S&P 500 May Fall Another 15%

2022.06.24 12:41

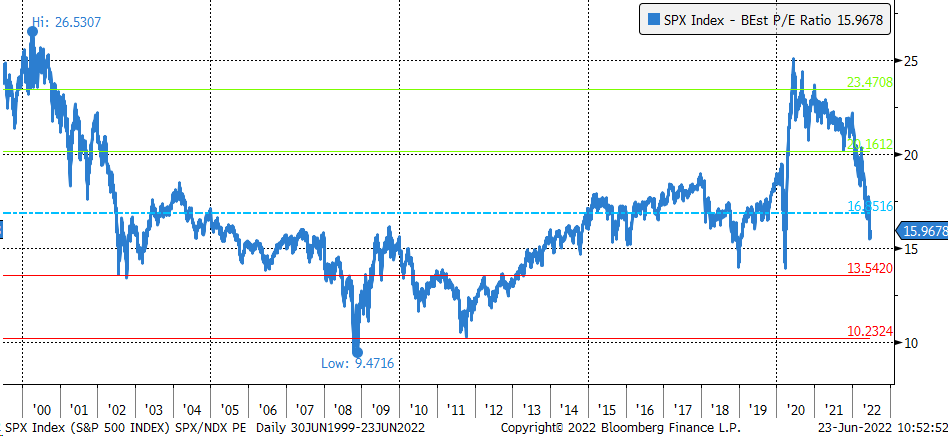

While stocks are down sharply on the year and cheaper in price, markets are still not reasonable from a valuation perspective. The S&P 500 is still trading at an elevated PE ratio when considering the Fed’s agenda to tighten monetary policy and the rising risk of a recession.

That valuation will likely drive the market down even more because historically, when the market has this many questions, it tends to bottom at a lower PE ratio. That means the current PE ratio of 16.0 is probably too high for the time being because that has been around the historical average for the last 20 years.

At least in recent times, the S&P 500 has seen its PE ratio bottom closer to 14 times earnings. That suggests there is still a decline for the broader markets as investors wrestle with the economy’s direction. Additionally, as the Fed raises rates and financial conditions tighten, that will help reduce liquidity in markets which will also help to compress that PE multiple further.

Historically going back to 2000, the average PE ratio for the next four quarters has been around 16.8. Following the 2000 stock market bubble, the S&P 500 PE ratio fell to about 14 by 2002, and that low held for several years until late 2008 when it dropped below 14 following the collapse of Lehman and the financial crisis. The 14 region also helped be a support area for the markets again in late 2018 and early 2020.

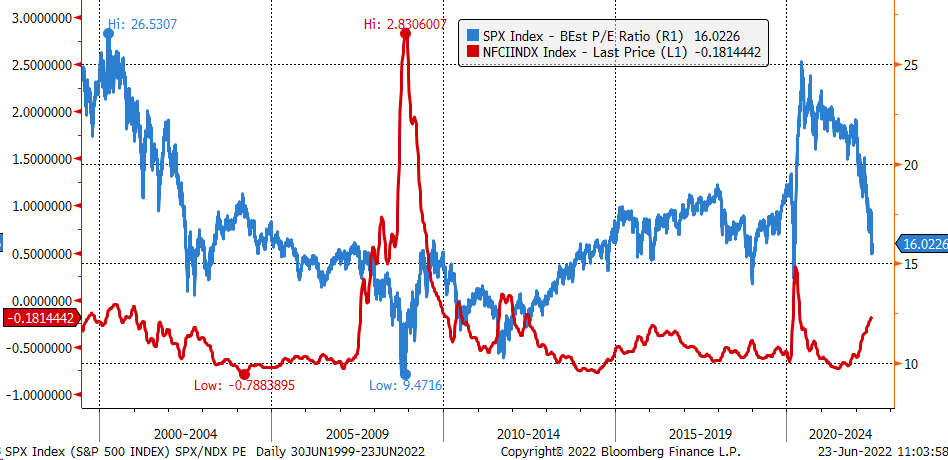

On top of the rising risk of a potential recession, tightening financial conditions will also help compress the PE multiple further. When the Chicago Fed’s national financial conditions index rises, PE falls. Based on the current path of financial conditions and the Fed’s desire to tighten financial conditions and potentially have them become restrictive on the economy, those conditions need to tighten further. That means the Chicago Fed NFCI will probably rise above 0, which in turn would indicate that the PE ratio for the S&P 500 needs to fall further.

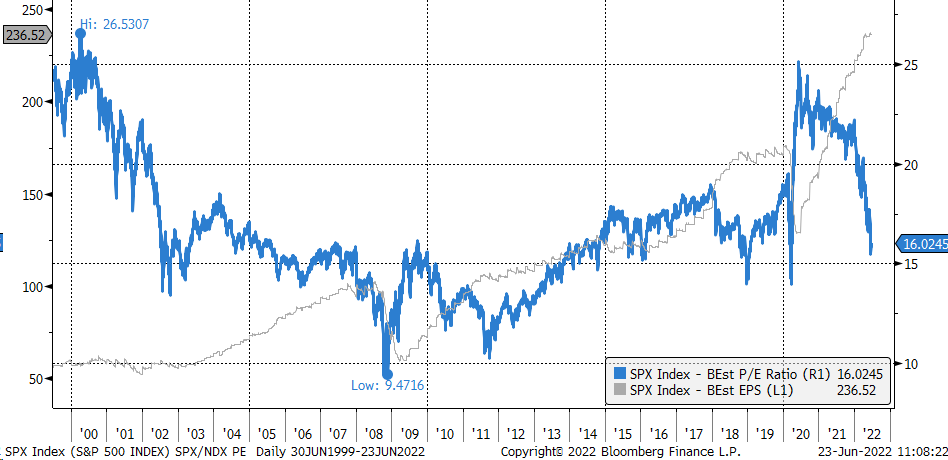

If that PE ratio does fall to around 14, it could mean the S&P 500 has approximately 15% or so to fall. Assuming that earnings estimates remain unchanged at $236.52 over the next four quarters, the value of the S&P 500 would drop to around 3,300.

A drop in the PE ratio to around 14 also discounts a potential decline in earnings estimates. Should the S&P 500 drop to about 3,300, for the PE ratio to move back to the historical average of 16.8 would imply that earnings drop to $196.42 per share or about 17%.

A decline in earnings estimates seems like that needs to happen because higher interest rates and tightening financial conditions will not only cool inflation but also help bring down earnings estimates.

Whether or not the S&P 500 makes it to 3,300 or perhaps goes even further will be entirely dependent on the course of the Fed rate hiking cycle and its potential impacts on the economy. If the Fed shows signs of backing off, the market will likely resolve its issues sooner and provide a much-needed relief rally.