Risk Assets Rally Ahead of Fed Minutes, RBNZ Lifts Kiwi

2022.11.23 06:59

[ad_1]

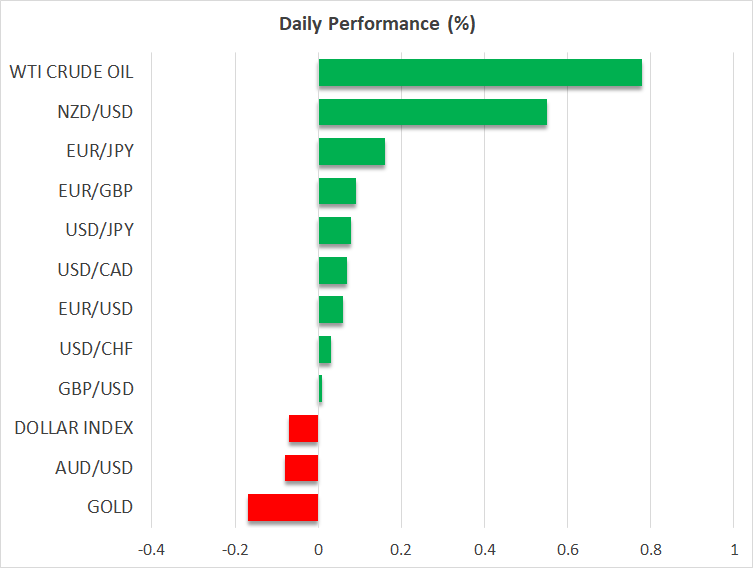

- Retreat in the dollar and yields helps fuel risk appetite

- Stock markets rally, jumps after RBNZ decision

- European PMIs paint grim picture, Fed minutes next

Risk appetite returns

Investors went on a shopping spree on Tuesday, raising their exposure to riskier assets without any clear news catalyst behind this sudden shift in sentiment. The S&P 500 closed at its highest levels since mid-September as implied volatility collapsed, with a pullback in the dollar and real yields helping to fuel risk appetite.

It is quite striking that implied volatility has declined so dramatically heading into what could be a stormy and illiquid holiday season. Even though every leading economic indicator points to trouble ahead, demand for downside protection has evaporated, which suggests that equity traders are either too complacent or heavily hedged already.

There’s a sharp contrast between asset classes about what lies ahead. Valuations and earnings estimates in stock markets are still consistent with a soft economic landing whereas the bond market is saying the plane is more likely to crash-land, with the yield curve sinking deeper into inverted territory.

One of these markets is mispriced and it is more likely that stocks will need to adjust to reality, as the weakening economic data pulse across the world suggests that avoiding a recession next year would be a miracle. It seems like a better time to play defense rather than load up on risky bets.

RBNZ goes big

In New Zealand, the Reserve Bank raised interest rates by 75bps overnight to 4.25%. This move was on the hawkish side of market expectations and the officials noted that they spent a lot of time discussing an even bigger increase of a full percentage point.

Baked into the RBNZ’s latest economic projections is a recession that’s expected to hit early next year, which Governor Orr downplayed as likely to be “shallow”, stressing that reining in inflation is still the main priority and that interest rates will need to move even higher.

The New Zealand dollar rose, although not in a convincing manner. It’s worrisome that the kiwi couldn’t stage a mighty relief rally even despite such hawkish rhetoric from the RBNZ, a softer US dollar, and the brighter mood in risk assets. The outlook remains gloomy, with worries around China and the global economy likely to overshadow any positive domestic developments.

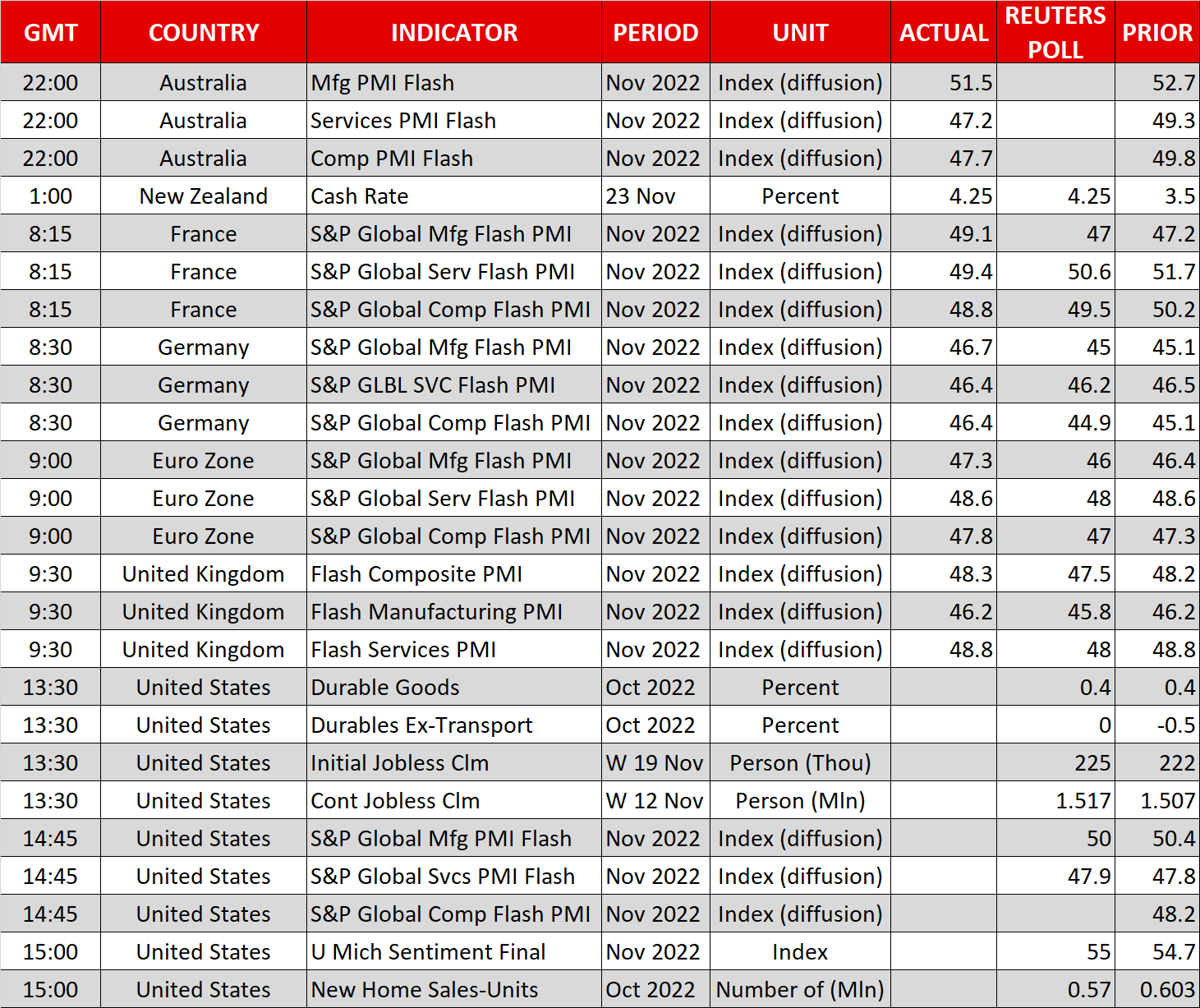

European PMIs and Fed minutes

In Europe, the latest batch of business surveys contained both good and bad news. Sadly, the surveys are consistent with the Eurozone economy contracting at a quarterly rate of 0.2% this quarter. On the bright side, the rate of decline eased from October and inflation is showing signs of cooling.

Overall, these surveys lend credence to the narrative that the Eurozone is on the brink of recession but the downturn won’t be as deep as investors feared initially, thanks to the massive decline in energy prices. Hence, while the outlook for the euro has started to improve, the prospect of a trend reversal is still premature, and probably a story for next year.

It’s a similar story for sterling. The latest business surveys suggest the UK economy is already in recession, on pace to contract 0.4% this quarter, which will likely deepen further considering the sharp drop in forward-looking indicators such as new orders. With the economy rolling over just as the government tightens its belt, it’s difficult to be optimistic on the pound, especially considering its close links to global risk sentiment.

Finally, the minutes of the latest Fed meeting will be released at 19:00 GMT. A pivotal inflation report and speeches from most FOMC officials since that meeting render the minutes outdated. Nonetheless, the market almost always reacts to this release, and a hawkish tone could give the dollar a helping hand.

[ad_2]

Source link