Financial market overview

S&P 500 E-Mini Follow-Through Bull Bar

2023.11.27 08:09

Market Overview: S&P 500 E-mini Futures

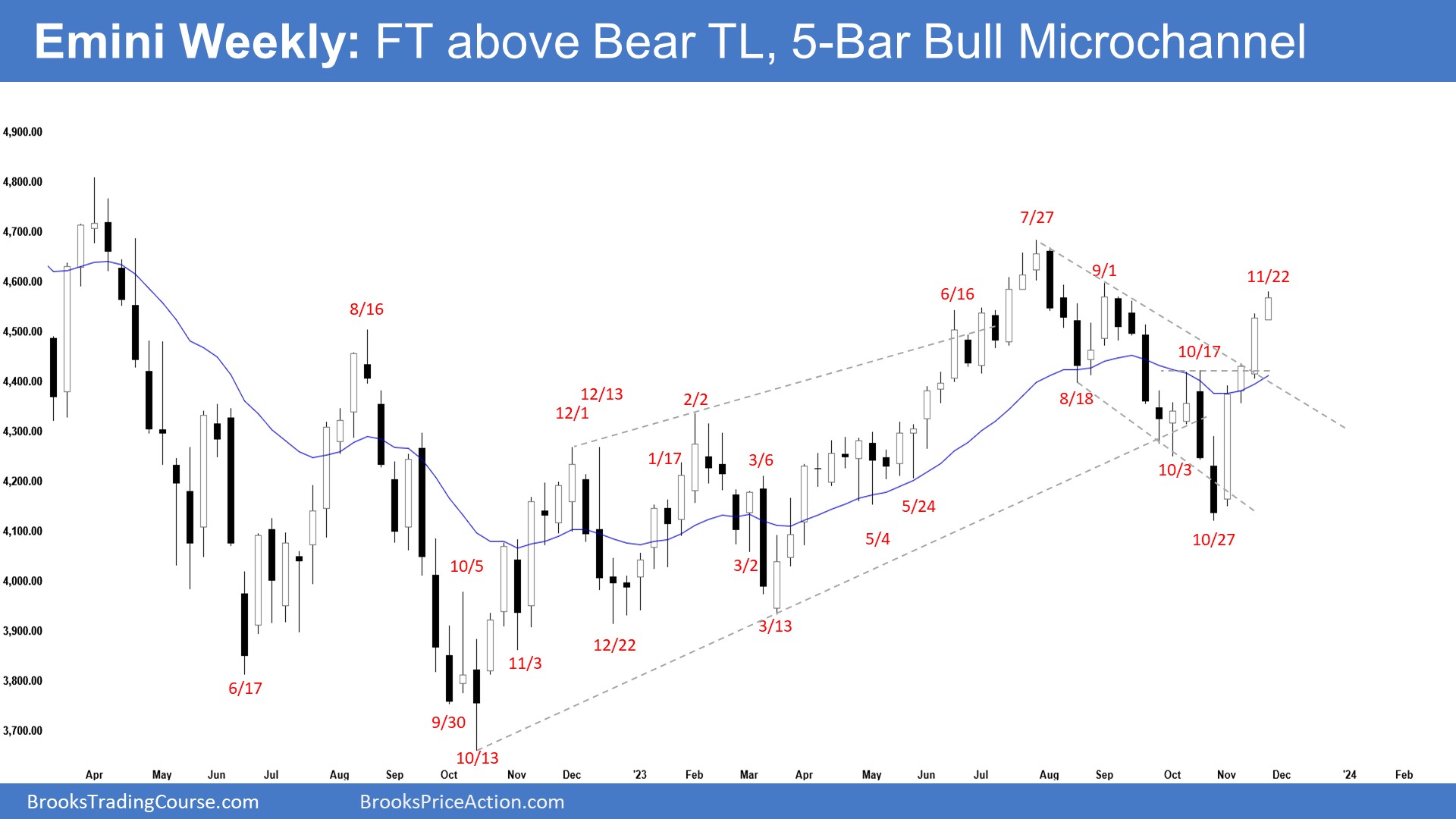

The weekly chart formed an follow-through bull bar following the breakout above the bear trend line. The next target for the bulls is the July 27 high. The bears want a reversal from a lower high major trend reversal or a double top with either the September 1 or July 27 high.

S&P 500 E-mini Futures S&P 500 Emini-Weekly Chart

S&P 500 Emini-Weekly Chart

- This week’s E-mini candlestick was another consecutive bull bar closing near its high.

- Last week, we said that the odds continue to slightly favor the market to still be in the sideways to up phase.

- This week traded slightly higher in a shortened week.

- The bulls see the move down (from July 27) as a deep pullback of the whole move up which started in October 2022.

- They got a reversal from a wedge bull flag (Aug 18, Oct 3, and Oct 27) and a trend channel line overshoot.

- They then got a strong rally with consecutive bull bars breaking far above the 20-week EMA and the bear trend line.

- The current move-up is in a 5-bar bull microchannel with bull bars closing near their highs. That means strong bulls.

- The next target for the bulls is the July 27 high, a logical area for protective stops for the bears.

- If a pullback begins, the bulls want it to be sideways and shallow, with doji(s), overlapping bars and candlesticks with long tails below.

- If there is a deep pullback, they want a reversal up from a higher low major trend reversal and the 20-week EMA to act as support.

- The bears see the strong rally simply as a retest of the July 27 high.

- They hope that the move is simply a buy-vacuum test of what they believe to be a 36-month trading range high.

- They want a reversal from a lower high major trend reversal or a double top with either the September 1 or July 27 high.

- The problem with the bear’s case is that the current rally is very strong.

- They will need to create strong bear bars with sustained follow-through selling to increase the odds of a deeper pullback.

- Since this week’s candlestick is a bull bar closing near its high, it is a buy signal bar for next week.

- Odds continue to slightly favor the market to still be in the sideways to up phase.

- However, the move has lasted a long time and is slightly climactic. A minor pullback can begin within a few weeks.

- Odds favor the first pullback to be minor. If there is a deeper pullback, odds slightly favor at least a small second leg sideways to up.

- Traders will see if the bulls can get another follow-through bull bar or will the market trade slightly higher but close as a doji or with a bear body, beginning the minor pullback phase.

S&P 500 Emini-Daily Chart

S&P 500 Emini-Daily Chart

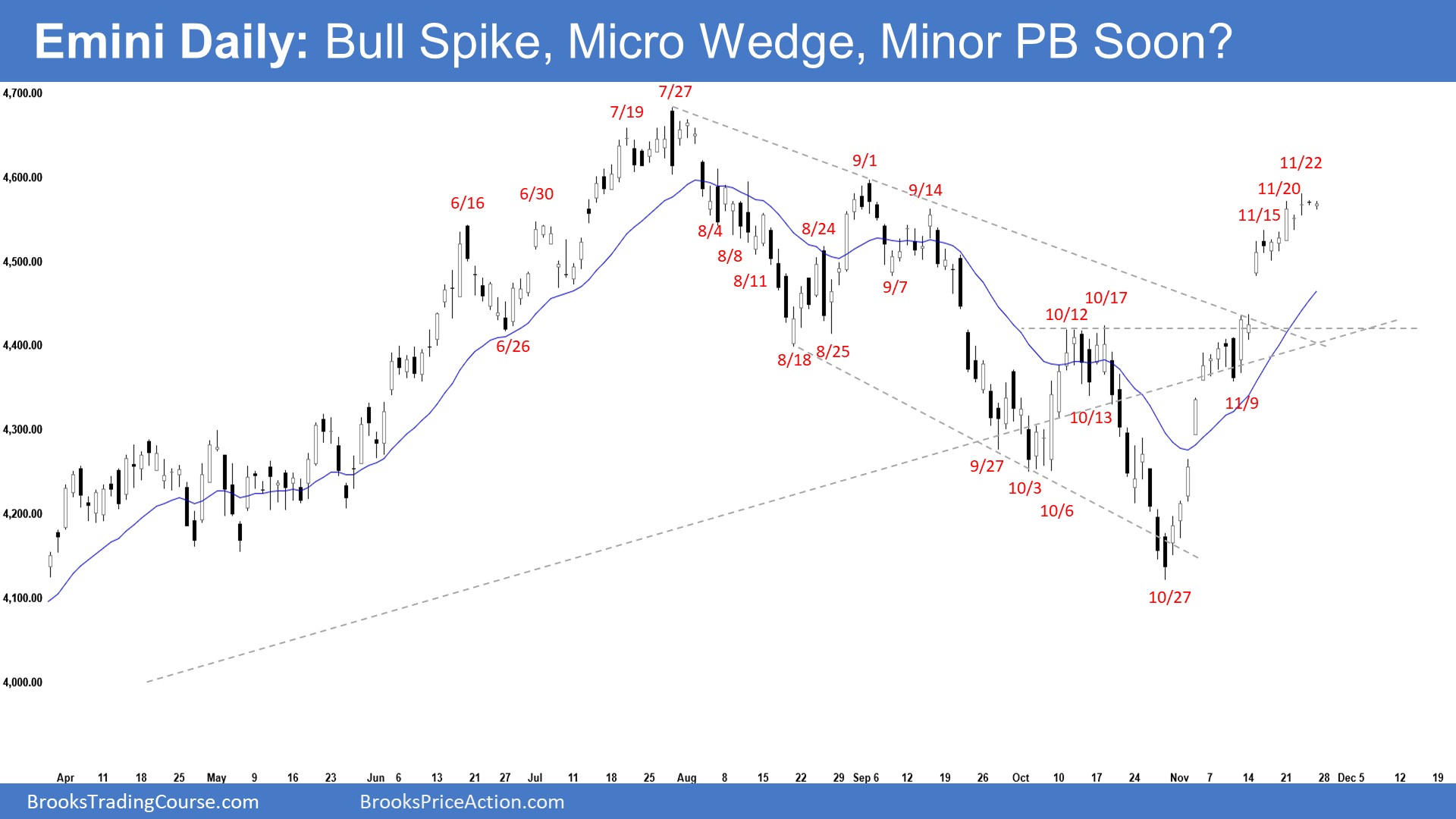

- The market traded sideways to up for the week.

- Last week, we said that the odds continue to favor the market to still be in the sideways to up phase.

- The bulls got a reversal from a wedge bull flag (Aug 18, Oct 3, and Oct 27) and a trend channel line overshoot.

- The move-up is strong with several big gaps that remained open and in a tight bull channel.

- The next targets for the bulls are the July 27 high and the all-time high.

- They hope that the current rally will form a spike and channel which last for many months after a pullback.

- They want a painful short squeeze (to the bears) that will fuel the move higher.

- The next target for the bulls is the July 27 high, a logical area for protective stops for the bears.

- If a deeper pullback begins, the bulls want the 20-day EMA to act as support.

- The bears hope that the strong rally is simply a retest of the July 27 high.

- They want a strong reversal down, like the one in August 2022 following a similar strong rally.

- They want a reversal down from a lower high major trend reversal and a double top with the September 1 or July 27 high.

- For now, the buying pressure remains very strong. Odds continue to favor the market to still be Always In Long.

- However, the move is slightly climactic. A minor pullback can begin at any moment. Odds favor the first pullback to be minor.

- Until the bears can create strong bear bars with sustained follow-through selling, odds continue to favor the market to still be in the sideways to up phase with pullbacks in between.