S&P 500: What History Says About Years That Started As Badly As 2022?

2022.09.19 15:01

[ad_1]

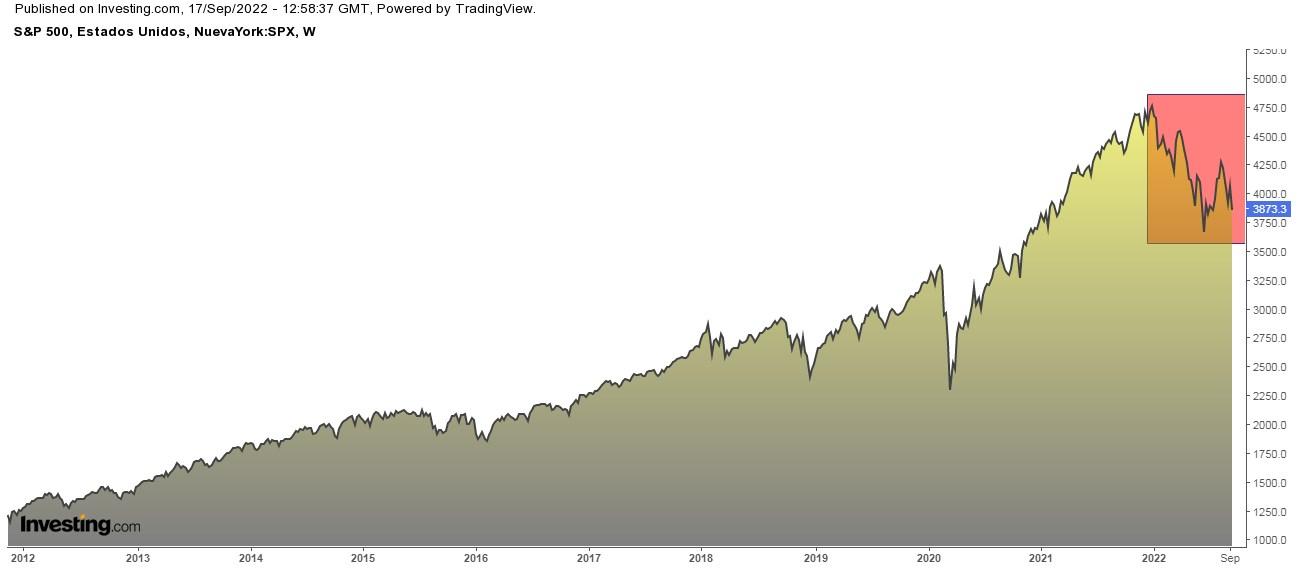

- The S&P 500 has now recorded its sixth-worst performance through the year’s first 178 days of trading

- The U.S. benchmark index is also on track to record the greatest number of negative Fridays in a year on record

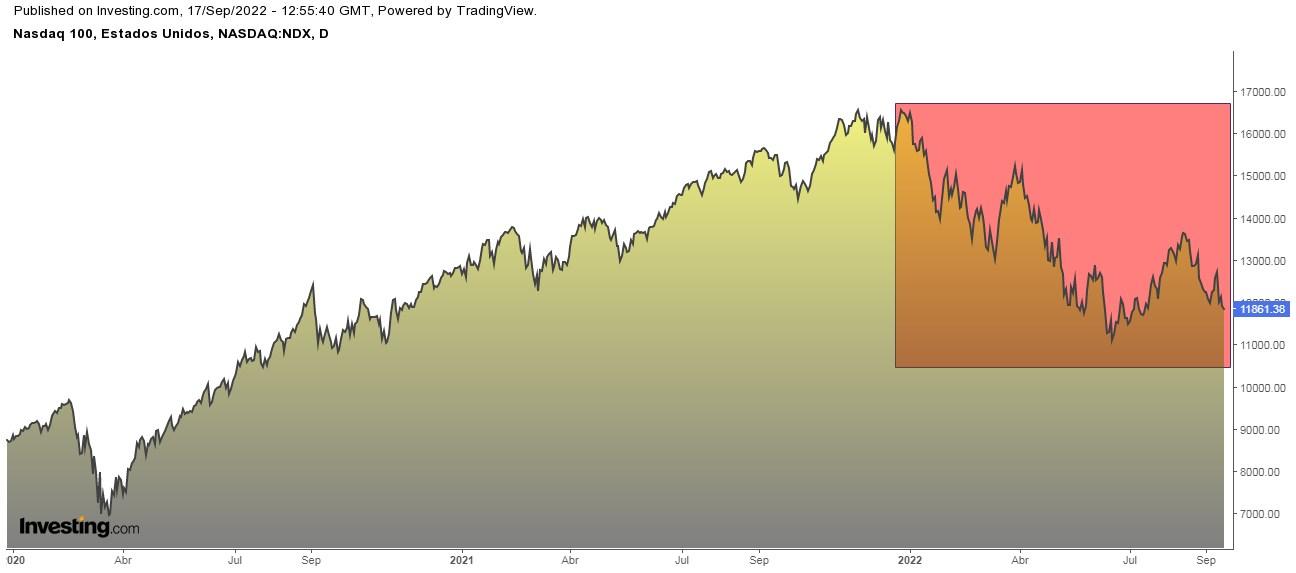

- The Nasdaq 100 is currently the worst-performing major global index of 2022

After last week’s numbers, the returned to full bearish mode. Despite the short-lived summer rebound, if we look at the first 178 trading days of the stock market (which is how far we are into 2022) from 1928 through 2022, we can see that we are still off to the sixth-worst start to a year in history.

But how did the U.S. benchmark index historically respond in the rest of the year those other five times?

- 1974 (-33.2%): rest of year +5.2%, full year -29.7%

- 2001 (-25.4%): rest of year +16.6%, full year -13%

- 2002 (-22.4%): remainder of the year -1.3%, full year -23.4%

- 1931 (-21.1%): rest of the year -32.9%, full year -47.1%

- 2008 (-18.8%): rest of the year -25.3%, full year -39.3%

- 2022 (-18.7%): rest of the year: ?

Another Grim Milestone

The S&P 500 has now fallen by -1% or more 12 times on Fridays this year. If we go back 70 years, which is how long the 5-day trading week has been in effect, there have only been five years with a greater number of Fridays with such a decline. Those years are 1974, 2000, 2001, 2002, and 2008. They have in common that they were not good years for the stock market.

We still have a good number of Fridays left until the end of the year so that we can see a new record, mainly because in 2001 there were 12 Fridays, in 2002 there were 13 Fridays, in 2000 there were 14 Fridays, in 1974 and 2008 there were 14 Fridays. We have 12 Fridays, and we still have 15 more Fridays, so it is not difficult.

Worst-Performing Index In 2022

After plunging by -5.8% last week (its steepest one-week drop since January), the has consolidated as the worst YTD performer among major global indexes. Furthermore, it is the third weekly drop of more than -4% since the end of the summer rebound in mid-August.

Some companies deserve a separate mention. For example, Meta Platforms (NASDAQ:) touched lows at the beginning of 2019 after falling by -14%. Meanwhile, NVIDIA (NASDAQ:) is at the lowest point in a year and a half after a -8% drop. And FedEx Corporation (NYSE:) was down -20% in its worst daily fall since its stock market debut in 1978 (its previous record was -16% on the famous Black Monday of October 19, 1987).

In addition, nine Nasdaq 100 companies set new lows on Friday, including Alphabet (NASDAQ:), Intel (NASDAQ:), and Zoom Video Communications (NASDAQ:).

All eyes will be on this week’s Fed meeting and how much they will raise . All signs point to another 75 basis point move, although money fund futures were already starting to give a 22% chance of seeing 100 basis point hikes.

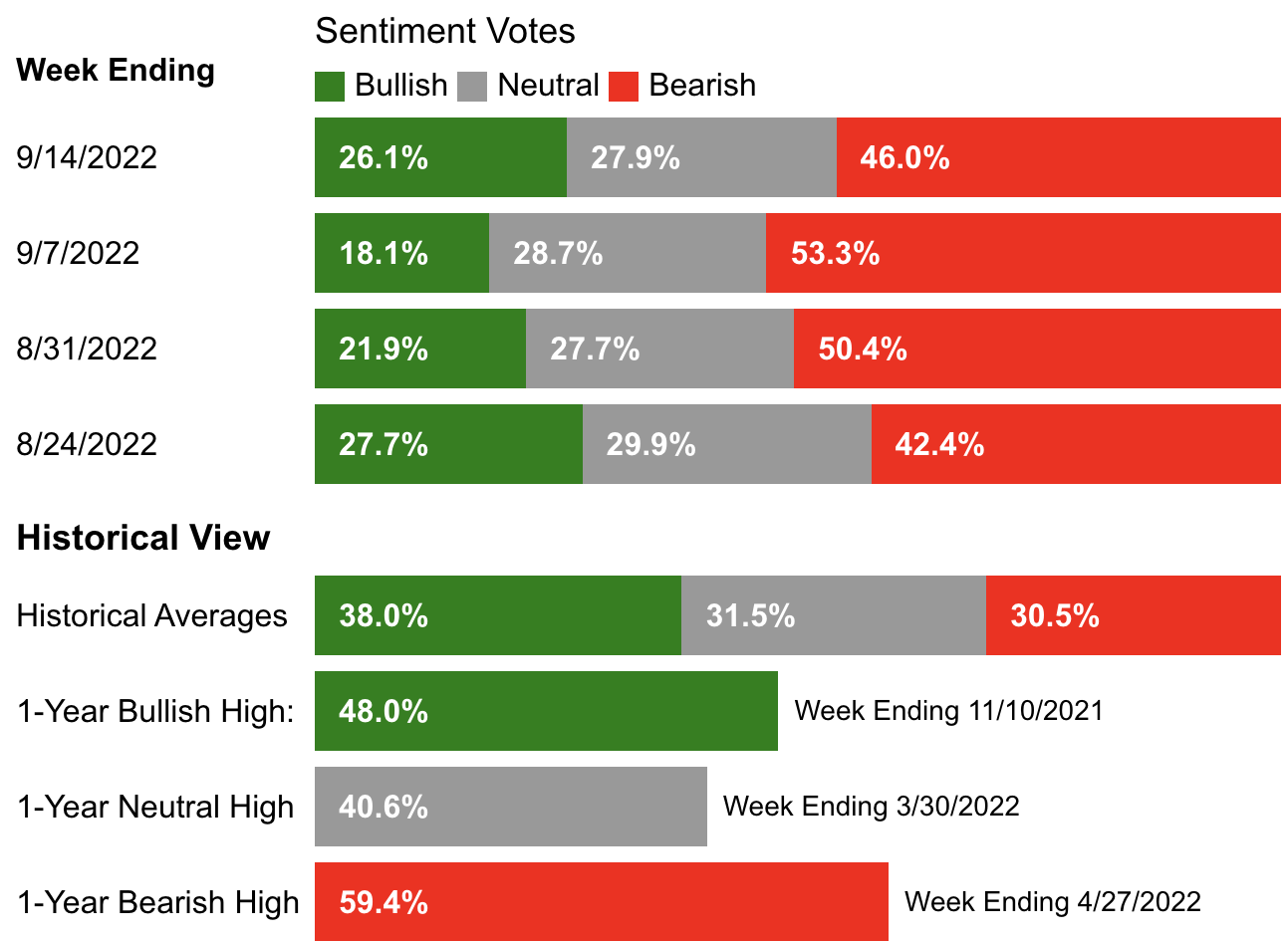

Investor sentiment (AAII)

* Bullish sentiment (expectations that stocks will rise over the next six months) remains below its historical average of 38% for the 43rd consecutive week.

* Bearish sentiment (expectations that stocks will fall over the next six months) remains above its historical average of 30.5% for the 42nd time in the last 43 weeks.

Yield Curve Inversion

U.S. bond yields will likely continue to rise in the coming months, possibly pushing the inverted to levels unseen since the 1980s.

Wall Street is already saying that 2-year yields could rise to 4%-4.5%, while yields could fall to 3%.

However, an inverted yield curve hasn’t ever prevented the S&P 500 from continuing to rise, except once, in 1973. Historically speaking, the index continued its uptrend for 11 months, thereafter rising an average of +8% over those periods.

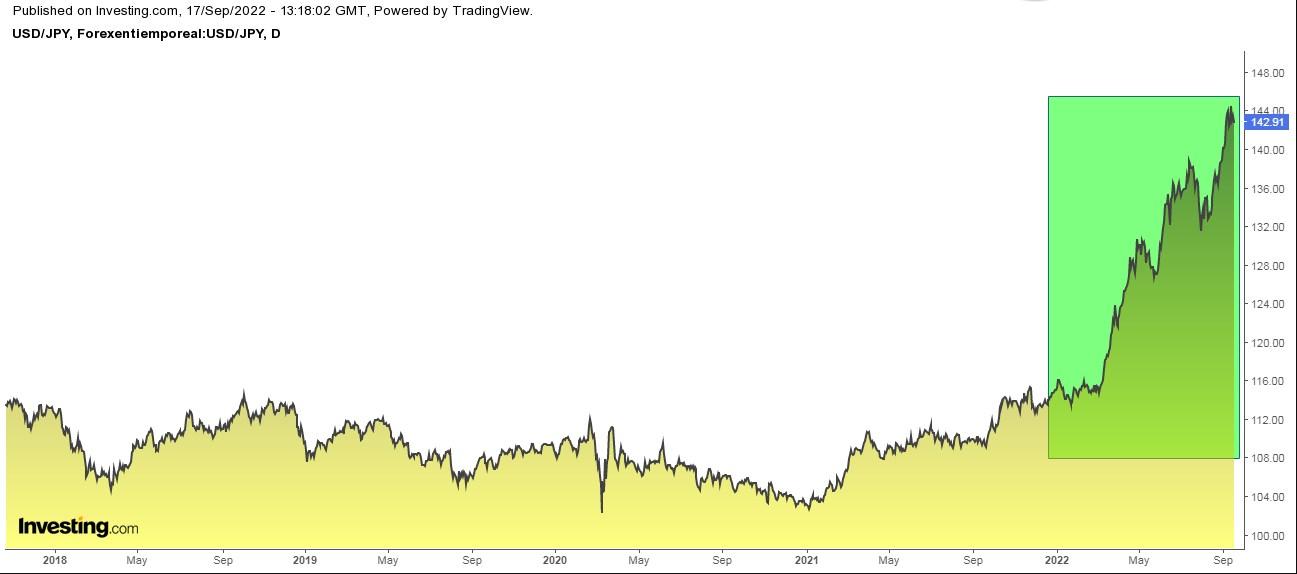

No One Can Catch The U.S. Dollar

The remains very weak against the , falling to its lowest level in 24 years. The sharp gap between the Fed and BoJ strategy is one of the reasons.

There is talk of a Central Bank intervention in the yen as in the past, but it should be remembered that on that occasion it was assisted by the U.S. This time, Japan is alone and thus unable to do much.

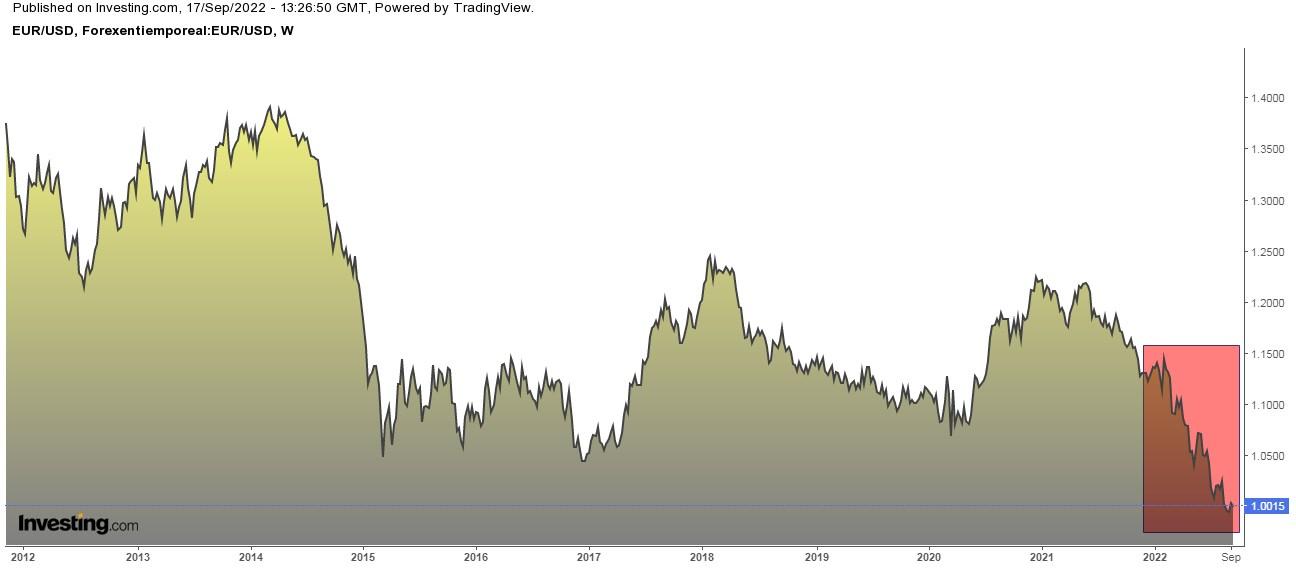

The remains weak as the pace of rate hikes remains more intense at the Fed than at the European Central Bank. The economic outlook is also worse for the Old Continent because of the impact of the energy crisis, in contrast to greater energy independence from the United States.

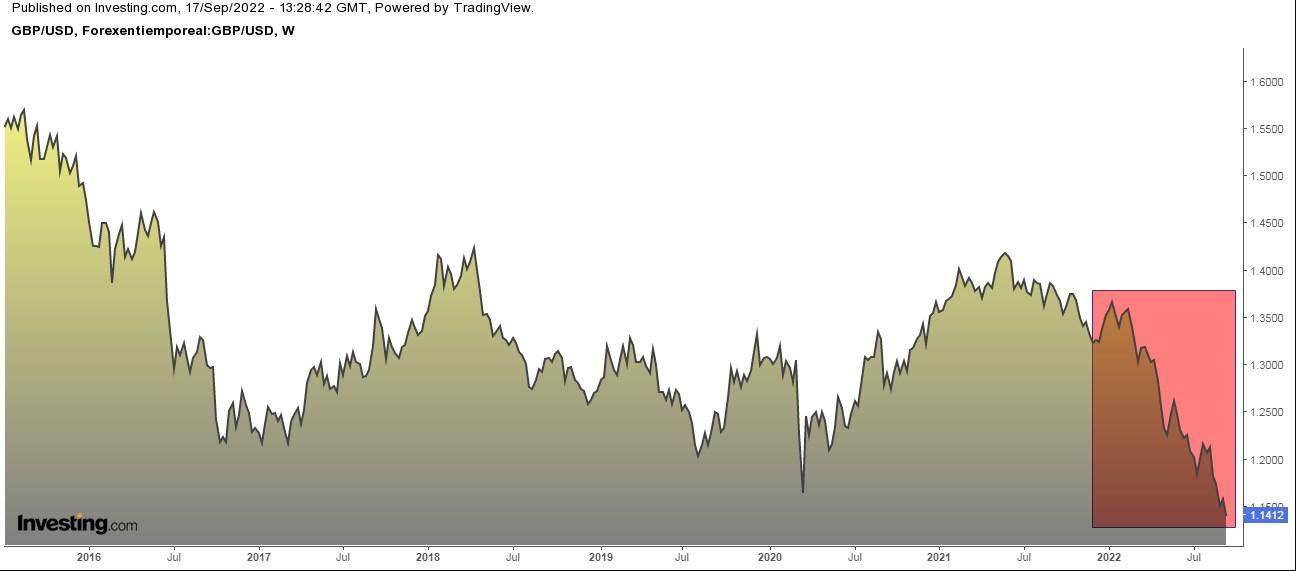

Similarly, the fell to a 37-year low against the greenback. So far this year, it is down -16%.

The has also succumbed and is in a downtrend and approaching 2020 lows.

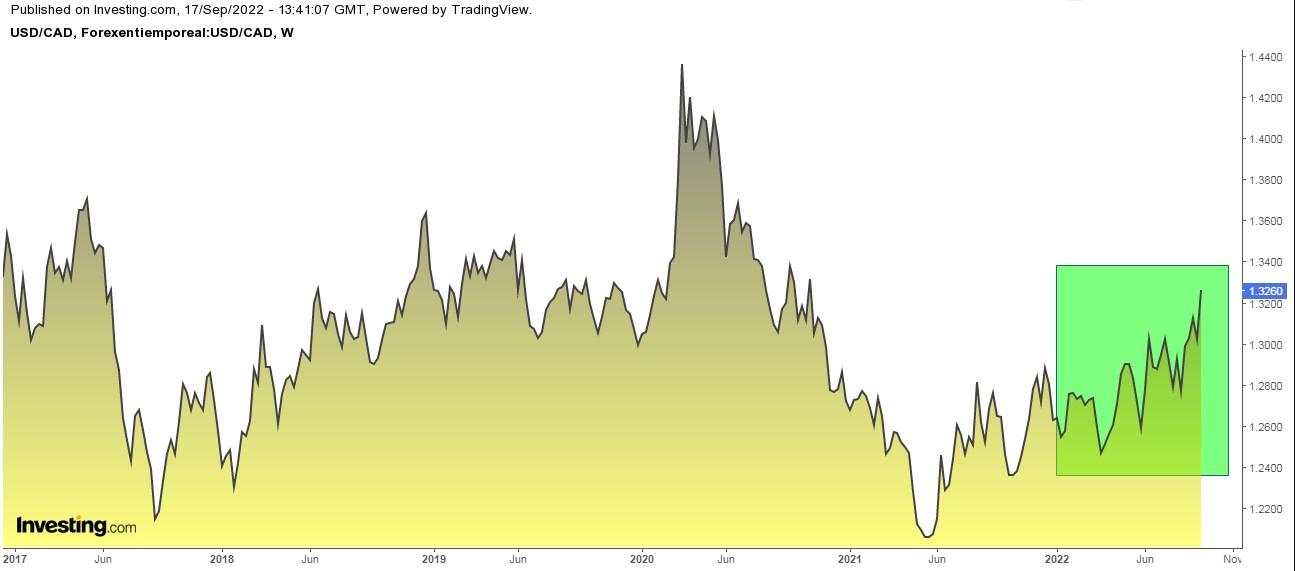

The likewise depreciated against the greenback and reached its weakest level in almost two years.

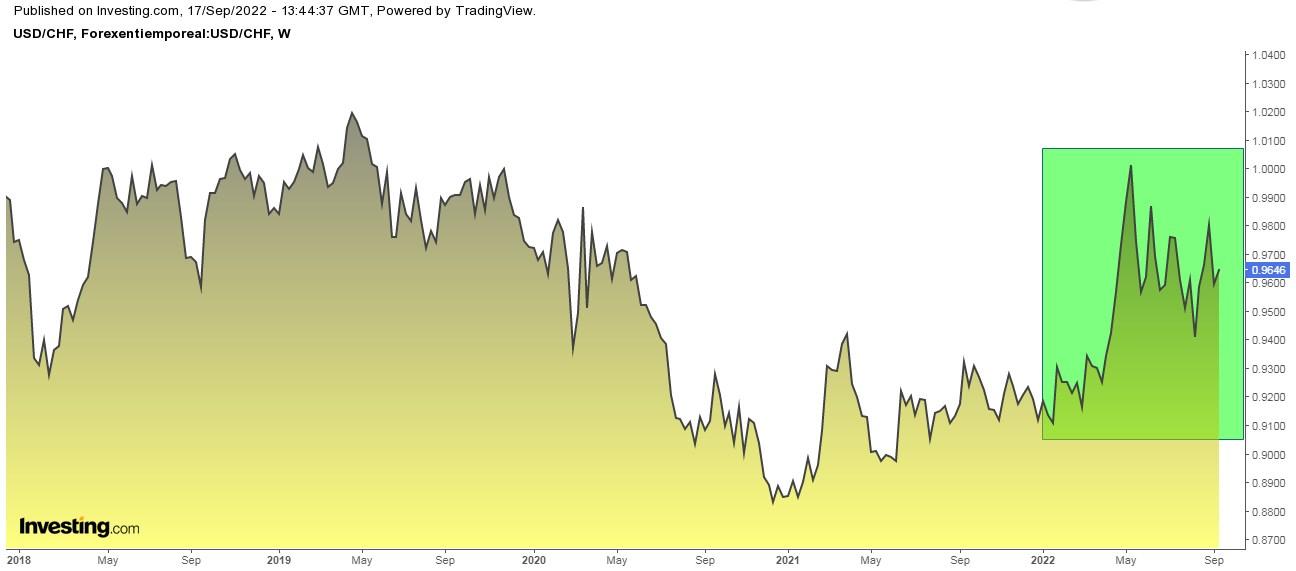

The (surprise) also lost ground against the dollar, and although it recovered some ground since May, the long-term scenario will hardly change. The Swiss National Bank on Thursday in what should mark the country’s pivot from negative interest rates.

Global Stock Market Ranking

The year-to-date global stock market ranking is as follows:

- Brazilian +6%

- Indian +1.52%

- British -2%

- Japanese -4.25%

- Spanish -8.37%

- French -15.04%

- Dow Jones -15.18%

- -18.57%

- S&P 500 -18.73%

- Italian -19.15%

- German -19.79%

- Chinese -20.40%

- NASDAQ -26.82%

Disclosure: The author currently does not own any of the securities mentioned in this article.

[ad_2]

Source link