Financial market overview

S&P 500 E-Mini: Follow-through Selling Likely

2023.08.14 09:34

The bears got follow-through selling on the weekly chart. The minor pullback phase has likely begun. A reasonable target for the bears is the 20-week exponential moving average.

The bulls want the pullback to be weak and sideways, followed by a retest of the recent extreme high (Jul 27).

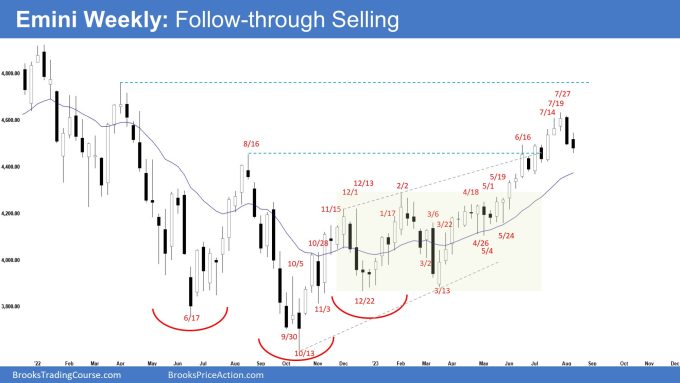

The Weekly Emini chart

- This week’s Emini candlestick was a consecutive bear bar closing in the lower half of its range.

- Last week, we said that the odds slightly favor the market to still be in the sideways to down pullback phase and traders will see if the bears can create strong follow-through selling or not.

- Previously, the problem with the bear’s case was that they were able to create strong follow-through selling since the March low.

- The bears managed to get decent follow-through selling this week.

- They want a reversal down from a wedge pattern (Dec 13, Feb 2, and Jul 27) and a micro wedge (Jul 14, Jul 19, and Jul 27).

- At the very least, they want a larger pullback from what seems like a climactic move.

- They will need to continue creating consecutive strong bear bars closing near their lows to convince traders that a reversal down could be underway.

- A reasonable target for the bears is the 20-week exponential moving average.

- The bulls got a strong leg up since March in a tight bull channel.

- They want a measured move using the height of the 6-month trading range which will take them to the March 2022 high area.

- The move up has lasted a long time (4 months) and is slightly climactic.

- The market may need to trade sideways to down to work off the overbought condition. The minor pullback likely has begun.

- The bulls want any pullback to be shallow and weak (with overlapping bars, doji(s) and bull bars).

- Odds are the pullback would likely be minor to be followed by at least a small retest of the prior leg high (Jul 27).

- Since this week’s candlestick was a bear bar closing in the lower half, it is a sell signal bar for next week.

- The odds continue to slightly favor the market to still be in the sideways to down pullback phase.

- Traders will see if the bears can continue to create consecutive bear bars or will the pullback be sideways and weak (with overlapping bars, doji(s) and bull bars).

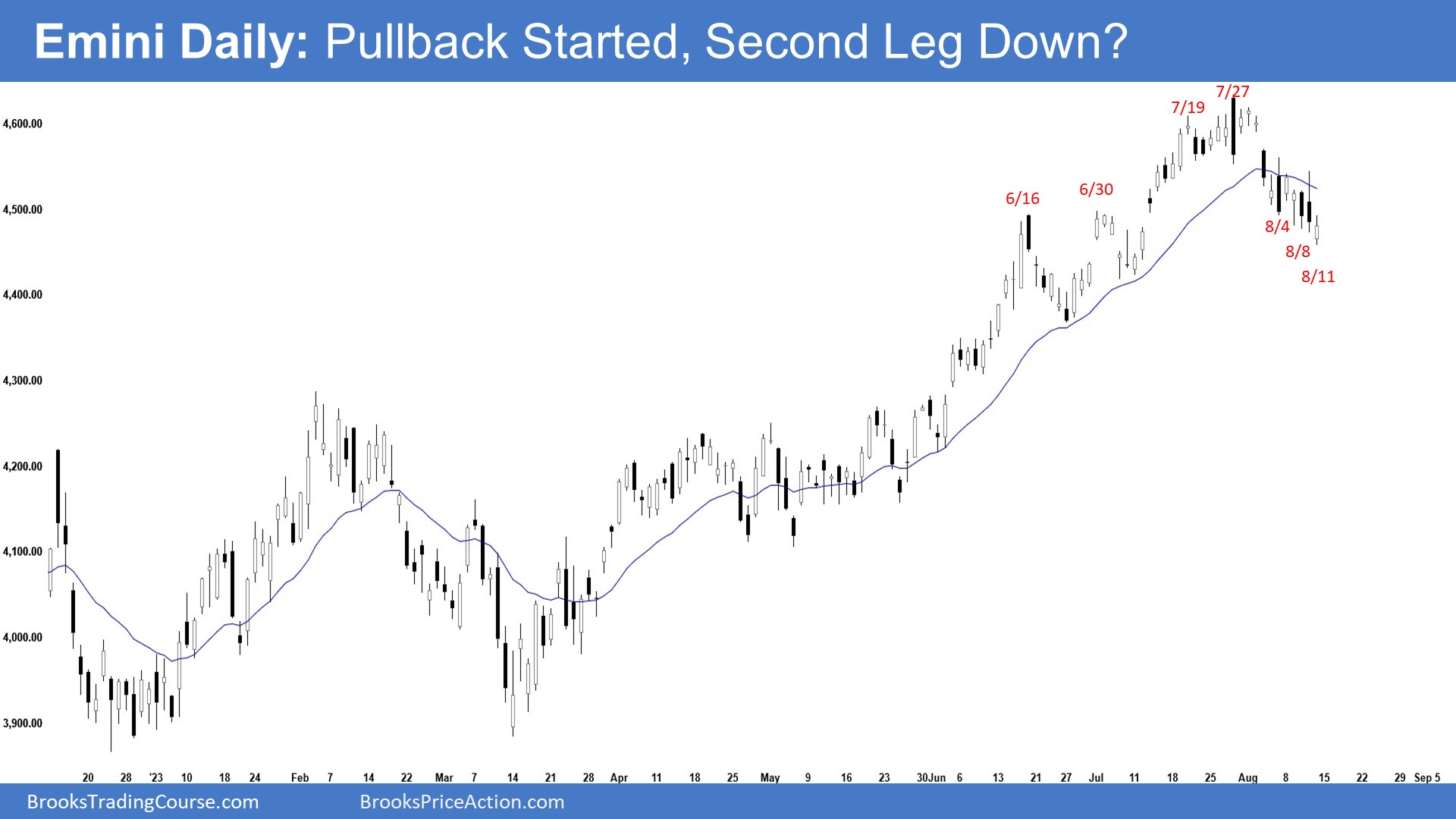

The Daily S&P 500 Emini chart

- The Emini traded sideways to down for the week. Wednesday traded higher but reversed to close near its low. Friday gap is lower but reverse to close with a bull body.

- Previously, we said that the move-up has lasted a long time and is slightly climactic. A minor pullback can begin at any moment.

- The bears manage to create what could be the first leg of a minor pullback.

- They want a reversal from a climactic move and a small wedge (Jun 30, Jun 19, and July 27).

- A pullback would usually last at least TBTL (Ten Bars, Two Legs).

- They will need to continue creating consecutive bear bars closing near their lows, trading far below the 20-day exponential moving average to increase the odds of a deeper pullback.

- If there is a pullback (bounce), they want at least a small second leg sideways to down.

- The bulls want a measured move up using the height of the 6-month trading range which will take them near the March 2022 high.

- The move up since March 13 low is in a tight bull channel which means strong bulls.

- However, it has also lasted a long time and is climactic. A minor pullback likely has begun.

- The Bulls want any pullback to be weak and sideways. They then want at least a small retest of the July 27 high.

- For now, odds slightly favor the market to still be in the sideways to down pullback phase and at least a small second leg sideways to down after a pullback (bounce).

- Traders will see if the bears can create strong consecutive bear bars or will the pullback be sideways and weak (with overlapping bars, doji(s), and bull bars).