Silver: Golden Cross Indicates Upside

2023.06.27 09:03

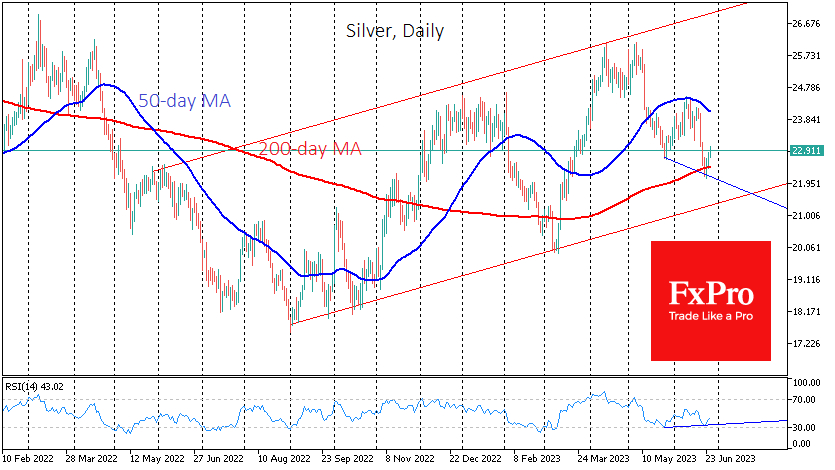

Silver fell sharply last week but has recently shown encouraging signs of recovery. The tactical objectives of silver’s decline appear to have been achieved, and silver is now in demand, reinforcing confidence that the bulls have defended the long-term uptrend.

Last week, silver lost over 8.5% from Monday’s high to Friday’s low. This appeared to be the final chord of the sellers, followed by a tidy comeback by the buyers on Friday afternoon. Notably, this uptrend is going against the downtrends in other risk-sensitive markets.

Looming Golden Cross on weekly timeframes

Looming Golden Cross on weekly timeframes

On the weekly timeframe, last week’s low was a touch of the 200-week moving average (now at $22.17), reflecting traders’ bullish sentiment. Slightly lower, at $22, is the faster 50-week MA. Both are pointing up, indicating a bullish market and the faster one is about to cross the slower one.

Such a pattern in technical analysis is called a Golden Cross. It is often seen on the daily timeframe, but very rarely, and therefore can be even more significant on the weekly timeframe.

The closest analogy, in terms of price action and these key averages and fundamentals, was seen in 2009, which preceded the 200%+ rally of the following two years. However, it did not occur immediately after the cross.

The May-June decline also looks like a test of the lower boundary of the upward corridor formed last August. The upper limit is now at $26.6 and will rise to $29 by the end of the year.

Silver quickly managed to get back above its 200-day MA

Silver quickly managed to get back above its 200-day MA

On the daily timeframe, the local picture is bullish. Silver quickly managed to get back above its 200-day MA, and with the price touching $23.0 on Tuesday morning, the question arises as to whether the recent rally is a bounce as part of a broader decline.

Separately, on the same daily timeframe, we note the divergence between the RSI and the silver price: lower price lows in June correspond to higher index lows. This suggests that the downward momentum is waning. The RSI has not even reached an oversold level for the second time.

If our view on silver is correct, we should see a return to the flat 24s and above and a repeat of the local highs at $26 before the end of the summer.

The FxPro Analyst Team