Silver: Cup-and-Handle Formation Signals Explosive Move – Is $40 Likely in 2025?

2024.10.21 06:58

is up nearly 4% as I write this. Here’s the title from the September 19th issue: “The Mining Stocks Remain Historically Undervalued.” GDX (NYSE:) is up 4% as I write this. Several of the micro-cap, project development stocks that I recommend are up over 20% since mid-September.

Some of them, like Cabral , have potential 10-20x returns ahead of them. I updated Cabral in yesterday’s issue with a couple of imminent catalysts that could trigger a 25% to 35% move in the stock before Christmas.

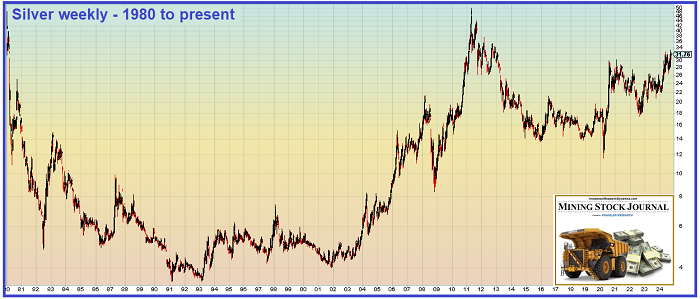

The left “rim” of the cup goes back to silver’s all-time high in 1980. The right “rim” of the cup formed in 2011, when silver peaked just $1 below the 1980 all-time high. The “handle” has been forming over the last 13 years. Perhaps, most interesting, a 5-year chart shows that part of the handle is an upside-down head and shoulders technical formation.

The point here is that silver looks potentially explosive. Since April, silver has been banging its head on $32.50 (Comex front-month contract price basis). In my opinion, if it breaks over $33 and holds, it will trade towards $40 very quickly.

This view is supported by the fundamental set-up in the silver market. It’s been well circulated that the Silver Institute of America is forecasting a 215 million ounce silver supply/demand deficit for 2024. Several factors will likely increase the size of that deficit in 2025. First, Russia announced in its Draft Federal Budget release that it plans to significantly increase the holdings in precious metals in its State Fund (sovereign wealth fund). This includes plans to acquire gold, platinum, palladium and, for the first time, silver.

In addition, China recently announced that its build-out of a national solar grid will continue through 2030. This endeavor requires a massive amount of silver. Though China does not publish official silver import numbers, I recall that when the program was underway it was consuming more than all of the annual amount of silver produced in China.

India also has a similar program in place, which is part of the reason it has been importing large amounts of silver. In fact, earlier this week India announced another $109 billion in grid investments for renewable energy sources. This will also require large quantities of silver.

Finally, at some point – as occurred in the late 1970’s and again leading up to the 2011 top in silver – the “poor man’s gold” attribute of silver will become a large factor in driving a massive amount of investor money into silver as a cheap substitute for gold. This demand would be coming from the greater public beyond the precious metals “bugs” who have been stacking silver for years.

I believe that in the next 12 to 18 months, silver will make a move higher that will shock just about everyone except the most ardent silver bulls. I don’t like to make price forecasts based on a specific point in time, but I think $40 silver within the next year has a high probability.

Furthermore, the primary silver producer stocks will soar and the junior silver project development stocks will soar x 5. This is likely why both Coeur Mining (NYSE:) announced the acquisition of Silvercrest Metals and First Majestic announced the acquisition of Gatos Silver. Six months to a year from now the cost to acquire these companies might have doubled.