Risk-On Takes a Hit as China Protests Spark Unease

2022.11.28 09:38

[ad_1]

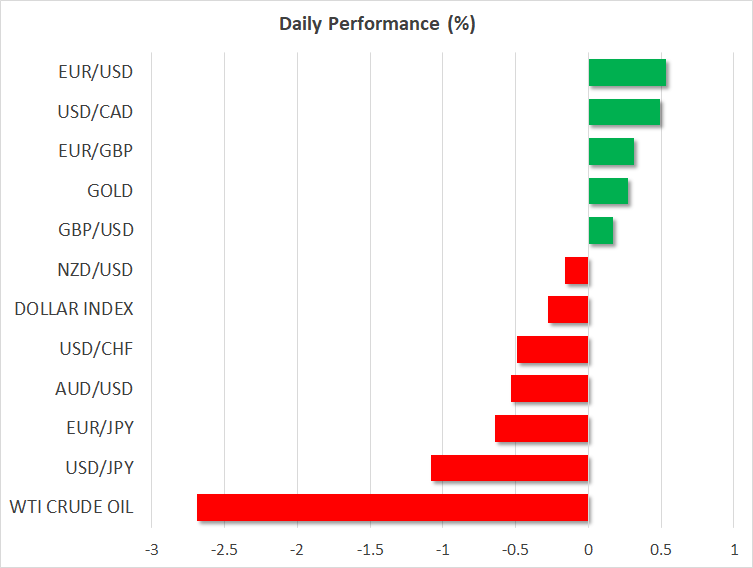

- Yen jumps, yields slip as anti-lockdown protests in China dent sentiment

- Oil slumps to one-year low amid rising concerns about Chinese demand

- Stocks start the week in the red as NFP and other crucial data eyed

Growing protests in China rattle markets

Risk assets took a knock at the start of the week as worries about instability in China and how the country’s unyielding zero-Covid policy might further blight the outlook led investors to search for safety. Anti-lockdown protests started spreading after a deadly fire in Xinjiang last Thursday where residents were reportedly unable to escape the residential complex due to the harsh Covid restrictions.

But the protests erupted further over the weekend, turning into nationwide demonstrations against the government’s handling of the pandemic as anger boiled over. It is yet unclear how authorities plan to quell the ever-growing unrest given their unprecedented scale, or just how much more widespread these protests will become. But this is uncharted territory for President Xi Jinping and the Communist Party, and it is making the markets nervous.

Yen leads safe havens, euro shrugs off risk-averse climate

Traditional safe havens were met with strong demand on Monday. The Japanese yen and Swiss franc led the way in currency markets, followed by the US dollar. US Treasuries also climbed, pushing the 10-year yield to a seven-week low. But gold put on a lacklustre performance, hovering around the $1,750/oz level.

The Australian and New Zealand dollars were the biggest fallers, tumbling against both the yen and greenback. The yen also rallied against its US counterpart, hitting three-month highs. But the euro and pound were relatively steady, with the former erasing its losses and edging higher as European trading got underway.

Expectations that the European Central Bank will raise rates by 75 basis points rather than 50 have inched up slightly despite mixed signals from policymakers about the pace of tightening. But following the somewhat better-than-expected flash PMI readings for November, investors are putting their bets on a larger increment in December.

The euro’s gains today are even more surprising considering that the flash inflation estimates for November are due on Wednesday and traders aren’t taking a more cautious stance ahead of it.

Oil’s outlook goes from bad to worse

was the biggest casualty of the events unfolding in China, which are weighing on the demand outlook. Investors are worried that authorities will clamp down hard against protestors and tighten restrictions even more amid record high daily infections.

WTI and futures were both down about 3%, sliding to near one-year lows.

Headlines about the breakout of protests across major cities have overshadowed Friday’s announcement by China’s central bank of a 25-bps reduction in the reserve requirement ratio aimed at encouraging more lending by banks.

Stocks struggle as China protests sour sentiment, Powell eyed

China’s benchmark CSI 300 index closed down more than 1% on Monday, though it recovered significantly from intraday lows. Most other Asian markets were also in negative territory and European shares were down too, along with US futures.

Wall Street had a mixed day on Friday’s shortened session as thin liquidity due to the Thanksgiving holiday and anxiety about how retailers would fare from the Black Friday sales kept some traders on the sidelines.

But markets are expected to get back into full-swing this week amid a flurry of data releases out of the United States as well as another fairly busy week for Fed speakers.

Investors will be watching very closely this week’s PCE inflation and nonfarm payroll reports for more clues of easing price pressures and a slowing labour market as the December FOMC approaches.

Bullard and Williams will kick things off for the Fed today, though Powell’s appearance on Wednesday will likely attract the most attention as the odds for a 75-bps hike remain sizeable at around 35%.

[ad_2]

Source link