Recession Forecasts Persist as U.S. Economic Growth Muddles On

2023.05.17 08:54

Warnings that the US economy is close to the tipping point for recession have endured for months, but the expansion keeps surprising on the upside. More of the same is likely for the immediate future and perhaps longer.

There’s no shortage of reasons to embrace a darker view. Examples include the ongoing inversion of the Treasury yield curve, which remains deep in the red. The spread on the Note less the Bill is currently underwater at 52 basis points (May 16) and has consistently been subzero since July 2022.

Numerous studies advise that an inverted curve has been a reliable recession predictor over the decades. It may yet prove to be yet again, but the economy continues to defy the odds implied by the yield curve and other business cycle metrics.

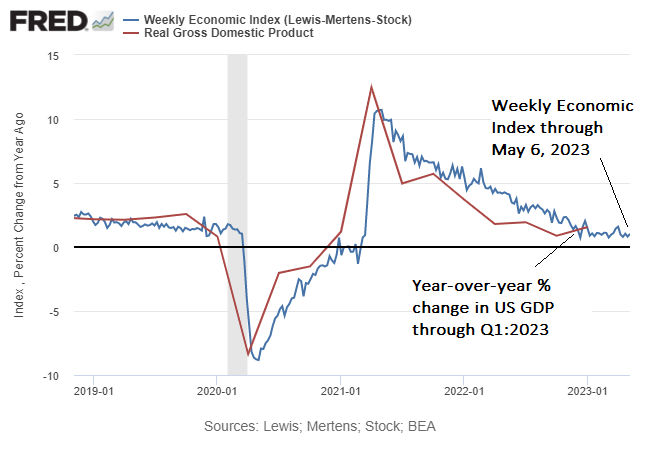

Economic activity has slowed recently, but the New York Fed Weekly Economic Index (WEI) suggests the slowdown is stabilizing (through May 6). After trending lower in 2022, WEI has been flatlining this year, albeit at a level that reflects modest/weak growth.

Weekly Economic Index

Economists are debating why the economy has remained resilient, and uncertainty abounds about how long the slow growth can continue. But for the moment, the US has sidestepped the start of an NBER-defined recession, and a tipping point doesn’t look imminent.

The persistence of growth has been surprising, based on various measures of the broad macro trend. Here on the pages of CapitalSpectator.com, the odds looked high late last year that a tipping point was near. But a funny thing happened on the way to the recession: the economy’s initial downshift in the fall of 2022 defied the odds and stabilized.

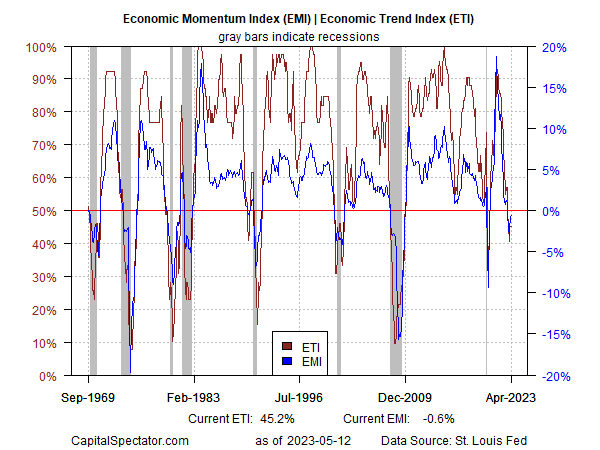

By my estimates, flat to modestly negative business-cycle conditions still apply, based on a pair of proprietary metrics updated weekly in The US Business Cycle Risk Report. History suggests that when the Economic Trend Index and Economic Momentum Index fall below their tipping points, an NBER-defined recession has started or is near.

But this time has proven to be the exception. After the initial decline of ETI and EMI in late-2022, the expected slide deeper into negative terrain didn’t happen; instead, the indexes recovered a bit.

EMI and ETI Index

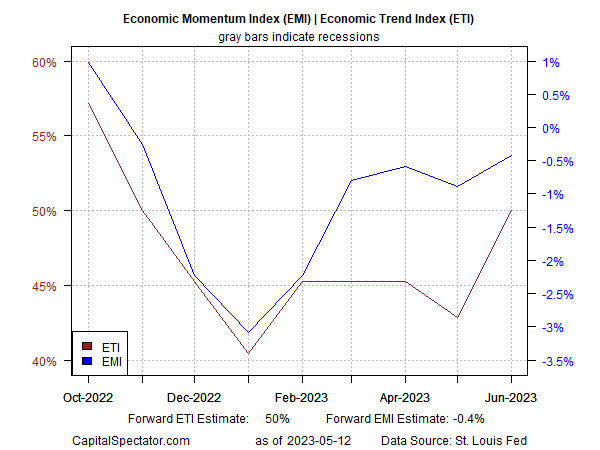

In fact, forward estimates of ETI and EMI through June show signs of strengthening. Forecasts for both indexes point to a return to a flat to a modest pace of growth.

EMI and ETI Index Forward Estimates

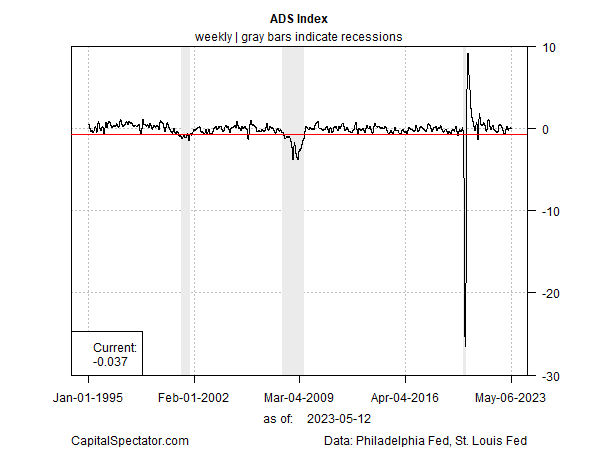

The persistence of slow growth also aligns with the Philly Fed’s ADS Index, which reflects slightly above-average activity for the US economy as of May 6.

ADS Index

What could derail the economy’s resilience? There are many possibilities when growth is slow/sluggish, including the elephant in the room: the debt-ceiling crisis. If a deal in Washington isn’t hammered out soon, the resulting blowback from a US default could easily push the economy over the edge. Assuming the politicians find a solution, on the other hand, suggests a US recession remains unlikely in the immediate future.

View Warren Buffet’s Portfolio Details on InvestingPro