Sell Alert: Gold’s Breakout Was Just Invalidated

2024.07.19 16:43

Every now and then, something unlikely happens – but not right now.

I wrote that given high-volume shooting star reversal, it was likely to invalidate its recent breakout any day (or hour) now. Quoting my previous comments:

“Moving back to the near-term outlook, when gold invalidates the move to new highs, it will create a powerful sell signal that can take gold as well as mining stocks much lower. Of course, I could have written “if” and not “when”, but this is so likely in my view that writing “if” in this sentence could be misleading.”

Also, on Sunday, I warned that we might see some short-term Trump-assassination-attempt-driven chaos that’s likely to be followed by gold’s declines as markets realize what the implications really are.

And that’s exactly what happened.

Gold reversed its course once again during yesterday’s session, and then it kept on declining. At the moment of writing these words, it’s visibly below its April and May highs. Since invalidations don’t require confirmations or verifications, this is already a massive sell signal. Why is it so important? Because the price levels that were first broken were so important – these were all-time nominal highs – you don’t get a more meaningful breakout (and an invalidation) than that.

Positioning for Profits in Mining Stocks’ Decline

The fact that it took place very close to gold’s triangle-vertex-based reversal and given that gold formed a shooting star reversal pattern at the exact top strongly suggest that this was indeed the final top.

Meanwhile, the following happened in and miners:

Silver just invalidated its move above the $30 level – again as I warned it would.

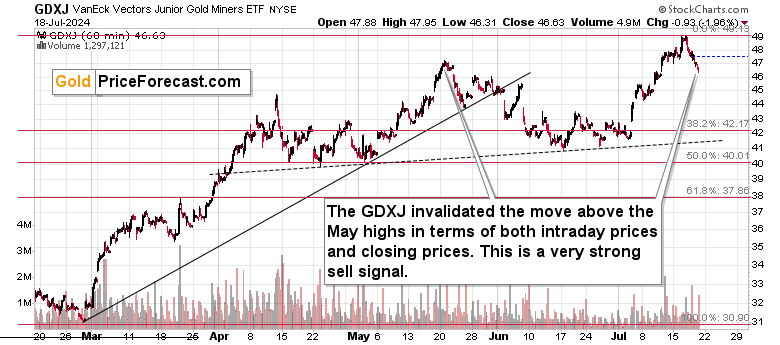

The VanEck Junior Gold Miners ETF (NYSE:) invalidated its own breakout. It moved and closed (!) below its May highs.

This is a strong bearish signal on its own, but the fact that we saw invalidations in both: miners AND gold makes the sell signal particularly strong.

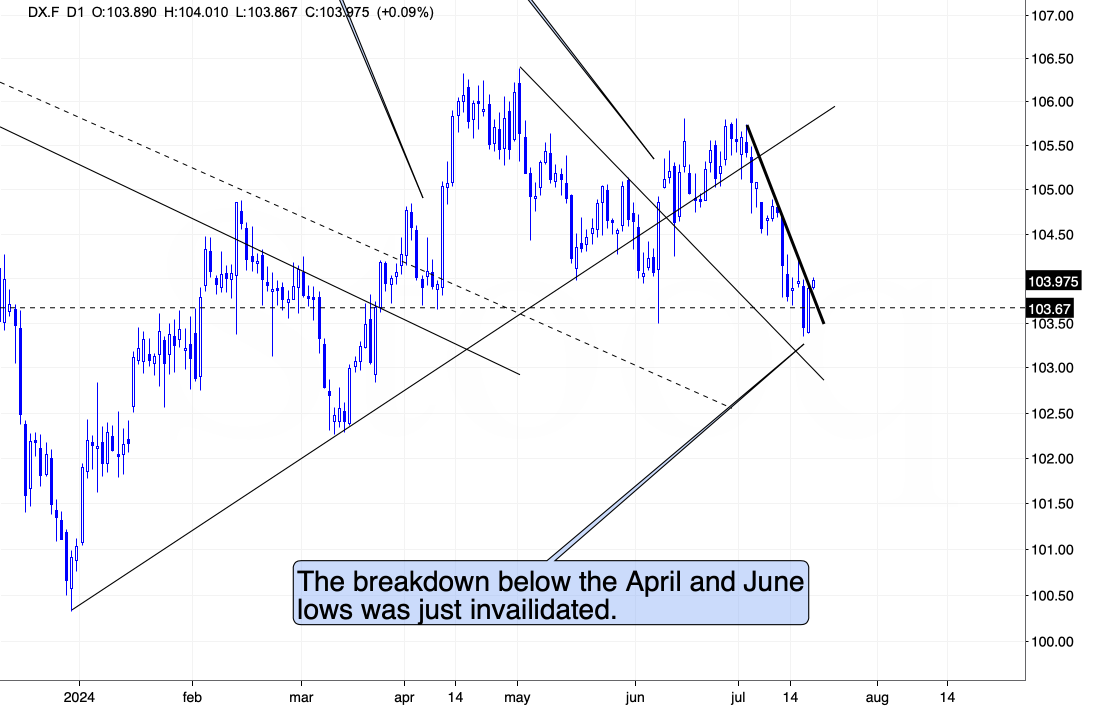

I already wrote that the USD Index invalidated its breakdown below its April and June lows, but now it also moved above its very short-term, declining resistance line. This breakout is not yet confirmed, but we can still say that the outlook for the USDX for the short term has just improved.

What does it all mean?

It means that if one has been waiting on the sidelines to position themselves in order to profit from the decline in the prices of mining stocks (which remain in a medium-term downtrend), THIS IS IT – at least in my opinion.