Retail Sales Help the Dollar, Pound Slides on CPIs

2023.07.19 06:01

- Dollar sellers lock profits on resilient core retail sales

- ECB hawk Knot casts doubts over September rate hike

- UK inflation slows more than expected, pound pulls back

- Tesla (NASDAQ:) and Netflix (NASDAQ:) earnings enter the limelight

Dollar rebounds, but Fed cut bets remain firmly on the table

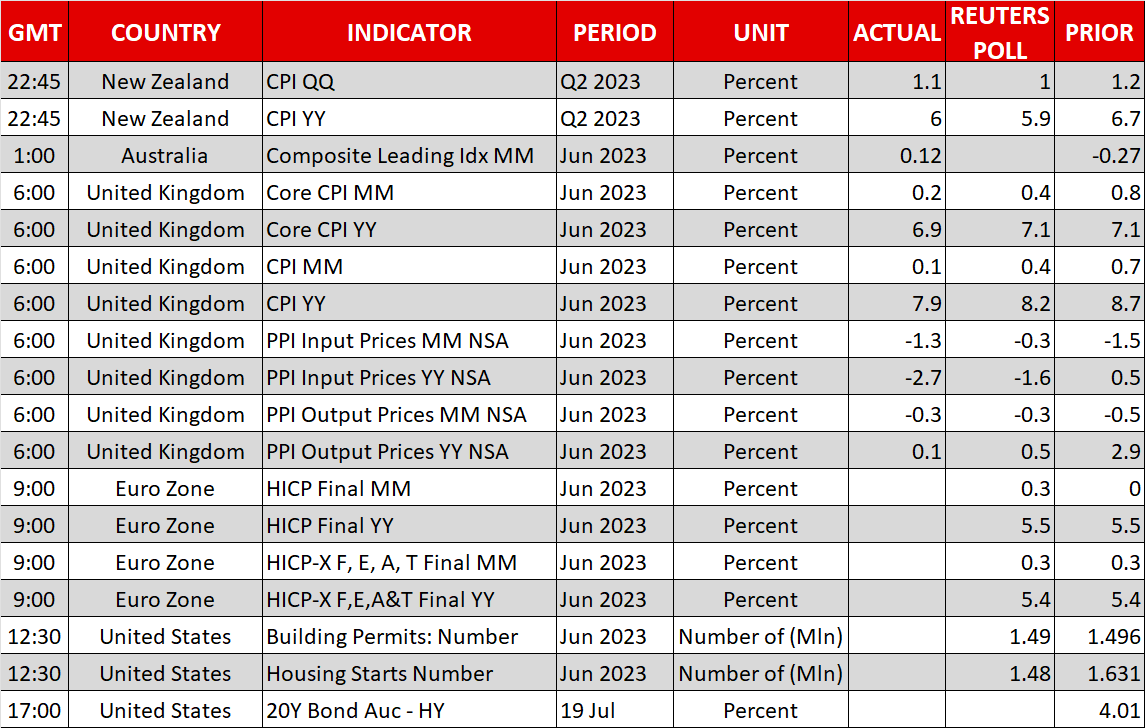

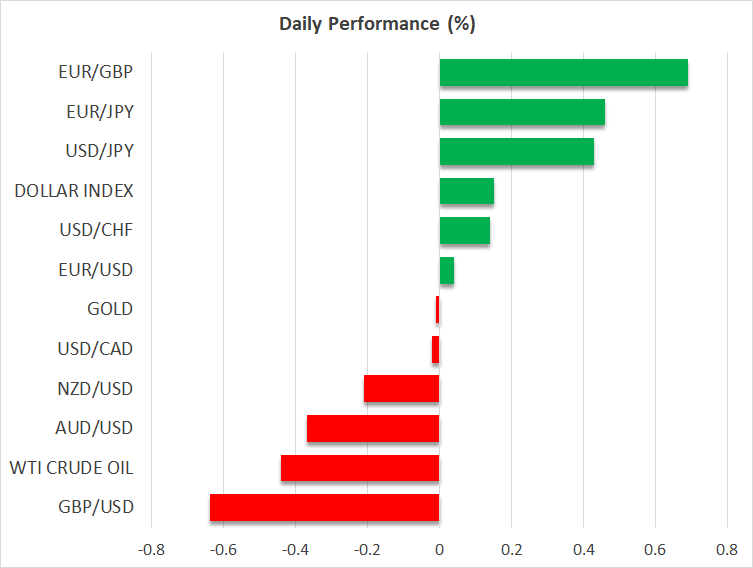

The US dollar traded slightly higher against most of the other major currencies on Tuesday, extending its recovery during the Asian session Wednesday.

Although data showed that US retail sales rose less than expected in June, dollar traders refrained from selling the dollar, perhaps as core sales showed more resilience. Excluding automobiles, gasoline, building materials and food services, sales accelerated to 0.6% month-on-month from 0.3% in May, confounding expectations of a 0.3% slide.

Perhaps traders used this report as an excuse to liquidate short positions and lock decent profits after last week’s tumble that was triggered by the larger-than-expected slowdown in consumer and producer prices.

What adds credence to the view that investors have not changed their mind and just capitalized on prior short positions is the fact that the implied path reflecting market expectations of the Fed’s future course of action has not changed much. Market participants are still expecting only one more hike and a series of rate reductions throughout 2024. Conditional upon a 25bps hike being delivered next week, they are penciling in 150bps worth of rate cuts by the end of next year.

This is likely to keep the dollar in downtrend mode even if the current rebound extends for a while longer. A further recovery may just provide more attractive entry points to those wanting to sell dollars again.

ECB’s Knot pushes against September hike, pound drops on cooling CPIs

Euro/dollar may extend its uptrend towards the key territory of 1.1485, which acted as a ceiling back in January and February 2022, but at a slower pace than it did last week as some ECB members seem to be pushing back on bets for a September hike.

Just yesterday, ECB hawk Klaas Knot said they will look closely for signs of inflation cooling down in the foreseeable future to avoid taking interest rates higher than necessary. He also added that a July hike is a necessity, but anything beyond that would at most be a possibility, a view also echoed by his colleague Joachim Nagel.

Today, it was the pound’s turn to be sold aggressively, as UK CPI data revealed a larger than expected inflation slowdown in both headline and core terms. Although market participants remained convinced that a 50bps hike is more likely than a smaller 25bps increment in August, they took off the table a decent amount of expected basis points worth of additional rate hikes. They are now pricing slightly less than 100bps worth of hikes from current levels compared to 150bps last week.

Yet, this is still a more hawkish view than what the market expects the Fed to do. Therefore, calling today’s tumble in pound/dollar the beginning of a major trend reversal is very premature. Cable bulls may decide to recharge from near the 1.2845 zone, which is marked as support by the inside swing high of June 16.

Outside the major FX sphere, the Turkish lira fell around 2.5% yesterday to a fresh record low against the US dollar after a newspaper columnist wrote that his impression was that interest rates should be raised to around 16.50-17.00% at Thursday’s gathering. With Turkish inflation hovering at 38.21% and the market anticipating a 500bps hike, news favoring a smaller hike is working against the wounded lira.

Wall Street gains ahead of Tesla and Netflix earnings

Wall Street closed well in the green yesterday, with the Dow Jones gaining 1.06% and marking its longest streak of daily gains in more than two years.

Better-than-projected bank earnings seem to have added fuel to the stock rally that started back in October. However, the main drivers of this latest uptrend are tech stocks and thus, investors may pay closer attention to the results of tech giants. Tesla and Netflix make the start today after the closing bell and should they continue to project accelerating growth for the quarters ahead, their stocks’ uptrends may be destined to continue, especially with the market pricing in a series of rate cuts by the Fed by the end of next year.