Silver Shines in Uncertainty: Why It’s a Key Safe Haven Asset

2024.11.22 12:26

By Mike Maharrey

We generally think of as a safe haven asset.

But what about ?

Since the silver price tends to be more volatile than gold, and because more than half of silver demand comes from industrial use, you might not think of silver as a haven. But historically, silver has outperformed gold during periods of geopolitical and financial uncertainty, as shown by a recent report by Capitalight Research prepared for the Silver Institute.

What do we mean by safe haven?

Investors prefer a safe haven asset during times of political or economic uncertainty. They expect haven assets to maintain their price and possibly rise during chaotic times, even as most traditional assets fall in price. A safe haven’s performance during these periods tends to hedge a portfolio, minimizing overall losses.

During periods of geopolitical uncertainty such as war, terror attacks, and significant political shifts (like the recent presidential election in the U.S.), investors tend to shun risk due to the high levels of uncertainty. They turn to safe-haven assets to preserve the overall value of their portfolios until the crisis passes.

Assets with little counterparty risk tend to make the best safe havens. Counterparty risk is the possibility that the party on the other side of a transaction might not fulfill its obligation. As the report points out, “This risk is critical in financial markets as it can lead to significant disruptions, especially in interconnected systems where the failure of one entity can trigger a cascade of defaults.”

Silver and Geopolitical Tumult

According to the analysis by Capitalight Research, silver has performed well during times of geopolitical chaos. For instance, safe haven demand as Ukraine tensions escalated reversed the previous downward trend in the silver price that occurred during the second half of 2021 as investors anticipated Federal Reserve rate hikes.

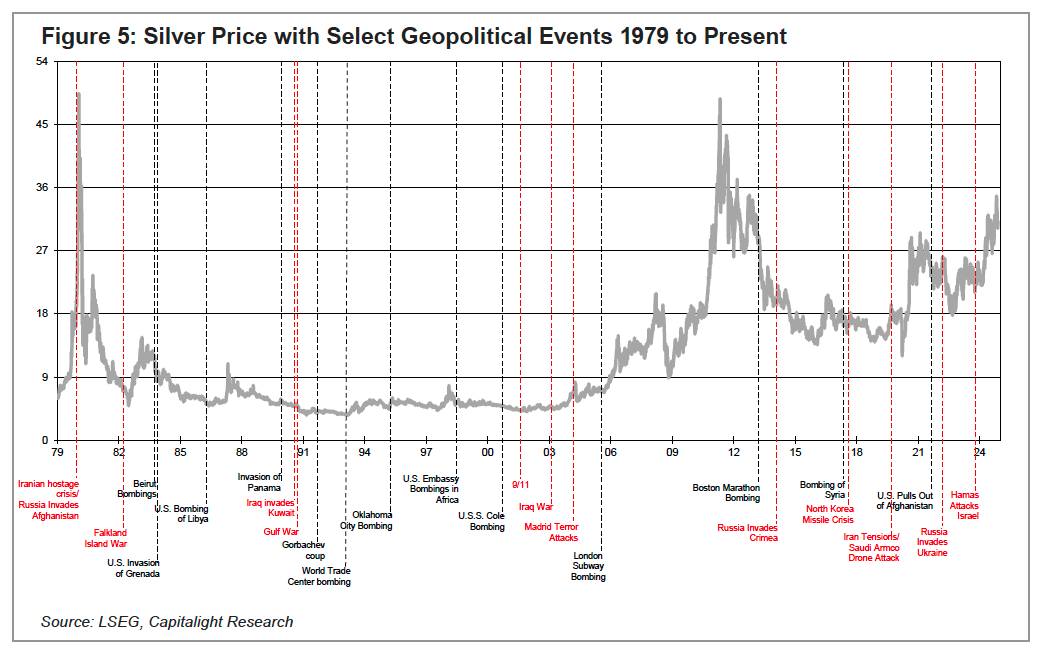

Capitalight analyzed silver’s performance during several geopolitical upheavals dating back to 1979.

The events in red represent those that had a noticeable impact on the silver price.

One-day events, such as the Oklahoma City bombing in 1995 and the terror attack on the Boston Marathon in 2013, didn’t have much effect on the silver price.

Several military conflicts also failed to drive safe-haven buying in the silver market, including the U.S. bombing of Libya in 1986 and the 1989 invasion of Panama.

“Although these were conflicts between countries, the perception was that these events would not escalate to the point of significant negative impact on overall economic conditions and/or did not present a significant increase in counterparty risk.”

However, the 12 highlighted events in the chart did drive significant safe-haven demand for both gold and silver.

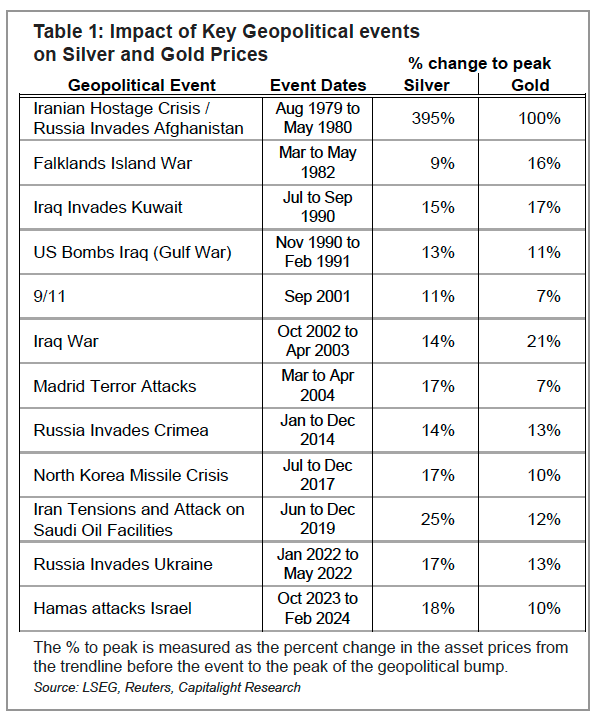

As you can see by the following chart, the percentage increase in the silver price was generally bigger than gold’s:

Excluding the Iranian hostage crisis, the average increase in the silver price was 15 percent. Gold’s price increase averaged 12 percent.

Silver During Financial Crises

Silver has also historically provided a safe haven during financial crises.

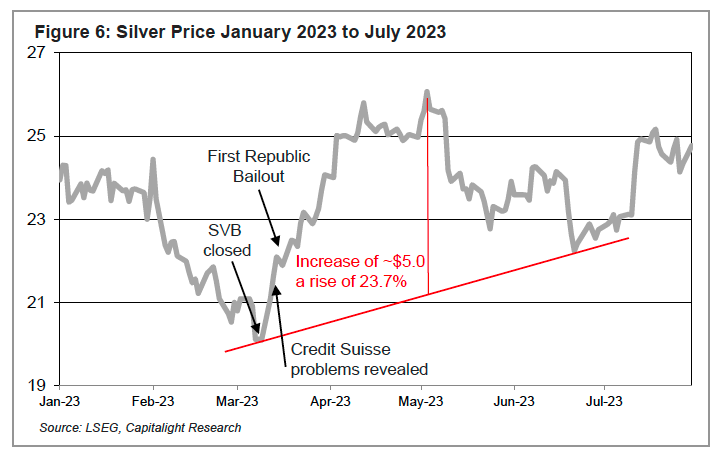

We saw this most recently during the 2023 banking crisis precipitated by the Federal Reserve’s rate increases. During that time, Silicon Valley Bank and Signature Bank (OTC:) went under, and other banks struggled as bond portfolio losses wrecked their balance sheets. The Federal Reserve managed to paper over the crisis with a bailout.

During that time, gold charted a 23.7 percent gain.

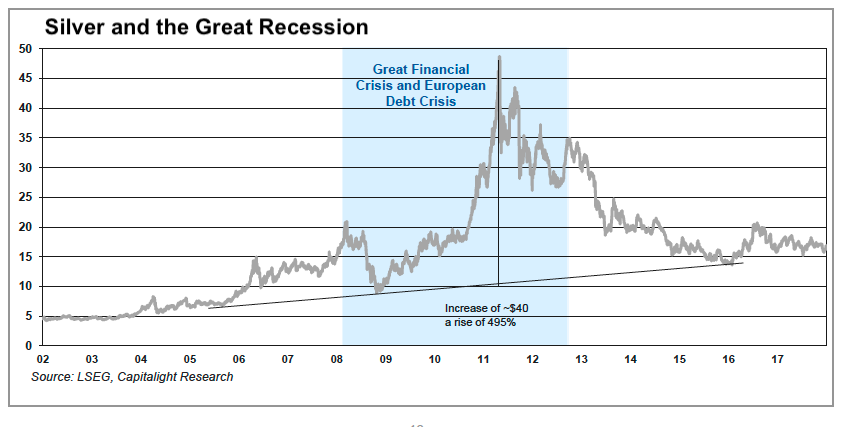

After the 2008 financial crisis and through the Great Recession, silver rose by $40. That was a 495 percent increase from the underlying trend.

Through the same period, gold rose 238 percent.

Capitalight summed it up succinctly.

“Investors seek silver for its safe haven quality during periods of political and economic uncertainty.”

It’s clear from this analysis that silver’s role as a safe haven is underappreciated in the investment work. Investors should consider holding silver in their portfolio to take advantage of its hedging properties.