the large stop required.

- Swing bulls will likely continue to hold their longs established at much lower prices through the anticipated pullback, expecting any pullback to be minor.

- As the trend is becoming increasingly climactic, a small pullback can begin within a few weeks.

- However, until the bears can create strong consecutive bear bars, odds continue to favor the market to remain in the sideways to up phase.

- Traders will see if the bulls can get another follow-through bull bar (even if it is just a bull doji) or will the market close with a bear body and a prominent tail above, beginning the minor pullback phase.

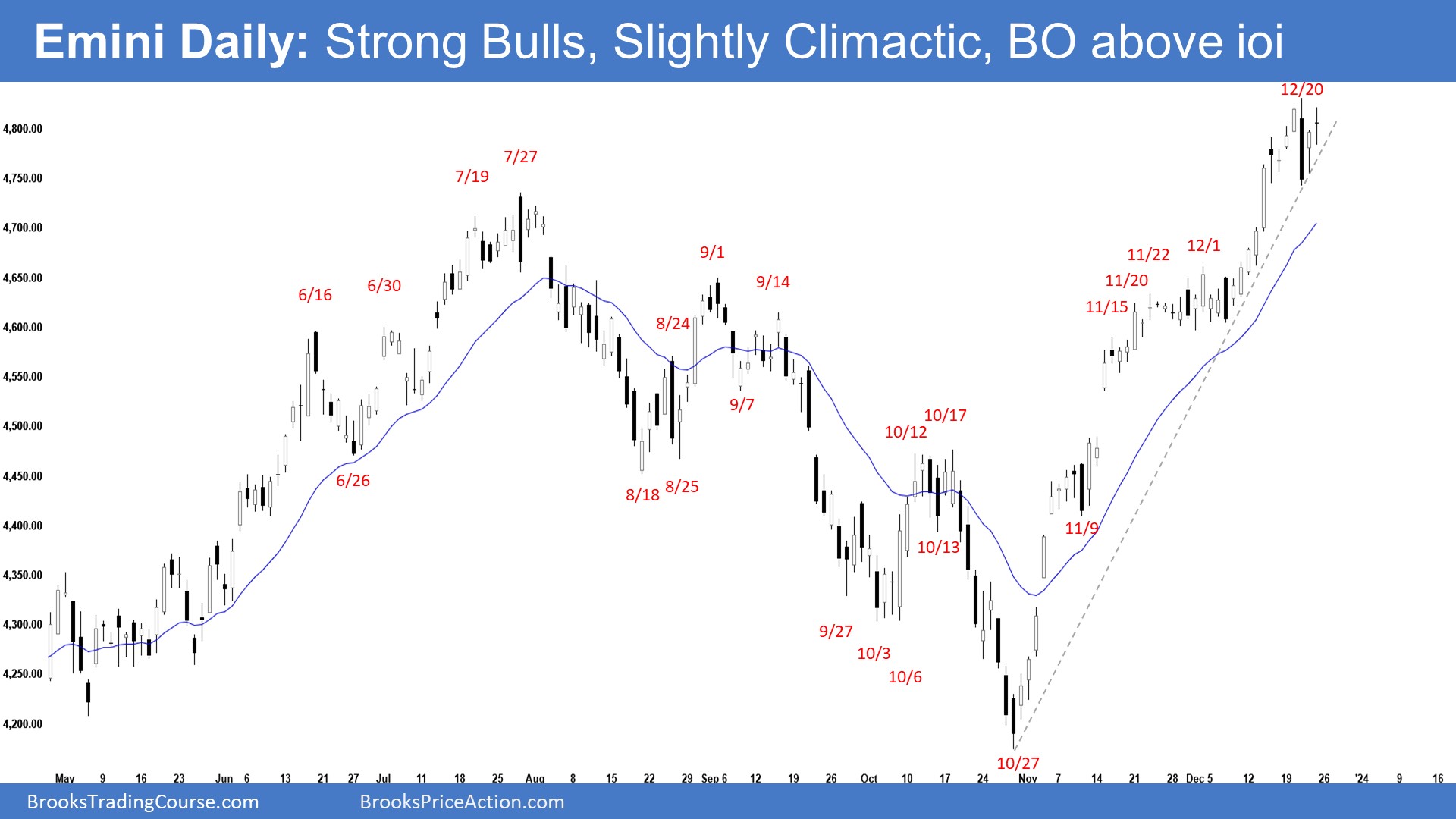

- The market traded sideways to up for the week. Wednesday was a big outside bear bar but there was no follow-through selling. Friday broke above the IOI (inside-outside-inside) pattern.

- Last week, we said that the odds slightly favor any pullback to be minor, followed by a retest of the current leg extremely high.

- Wednesday formed a 1-bar pullback followed by a retest of the current leg high (Dec 20) on Thursday and Friday.

- The bulls got a strong rally with several big gaps that remained open and in a tight bull channel.

- They hope that the current rally will form a spike and channel which will last for many months after a pullback.

- They want a strong short covering above the July 27 high that will fuel the move toward the all-time high. (Side note: This may be playing out on the cash index or SPY ETF charts already)

- If a pullback begins, the bulls want the 20-day EMA to act as support and form a 20-gap-bar buy setup.

- They want any pullback to be sideways and shallow (with doji(s), overlapping bars, bull bars, and candlesticks with long tails below).

- The last 7 candlesticks are overlapping sideways. It could be part of a minor pullback phase.

- The bears hope that the strong rally is simply a buy vacuum retest of the July 27 high.

- They want a reversal down from a lower high major trend reversal (against the all-time high) and a double top (with July 27).

- They hope to get at least a TBTL (Ten Bars, Two Legs) pullback. They want the market to stall around the current levels and begin the pullback phase soon.

- The problem for the bears is that the selling pressure remains weak (no consecutive bear bars) while the buying pressure is very strong (strong bull bars closing near their highs).

- The bears will need to create consecutive bear bars closing near their lows and trading far below the 20-day EMA to increase the odds of a deeper pullback.

- For now, the buying pressure remains very strong with bear bars not getting follow-through selling.

- While the market is becoming increasingly climactic, until the bears can create strong bear bars, odds slightly favor the market to remain in the sideways to up phase.