Real Yields Spike And The Equity Risk Premium Plunges

2022.09.26 07:23

[ad_1]

- Positive inflation-adjusted return on default-risk-free Treasuries/corporate bonds

- Higher market rates means a much lower S&P 500 equity risk premium

- Consider asset allocation tweaks but wholesale changes not warranted

Treasury yields have been on a massive advance. While the bond bear market arguably began more than two years ago, it’s just since early August that intense selling has rendered rates to their highest level in 15 years on parts of the curve. What’s more, expected inflation appears to be cooling off despite a much hotter than expected August report.

Treasuries vs TIPS

Investors can compare rates on conventional Treasuries to Treasury-Inflation Protected Securities (TIPS) to get a sense of where inflation goes from here. There’s a handy dashboard put together by Jeremy Schwartz at WisdomTree that illustrates well how positive the outlook is for owning boring old Treasury bills, notes, and bonds.

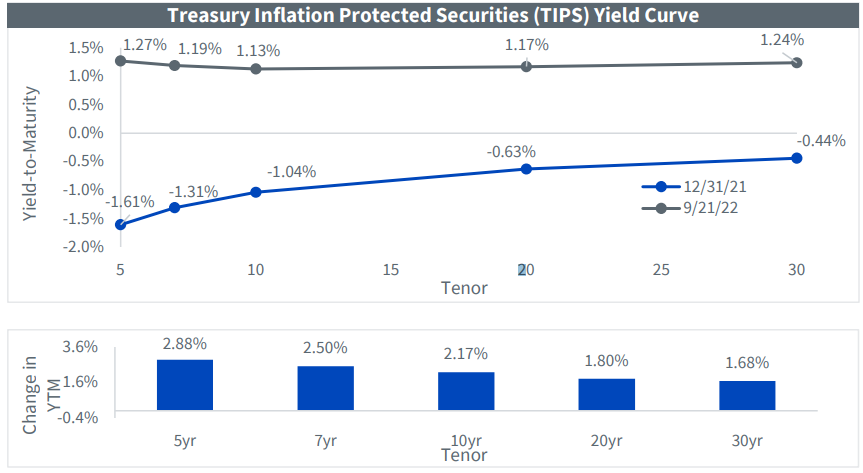

The chart below shows the TIPS yield curve—basically the inflation-adjusted rates of return you can currently capture on Treasuries. Notice that they are positive across the maturity spectrum. Moreover, real yields on short-term Treasuries, under five years in maturity, are particularly positive.

TIPS Yield Curve: In the Black After Years in the Red

Source: WisdomTree

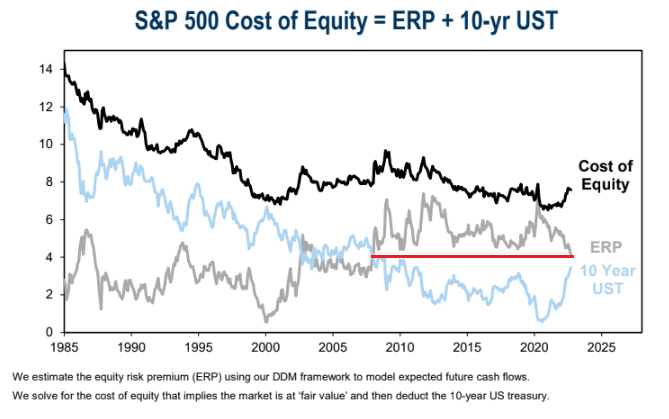

Higher yields on default-risk-free fixed income is not just an ‘oh that’s interesting’ story of the market. It has big implications for the value of equities. As the yield on the U.S. Treasury note increases, that raises the cost of capital for many firms. Finance 101 teaches that when the cost of debt financing shoots up, investment projects become pricier. Also, consider that a higher safe bond yield makes stocks look relatively more expensive for investors.

The S&P 500 Equity Risk Premium Falls to 14-Year Lows

The equity risk premium, or the earnings yield on the minus the 10-year Treasury rate, has fallen to its lowest level since 2008. What’s that mean? Well, perhaps stocks are not much of a bargain despite the 22.5% plunge so far this year.

Higher Interest Rates = Lower Equity Risk Premium

Source: Goldman Sachs Investment Management

With the so-called “TINA” (there is no alternative) trade seemingly dead now that we can snatch up a Treasury note at 4.2% or buy the iShares iBoxx Investment Grade Corporate Bond ETF (NYSE:) with a whopping 5.4% yield to maturity, should you make wholesale changes to your asset allocation?

Rethinking Your Portfolio?

This is actually something I’ve been thinking about. I think we can all agree that fixed income yields today, assuming the inflation outlook is roughly correct, are enticing for certain investors. What makes dipping your toe into bonds so hard is that they just keep falling in price! Today’s intriguing rates might be far better a month from now if the global fixed-income selloff keeps at this pace.

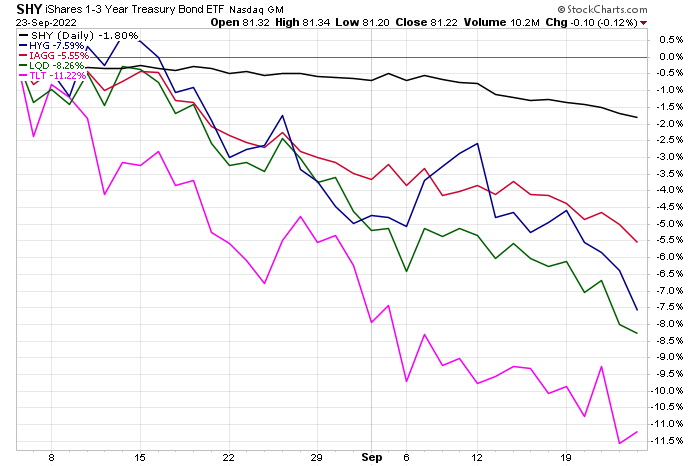

Catching the Falling Fixed Income Knife

Just in the last 35 trading days, take a look at the carnage across credit markets. The “long bond” is down more than 11% (including dividends) while corporates are off about 8%. Short-term – year Treasuries, despite their strong current yields, are down almost 2%. Foreign fixed income has also taken a beating with a 5.6% total return loss in that time as the soars. A true bond bloodbath.

Investors Bail from Bonds

Source: Stockcharts.com

I won’t be making major changes to my portfolio, but I will ensure my emergency fund cash earns north of 4% via short-term Treasuries. Also, consider that money market mutual funds now yield about 2.8% following last Wednesday’s —those funds will likely pay out close to 4.5% at some time next year based on Fed Funds futures.

The Bottom Line

Stocks might not be as cheap as you might think. A feature of this bear market is that interest rates have surged, not collapsed. That means the cost of capital effectively rises for corporations while the equity risk premium for investors has dropped hard. What a difference a year makes.

Disclaimer: Mike Zaccardi does not own any securities mentioned in this article.

[ad_2]

Source link