Risk-On Yet Neutral Market Signals

2023.06.21 15:45

Whether you want to call it a skip or a pause, the Fed’s to pass on another quarter-point rate hike was probably the right one. Headline has come down quite a bit and the majority of rate hikes likely haven’t had a chance to funnel through to the economy yet, so taking a breather instead of tightening further at this point makes sense. The big problem, of course, is that the headline rate is likely to start moving higher again in the 3rd quarter and is still running at a 5-6% annualized clip. The dot plot, which should pretty much be ignored, suggested two more rate hikes before the end of the year. I think there’s a chance we get one more in either July or August before we hit the terminal rate. As rate cuts over the past 12 months get baked into the cake, I’d expect the economic headwinds will continue to grow stronger towards the end of the year before the Fed is finally forced to start considering cuts at some point in 2024.

Even though all four of my signals are risk-on at the moment, conditions feel pretty neutral overall. We have to acknowledge that the labor market is showing few signs of weakness, but the conditions surrounding the housing market look a little more impactful in the short term. Housing starts and building permits came in unexpectedly stronger than expected last month and homebuilder sentiment has begun moving higher. I think this is more likely to be a one-off bump in activity instead of a larger rebound in the real estate market, but I do think there’s a bit more optimism here. Bottoms in housing activity tend to correlate quite strongly with recessions. This would be the very rare occasion where a major decline in housing activity didn’t lead to a recession, which is why I’m skeptical that we’re out of the woods.

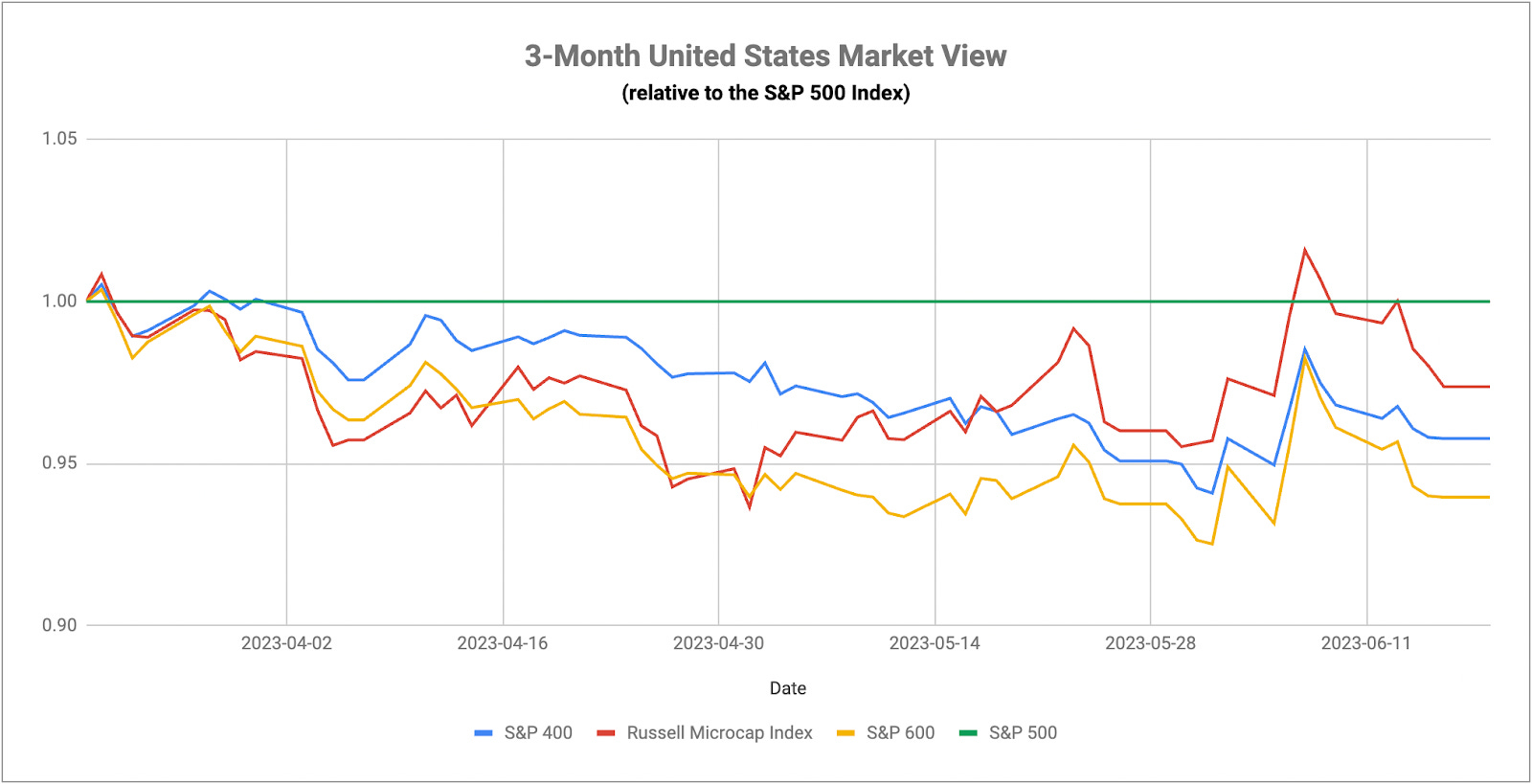

In terms of market activity, I’ve been really interested in utilities since they’ve been holding relatively steady against the over the past 2-3 weeks. If they held up well again this week, I think there would be a stronger case that the euphoria surrounding the markets over the past month was dissipating, but the early action in the sector this week could be signaling that we’re not done quite yet. Utilities, staples, value and low volatility stocks have all gotten off to a bad start this week, so bulls still appear to have the upper hand. The Treasuries market, however, could be turning a bit. The 10Y/3M yield spread has been shrinking, which could be a sign that investors are buying into the economic recovery narrative. I don’t think a whole lot has really changed in the longer-term view and investors shouldn’t get too bullish here, but it does look to be consistent with the “stronger for longer” theme with respect to the U.S. economy.