Say Goodbye to the VIX: New Index to Reflect Market Volatility More Accurately

2023.04.26 06:45

- VIX has become obsolete, and institutional investors agree.

- The increasing use of 0DTE options has affected its ability to accurately reflect market volatility.

- So, the CBOE has launched the VIX1D as a new barometer of market volatility.

You may be familiar with the well-known volatility index, the . In this article, I will highlight why many investors, particularly institutional investors, question its usefulness and consider it an outdated indicator. In addition, I will provide details on a new volatility index that began operating this Monday as a potential alternative to the VIX.

The VIX was created by the Chicago Board Options Exchange (CBOE) in 1993. It reflects the implied volatility of over the next 30 days. It also goes by other names such as fear index, investor sentiment index, CBOE VIX, or S&P 500 VIX.

It is calculated in real-time using the prices of options on the S&P 500 index, i.e., options expiring on the 3rd Friday of each month and options expiring every Friday.

When the VIX rises, it often indicates an increased risk of a decline in the stock market. Typically, if the VIX rises above the 20 level, it can be a sign of nervousness among investors.

A drop in the VIX translates into rises in the stock markets, as lower volatility is associated with lower risk. If the index goes below the 20 zone, it can be a sign of investors being calm and positive.

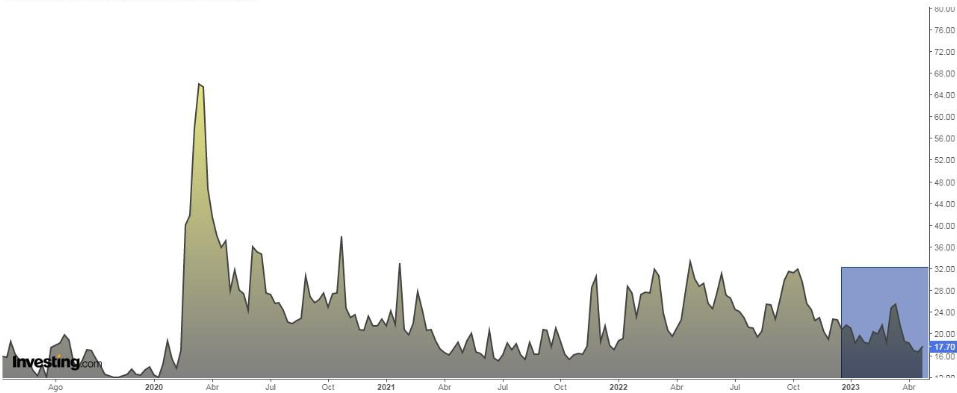

The VIX was at 16 last week and on Monday, levels not seen since the last few months of 2021. These are excessively low levels considering the current scenario (high inflation, a monetary tightening cycle with interest rate hikes, Russia’s war in Ukraine, and fear of an economic recession).

In March, the VIX rallied only on a few occasions despite the second and third-largest bank failures in the history of the United States causing sharp declines in the equity markets.

Although it rose, its intraday high was not even close to the levels seen on many occasions a year ago.

The reason for the VIX not moving and reflecting reality is due to the increasing demand and use of 0DTE zero-day expiration options by investors.

These options have a daily expiration, Monday through Friday, hence the name 0DTE. This peculiarity has led to a relentless increase in their demand and use, which is affecting the VIX’s ability to accurately reflect the market’s volatility.

The typical strategy with 0DTE options is to initiate a trade at the start of the trading session and close it before the session ends.

These options are commonly used by investors when important economic data, such as , , , and Federal Reserve , are released.

The objective is to capitalize on fast market movements and generate profits in a short time, and this approach is high risk.

0DTE options have up to 250 maturities during the year, which is much more than the 52 maturities for weekly options and 12 maturities for monthly options. As a result, many more operations are carried out with 0DTE options, leading to their high trading volume.

Notice how these types of options are booming. For example, in the third quarter of last year, they accounted for more than 40% of the total options volume in the S&P 500, almost twice as much as six months earlier.

The popularity of 0DTE options soared when investors sought to profit from the skyrocketing “meme” stocks, which later experienced significant declines.

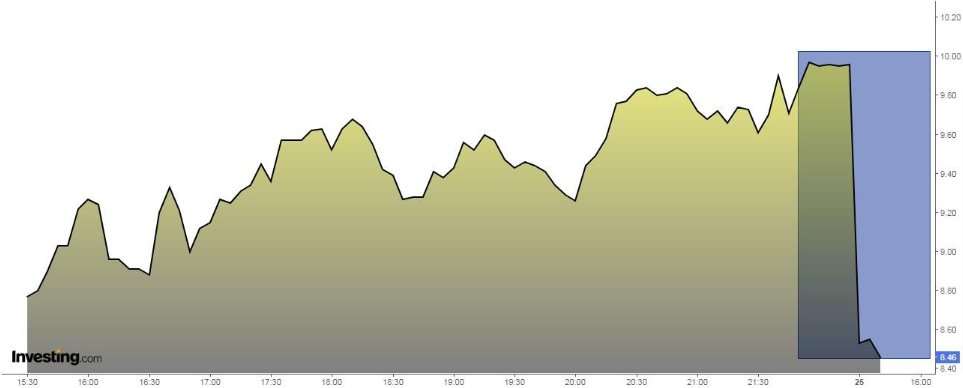

Well, the high volume of 0DTE options is distorting reality and, with it, the VIX. So, CBOE launched a new version of the VIX, called (VIX1D), in order to capture the sentiment implicit in 0DTE options since the VIX is a barometer of investor sentiment over one month. In contrast, 0DTE options are measured in minutes and hours, not days or weeks.

This is the VIX1D chart for Monday and Tuesday. As this new volatility index gains traction, investors will have better insights about market volatility than they did before.

By the way, if we talk about stocks, some of those with excessively high volatility are Aclarion (NASDAQ:), EUDA Health Holdings (NASDAQ:), Netcapital (NASDAQ:), Caravelle International (NASDAQ:), Tempo Automation (NASDAQ:), Mangoceuticals (NASDAQ:), NextPlat (NASDAQ:), Powerbridge Technologies (NASDAQ:), and Biomerica (NASDAQ:).

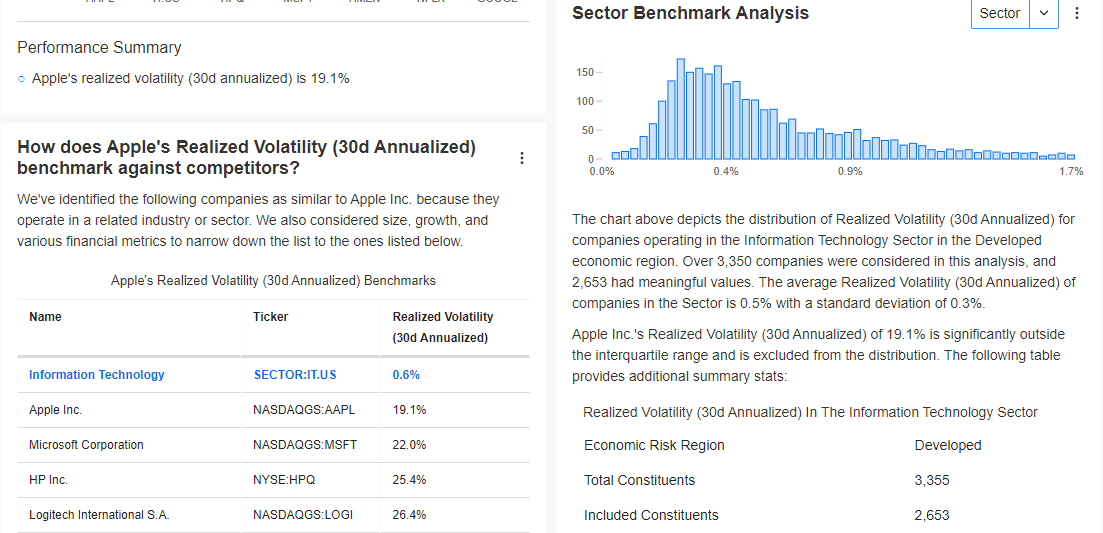

Apple Realized 30-Day Volatility

Apple Realized 30-Day Volatility

Source: InvestingPro

The InvestingPro tool enables you to monitor the volatility of stocks, providing real-time rankings and listings of the most and least volatile stocks and allowing you to determine which stocks are more or less volatile at any given time.

Find All the Info you Need on InvestingPro!

Disclosure: The author does not own any of the securities mentioned.