Risk-Off Odds Rise as Markets Retreat, Bond Yields Spike

2023.09.27 08:46

Earlier this month I that there was still room for debating if a broad-based risk-off signal was brewing. Three weeks later, the space is narrowing for keeping an open mind, based on several sets of ETF pairs for markets through yesterday’s close (Sep. 26).

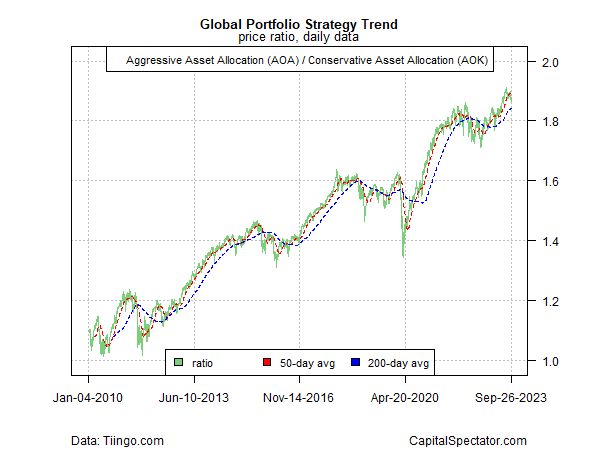

To be fair, there’s no smoking gun via a global asset allocation profile. The downturn in the ratio for aggressive () vs. conservative () asset allocation ETFs is still modest and has yet to signal a downside regime change. In other words, this pairing still implies that the recent market turbulence is noise.

Global Portfolio Strategy Trend Price Ratio Chart

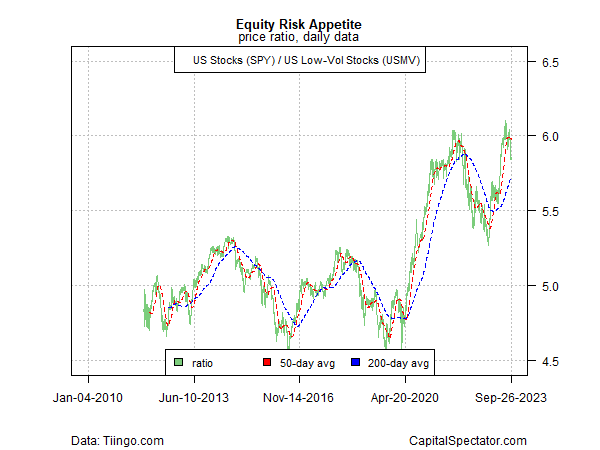

The technical profile for the US stock market, by contrast, paints a somewhat darker setting. The ratio for US stocks () vs. low-volatility shares () – a proxy for gauging the risk appetite for American shares – has clearly peaked, although it’s not yet fallen to a level that decisively marks a bearish reversal.

Equity Risk Appetite

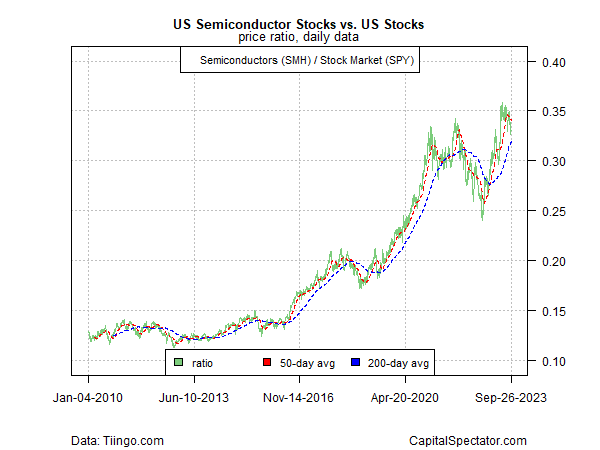

A similar story in favor of caution applies to shares for semiconductor firms () vs. the broad US equities market (SPY). Semi stocks are considered a proxy for the risk appetite and the business cycle and on this front, there’s been a relatively clear change in sentiment following an exuberant run of risk-on.

SMH vs SPY Chart

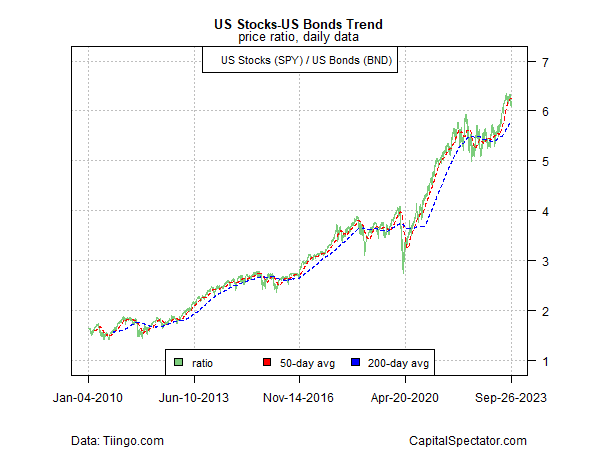

In a sign of possible distortion of the usual signals, the US stock market/US bond market ratio (SPY vs. ) still reflects strength. But this is misleading because equities and fixed income are both suffering. As a result, the standard diversification benefit of holding both asset classes has faded as both markets break with history and move in line with each other lately.

SPY vs BND Daily Chart

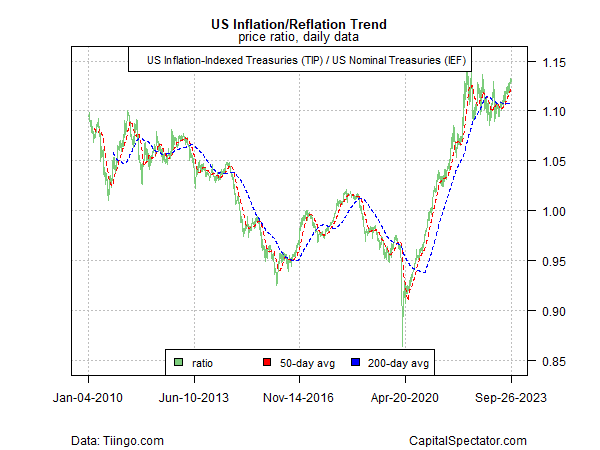

Finally, a potentially troubling reversal for markets may be brewing via the renewed rise in the relative price of inflation-indexed US Treasuries () vs. their nominal counterparts (). In recent months the reflation trade appeared to be peaking — a bullish signal.

But recent history suggests that the appetite for inflation-hedging is reviving. That’s a worrisome sign if it persists because it suggests that markets perceive that inflation risk poses a new headwind for risk assets again. Accordingly, watching this pairing deserves close attention as a possible early warning for what happens next.

TIP vs IEF Daily Chart