Risk Free Government Debt: Fact or Fiction?

2023.09.06 12:12

Most investors believe that U.S. government debt is risk-free. Why shouldn’t they, every economic and financial textbook, media outlet, and bond guru say so?

Did you know it used to be a fact that the earth was flat and “health cigars” were a thing? Obviously, those facts and myths have been disproven, as have many others that seem equally preposterous today.

Cigar

Facts, even if we are not 100% confident that they are factual, provide stability in an otherwise chaotic world. Our need for stability allows unproven “facts” to perpetuate.

In this article, we challenge a “fact” that serves as the foundation for pricing all financial assets. However, our concern for the risk-free status of government debt may be very different from where you think we might be going with this article.

Fitch Downgrades U.S. Government Debt

On August 1, 2023, Fitch downgraded U.S. government debt from AAA to AA+. The event occurred almost twelve years to the day that took the same action. The recent downgrade was ridiculous for two reasons.

First, why does the U.S. government have a debt rating? The Treasury and or Fed can print money to ensure its debt never defaults.

Second, if you were to apply traditional credit metrics to the federal government, its rating should have been well below the AAA rating that it had before the downgrade.

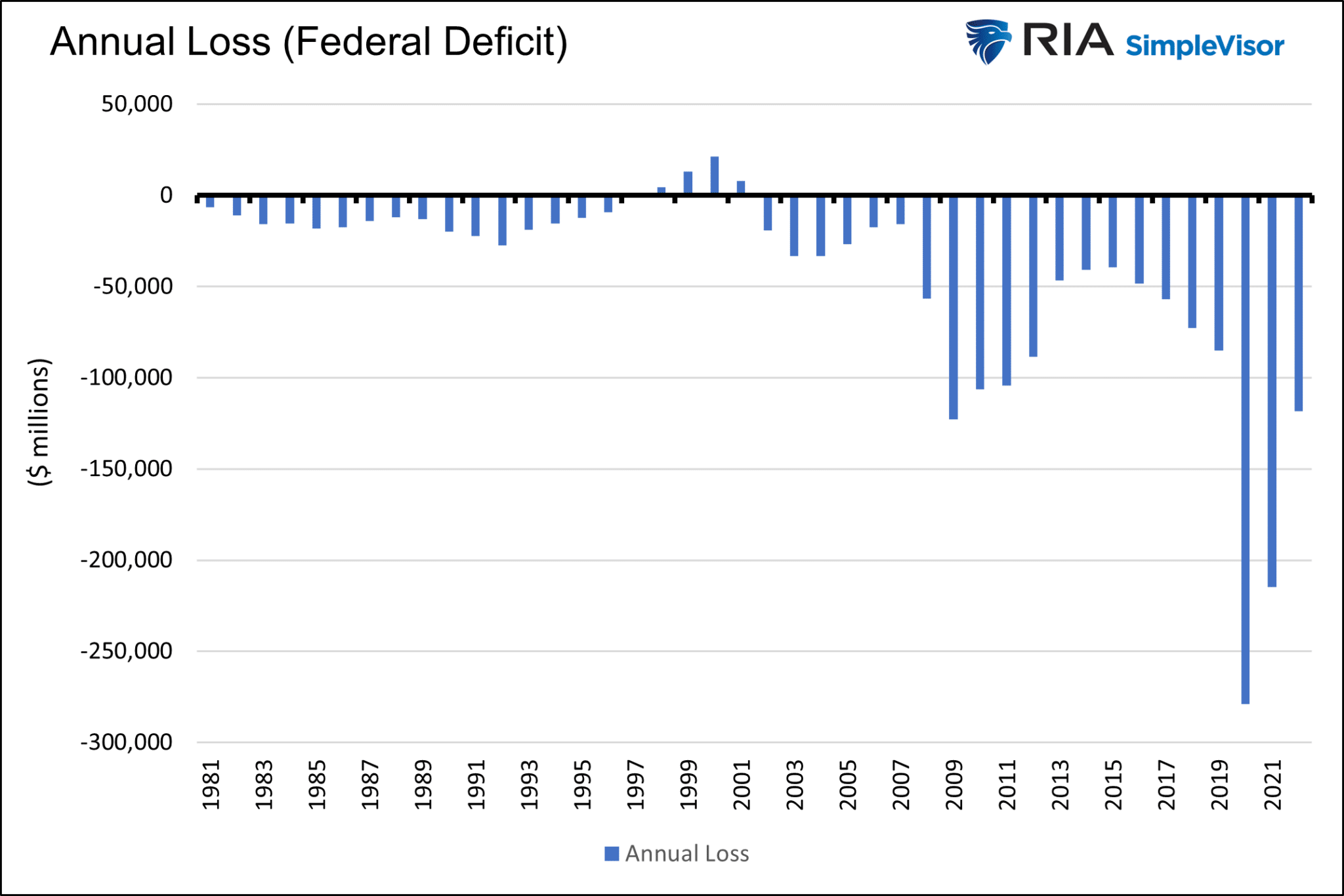

Treating the government as we would a company, we find that it has incurred a loss in all but four of the last 40 years. It’s hard to imagine a company could lose so much money consistently, remain in business, be AA+-rated, and be globally considered risk-free.

Rating The Government With Traditional Measures

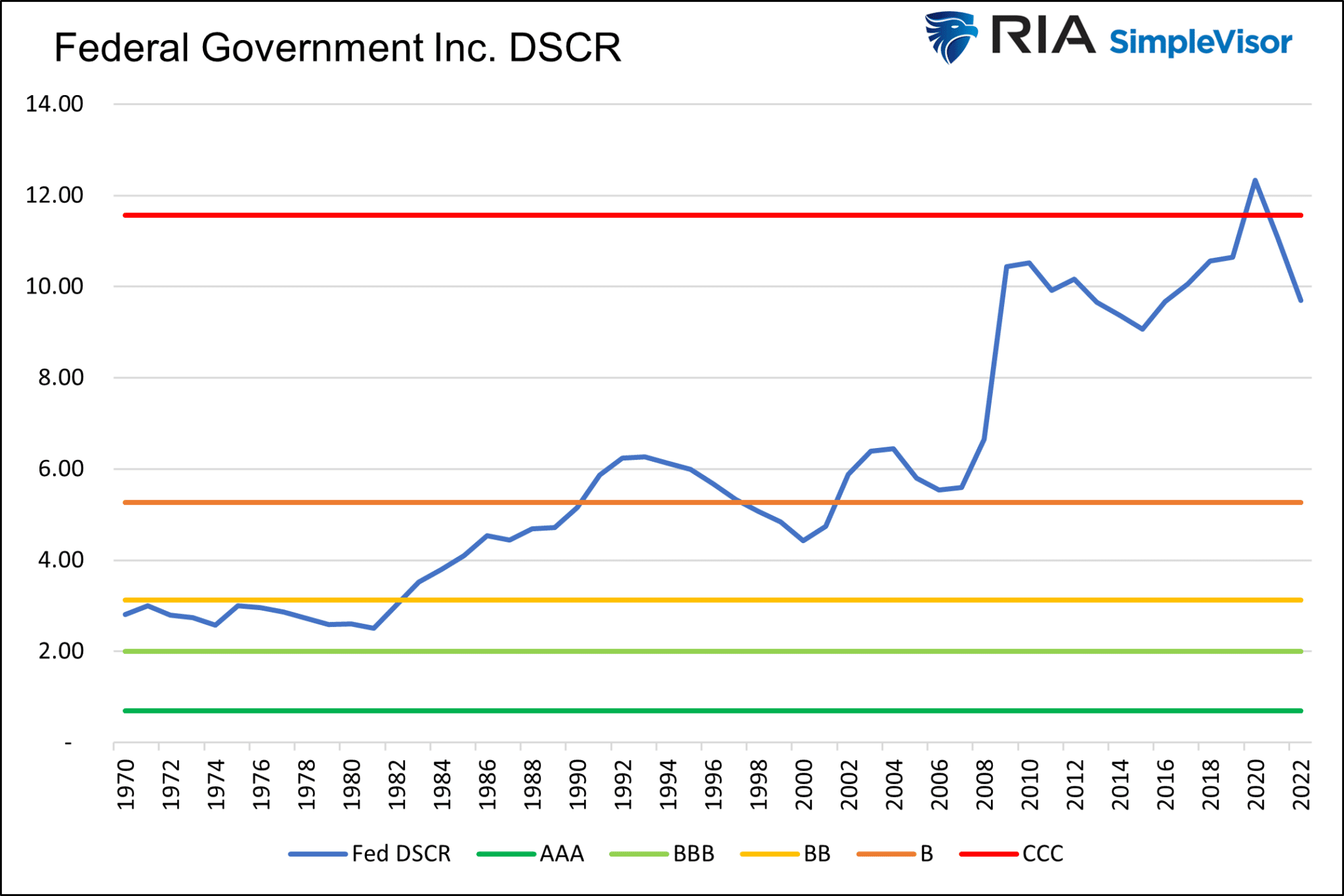

When Fitch calculates the credit rating for a company, it uses the debt service coverage ratio (DSCR), among other fundamental measures of debt, assets, and liquidity. DSCR measures corporate cash flows as compared to debt obligations. Basically, it’s a rough calculation of a company’s ability to pay down its debt.

The government’s DSCR is just under 10. As of 2022, it had debt outstanding of $30.8 billion and $3.1 billion in tax receipts. Remember that tax receipts are like sales for a company and not net profit. The government will spend the $3.1 billion of tax receipts plus a couple more billion to keep the government running. Just the cost of the interest on the debt will eat into a third of the tax receipts.

The graph below shows the growth of the government’s DSCR from 3.0 to 10.0 over the last fifty years. The horizontal lines are NYU Stern School estimates of the appropriate credit rating based on the DSCR for non-financial corporations. As shown, the government’s DSCR would land it firmly in junk bond territory between a B and CCC rating.

Government Debt Service Coverage Ratio

Government Debt Service Coverage Ratio

A Different Kind of Default Risk

If the government’s debt rating resembles a CCC-rated bond, why do we consider it risk-free? The simple answer is that the government and the Fed own the money printing press. If need be, they will print money to fund its debt.

As such, the odds of a government bond investor not receiving their interest and principal in its entirety are zero percent. However, the risks for domestic bondholders and the American people are plentiful when the government and Fed ignore their fiscal and monetary responsibilities.

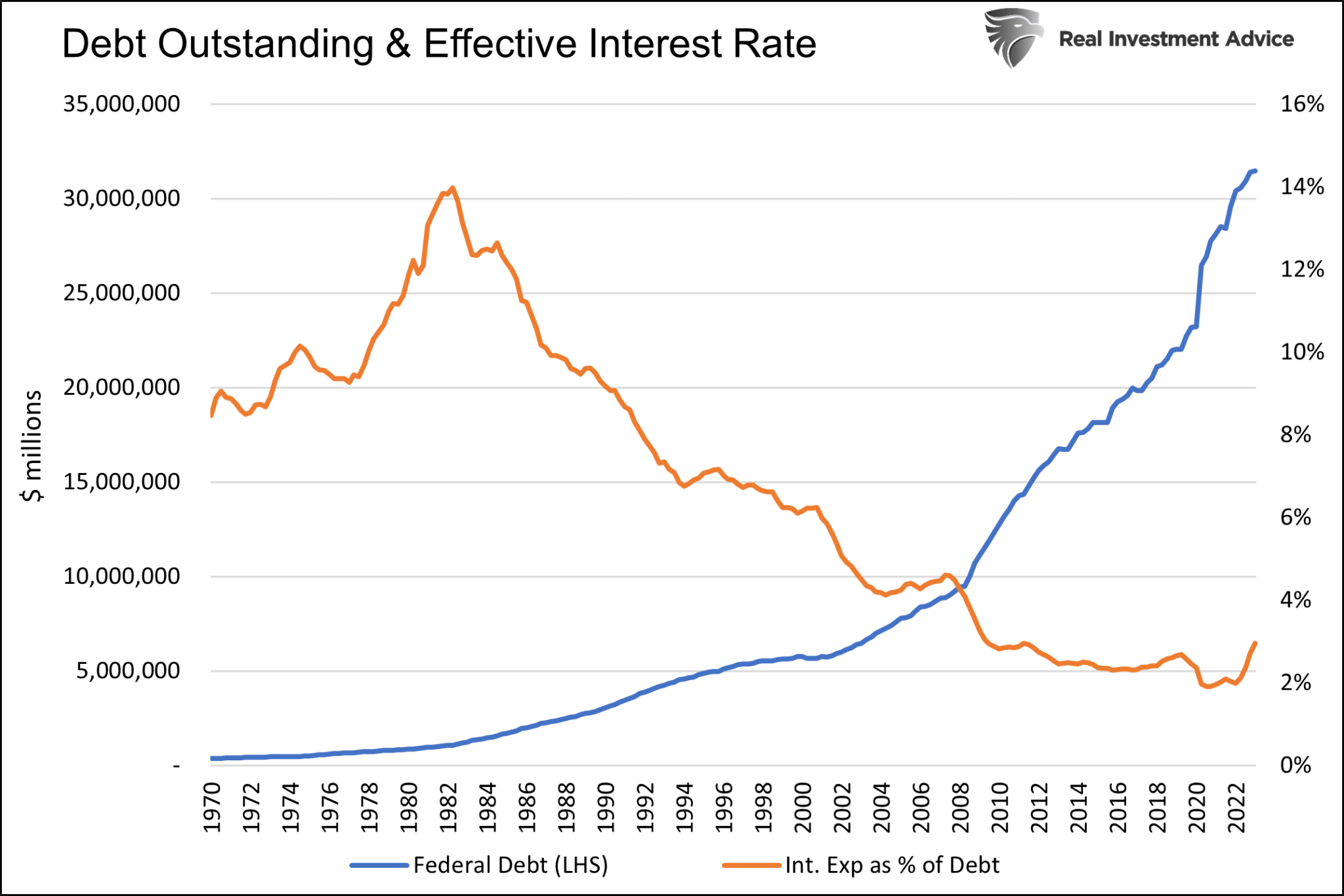

Government debt has risen significantly, but government interest rate expenses have increased by far less, as shown below.

Debt Outstanding And Effective Interest Rate

Debt Outstanding And Effective Interest Rate

To accomplish this feat, the Fed has administered near-zero interest rates and, since 2008, has bought nearly $9 trillion, or about a quarter of the total public debt outstanding. Historically, low interest rates have allowed the Treasury to increase its debt outstanding since 2000 sixfold, while its interest expense has slightly more than doubled over the same period.

The cost of continual deficits, or the risk, is weaker economic growth. While our prosperity is less than it otherwise would be, weaker economic growth contributes to lower interest rates.

Government debt has a negative multiplier. Each dollar of debt the government issues results in negative economic growth and weaker inflation over the long run. Government spending initially boosts economic activity. But over time, the aggregate costs of the debt in terms of interest expenses outstrip the benefits. Further, the capital used by the government likely would have been invested in more productive uses by the private sector.

Hoisington Investment Management On The Negative Multiplier

For more on the topic, we lean on Hoisington Investment Management’s latest quarterly update:

Estimates from econometric studies of highly indebted industrialized economies indicate that the government expenditure multiplier is positive for the first four to six quarters after the initial deficit financing, then turns negative after three years. This implies that a dollar of debt financed federal expenditures will, ‘at the end of the day,’ reduce private GDP.

Regarding how recent surges in deficits will affect economic growth, they have this to say:

“After taking into consideration the benefits of deficit spending, the lagged negative multiplier effects, and the way in which debt is being financed, the upcoming deficits are likely to have a negligible, if not contractionary, impact on economic growth this year and next.”

Simply, more deficit spending reduces economic growth and inflation, pushing bond yields lower. Instead of punishing fiscal abuse, the government is rewarded with lower yields, albeit at the cost of less economic activity and, therefore, lower tax receipts.

Such is the magic of exceedingly low-interest rates generated by the Fed and the government’s fiscal irresponsibility.

Wicksell Warned Us

As we said, the risk of holding Treasury bonds is not a technical default. The risk is that the methods used to manipulate the interest rate markets to help keep debt affordable harm the nation’s prosperity.

A few years back, we wrote Wicksell’s Elegant Model. The article summarizes Knut Wicksell’s theories concerning the level of interest rates versus the natural economic growth rate.

The following quotes from the article help us appreciate his concepts and why the necessity for lower interest rates presents a significant risk to the populace.

On the other hand, if market rates of interest are held abnormally below the natural rate then capital allocation decisions are not made on the basis of marginal efficiency but according to the average return on invested capital. This explains why, in those periods, more speculative assets such as stocks and real estate boomed.

But when short-term market rates are below the natural rate, intelligent investors respond appropriately. They borrow heavily at a low rate and buy existing assets with somewhat predictable returns and shorter time horizons. Financial assets skyrocket in value while long-term, cash-flow-driven investments with riskier prospects languish. The bottom line: existing assets rise in value, but few new assets are added to the capital stock, which is decidedly bad for productivity and the economy’s structural growth.

Summary

Risk-free Treasury securities will always pay its investors in full. But the means and schemes used to pay them will detract from economic activity and, ultimately, the prosperity of the nation’s citizens. We think that is quite a risk and one grossly underappreciated!