Rebound in Money Supply Growth Is New Tailwind for US Economy

2024.10.08 09:17

There are several reasons for downplaying the recent recession warnings. Last week’s dramatically stronger-than-expected rise in September is one. The revival of US money supply growth in year-over-year terms is another.

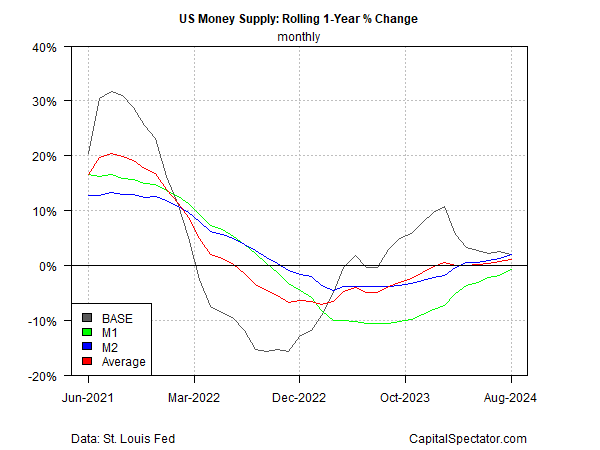

The average one-year change for several measures of money supply started rising again in February. But the increases have been incremental.

That began to change in the summer and for August the trend topped 1.0% for the first time in more than two years (red line in chart below).

More importantly, the 1.1% year-over-year increase in the average pace of money supply growth ends 18 straight months of contraction.

Notably, the economy continued to expand during that money-supply-drought period. The return of a growth trend – presumably one that will continue and accelerate for the near term – brings another facet of support for economic activity.

Not surprisingly, the return of money supply growth coincides with the Federal Reserve’s interest rate cut last month – the first reduction in the target rate since the central bank began raising rates in March 2022.

The slow and then accelerating pace in money supply growth ahead of the Fed cut in September was a sign that a dovish turn in policy was approaching.

The revival of money supply growth adds to the empirical support that downplays the summer fears that US recession risk is rising.

That forecast was always drawing primarily on speculation rather than hard data, as explained and , for instance.

The current numbers tracking money-supply trend reaffirm that the macro trend for the US continues to skew positive and may even be strengthening.

As a result, the outlook for another ½-point rate cut by the Federal Reserve has faded. Fed funds futures this morning are pricing in an 87% for a ¼-point cut at the next FOMC meeting on Nov. 7.

Meanwhile, some analysts are starting to question if the Fed cut too much last month, or if a cut was even necessary.

“With the benefit of hindsight, the 50 basis point cut in September was a mistake though not one of great consequence,” Former Treasury Secretary Larry Summers wrote last week.

“Today’s employment report confirms suspicions that we are in a high neutral rate environment where responsible monetary policy requires caution in rate cutting.”