Silver Enters Bullish Phase: Another Rally in the Offing?

2023.08.30 03:38

Conference Board Economic Forecast:

Looking into 2024, we expect the volatility that dominated the US economy over the pandemic period to diminish. In the second half of 2024, we forecast that overall growth will return to more stable pre-pandemic rates, will drift closer to 2 percent, and the Fed will lower rates to near 4 percent. However, due to an aging labor force, we expect tightness in the labor market to remain an ongoing challenge for the foreseeable future.

Yesterday, we had this to say about Bonds:

“The good news is the market has absorbed the bond’s performance. A better risk-on environment is when the SPY outperforms the long bonds.

“Talking technical, we are watching the October 2022 lows carefully. A potential double bottom exists if TLTs can clear back able 98. A move under 95 though, points more to a retest and possible break of the low 91.85.”

The whole market rallied, from bonds to small caps to metals and .

Clearly, the economic statistics coming at us with blinding speed, more of a can-can than a waltz, has begun.

Can everything move up together, or will the rally today resolve lower for some instruments while higher for others?

The relief rally in bonds, coupled with the reversing closer weaker, helped everything run higher.

If you watch the clip from The Final Bar that Mish guest hosted alongside Keith, we showed you how this rally could happen, especially with volatility looking like anything but volatility.

In the spirit of the forecasts, the expectation for 2024 remains for lower inflation, no recession, steady growth, and a Fed that will begin to ease up on rates.

Sounds amazing right?

Enter the Dragon.

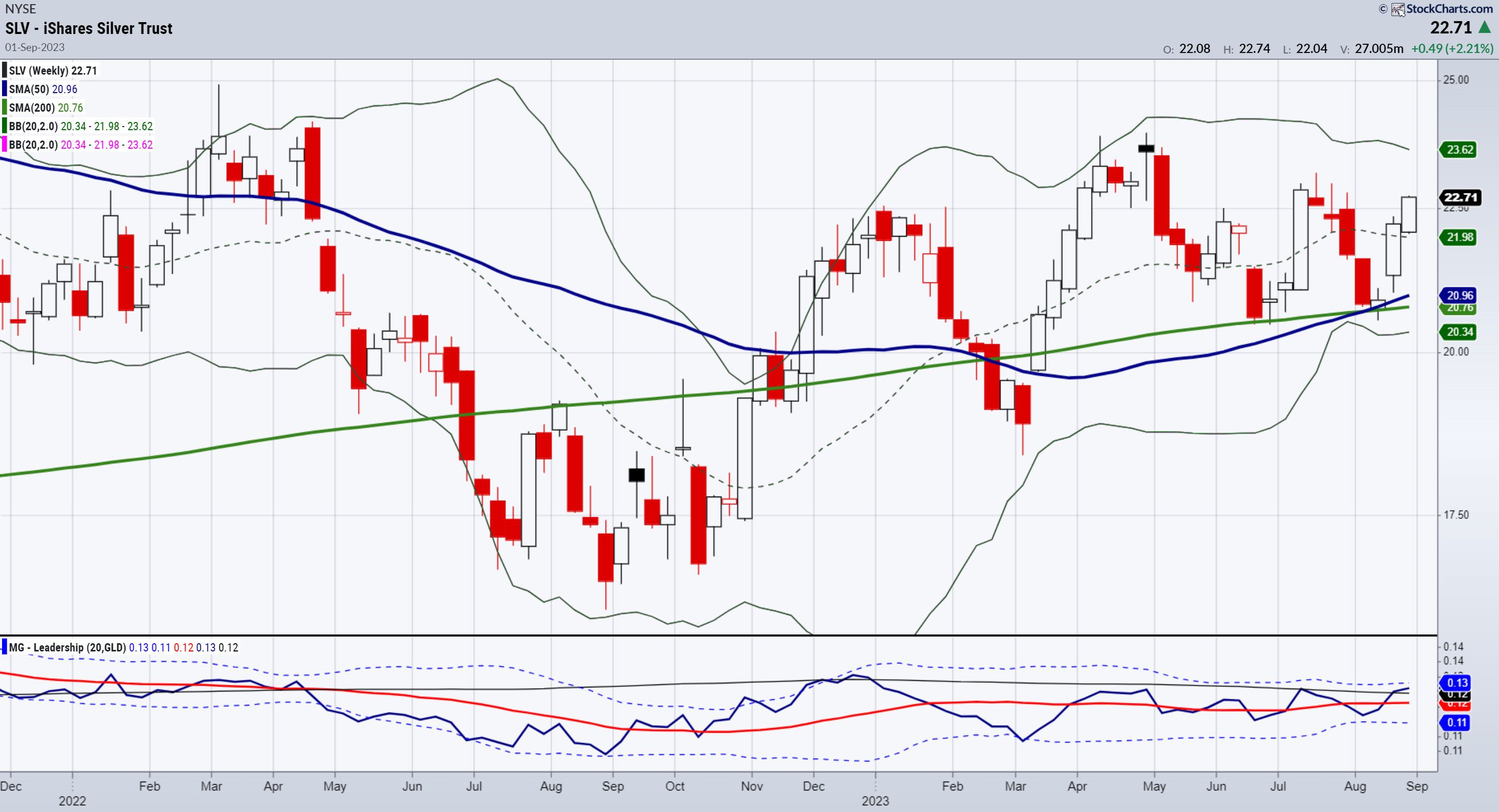

is in a bullish phase.

It is also outperforming the market using the ETFs SLV (NYSE:) and GLD (NYSE:).

Furthermore, on the leadership indicator, silver is nowhere near overbought relative to gold.

The gold-silver ratio has fallen below the 80 level, suggesting that silver will outperform gold prices going ahead.

2 reasons are stimulus measures in China and robust industrial demand as the U.S. looks to spend $45 million to develop domestic manufacturing with the solar power sector.

Historically, silver often outperformed gold during periods of strong economic expansion and tended to underperform gold during periods of economic stress.

With inflation persistent, we will continue to watch bonds and the gold-to-silver ratio. Plus, we are still focused on small caps and iShares Russell 2000 ETF (NYSE:) clearing 190.

In the meantime, you all have a wonderful rest of the week and long weekend.

Happy Labor Day weekend!

ETF Summary

- S&P 500 (SPY) 440 support 458 resistance

- Russell 2000 (IWM) 185 pivotal 190 has to clear

- Dow (DIA) 347 now pivotal support

- Nasdaq (QQQ) 363 support and over 375 looks good

- Regional banks (KRE) Needs to hold 44 to be convincing

- Semiconductors (SMH) 150-161 range to watch

- Transportation (IYT) 252 biggest overhead resistance

- Biotechnology (IBB) Compression between 124-130

- Retail (XRT) 62.90-key support to hold