Record retail sales not as good as they appear

2024.12.17 12:34

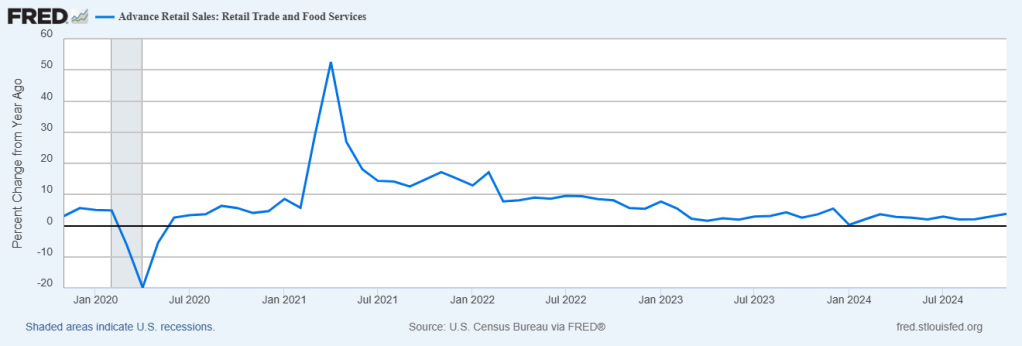

Total (EPA:) retail sales for November came in better than expectations, now $724.6 billion and another record high. Retail sales are now +38% above the pre-COVID high.

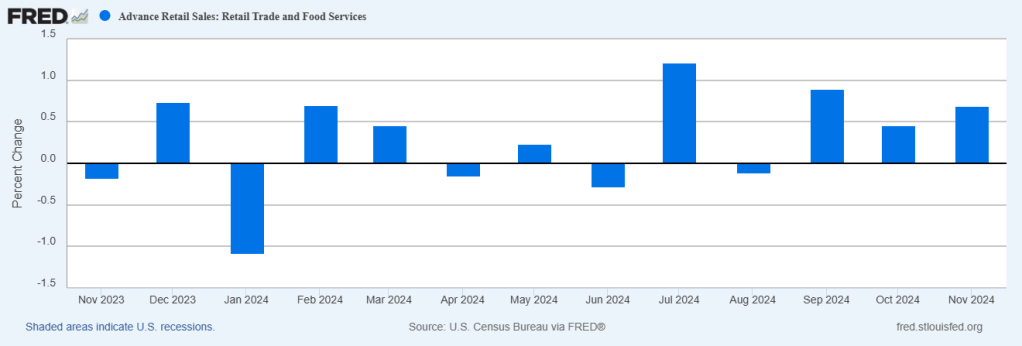

Novembers gain came in at +0.7% (street was expecting +0.5%), above the historical average of +0.4% and last months +0.5% (which was revised higher, up from +0.4%).

Total retail sales are up +3.8% over the last 12 months, below the historical average of +4.7%, but up from last month’s +2.9%.

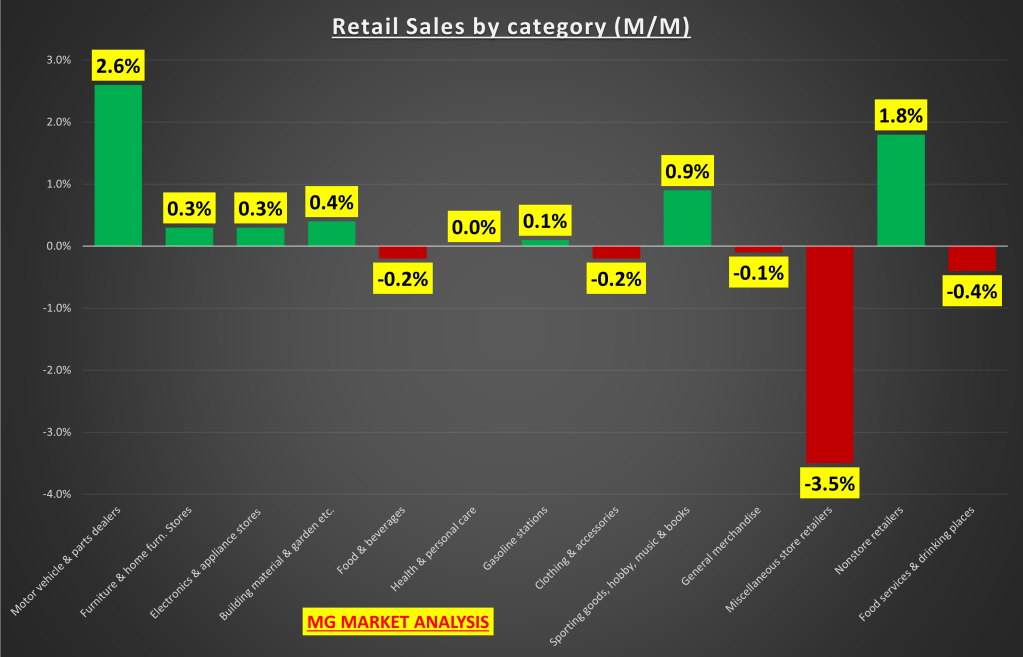

Breaking down retail sales by category, 9 of 13 categories showed gains in November, led by motor vehicles and nonstore retailers (online). The biggest drag came from the brick and mortar stores.

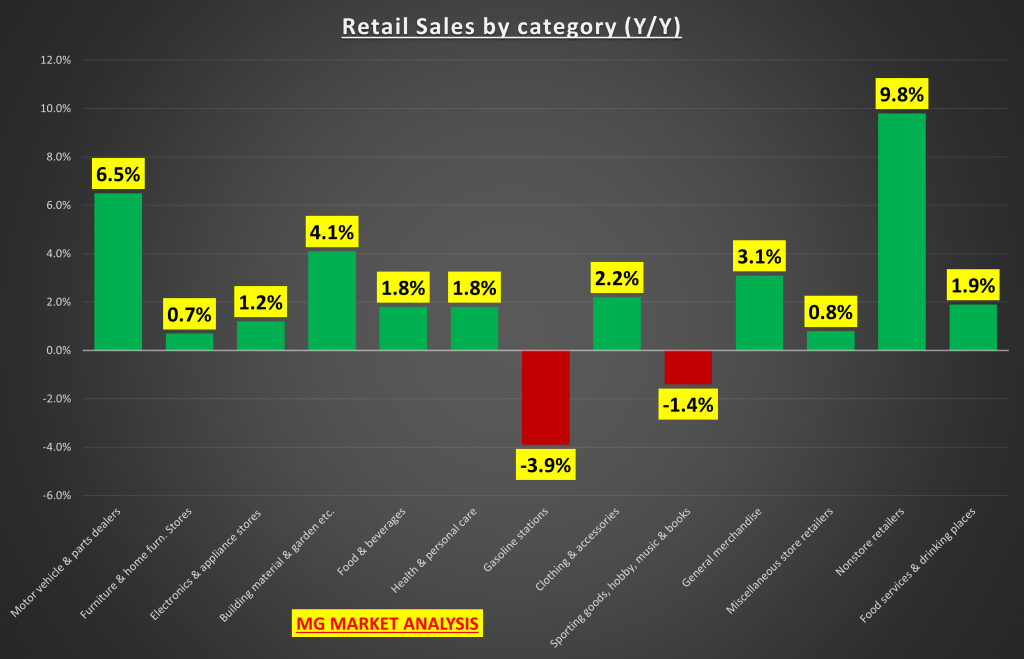

Over the last 12 months, 11 of 13 retail sales categories increased. Similar to the monthly data, it was the motor vehicle and online stores categories that led the way. While gasoline and sporting goods were the only 2 categories that declined.

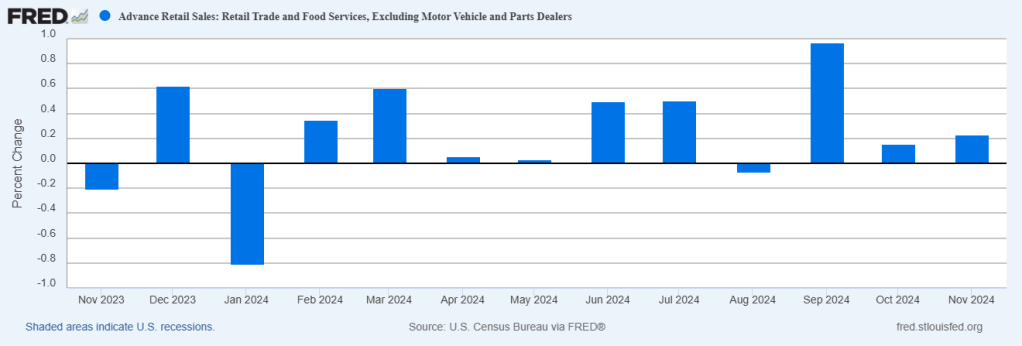

So record retail sales is great news right? Not so fast. Things aren’t quite as good as they appear. When we look at core retail sales (stripping out the volatile auto’s category), that number came in +0.2% in November, which missed street expectations of +0.4%.

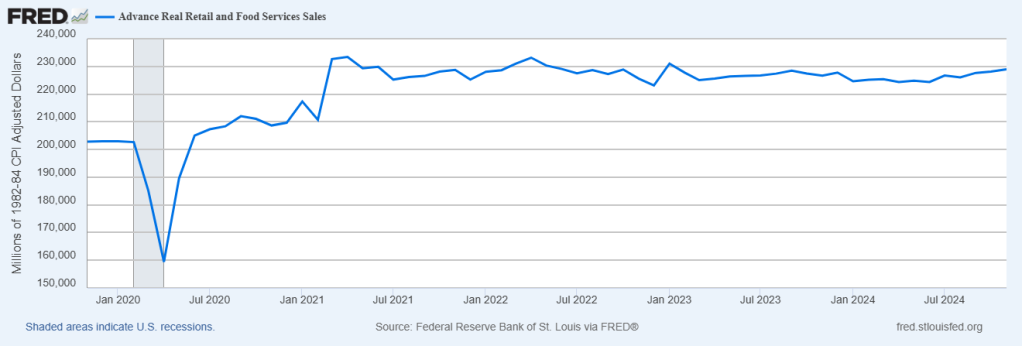

And when we look closer at “real” retail sales (total retail sales minus inflation) we actually see that real sales haven’t gone anywhere in 3.5 years. On April 2021, real sales came in at $233.4 billion, fast forward to November 2024 and real sales still haven’t made another high, currently $229 billion.

During that April 2021 to November 2024 time frame, total retail sales have increased +16.4%. But this is 100% attributed to the increase in the price of goods. Consumers are buying the same amount of goods that they did 3.5 years ago, but paying more for them.

This reaffirms the manufacturing slump. Consumers loaded up on goods when they were locked away during COVID, but have shifted their spending patterns towards services, and paying higher prices for the same amount of goods.