RBA Next to Hike, UK Might Avoid a Recession (For Now)

2023.02.03 13:08

After the past week’s central bank bonanza, things will quieten down in the coming days, although not completely, as the Reserve Bank of Australia will keep the rate hike theme running. On the data front, the highlights will be Canada’s employment report and the first look at UK GDP in the final quarter of 2022. US indicators will be sparse, giving the dollar little to go on as it bounces back from the knock it took from the not-so-hawkish Fed meeting.

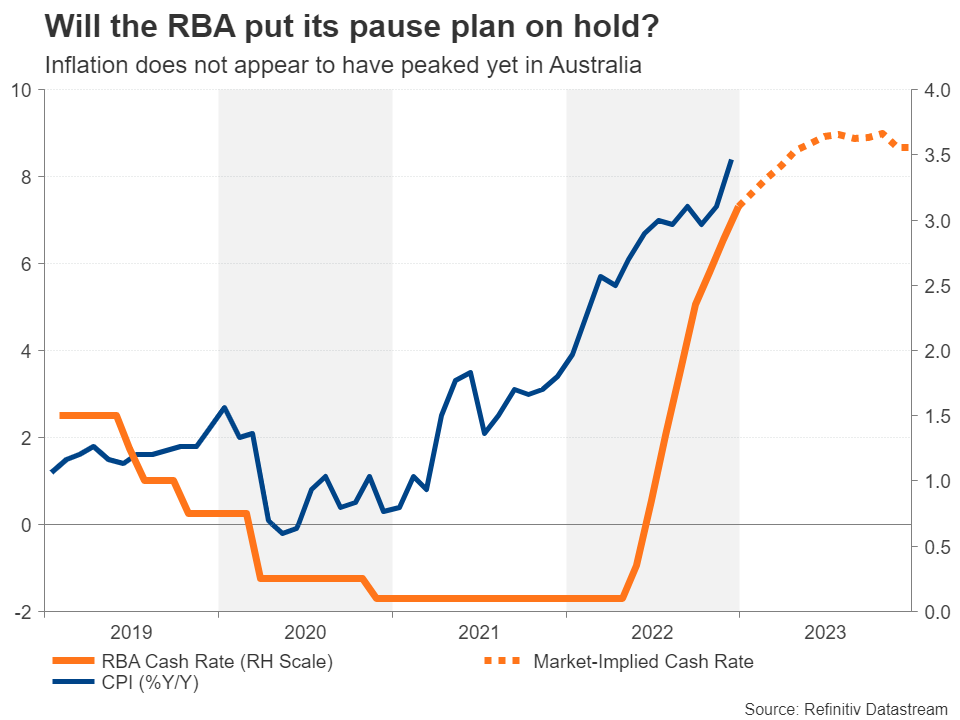

Inflation in Australia accelerated towards the end of 2022, hitting 8.3% y/y in December. This was above what the markets were predicting but more or less in line with the RBA’s forecast of around 8%. In contrast, employment unexpectedly fell in December, and the recent PMI readings have been weak too and so the risk of the RBA sounding notably more hawkish on Tuesday is probably not that high.

There is additionally China’s reopening to add to the outlook equation – something that could lift demand for Australian exports in the coming months. However, it’s unlikely that policymakers will make big adjustments to their growth forecasts so soon, although investors will certainly be keeping a close eye on the RBA’s updated projections in their quarterly Monetary Policy Statement that will be published on Friday.

At the same time, it’s hard to see the RBA pre-committing to a pause just yet given the upside surprise in inflation and may want to maintain its language that it “expects to increase interest rates further over the period ahead”. Markets have assigned about an 88% probability of a 25-basis-point rate increase in February and the remaining odds are for no change. Thus, a hawkish hike has some potential to boost the Australian dollar. But there is also a risk that Governor Philip Lowe hints that a pause could come as early as the next meeting in March, prompting a selloff.

Can the UK dodge a recession?

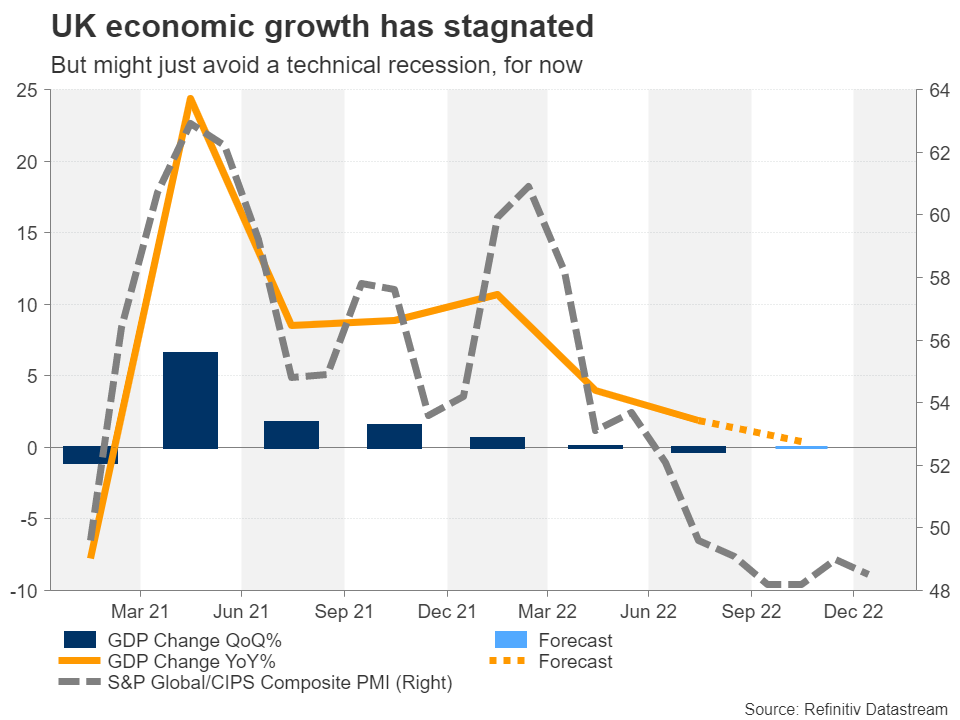

Rocketing inflation led by the surge in energy prices has had a devastating effect on the British economy, curtailing spending by both businesses and households. But that’s not been the only drag on growth in recent weeks. Strike action by public sector workers is also costing the economy and so GDP numbers due on Friday are not anticipated to be great.

GDP is expected to have been flat in Q4, which would mean that the UK economy avoided a technical recession. Other data will include the monthly estimates of industrial production and the trade balance.

Even if the economy managed to eke out slim growth in the fourth quarter, GDP is on a sure path to contracting in Q1. Hence, the pound is likely to enjoy only a temporary lift from better-than-expected performance towards the end of 2022.

Until recently, there was a strong prospect of sterling being able to extend its rebound against the US dollar despite the UK’s economic headwinds, as the Fed got closer to reaching the end of its tightening cycle. But now that the Bank of England has hinted that it may soon be pausing too, that uptrend is on an increasingly shaky ground.

Canadian jobs on tap

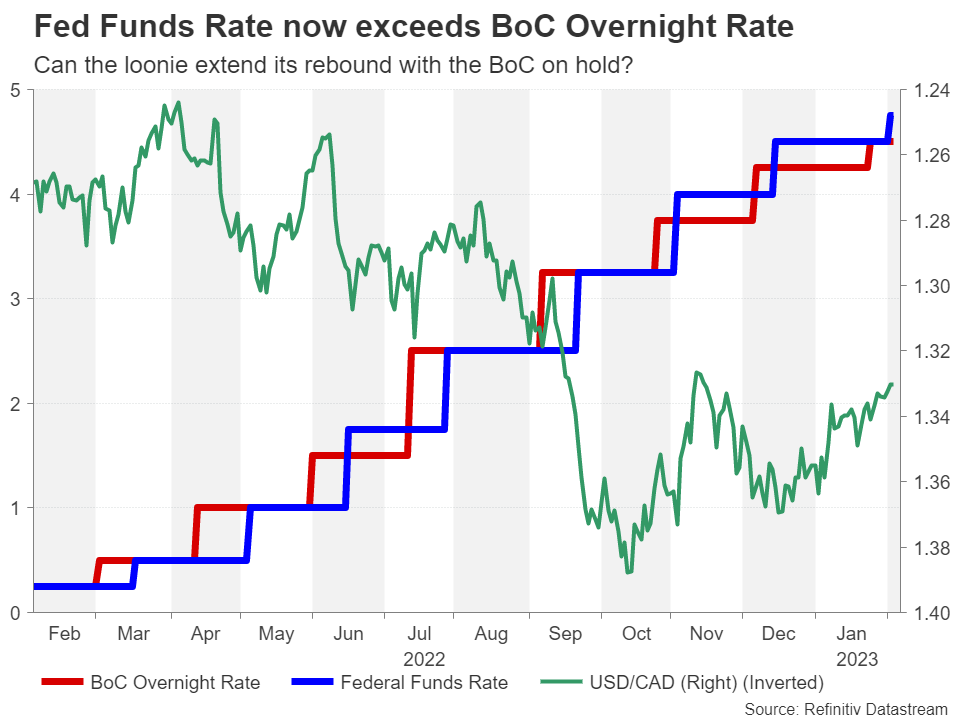

The Canadian dollar has been gaining ground against its US counterpart lately even though the Bank of Canada just signalled that it may have hiked rates for the last time during this tightening cycle, while the Fed has a few more in the pipeline. The improved risk mood on the back of the Fed slowing down its pace of rate hikes and China ditching all its Covid curbs has spurred an impressive rally for commodity-linked currencies like the .

Friday’s employment report may therefore not attract as much attention as usual, although it will still be watched by policymakers as Canada’s tight labour market could yet come back to haunt those betting that the inflation problem has gone away. But unless there are very big surprises in the data, the loonie will likely be unfazed by it.

The BoC has not completely shut the door to further rate hikes so a large beat in the headline employment figure or in wage growth could push the loonie to fresh highs.

Muted dollar to seek direction from Powell

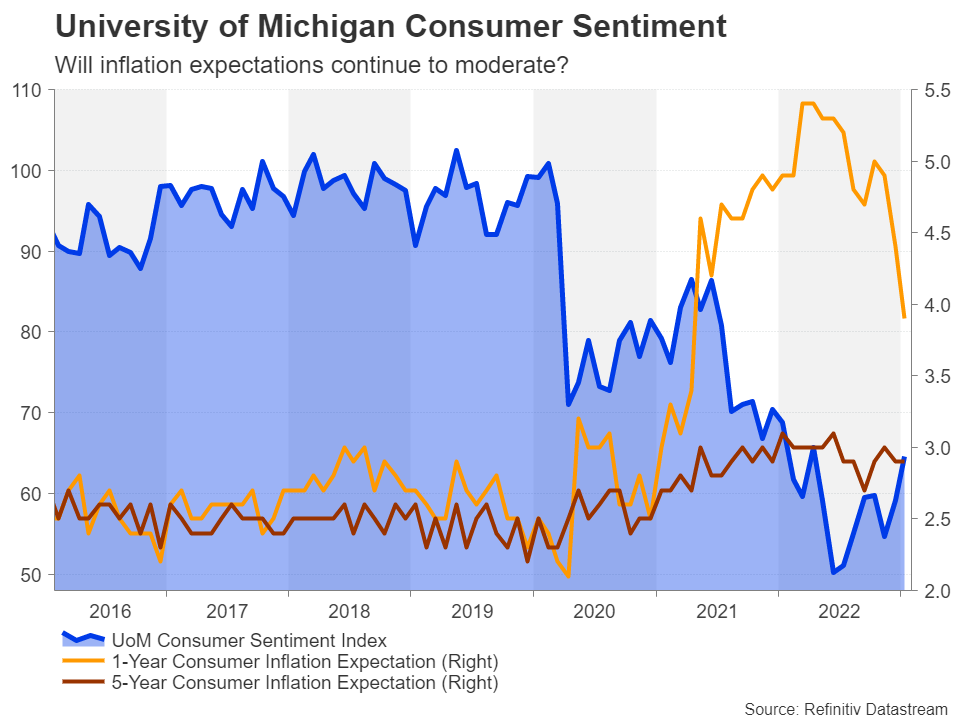

In the United States, there will be some downtime for traders after the Fed meeting and data overload of the past few days, and the only top-tier release on the agenda is the University of Michigan’s preliminary consumer sentiment survey. The closely watched consumer sentiment gauge has been recovering in recent months, while consumer inflation expectations have been levelling off and starting to come down. A continuation of that trend in February would be positive for risk appetite.

However, the dollar will more likely be taking its cues from Fed Chair Jerome Powell who is scheduled to speak at the Economic Club of Washington on Tuesday. Powell avoided pushing back against market bets of a shallower rate path in his post-FOMC press briefing so any remarks on the inflation and interest rate outlooks will be critical for the greenback.