Silver’s Swoon Should Resume

2023.06.05 16:57

After a brief rally, U.S. nonfarm payrolls helped suppress momentum. Is there more downside ahead? While the permabulls bought into the rate-cut hype, we warned on Apr. 14 that the fundamentals did not support their enthusiasm. We wrote: Market participants are pricing in ~60 basis points of rate cuts. If those cuts get priced out, the market impact is similar to the Fed raising the U.S. federal funds rate (FFR). No matter how you slice it, no cuts mean the FFR stays higher for longer, and a realization should have a profound impact on the PMs.

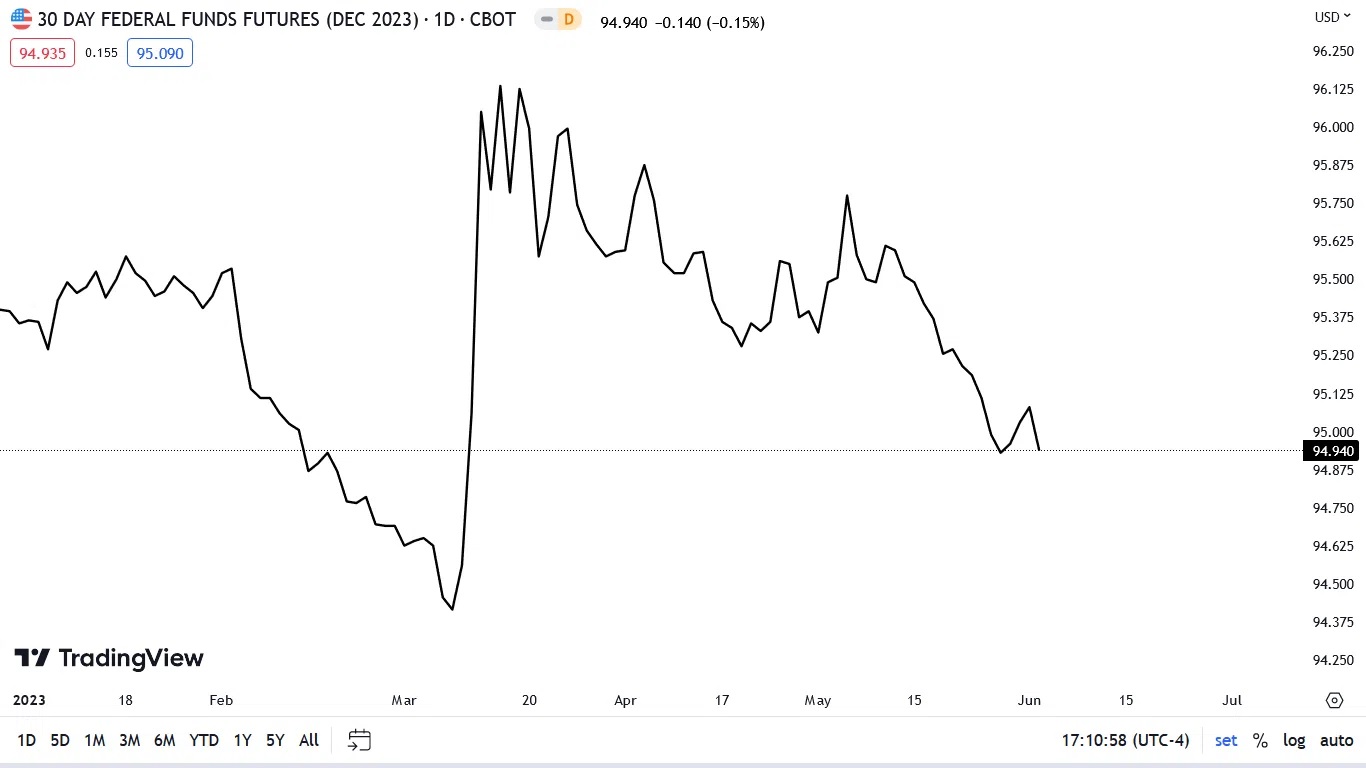

Mining stocks are particularly vulnerable. The rate-cut optimism contrasts the realities on the ground, and market participants are overconfident because the Fed has been wrong more than it’s been right. However, we believe the QE bulls will suffer disappointment in the months ahead. To that point, with investors erasing roughly two-thirds of the rate cuts priced in for December, the hawkish reset has unfolded as expected. See below:

To explain, the black line above tracks the December contract. And since the yield moves inversely to the price, the black line’s decent highlights how bank runs fears have abated and economic reality is in style once again. Moreover, the metric should have more room to run. With inflation too high and the unemployment rate too low, the Fed needs to maintain its hawkish stance to find the right equilibrium. And we believe rate cuts will continue to get priced out as these realities become more obvious. Furthermore, while we have been consistent in our thesis that real interest rates need to rise to normalize inflation, Bank of America’s Chief Investment Strategist Michael Hartnett highlighted how the AI frenzy indicates inflation-adjusted yields are too low. He wrote:

“4% real yields popped internet bubble, 3% popped subprime, crypto crashed on real yield rip from -100bps to 150bps. But the market telling you real rates may need to rise another 100-150 bps from here to pop the ‘baby bubble’ in AI.”

See below:

To explain, the blue line’s movement on the right side of the chart shows how the U.S. real yield soared by ~250 basis points in eight months. And unsurprisingly, the VanEck Junior Gold Miners ETF (NYSE:) and silver suffered mightily along the way. Therefore, if resilient demand necessitates another 100 to 150 basis point rise from here, silver could suffer a substantial drawdown. As further evidence, the Fed released its latest on May 31. An excerpt read:

“Economic activity was little changed overall in April and early May. Four Districts reported small increases in activity, six no change, and two slight to moderate declines…Employment increased in most Districts, though at a slower pace than in previous reports. Overall, the labor market continued to be strong, with contacts reporting difficulty finding workers across a wide range of skill levels and industries.”

In addition:

“Prices rose moderately over the reporting period, though the rate of increase slowed in many Districts. Contacts in most Districts expected a similar pace of price increases in the coming months. Consumer prices continued to move up due to solid demand and rising costs, though several Districts noted greater price sensitivity by consumers than in the prior report.”

So, while the inflation data was somewhat mixed, the report highlighted how economic growth and employment remained resilient. Consequently, demand destruction has not unfolded with a 5.25% FFR.

Fed Whispers

Cleveland Fed President Loretta Mester said on May 31:

“I just think that we may have to go further. At this point, I don’t really necessarily see a compelling reason that we wouldn’t want to take another small step to counter some of that really embedded, stubborn inflationary pressure.”

Richmond Fed President Thomas Barkin said on May 30:

“However I look at it, it just looks like inflation is too high…. I believe you need to bring inflation down by bringing demand down.”

Yet, as we’ve stated repeatedly, he still sees resilient demand. Please see below:

Similarly, while some Fed officials have advocated for a pause or not hiking at the June meeting, the overall hawkish message is clear. Remember, the crowd is still pricing in rate cuts. And if the Fed holds the FFR at 5.25% for the next seven months, it’s more hawkish than expected. Furthermore, we believe the FFR needs to rise further, and a realization should inflict plenty of pain on the PMs. Again, we’ve noted on several occasions that the FFR has eclipsed the peak YoY core CPI in every tightening cycle since the 1950s. And with the latter peaking north of 6.6%, rate cuts are a fantasy, in our opinion.

Overall, the Taylor Rule implies an FFR in the 5% to 7% range. And unless long-term interest rates rise substantially or a Black Swan event unfolds, a 6%+ FFR should materialize before it’s all said and done. As such, silver is unlikely to board the QE train anytime soon. Will the Fed cut the FFR at some point over the next seven months?